Introduction to LIT Token and Lighter Airdrop

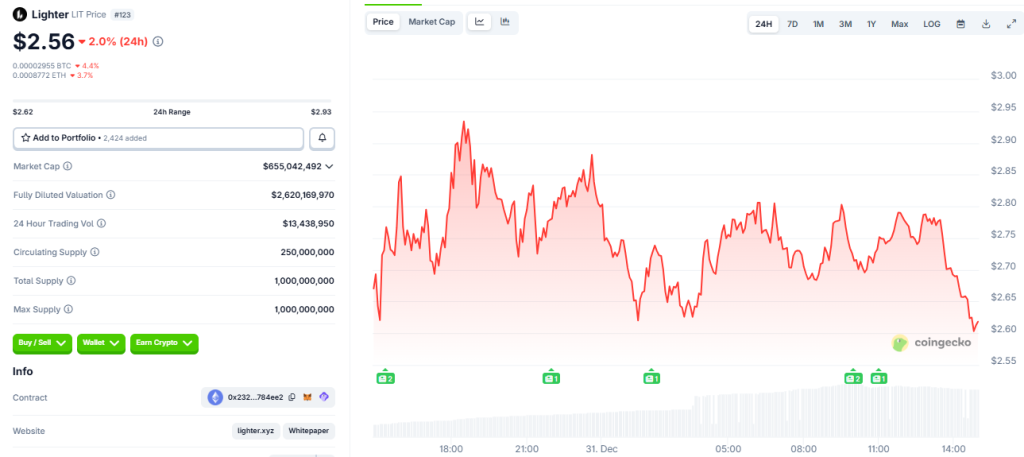

The LIT token, newly launched by decentralized perpetual exchange Lighter, experienced a significant price drop in premarket trading on Tuesday, shortly after its long-awaited airdrop distribution went live. This drop was largely due to heavy selling from early recipients and leveraged traders. According to reports, the token initially climbed to a post-launch high of $4.04 before reversing its course and falling to around $2.62, a decline of approximately 22.2%.

This price also marked LIT’s lowest level since its launch, reflecting ongoing bearish pressure as the market absorbed the large token distribution. However, trading volume increased in the last 24 hours, with LIT recording a trading volume of 13.43 million, almost three times the amount from the previous day.

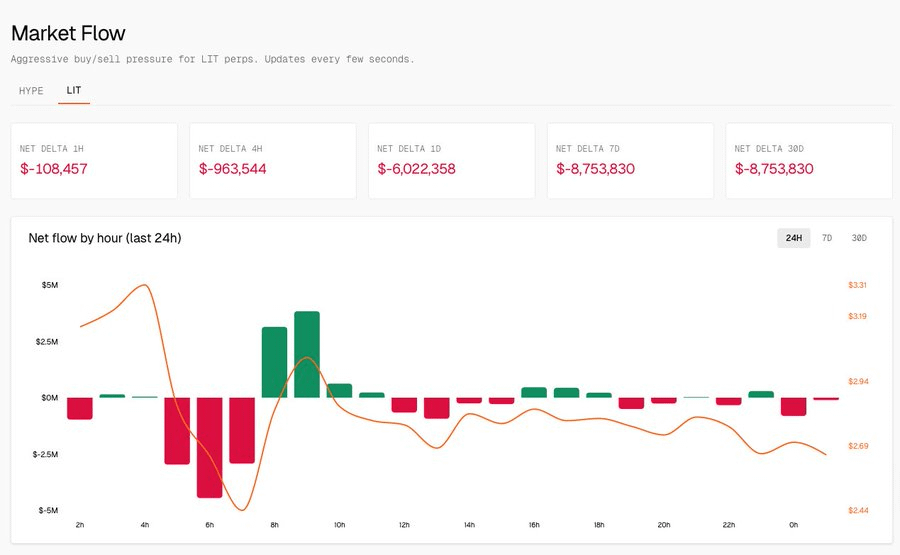

Heavy Trading and Selling Activity

Despite the excessive price drop, the increased volume was indicative of greater participation in the market, driven primarily by volatility, short-term speculation, and position unwinding, rather than long-term accumulation. LIT is trading almost 35% lower than its peak, and the token is now directly in a post-launch correction phase with price discovery still ongoing.

