Big Tech Companies to Integrate Crypto Wallets and Launch Private Blockchains in 2026

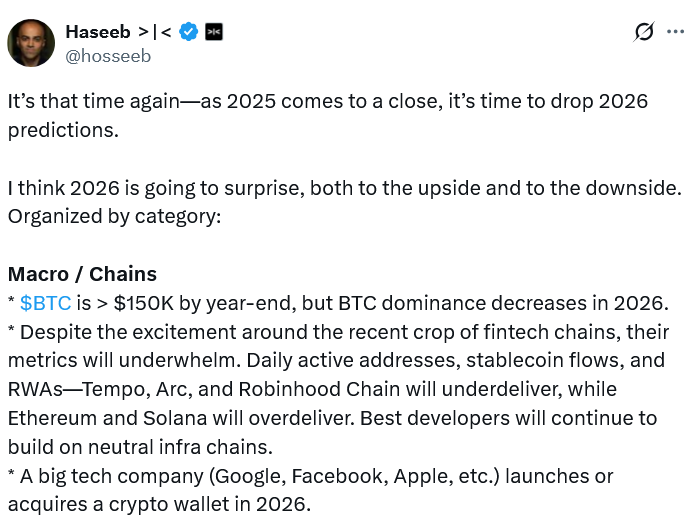

A significant development is expected in the crypto space in 2026, with a Big Tech company likely to integrate a crypto wallet, according to Haseeb Qureshi, managing partner of crypto VC firm Dragonfly. This move has the potential to bring billions of users into the crypto world. Additionally, more Fortune 100 companies are predicted to launch their own blockchains, following in the footsteps of companies like JPMorgan, Bank of America, Goldman Sachs, and IBM, which have already built private blockchains.

Qureshi’s predictions are based on the growing trend of companies exploring the use of blockchain technology to improve their services and operations. The integration of crypto wallets by Big Tech companies will provide users with a seamless and secure way to store and manage their digital assets. Furthermore, the launch of private blockchains by Fortune 100 companies will enable them to leverage the benefits of blockchain technology while maintaining control over their networks.

Source: Haseeb Qureshi

Fintech Public Chains Will Not Threaten Ethereum’s Dominance

Despite the excitement surrounding new L1 blockchains being developed by fintech firms, Qureshi is not optimistic about their potential to challenge the dominance of crypto-native networks like Ethereum and Solana. He believes that these new chains will not attract enough users or capture enough network activity to pose a significant threat to established players. “The best developers will continue to build on neutral infrastructure chains,” Qureshi added.

Qureshi’s comments are supported by data from the crypto market, which shows that Ethereum and Solana have maintained their position as leading blockchain platforms. The success of these platforms can be attributed to their strong developer communities, robust infrastructure, and wide adoption. In contrast, new L1 blockchains face significant challenges in attracting users and gaining traction in a crowded market.

Bitcoin Price Predictions and Market Trends

Qureshi expects Bitcoin to trade above $150,000 by the end of 2026, but suggests that its dominance will decline. This prediction is based on the growing adoption of alternative cryptocurrencies and the increasing diversity of the crypto market. Meanwhile, the $312 billion stablecoin market is expected to grow by 60% in 2026, with the dominance of current market leader Tether (USDT) falling from 60% to 55%.

Source: Galaxy Digital

Prediction Markets and AI in Cryptocurrencies

Prediction markets are expected to continue to boom in 2026, but AI will not find a significant use case in crypto beyond security, according to Qureshi. “AI agents will still not pay each other or spend significant money in 2026,” Qureshi said, while predicting that no effective solution will emerge to curb the spread of spambots on social platforms.

For more information on the latest developments in the crypto space, visit Cointelegraph.