Bitcoin’s End-of-Year Rally Stalls: What’s Next for the Cryptocurrency?

As the year comes to a close, Bitcoin’s (BTC) rally to $90,000 appears to be losing momentum due to a lack of demand and weak on-chain activity. Despite this, a new technical setup suggests that momentum will increase once the BTC/USD pair breaks above $90,000. To understand what’s driving this trend, it’s essential to examine the current market conditions and technical indicators.

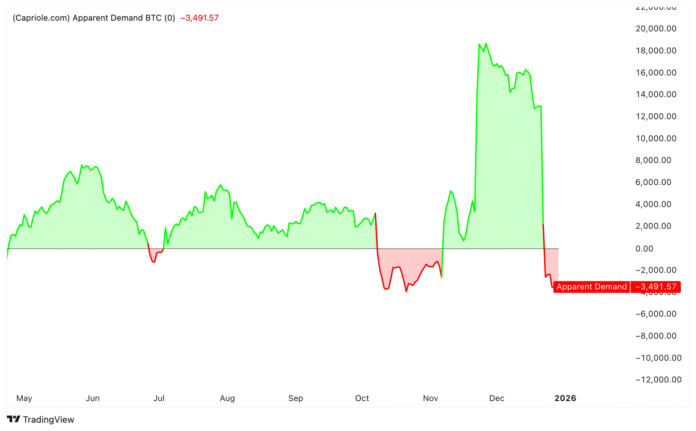

One key metric to consider is the Bitcoin Apparent Demand, which has flipped negative after falling to its lowest level since October. According to Capriole Investment’s Bitcoin Apparent Demand metric, the demand for Bitcoin has dropped sharply over the last two weeks to -3,491 BTC. This negative value suggests declining demand, which could be a significant obstacle for the cryptocurrency’s potential rally.

Bitcoin apparent demand. Source: Capriole Investments.

Bitcoin apparent demand. Source: Capriole Investments.

Weak On-Chain Activity and Lack of Demand

Another crucial indicator is the Coinbase Premium Index, which measures the difference in pricing between the BTC/USD pair on the largest US exchange, Coinbase, and Binance’s BTC/USDT equivalent. The index has tanked to the current value of -0.08 from 0.031 on Dec. 11, indicating more selling pressure. As analyst Mv_Crypto noted, “The Coinbase $BTC Premium Index is still printing deep red bars, signalling that US selling pressure hasn’t lifted yet.” Until this metric recovers, approaching the long side requires extreme caution.

Bitcoin Coinbase Premium Index. Source: CryptoQuant.

Bitcoin Coinbase Premium Index. Source: CryptoQuant.

Technical Setup and Potential Breakout

Data from TradingView shows the BTC/USD pair trading 6.6% below its yearly open of $93,300, risking the first-ever post-halving “red” year. To trigger a rally going into 2026, Bitcoin must overcome the resistance at $90,000, an area that acted as formidable support in early December. The price has now been rejected four times from this level since Dec. 15. Since the price is still holding the support at $84,000, momentum should start to return once the bulls reclaim the $90,000-$92,000 zone.

BTC/USD hourly chart. Source: Cointelegraph/TradingView.

BTC/USD hourly chart. Source: Cointelegraph/TradingView.

Expert Analysis and Potential Targets

Crypto analyst Jelle noted a “potential hidden bullish divergence” on the monthly chart, suggesting an impending upward breakout. “Bitcoin needs to end the month in the green to lock in; close above $90,360 and we’re golden.”  BTC/USD monthly chart. Source: Jelle. Meanwhile, Captain Faibik shared a chart showing that the $90,000 level coincided with the upper trendline of a descending broadening wedge on the eight-hour timeframe. A breakout from this pattern would lead to a rally toward the measured target of the wedge at $122,000.

BTC/USD monthly chart. Source: Jelle. Meanwhile, Captain Faibik shared a chart showing that the $90,000 level coincided with the upper trendline of a descending broadening wedge on the eight-hour timeframe. A breakout from this pattern would lead to a rally toward the measured target of the wedge at $122,000.

BTC/USD eight-hour chart. Source: Captain Faibik.

BTC/USD eight-hour chart. Source: Captain Faibik.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. For more information, visit the original source: https://cointelegraph.com/news/btc-price-pauses-90k-what-will-trigger-new-year-rally