2025: A Year of Mispriced Expectations for Cryptocurrencies

For Yat Siu, co-founder of Animoca Brands, 2025 will be remembered as a “Trump year” not because US President Donald Trump bailed out crypto, but because the industry bet too heavily on him and mispriced everything from tariffs to interest rate cuts. According to Siu, Trump should have been the catalyst for cryptocurrencies in 2025, but instead, Bitcoin (BTC) is limping toward the end of the year, facing its fourth annual decline in history.

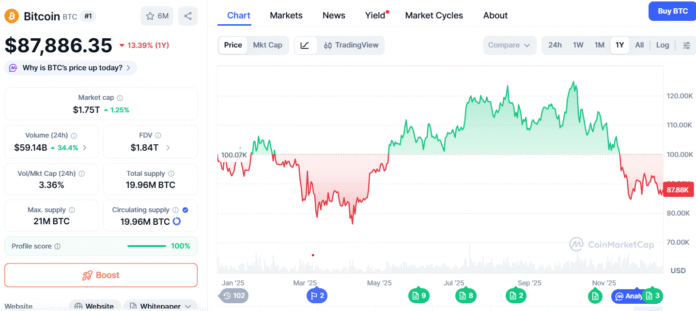

Memecoin liquidity has been sucked into political sidelines, and one of the sector’s longest-running developers believes the market has trusted the new president too much. As can be seen from the performance of Bitcoin in 2025, the market has not reacted as expected.  Bitcoin’s performance in 2025. Source: CoinMarketCap

Bitcoin’s performance in 2025. Source: CoinMarketCap

Yat Siu gave a grade of B-/C+ for the year, stating that traders treated Trump as if crypto was his “first child,” when in reality, the industry is “probably his third, fourth or fifth child, maybe even an eighth child.” Trump’s priorities, such as tariffs, trade wars, and fights over the Federal Reserve, are hitting risk assets hard, and Siu pointed out that if the president starts a tariff war, he’s “not thinking about what’s going to happen to the price of Bitcoin.”

Animoca’s IPO as an Altcoin Proxy

He said crypto’s “Trump trade” didn’t happen in 2025, and that 2026 will force the industry to focus on compliance and real-world use cases. Animoca’s planned reverse merger listing is its bet that public investors will want an “altcoin proxy” once U.S. rules are clearer. In March 2025, Trump’s trade war hit Bitcoin, and there were $22 million worth of DeFi hacks.

The company plans to go public through a reverse merger with Currenc Group, a Nasdaq-listed fintech company, on terms that would result in Animoca owning 95% of the combined company. “Technically, they’re buying us on paper,” Siu said, “even though we control it.” The idea is clear: MicroStrategy has emerged as a leveraged public vehicle for Bitcoin exposure, but there is no equivalent for the token’s long tail.

Buying a base layer token like Ether (ETH) or Solana (SOL) only allows limited access, he argues. Animoca’s answer is to position itself as a SoftBank-style publicly traded altcoin aggregator, giving public market investors the opportunity to own a diversified portion of the altcoin and Web3 stack.  Animoca Brands investment thesis. Source: Animoca Brands

Animoca Brands investment thesis. Source: Animoca Brands

Clarity, GENIUS, and the “Tokenize or Die” Moment

Siu expects Animoca itself to become fully tokenized over time, and the company to become a bridge between traditional stock markets and on-chain ownership. He sees key US laws, including the Clarity Act and the GENIUS Act, as more of a catalyst than existential. “The phrase we like to use is ‘tokenize or die,'” he said.

Once companies have a clear framework for issuing, trading, and monitoring tokens, he expects a flood of incumbents to enter the market. Established issuers will launch tokens tied to their existing operations because they finally have “legal certainty they didn’t have before.” This is where real-world assets (RWAs) and tokenized securities serve as a bridge, as an industry expected to grow to trillions by 2030.

Animoca has already started cutting RWA partnerships, including an agreement with Grow, a major Chinese asset manager, to work on tokenization and access to token markets for traditional clients. Siu believes that the next thematic shift has already occurred, and 2026 will be about “new retail” coming in under clearer rules and with products based on usage and not just speculation.

2026: The Year of the Utility Token

Until now, the focus has been on the existing crypto trader and the introduction of tokens and memecoins with platforms like Pump.fun. In this environment, builders could launch a token without worrying about where the customer would come from and focus on the narrative rather than the product, but now market conditions are forcing a reboot.

The “Memecoin madness” was capped by Trump and Melania Trump-branded tokens earlier this year, as the official Trump price (TRUMP) slid more than 75% from its peak, and Melania Meme (MELANIA) fell about 90% from its peak, with hundreds of thousands of small wallets suffering losses. According to Siu, this was “a bloody vampire attack on the meme community” that bankrupted much of the retail sector and drained liquidity from the rest of the market.

As capital moves away from pure speculation, the next wave will depend on products that solve real problems for gamers, developers, and brands and attract users who have never considered themselves “crypto people.” With the Clarity and GENIUS laws providing a path for compliant issuance, he argues that “2026 will be the year of the utility token because everyone will launch a token that has a use case and we can talk about it.”

So, crypto companies are basically growing up? “They have to, they have to… We’re not the only company going public.” For more information, visit https://cointelegraph.com/news/trump-tariffs-and-the-year-of-the-utility-token-animoca-s-yat-siu-says-crypto-finally-has-to-grow-up?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound