Do business in the trail of least resistance

Incessantly a mistake that many investors create this error, and I’m accountable of this too. I impaired to industry in line with what I feel now not what I see.

I take a look at the chart and I feel…

“Oh man, look how high the price is, it looks really expensive time to sell”

I do exactly that, I snip the marketplace nearest factor you already know the marketplace continues up even upper.

How about this the book worth is in a downtrend and I’m considering to myself

“Man look how cheap this stock is it can go down let me buy and dabble a little bit”

Upcoming factor you already know the book worth were given even less expensive.

The error I made is as a result of I industry in line with what I feel now not what I see.

That is the place I need you to industry alongside the trail of least resistance industry in line with what you notice and now not what you assume and to try this may be very easy.

Take a look at this.

If the marketplace is in an uptrend, you search for purchasing alternatives, and if the marketplace is in a downtrend, you search for promoting alternatives and that’s it.

If you happen to’re a professional dealer and also you do counter pattern buying and selling and stuff like that all of the fancy stuff, journey forward.

However in the event you’re a unutilized dealer, in the event you’re suffering to create a cash in I like to recommend buying and selling alongside the trail of least resistance.

That is the place buying and selling turns into more uncomplicated for you.

Examples

You may well be questioning…

“Rayner, the market is in an uptrend, but where exactly do I buy?

Good question.

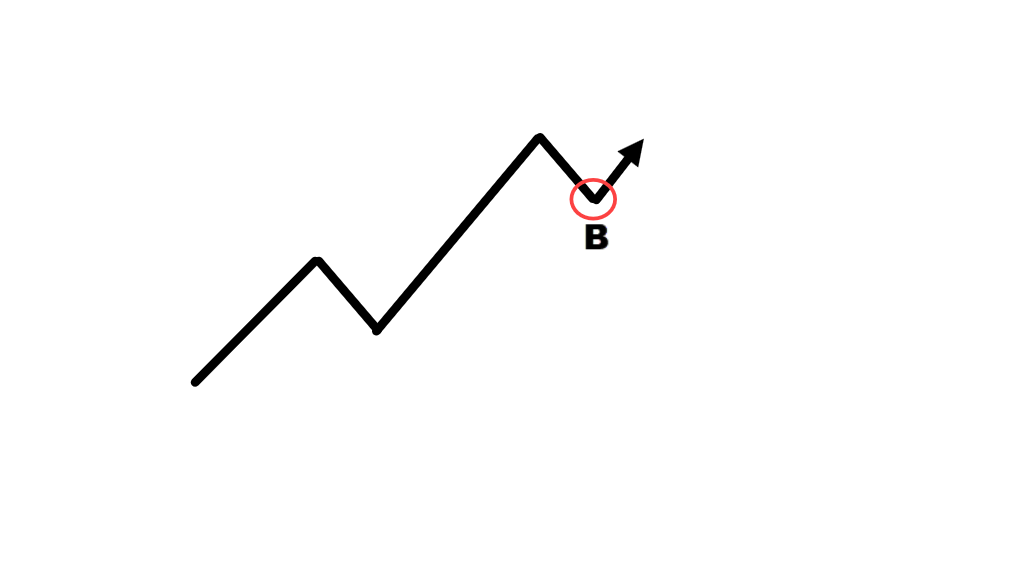

If we look at this chart over here:

You can see that this stock is in an uptrend, you might be wondering…

“Rayner, where exactly do I buy now that this stock is in an uptrend?

One thing to share with you is that I like to look for buying opportunities right in the area of support.

The area of support is an area on the chart where the market prices reverse up higher.

Here is what I mean:

To walk you through, the market rallied up higher, it made a pullback, then it rallied up higher, gave me another pullback, rallied up higher, gave me another pullback, and then boom, rallied up higher to where it is right now.

If you ask me, this is an area of support a level that I want to pay attention to. Here is an example:

This is one way to identify your area of value in the chart to look for buying opportunities and of course, you can stack it up with multiple tools and indicators to identify whether that level has a high probability of reversal.

Another technique I want to share with you is a technique I learned from a trader called @trader1sz, from Korea.

He likes to use the yearly open the yearly highs and the yearly lows to look for potential buying opportunities.

I’m going to pull that out you can see over here on the chart:

This dark red line over here simply tells me that is the previous year’s high. The current year is 2023, which tells me that this is the high of 2022. This is what I mean:

The blue line is the low of 2022.

Again, this indicator is free on TradingView. This is a significant area on the chart when you look for potential buying opportunities.

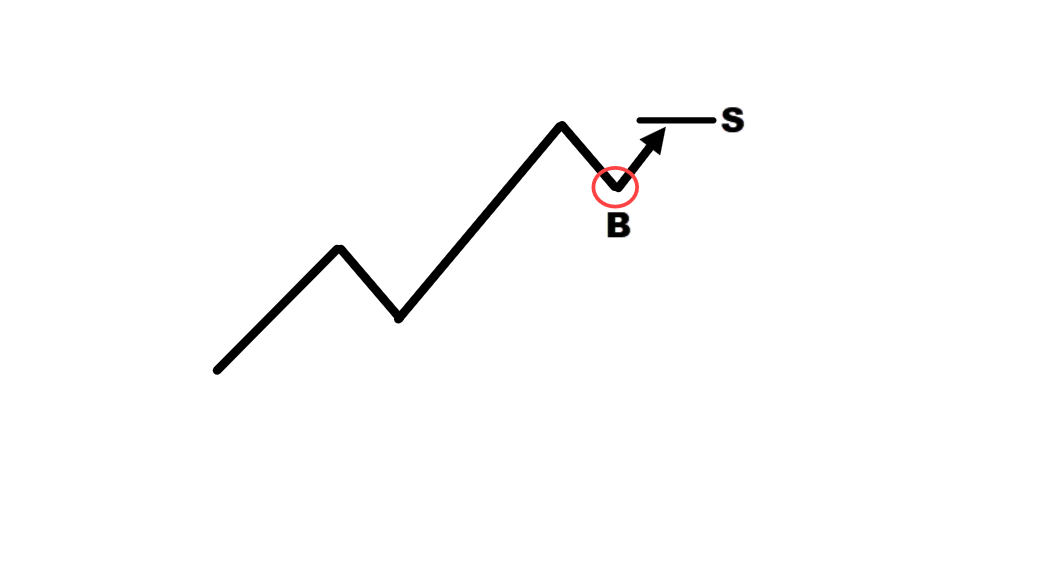

One simple technique is that if the market makes a pullback over here:

I’m looking for bullish reversal candlestick patterns like a hammer., when that happens that’s a sign that the buyers are possibly stepping in. Here’s how it looks like:

Take a long position to enter the next candle open, stop would be a distance below the low. A possible target could be just before this recent swing high. Here is what I mean:

Allowing me to capture that one swing up higher so there’s a potential trading opportunity that I’m looking at.

Along the way, you will understand why I’m looking for this buying opportunity and how I’m looking to trade this setup.

Now look at this chart:

Let me ask you…

Are you looking for buying opportunities or selling opportunities?

The answer is selling opportunities.

Because the market is in a downtrend.

You are seeing several blue arrows and you are wondering…

“Rayner, what are those blue arrows?”

The ones blue arrows are the place the associated fee reverses.

How may you may have predicted the place this marketplace may opposite forward of generation?

Some other factor to proportion with you is that while you’re coping with assistance and resistance, the ones are helpful tactics to spot the place the marketplace may opposite from.

Because the marketplace is in a downtrend, you wish to have to search for promoting alternatives at resistance.

Some other factor to show is that once the marketplace breaks underneath assistance, assistance may turn into resistance and opposite ill decrease from there.

Examples

USD/MXN

This actual foreign money pair appreciates this phenomenon.

Realize how well proper earlier assistance when damaged was resistance proper over right here.

Some other segment of assistance examined as soon as, two times, and three times

We had this reversal at this earlier level, which was resistance. Right here’s what it looks as if:

You’ll do that forward of generation.

If the marketplace have been to fracture underneath this low, here’s what I cruel:

Later there’s a excellent anticipation that it’s going to seek out resistance over right here:

Search for promoting alternatives with the expectancy of decrease costs to come back since this can be a downtrend.

Expectantly, those tactics will assistance you already know the place to shop for and promote at the chart and when to be a purchaser and a dealer.

If in suspicion, zoom out

EURNZD H4

You may well be considering…

“Rayner, should I look for shorting or buying opportunities?”

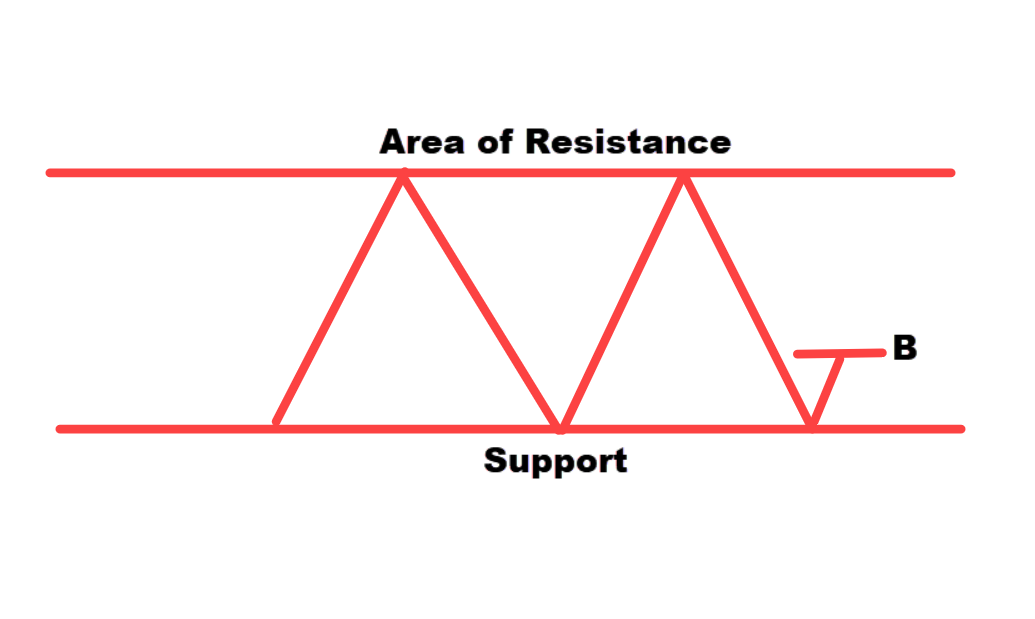

As a result of later all this marketplace seems adore it’s in a area. That is what I cruel:

Must I glance to shop for or promote?

Now, in the event you simply glance only in line with this chart, it’s rather dehydrated to inform since you don’t have any directional partiality.

In case you are in suspicion, in the event you’re now not certain whether or not to be a purchaser or dealer, nearest simply zoom out.

Let’s journey as much as the day by day time frame on this case:

You’ll see that this marketplace is in a long-term uptrend.

Realize the associated fee creating a sequence of upper lows and better highs. That is what I cruel:

There’s an segment of resistance over right here:

Launch an ascending triangle development.

There’s a excellent anticipation that the marketplace may fracture up upper of this resistance.

Since you already know this marketplace is in an uptrend, you’re getting to search for purchasing alternatives.

Does that create sense?

Learn how to industry the setup

You’ll see how zooming out will provide you with a clearer standpoint.

Going again to the H4 time frame, figuring out what you already know now.

There are a couple of techniques you’ll industry this setup.

Purchasing alternatives in an uptrend

If you wish to search for purchasing alternatives in an uptrend, this will probably be an segment of worth that you’ll search for. Here’s an instance:

That is an segment of worth.

If you happen to take a look at this, possibly the marketplace may fracture out upper and nearest retest the former resistance which might turn into assistance.

Let’s see… if our every year low and high have any confluence.

Sure, we’ve got…

You’ll see over right here, that that is the former 12 months’s top. The marketplace, let’s say makes a deeper pullback.

That is an segment of worth (AOV) and a key segment of assistance.

Examined two times, and most likely right here once more.

That is the place it’s important to search for purchasing alternatives in opposition to the lengthy facet.

TIP:

If in suspicion, simply zoom out.