Source: CoinGecko

Airdrop Distribution and Tokenomics

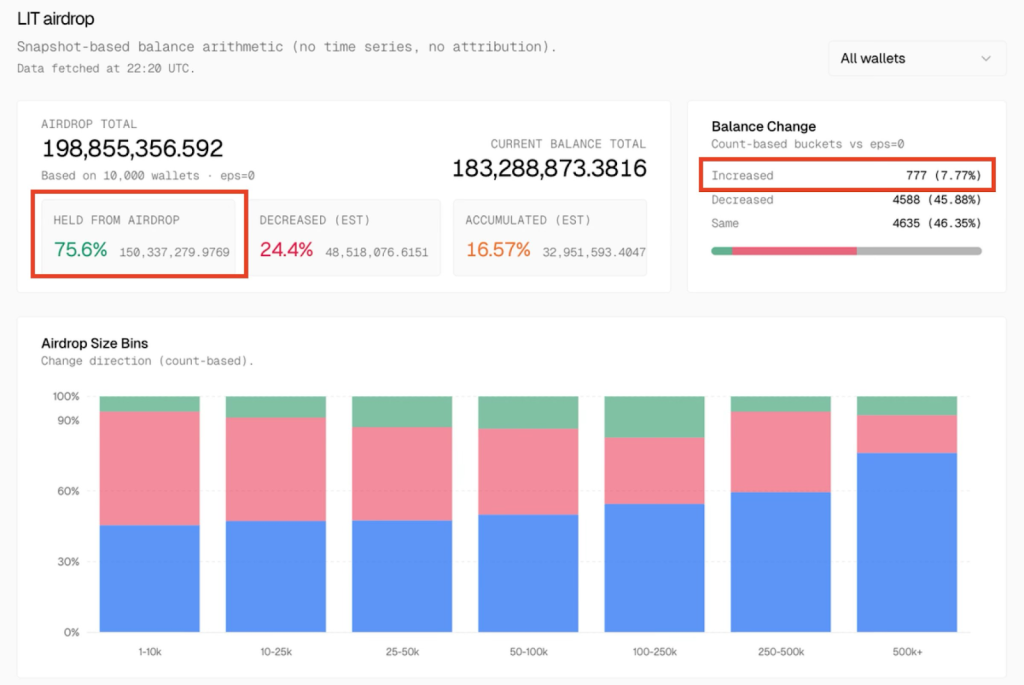

On-chain data based on the airdrop provided additional information about selling pressure. An analysis of 10,000 wallets conducted immediately after the distribution showed that participants initially received approximately 198.86 million LIT tokens. The existing balances in all these wallets amount to approximately 183.29 million LIT, which means that a significant part of the airdropped supply has already been reduced.

Source: Arndxt

Market Performance and Token Distribution

Only 7.77% of wallets increased their holdings, while 45.88% reduced their balances and 46.35% made no changes, suggesting that selling activity outweighed accumulation. In absolute terms, about 150.34 million LIT or about 75.6% of the airdropped tokens remain in possession. Around 48.52 million tokens or 24.4% were sold or transferred.

At the same time, only about LIT 32.95 million, representing 16.57% of the total, can be classified as accumulated in excess of the initial allocations. The imbalance suggests that buy-side conviction has lagged behind sell-side activity in the early trading window.

Source: Arndxt

Lighter’s Performance and Tokenomics Under Scrutiny

The selloff followed one of the largest token draws in cryptocurrency history, as Lighter distributed approximately $675 million worth of LIT tokens to early users, marking the 10th largest airdrop distribution by dollar value, according to data from CoinGecko.

Source: Coingecko

Conclusion and Future Outlook

The launch comes as Lighter continues to demonstrate strong trading metrics in a rapidly growing on-chain derivatives market. The platform processed around $3.90 billion in continuous 24-hour volume and around $201 billion over a 30-day period, making it one of the top decentralized venues alongside Hyperliquid and Aster.