Bitcoin’s Bullish Outlook for 2026: Analyzing the Signals

As the year draws to a close, Bitcoin (BTC) has entered its final week down 30% from its all-time high of $126,000 reached on October 6th. Despite this decline, many analysts believe that BTC has not yet peaked and that relief may be on the horizon in 2026. In this article, we will examine the key takeaways and signals that suggest a potential bull run for Bitcoin in the coming year.

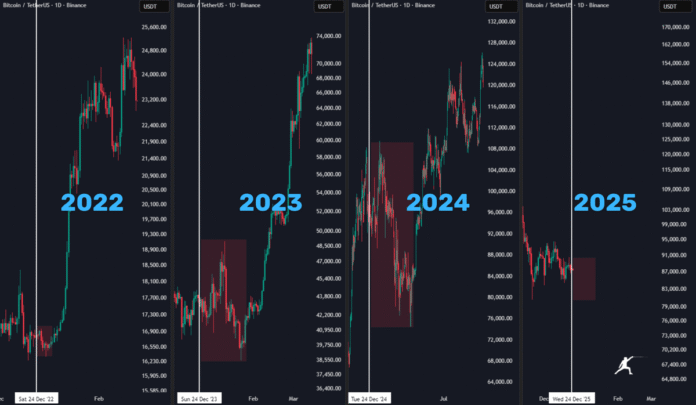

A typical “Christmas bear trap” could precede a possible recovery rally in 2026, according to analyst James Bull. A bear trap is a false technical signal in which the price briefly falls below a key support level, triggering sell-offs and stop losses, but then quickly reverses upward, trapping bears (short sellers) in losses. This phenomenon has been observed in previous years, with the BTC/USD pair falling by 8.5% between December 26th and December 31st, 2024, before returning by 12.5% between January 1st and January 6th, 2025.

Key Signals Pointing to a Bullish Outlook

Fading ETF outflows, reduced selling pressure among long-term holders, and macroeconomic factors such as interest rate cuts and liquidity all suggest that a longer bull cycle is possible. Analysts at Citi Group have set a 12-month base case forecast for Bitcoin at $143,000, largely due to “revived ETF demand,” with the bull case target at $189,000. Additionally, spot Bitcoin ETF flows have declined significantly since November 21st and are now “approaching zero,” according to James Bull. This decline in outflows has historically preceded price increases, such as the 33% price increase to $112,000 on May 22nd.

Bitcoin New Year Price Development; 2022-2025. Source: James Bull

Bitcoin New Year Price Development; 2022-2025. Source: James Bull

Technical Analysis: Symmetrical Triangle Points to $107,000

Data from TradingView shows that the BTC/USD pair is consolidating within a symmetrical triangle on the daily candlestick chart. Price must close above the upper trendline of the triangle at $90,000 to continue the uptrend, with a measured target of $107,400. Such a move would increase the total gain to 22% from current levels. Analyst Dami-Defi notes that “if Bitcoin climbs and stays above this upper trendline, we likely expect a bullish breakout to higher resistance levels around $94,000 and then a rise near $106,000.”

Spot net flows of Bitcoin ETFs. Source: Glassnode

Spot net flows of Bitcoin ETFs. Source: Glassnode

BTC/USD daily chart. Source: Cointelegraph/TradingView

BTC/USD daily chart. Source: Cointelegraph/TradingView

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/bitcoin-2026-bull-case-traders-strong-signals-6-figure-btc-price