Bitcoin’s Price Performance in 2024-2025: A Tale of Two Narratives

Bitcoin’s price performance in 2024-2025 highlighted a disconnect between improving high-time frame on-chain structure and restrictive macroeconomic conditions. While crypto-native liquidity and supply dynamics strengthened during Bitcoin’s (BTC) rally in 2024, external variables such as increased real yields and the Federal Reserve’s balance sheet contraction created valuation limits as the cycle progressed.

Key insights

-

Bitcoin rose from $42,000 in 2024 to over $100,000, accompanied by rising stablecoin inflows and continued BTC exchange outflows.

-

A key BTC valuation metric increased from 1.8 to 2.2 in 2024-2025, but remained below the overheating threshold of 2.7.

-

In 2025, increased real yields and balance sheet contraction may have limited BTC’s returns despite a robust on-chain position.

On-Chain Strength Underpinned the Rally in 2024

Bitcoin trading began 2024 at around $42,000 and rose steadily throughout the year until it broke $100,000 in the fourth quarter. This rally coincided with improving on-chain liquidity conditions. Monthly inflows to ERC-20 stablecoin exchanges averaged $38 billion to $45 billion per month, reflecting an excess of deployable capital in crypto markets.

At the same time, correlation analysis revealed a negative rolling relationship of 0.32 between stablecoin inflows and Bitcoin exchange net flows. This suggested that the liquidity entering exchanges coincided with the exodus of BTC from exchanges.

This combination was biased toward accumulation-driven rallies rather than distribution, contributing to the durability of Bitcoin’s uptrend in 2024. It also coincided with the era of spot ETF demand and long-term institutional positioning, rather than short-term, leverage-driven activity.

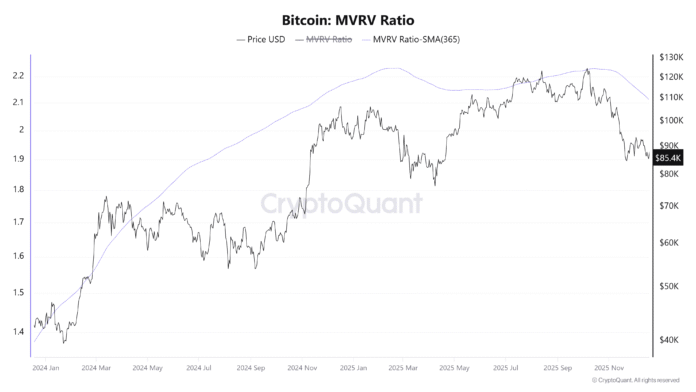

The Bitcoin MVRV ratio is below the 365-day moving average. Source: CryptoQuant

Valuation metrics supported this background. Bitcoin’s 365-day market value to realized value (MVRV) ratio rose from 1.8 at the start of 2024 to around 2.2 at the end of the year.

On a long-term basis, the data suggests structural strength rather than speculative overheating, allowing prices to trend higher without widespread profit realization or forced selling.

Bitcoin price, on-chain data and macroeconomic background (2024-2025). Source: CryptoQuant/FRED/Cointelegraph

Macroeconomic Constraints Limited Above-Average Returns in 2025

This balance shifted in 2025. After reaching highs, the Bitcoin cycle entered a period of volatility and experienced massive price swings between $126,000 and $75,000, although the on-chain structure remained largely intact.

Inflows to stablecoin exchanges peaked in late 2024 and early 2025 before declining by around 50%, indicating a decline in marginal purchasing power. Net inflows on exchanges became more mixed but did not support sustained rallies, suggesting that supply was gradually being distributed.

Liquidity vs. Valuation: What Worked and What Didn’t (2024-2025). Source: Cointelegraph

Valuation behavior reflected this regime change. MVRV’s 365-day SMA stabilized between around 1.8 and 2.2 throughout 2025, well above bear market levels, but failed to grow further.

Statistical analysis over the 2024-2025 period also found that stablecoin inflows and exchange net flows together explained less than 6% of MVRV variation, suggesting that valuation dynamics were no longer primarily driven by on-chain BTC flows.

Federal Reserve Balance Sheet 2024-2025. Source: FRED

What This Means for the Future of Bitcoin

The 2024-2025 data suggests that Bitcoin has entered a system where on-chain metrics define market structure but macroeconomic variables define valuation caps.

Stablecoin inflows and declining FX balances are helping to prevent sharp declines, but further price discovery remains dependent on easing financial conditions.

For investors, this meant that monitoring high-timeframe on-chain data without a macro overlay carried the risk of incomplete conclusions. In the current cycle, Bitcoin’s next rally is more likely to be triggered by falling real yields or renewed global liquidity growth, rather than foreign exchange flows alone.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Source: https://cointelegraph.com/news/bitcoin-onchain-flows-global-macro-here-s-what-changed-in-2025