Aave Founder Accused of ‘Governance Attack’ After $10M Token Purchase Ahead of Crucial Vote

Aave founder Stani Kulechov is facing scrutiny from the crypto community after purchasing $10 million worth of AAVE tokens shortly before a closely watched governance vote. Critics claim that this move was aimed at increasing his voting power rather than signaling a long-term alignment with token holders.

The claim emerged publicly after Robert Mullins, a decentralized finance strategist and liquidity specialist, said on X that the purchase appeared to be timed to influence an upcoming vote. Mullins argued that the transaction highlights structural weaknesses in token-based governance systems, where large holders can quickly build influence without long-term commitments.

Critics questioned the economic rationale for selling large quantities of AAVE over several years before making a major purchase ahead of a contentious vote. Prominent crypto user Sisyphus pointed to blockchain data that suggests Kulechov may have sold millions of dollars worth of AAVE between 2021 and 2025.

Aave Governance Turmoil Exposes Fault Lines in Power and Transparency

The debate has unfolded against the backdrop of a broader governance dispute within the Aave ecosystem over control of the protocol’s brand and associated assets. Aave Labs made a proposal to Snapshot regarding ownership of key brand assets, including the aave.com domain, social media accounts, GitHub organizations, and naming rights.

️ Aave Labs unilaterally pushed a brand ownership proposal for voting without notifying the author, escalating governance tensions over protocol asset control and value extraction.#Dao #Aavehttps://t.co/2uRM8QM6Jy

– Cryptonews.com (@cryptonews) December 22, 2025

The proposal was written by Ernesto Boado, co-founder of BGD Labs, but Boado publicly rejected the decision to put it to a vote, saying he was not notified and does not support the submitted version. Boado said the move broke trust during what he called a productive forum discussion, arguing that the proposal was aimed at transferring brand assets into a DAO-controlled legal shell with strong protections against theft.

Tensions Rise Around Aave Over Brand Usage, Fee Flows, and Whale Voting

The initiative followed increasing concerns from contributors that brand assets were being used to support private products without the DAO being the primary beneficiary. Recent examples cited by critics include Aave Labs’ replacement of Paraswap with CowSwap, a change estimated to divert approximately $10 million per year in fees away from the DAO.

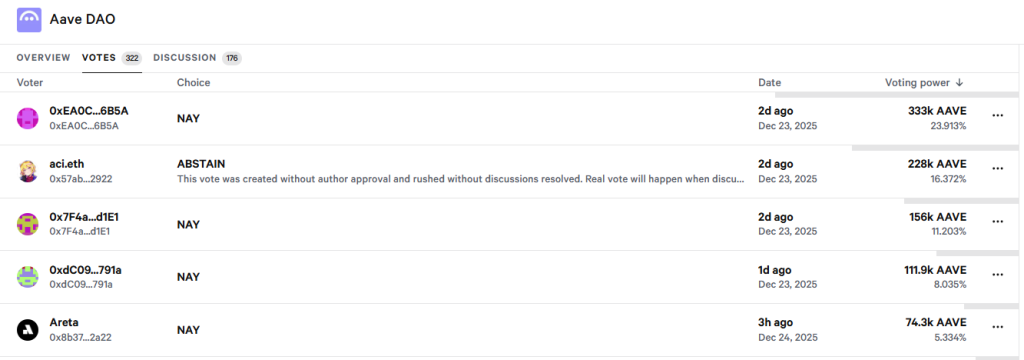

Source: Aave DAO

Kulechov defended the rushed vote, saying the discussion had already taken place and submitting proposals outside of expanded processes was not unprecedented. However, several observers, including crypto educator Duo Nine, expressed concerns about conflicts of interest when founders maintain influence over private companies while influencing DAO results.

Voting data has further fueled the debate. Samuel McCulloch of USD.ai noted that a small number of large holders account for a significant portion of the voting power. Snapshot data shows the top three voters control more than 58% of the vote, with the largest voter holding over 27%.

The controversy comes shortly after regulatory pressure on Aave eased. On December 16, Kulechov announced that the U.S. Securities and Exchange Commission had concluded its multi-year investigation into the protocol without recommending any enforcement action, ending nearly four years of uncertainty.

For more information, visit https://cryptonews.com/news/aave-founder-governance-attack-10m-token-buy/