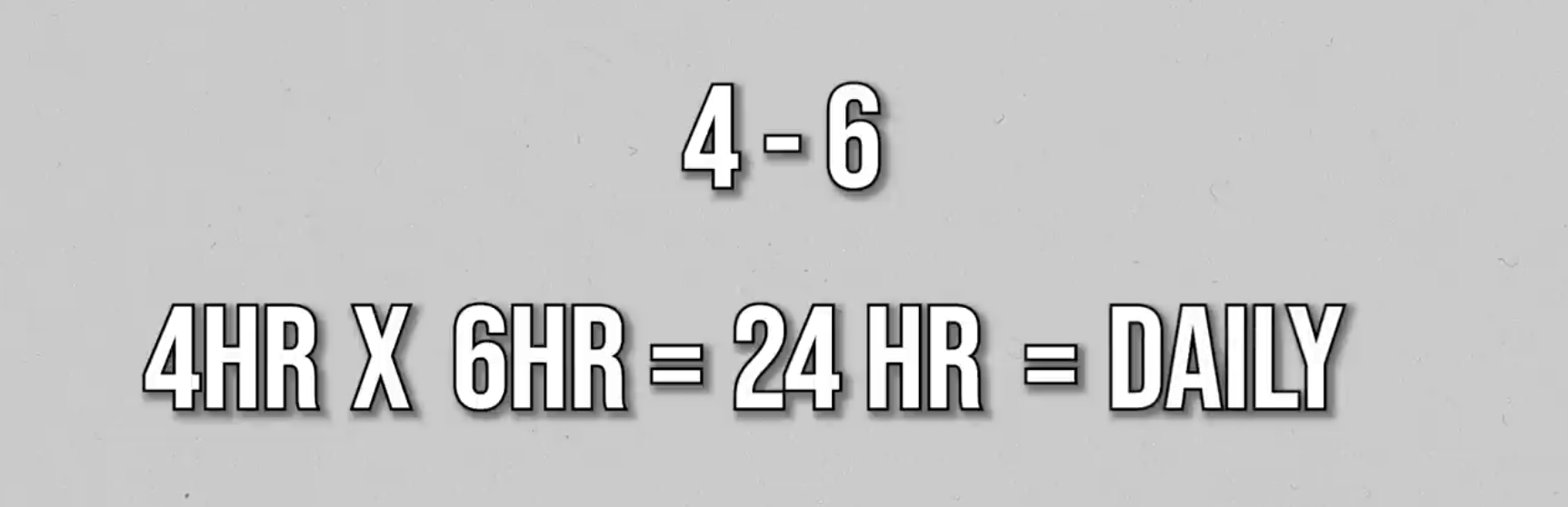

A handy guide a rough option to know what time frame to zoom out is you utility an element of 4-6

Prior to now, we have been at the four-hour generation body. If you happen to journey by way of an element of 6. Multiply 4 by way of 6hr which is the same as your day by day time frame.

Now, now and again while you zoom from your charts, issues may nonetheless now not create sense to you. And what do you do nearest?

This brings me to my 3rd lesson.

Nonetheless in suspicion? Keep out

If you happen to’re nonetheless in suspicion later zooming out, nearest keep out. Be mindful this…

“No position in the market is a position itself”

The terminating factor that you wish to have to do is to pressure a industry possibly since you’re bored.

You’ve got itchy arms, proper?

For the concern of lacking out you wish to have to pressure the industry.

What occurs nearest?

You find yourself incurring needless losses that wouldn’t have took place in the event you had adopted your buying and selling laws.

Your psychological capability and buying and selling account are blown.

You’ve got concept like, why am I so reckless? Why am I so ill-disciplined? Why am I so foolish?…

Let me jerk again what’s mine from the markets.

When you’ve got such ideas, what you’re getting to do is you begin to revenge industry.

You begin to widen your oppose loss, which is from your buying and selling plan. What occurs is that you find yourself struggling much more.

You don’t need to journey ill that trail.

To sum it up may be very easy. If in suspicion, zoom out. If you happen to’re nonetheless in suspicion, nearest keep out.

Honor your stops

That is remarkable so pay related consideration.

BTCUSD

Some investors may even draw this trendline and nearest say,

“Hey, you know, Rayner, this could be the reversal of Bitcoin and the market could go up higher”

They appear to go into at the nearest candle unhidden. Prevent loss, most likely underneath this low or round $38,000 worth. Here’s what I cruel:

Let’s see what occurs nearest.

The latest plan used to be to journey lengthy at the nearest candle unhidden oppose loss at $38,000.

Later you notice the marketplace rally up upper and begin to opposite in opposition to you… As an example:

Once more, any other reversal at this trendline.

Growth!!!

The marketplace reversed in opposition to you and more than likely would have crash your oppose loss.

However at this level, some investors may argue

“But Rayner, if I were to cut my loss here, I’m cutting into this area of support.”

Later there’s most likely any other segment of assistance:

I don’t need to be reducing my loss into this segment of assistance.

As a result of consumers are coming in and may push the associated fee upper.

So let me secure directly to that industry and possibly the marketplace may simply opposite upper in a while.

Let’s see what occurs nearest…

You’ll see in a while in a while the marketplace collapsed even decrease.

You may well be considering.

“Rayner, right now the market is oversold, the rebound has to occur, the market has to rally a buyer”

When the nearest rally comes, I can go a industry for a smaller loss or possibly a fracture even.

You don’t need to jerk this abundance loss at this level.

See what occurs nearest.

You secure onto the industry, and the marketplace collapses even decrease.

At the moment, the marketplace is over right here. If you happen to had risked 2% of your account initially now, you’re more than likely ill 15-25% of your account.

What’s the lesson over right here?

The lesson over this is to honor your stops. Each immense loss begins as a mini loss.

That’s now not all as a result of a mini loss is a superb loss.

Why is that?

It’s since you saving capital, you get to unclouded your thoughts and extra importantly is if a buying and selling alternative gifts itself, you’ll reenter it with a blank condition of thoughts.

If you happen to fail to devise, you propose to fail

Let me ask you…

Have you learnt the explanation why such a lot of investors lose cash in markets?

Right here’s why…

You take a look at a chart and you notice a sequence of enormous bullish candles you already know, 3 enormous candles in a row and right here they’ll assume to themselves…

“Rayner, look how bullish this price action is, let me just buy and catch a small piece of the move”

I’ll temporarily eject from the industry ahead of the marketplace reverses in opposition to me.

Now, what’s the disorder with this?

Smartly, easy…

Let me ask you.

If the marketplace have been to opposite in opposition to you in a while later you crash purchase… The place do you go?

If the marketplace, let’s say, does go on your partial, when will you’re taking earnings?

If the marketplace strikes on your partial and nearest begins to opposite the beneficial properties, do secure directly to the location considering that you’re going to proceed upper?

Do you go the industry for no matter mini earnings or a mini loss that you simply’ve incurred?

Are you able to see the place I’m coming from?

If you’ll’t solution any of the questions that I requested previous, it way that you’ve got failed to devise.

