Bitcoin ETFs Experience Significant Outflows as BTC Struggles to Reclaim $88,000

According to recent data, Bitcoin ETFs recorded $83.27 million in net outflows on December 26, marking a five-day streak of redemptions. This significant outflow has been attributed to Bitcoin’s struggle to reclaim the $88,000 level, with the cryptocurrency dropping over 1% in the past 24 hours. Fidelity’s FBTC led the redemptions with $74.38 million in outflows, while Grayscale’s GBTC posted $8.89 million in withdrawals.

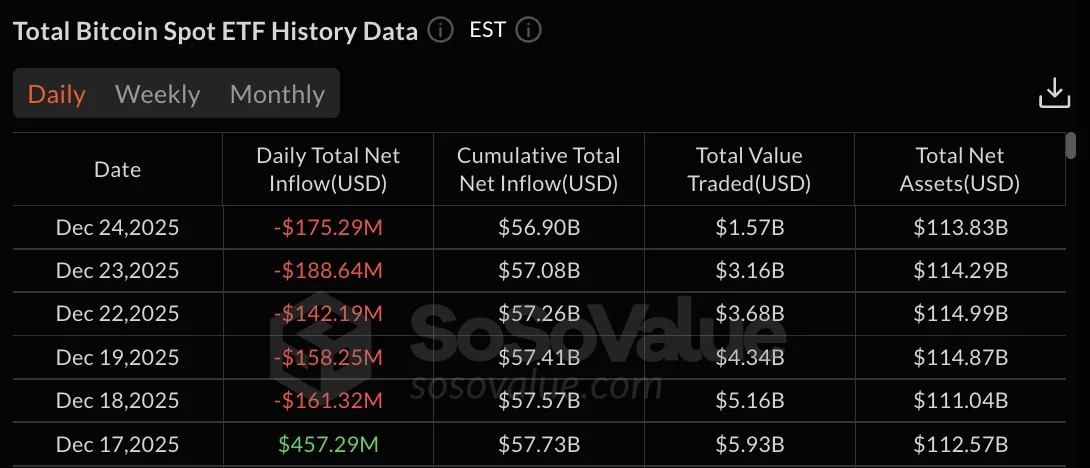

The total net assets under management fell to $113.83 billion, with cumulative total net inflow holding at $56.82 billion. The sustained outflow period has drained assets as Bitcoin’s price failed to maintain momentum above $90,000. The total value traded also fell to $1.57 billion on December 24 from $5.93 billion on December 17.  Bitcoin ETF data: SoSo Value

Bitcoin ETF data: SoSo Value

Five Consecutive Days of Bitcoin ETF Redemptions

The outflow streak began on December 18 with $161.32 million in withdrawals, following a brief rally on December 17 that attracted $457.29 million. December 19 saw $158.25 million in outflows, and trading resumed on December 22 with $142.19 million in redemptions. Outflows accelerated on December 23 with $188.64 million in withdrawals, followed by $175.29 million on December 24. The December 26 outflows of $83.27 million brought the five-day total to over $750 million in net redemptions.

Fidelity’s FBTC dominated the December 26 outflows at $74.38 million, accounting for 89% of total redemptions. Grayscale’s legacy GBTC fund posted $8.89 million in withdrawals, while other ETFs, including Grayscale’s mini BTC trust, Bitwise, Ark & 21Shares, VanEck, Invesco, Franklin, Valkyrie, WisdomTree, and Hashdex, recorded zero flows.

Ethereum ETFs Mirror Bitcoin Weakness

Ethereum (ETH) spot ETFs also faced selling pressure, recording $52.70 million in outflows on December 24. The withdrawals followed $95.53 million in redemptions on December 23. December 22 provided temporary relief with $84.59 million in Ethereum ETF inflows before outflows resumed. Total net assets for Ethereum products stood at $17.86 billion on December 24, down from $20.31 billion on December 11.

Cumulative total net inflow across Ethereum ETFs held at $12.38 billion. Bitcoin’s failure to break above $90,000 and hold gains has triggered profit-taking and position liquidation. For more information, visit the original source: https://crypto.news/bitcoin-etfs-extend-outflow-btc-struggles-below-88k/