Ethereum’s Struggle to Break $3,000: Weakening Trader Confidence and Stagnant Network Activity

Ether (ETH) has been trading within a tight 4% range over the past week, raising concerns about the sustainability of the $2,900 support level. The repeated failure to break above $3,000 has coincided with a decline in Ethereum network fees and muted demand for Ether exchange-traded funds (ETFs). This lack of conviction is also evident in the ETH derivatives markets, causing traders to reassess the possibility of a sustainable recovery in the near future.

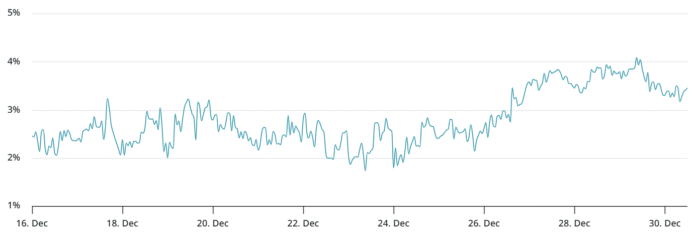

ETH 2-month futures base rate. Source: Laevitas.ch

ETH 2-month futures base rate. Source: Laevitas.ch

Monthly ETH futures traded at a 3% annual premium compared to spot markets on Tuesday, indicating extremely low demand for bullish leveraged positions. Under neutral conditions, this premium is typically above 5% to compensate for the longer billing period, but it has fallen below this threshold in recent weeks.

Ethereum Fees and Network Activity: A Cause for Concern

Part of the weak investor sentiment can be explained by falling Ethereum network fees as traders anticipate lower demand for ETH. More importantly, demand for competing blockchains focused on decentralized applications (DApps) has remained stable, leading investors to question why the Ethereum network is lagging behind.

Blockchains sorted by 7-day fees, USD. Source: Nansen

Blockchains sorted by 7-day fees, USD. Source: Nansen

Ethereum network fees fell by 26% compared to the baseline, despite the number of transactions increasing by 10% during this period. At first glance, Ethereum activity has not slowed down. However, a significant part of ETH’s price outlook depends on the actual demand for blockchain processing.

DApp Demand and ETF Flows: Key Indicators for Ethereum’s Price

Fees generated by Ethereum DApps have remained relatively constant over the past four weeks, although well below the peak of $140 million recorded in October. The data shows that activity on the Ethereum network is stagnating, but far from collapsing.

7-day decentralized application fees for Ethereum, USD. Source: DefiLlama

7-day decentralized application fees for Ethereum, USD. Source: DefiLlama

The lack of optimism about ETH’s short-term momentum is also evident in the selling pressure on Ether ETFs. This metric is often associated with institutional demand, especially since these instruments have seen nearly $17 billion in inflows. BlackRock’s iShares Ethereum Trust ETF (ETHA US) leads the group with $10.2 billion in assets under management.

Daily net inflows of Ether ETFs, USD. Source: Farside Investors

Daily net inflows of Ether ETFs, USD. Source: Farside Investors

Conclusion: A Sustained Recovery Depends on Stronger Network Activity and DApp Demand

Daily net outflows from Ether ETFs of $307 million since Dec. 17 may not be significant, accounting for less than 3% of total assets, but the lack of demand is still weighing on investor sentiment. Even professional traders may become skeptical after ETH repeatedly failed to stay above the $3,000 mark for two weeks.

While weak demand for bullish ETH leverage positions and Ether ETFs is not a death sentence, a sustained recovery will likely depend on stronger Ethereum network activity and increasing demand for DApps. For more information, visit the original article.