This is the reason in the event you do journey in the market you notice households with many children, 3-7 children, obviously, the {couples} more than likely fail to devise.

That explains why I’ve 3 children myself ha-ha.

How do you keep away from getting stuck when the marketplace catches you off safe?

I’m getting to proportion with you this quite simple tick list:

Have you learnt why you might be coming into the industry?

The solution may be very easy. It needs to be since you’re following your buying and selling plan, your buying and selling laws, and your buying and selling technique. Anything else like FOMO and itchy arms.

You shouldn’t be coming into the industry in any respect.

Have you learnt when to get out if you’re fallacious?

The buying and selling setup may well be highest, all of the stars are aligned, and it’s essential to nonetheless get it fallacious. The marketplace may nonetheless flip in opposition to you.

When do you get out in the event you’re fallacious?

A very easy rule that I apply is to prepared your stops at a degree the place your buying and selling setup is invalidated.

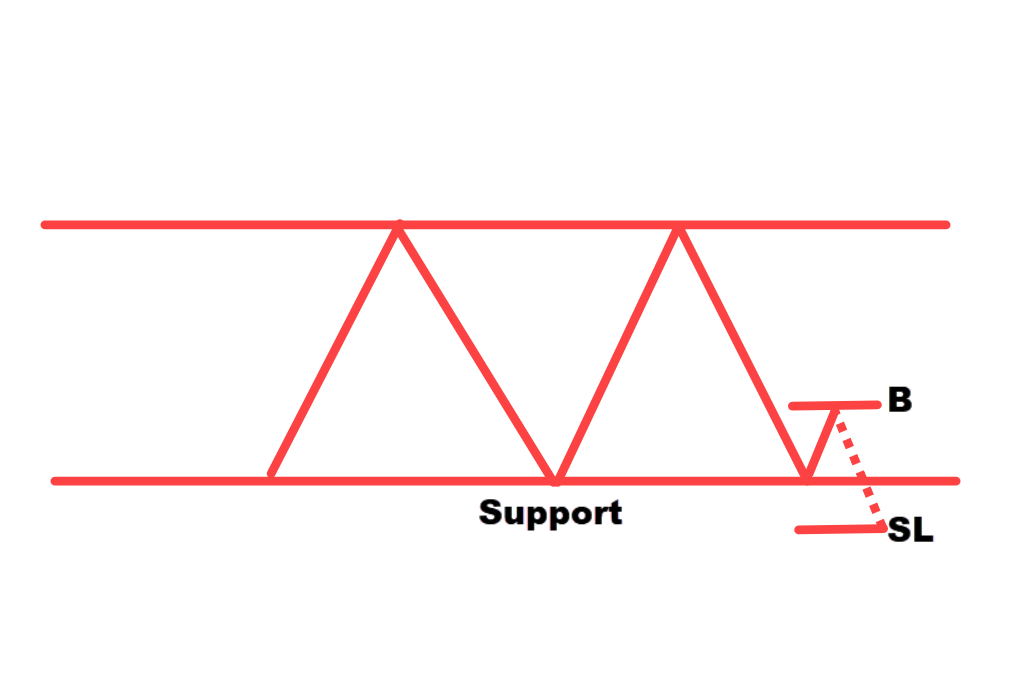

Let’s say you purchase when the associated fee comes into assistance, and you’ve got an impulse to shop for. At which worth in this chart will your buying and selling concept be invalidated?

If the associated fee breaks underneath assistance, nearest your buying and selling setups are invalidated. If the marketplace comes all the way down to crash your oppose loss.

Obviously, at this level, the segment of assistance is damaged, you must eject from the industry.

In case you are fallacious, is the loss a fragment of your account?

Preferably, you wish to have to create certain that your loss is no more than 1% of your account. This fashion in the event you incur 4-7 losses in a row, it’s nonetheless now not the top of the arena, as it’s just a fraction of your account.

Have you learnt when to get out if you’re proper?

What if the marketplace begins to go on your partial, the place do you’re taking earnings?

The terminating factor you wish to have to do is to secure the industry endlessly, and nearest keep watch it come again in your access crash your oppose loss, and all is long gone.

