Crypto Market Sees Second Day of Gains as Total Market Capitalization Reaches $3.07 Trillion

The crypto market is experiencing a surge, with the total market capitalization increasing by about 1% to $3.07 trillion and the 24-hour trading volume standing at $91.4 billion. Most major assets are trading in positive territory, reflecting a steady risk appetite despite relatively subdued volumes. According to market data, 9 out of the top 10 coins have traded higher, with Bitcoin (BTC) up 1.4% and Ethereum (ETH) up 1.3%.

Crypto Winners and Losers

Among the top 10 largest cryptocurrencies by market capitalization, 9 have posted gains in the last 24 hours. Bitcoin (BTC) is up 1.4% and is trading at $88,681, while Ethereum (ETH) is up 1.3% to $2,964. BNB (BNB) is slightly higher, up 0.1% to $840, and XRP (XRP) has gained 0.1% and is trading at $1.87. Solana (SUN) rose 0.7% to $122.80, recovering somewhat although remaining lower on the weekly time frame.

Analysts’ Insights

Analysts warn that Bitcoin is still struggling below $90,000 as holiday trading volumes add to a choppy market with high resistance. According to 10x Research, compressed volatility and options positioning suggest a potential multi-week uptrend if the breakout continues. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remains stuck below a key level as markets slide into the seasonal doldrums.

Levels and Events to Watch Next

At the time of writing, Bitcoin is trading at around $88,681, up about 1.7% in the last 24 hours. Price action has improved compared to recent sessions, with BTC climbing higher after defending the mid-$86,000 area earlier this week. A sustained rise above $89,000 would likely open the door for a test of $90,500, followed by resistance near $92,000-$93,000.

Crypto Market Sentiment

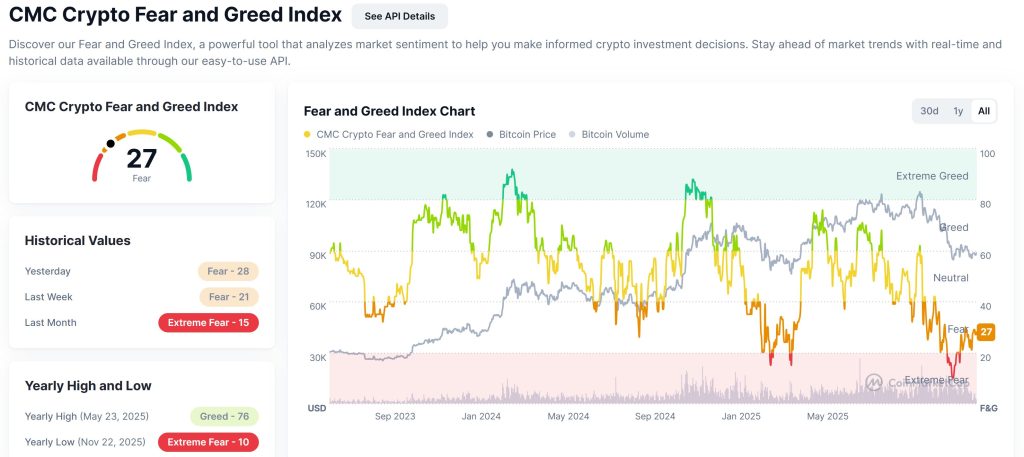

According to the latest CoinMarketCap data, crypto market sentiment remains firmly in the fear zone. The Crypto Fear and Greed Index stands at 27, largely unchanged from the previous day, indicating continued caution among investors. Although sentiment has improved slightly from last month’s extreme fear level of 15, it remains well below neutral levels.

US ETF Flows and Sberbank’s Crypto-Backed Loans

On December 24, US spot Bitcoin ETFs extended their losing streak, recording net outflows of $175.29 million. Selling pressure was broad-based, led by BlackRock’s IBIT, which posted a $91.37 million exit. Meanwhile, Sberbank is exploring crypto-backed loans as Russia’s financial sector accelerates its push into digital assets ahead of the country’s mid-2026 regulatory deadline.