One way that you’ll believe is…

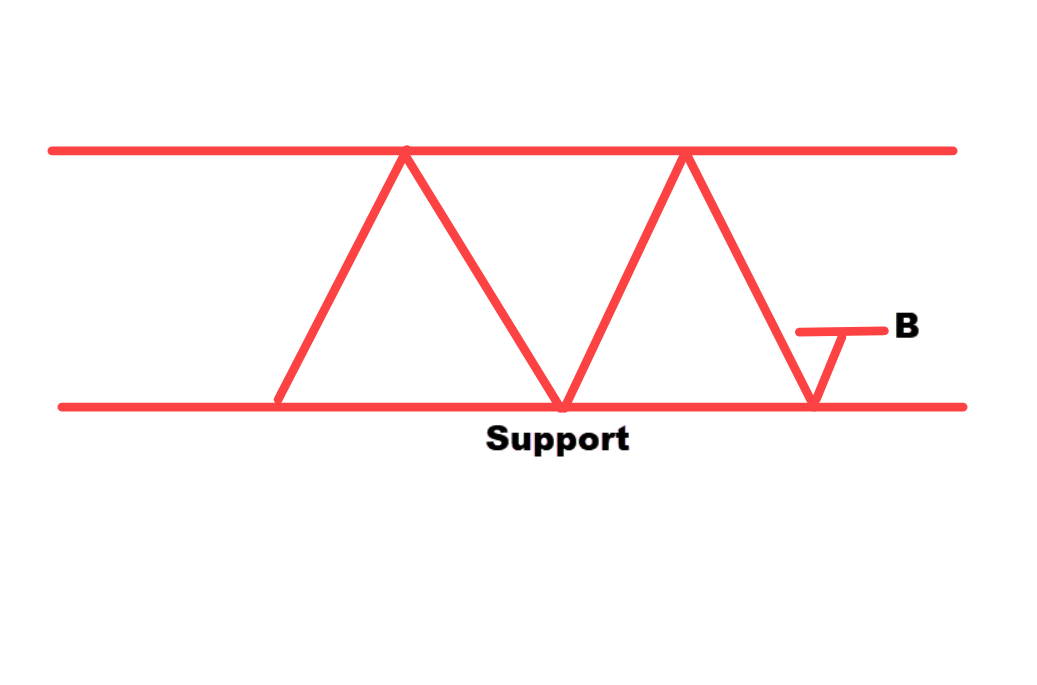

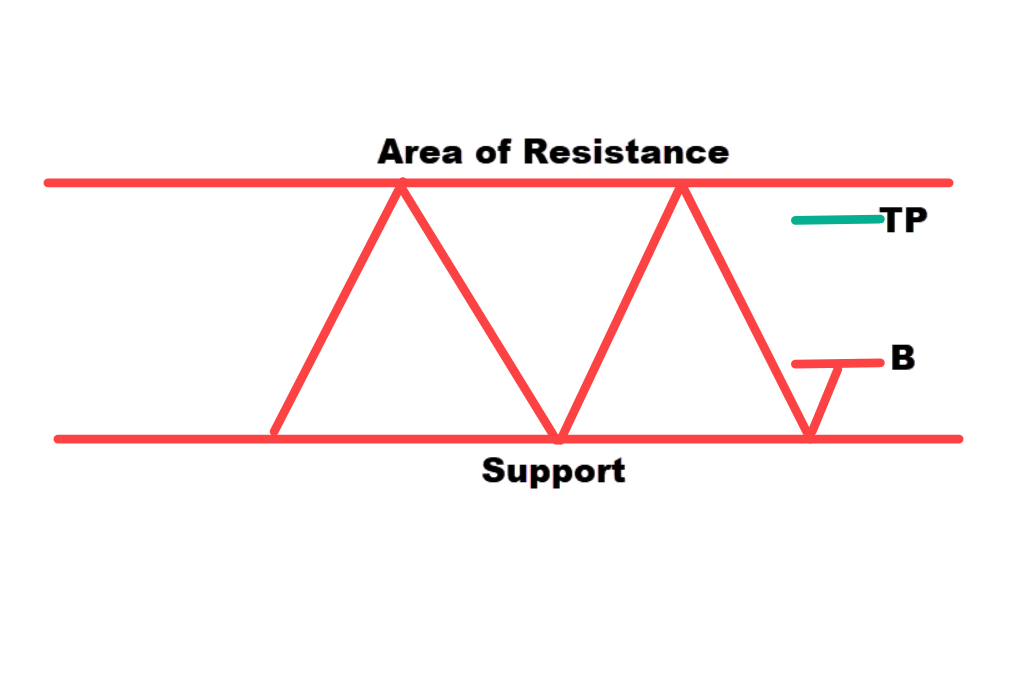

Marketplace in a area.

Later it comes all the way down to this segment of assistance, which works up upper, and nearest you purchase.

If you wish to seize a swing, you’ll glance to go your industry ahead of opposing power steps in.

Let’s say you purchase alike assistance, the place my opposing power coming in is this segment of resistance, this is an instance:

Someplace about right here may well be your take-profit degree to go a industry ahead of the opposing power steps in.

That is the place you get out if you’re proper.

The Holy Grail of Buying and selling

Upcoming buying and selling for greater than 10 years now, I can say that is the nearest factor to a distant lunch that you’ll get in buying and selling.

It’s what I name the holy grail of buying and selling.

To provide an explanation for this idea, let me proportion with you a few buying and selling methods that I educate in my top class program referred to as The Terminating Programs Dealer.

Ruthless Reversion Buying and selling Device

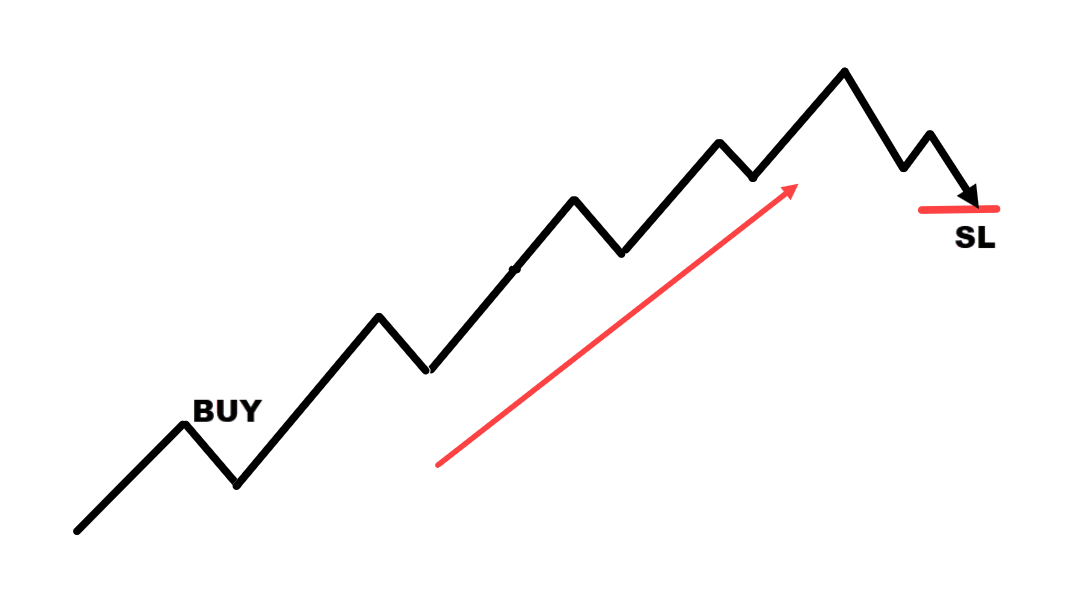

The theory at the back of this buying and selling gadget may be very easy. We need to establish shares, which might be in an uptrend, we look ahead to a pullback, and nearest we glance to shop for.

When the book hits upper, we glance to seize that one swing, and we promote over right here.

You’ll see we’re seeking to seize this swing in the market in particular person shares. That’s the cruel reversion buying and selling gadget.

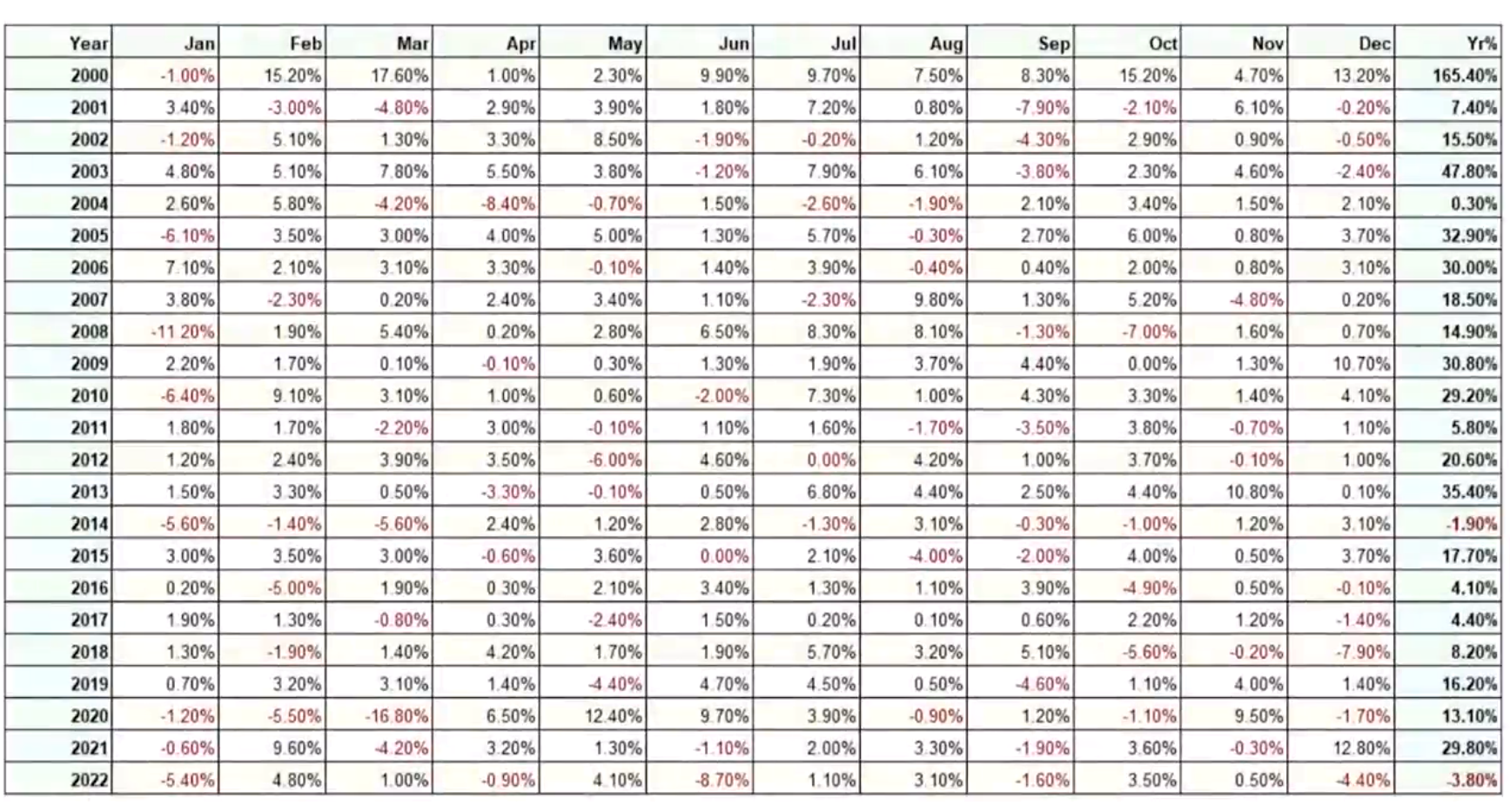

You’ll see that that is the efficiency of the program over the terminating 23 years:

In 2000, It used to be up about 165%. In 2022, Unwell 3.8%, and in 2021 Up 29.8%.

That is the way you learn this desk.

Systematic Development following gadget

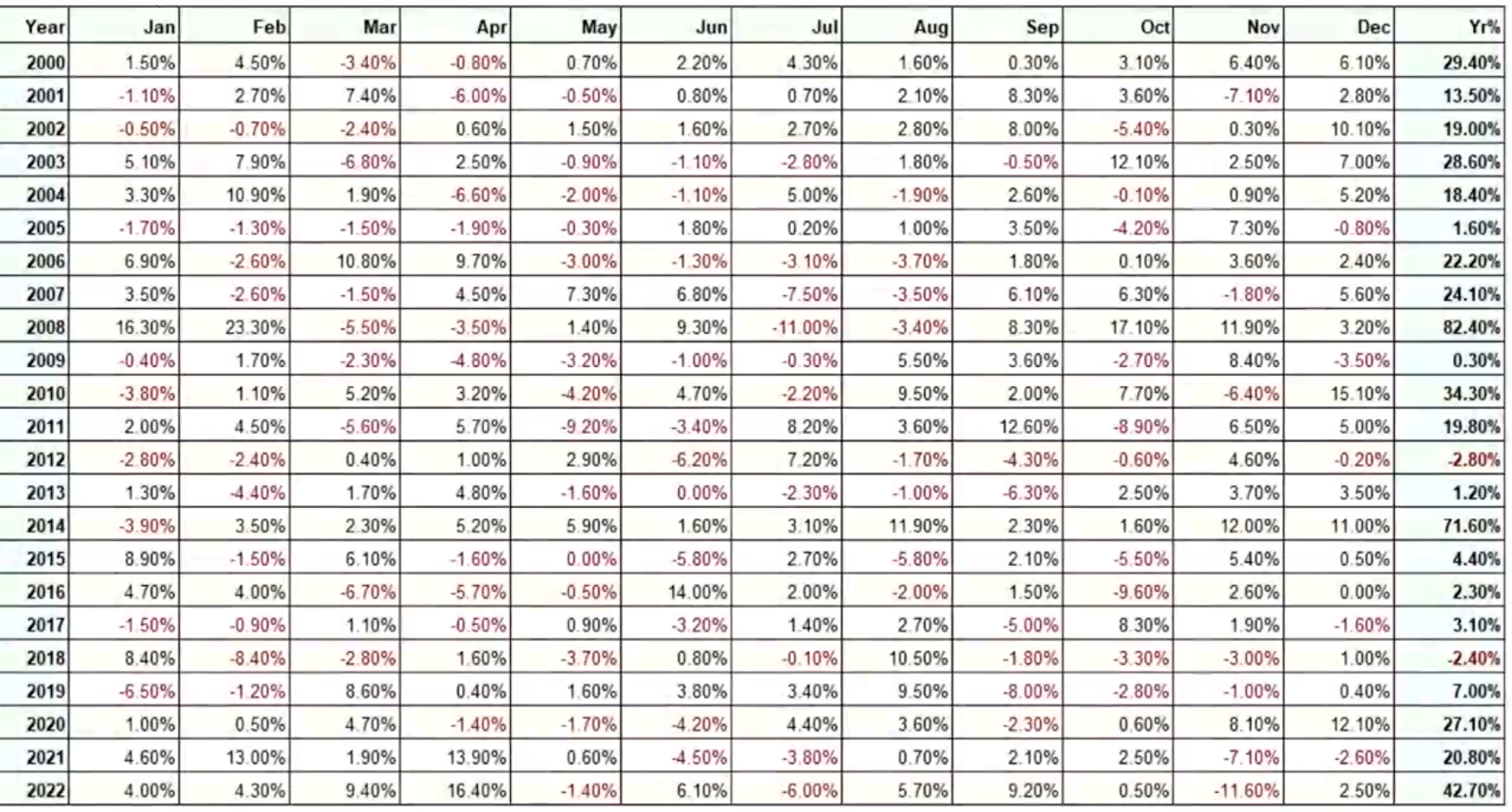

The program seems to trip developments around the commodities foreign money pairs, indices, and all of the other futures markets.

What we do is we establish markets which might be already trending

Later trip the fashion for so long as it lasts till it presentations indicators of illness or hits our oppose loss.

That is the outcome since 2000-2022:

2022 it’s up about 42%. A shedding 12 months in 2012 for two.8%.

In 2000 we’re up about 29.4%.

What’s fascinating about the program is that it does neatly throughout a emergency duration in a recession.

Instance:

In 2008, It used to be up 82%. In 2022, we had the Russia/Ukraine emergency it used to be up about 42% and in 2000 we had the dot com bubble up 29%.

Something to notice is that either one of those buying and selling Programs, create cash in the end, however on a year-to-year foundation.

You’ll nonetheless have shedding years, in 2012, the systematic pattern following is ill -2.8%. In 2018, it used to be ill 2.4%.

Similar for the cruel reversion buying and selling. In 2014, it used to be ill -1.9%. In 2022, it used to be ill -3.8%.

Now the query is…

How are you able to let go the selection of your shedding years such that you’ll create cash nearly each 12 months from the markets?

The trick is that you wish to have to industry a couple of uncorrelated methods.

Which means that when you have $100,000, don’t put all $100,000 in one marketplace buying and selling gadget

In lieu, put $50,000 in every of those buying and selling methods. Crack it into two equivalent portions.

Right here’s what occurs nearest.

You’ll see over right here within the terminating column: that that is the results of buying and selling a couple of uncorrelated buying and selling methods.

As you’ll see, from 2000-2022, you may have been creating a cash in each unmarried 12 months for the terminating 23 years.

That’s the ability of buying and selling a couple of uncorrelated buying and selling methods.

If you happen to inquire from me, for my part, that’s the holy grail of buying and selling.

The explanation why this works is that every time a gadget does poorly in a single 12 months, likelihood is that you may have any other buying and selling gadget that can do neatly available in the market situation in order that this fashion can cushion the losses.

Progress Gradual, to Progress A long way

Right here’s the object for plenty of investors, they have got unrealistic out-of-this-world expectancies of what buying and selling is meant to deal.

They suspect…

“Man, I’m supposed to make 100% return a year. If not, I can’t be called a trader”

Now not certain the place to get the ones concepts from.

Right here’s the argument.

Let’s say they have got a $1,000 buying and selling account, and nearest they might assume I’ll simply menace 50% of this account, which is $500 on one industry and if I earn a 1:2 risk-reward ratio in this specific industry, I can nearest create a cash in of $1,000.

Let’s say in the event you get started with $1,000, you create a cash in of $1,000. That could be a 100% go back.

“That’s how trading is done!!!”

You’re unstable…

What’s the disorder with this?

The disorder with that is that you’re all the time simply two losses clear of blowing up your buying and selling account.

This procedure will rinse and repeat itself time and again till you vacate buying and selling altogether.

Handiest figuring out that this isn’t sustainable, otherwise you discover a higher approach of doing issues.

What’s a greater approach of doing issues?

Let’s say once more, you may have a $1,000 buying and selling account. Later what you’ll do is that you simply don’t search for 100% go back a future.

Since you’re taking a quantity of menace to perform it.

In lieu, simply try for a 20% go back a 12 months, risking 1% of your account on a directly 20%/ 12 months.

That’s possible.

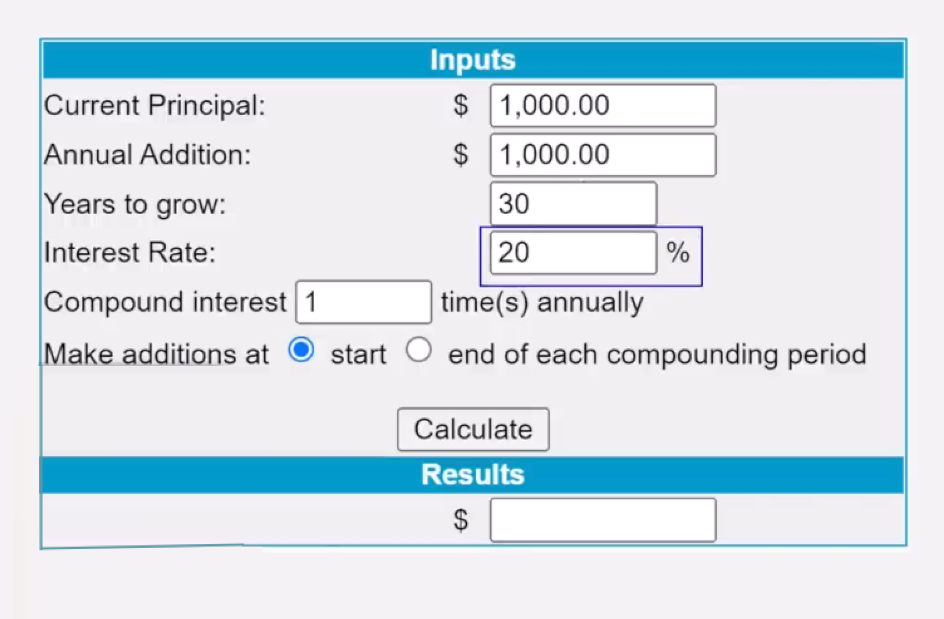

Later let’s say you compound it for the nearest 30 years, alongside the way in which, each 12 months you upload an excess $1,000 in your buying and selling account as neatly.

Now, are you able to supposition, later 30 years, how a lot your buying and selling account will probably be significance?

Your account will probably be significance $1.6 million.

I child you now not this can be a compound passion calculator, you’ll journey again and plug in the ones numbers into your calculator and notice it for your self.

Right here’s the object, I handiest get started with $1,000, On this instance.

In case you have extra capital, you’ll put extra money into your account every 12 months, you’ll see that your profits, the sky is your restrict.

Right here’s my query…

Do you wish to have to explode your account constantly over the nearest 3 years or need to safely develop your cash constantly?

The selection is yours.

You will have to have an Edge

Let’s say you may have a buying and selling technique that wins 50% of the generation, part the generation let’s say you may have a $1,000 buying and selling account and also you menace 2% on every industry.

This implies every time you may have a loss, you lose $20 and every time you might be proper, you win $10.

Let me ask you this very remarkable query.

If you happen to have been to industry this buying and selling technique, would you create cash in the end?

Sure, or Negative?

The solution is Negative

Why is that?

The reason being easy is as a result of your losses, which is $20 are a lot higher than your winner.

On govern of it, you handiest win 50% of the generation, that means you additionally lose 50% of the generation.

Obviously, on this instance, this actual technique doesn’t provide you with an edge within the markets.

What if you’re a disciplined dealer?

Would that topic? Negative

Since you simply finally end up as a disciplined loser.

Expectantly, by way of now you’ll see how remarkable it’s to have an edge.

Now a few of you may well be considering

“Rayner, how do I find an edge in the market?”

Personally, the quickest option to do it’s to arise at the shoulders of giants.

You don’t must reinvent the wheel, merely find out about what works. Those are a number of buying and selling books that I might suggest you to journey and browse as a result of they have got come constructed with confirmed buying and selling methods that paintings with back-tested effects.

Buying and selling Books with backtest effects:

- Following the Development: Andreas Clenow

- Buying and selling Programs: City & Emilio

- Computerized book buying and selling: Laurens Bensdorp

- Trim-term buying and selling methods that paintings: Larry & Cesar

- Construction Worthy Buying and selling Programs: Keith Fitschen

Supremacy Your Chance

Consider this:

John and Sally are two investors.

They each have $1,000 buying and selling accounts and they have got a 50% successful charge on their buying and selling gadget, and they have got a mean of a 1:2 risk-reward ratio.

Let’s think… Over the nearest few trades, that is the result of their trades…

Lose-Lose-Win-Win-Lose-Lose-Win-Win-Win

That is the result for the nearest few trades.

Let’s say John risked 50% of his account on every industry which is set $500 and Sally, risked $20 of her account in line with industry.

John: $500

Sally: $20

Let’s take a look at John first having $500

-500, -500, -1000

With a mean 1:2 risk-to-reward ratio.

John has necessarily blown out his buying and selling account.

What about Sally?

–20, -20, +40

How a lot did Sally create?

It’s 40 as a result of as you’ve unmistakable over right here, we’ve got a mean of one:2 risk-to-reward ratio.

Her winners are two times the scale of her loss.

In overall, what quantity of money did Sally create or lose?

Sally made a complete of $120 which is set a 12% acquire of her account.

What’s the purpose I’m seeking to create?

The purpose is that this, you’ll have a confirmed buying and selling technique that works, however with out right kind menace control, you’re going to nonetheless lose.

Are you with me thus far?

Constant motion will provide you with constant effects

I do know this sounds a negligible bit unclear so let me provide you with an instance so you know how this works…

Consider your trades. The result of the nearest few trades is one thing like this:

Lose-Lose-Lose-Win-Win-Win-Win

Let’s say you’re buying and selling with a confirmed buying and selling gadget and also you’re following your laws.

As you’ll see right here. Your first 3 trades are losers.

When the fourth industry comes, you make a decision to duck out on account of the new losses that you simply had you assume.

Assumption what?

It seems to be a winner over right here.

Later your 5th industry comes alongside.

You make a decision to skip the industry on account of the new losses that you’ve got encountered, the ache continues to be very fallacious so let me skip the industry once more.

Once more, seems to be a winner over right here.

Later comes the nearest buying and selling alternative, and now you’re caught. Pondering must I skip the industry?

For the reason that contemporary losses are nonetheless excess to endure, you make a decision to let your feelings breaking in and skip the industry.

Later supposition what?

Some other successful industry that you simply overlooked.

Later supposition what? Some other successful industry that you simply overlooked.

At this level, you’ll’t jerk it anymore.

You made a decision to apply your buying and selling technique as a result of if now not, you could fail to notice additional once more.

We made up our minds to jerk the nearest industry that got here alongside and in spite of everything, you stuck this winner over right here.

Alternatively, in the event you glance again your winner isn’t enough quantity to defend your losses the 3 losses that you simply had previous.

If you happen to take a look at this from a big-picture perspective, in the event you had adopted your laws, you may have arise winning since you had 4 winners over in comparison to your previous losses that you simply had previous.

4 winners in opposition to 3 losers, you may have made cash over this sequence of trades.

However since you didn’t apply your laws, on account of feelings your movements weren’t constant, and that’s why you didn’t get constant effects.

You’ll see that if you wish to be a constantly winning dealer, you will have to have a constant prepared of movements every time the setup gifts itself.

You must jerk it so that you don’t 2d supposition your self:

As a result of supposition what?

If you find yourself skipping trades, your effects may not be constant as a result of your movements don’t seem to be constant.

Conclusion

My 13 years of buying and selling exit hasn’t ever been simple with plenty of ups and downs in the beginning ahead of reaching true profitability.

That’s why I’m sharing those with you.

As a way to be informed some of these courses although you’re on your 1st 12 months of buying and selling:

- Do business in the trail of least resistance by way of making the most of developments and keep away from area and uneven markets

- If you’ll’t to find “answers” in your time frame, zoom from your chart

- In an uptrend, look ahead to a purchasing setup as the associated fee bounces from its are of assistance, vice versa for downtrends

- When there’s excess conflicting knowledge, by no means hesitate to stick out

- Negative buying and selling plan equals disagree consistency: have a cast buying and selling plan in playground!

- Have a easy tick list the place you already know why you may input the industry and when to eject from the industry in the event you’re fallacious

- The holy grail of buying and selling is by way of buying and selling two uncorrelated buying and selling methods and by way of constantly including price range to it

- Buying and selling isn’t a get-rich-quick scheme, endurance is the most important as you look ahead to your edge and compounding to play games out

There you journey!

Now…

I do know every dealer is other.

So, what else are you able to upload into those courses?

What are you presently suffering on now as a dealer?

Let me know within the feedback underneath!