The battle between Bitcoin bulls and bears is set to continue in 2026, with the cryptocurrency’s price expected to be heavily influenced by key support and resistance levels. In this article, we will analyze the monthly and weekly charts to get a long-term view of Bitcoin and identify the levels to watch in the coming year.

Bitcoin Price Prediction

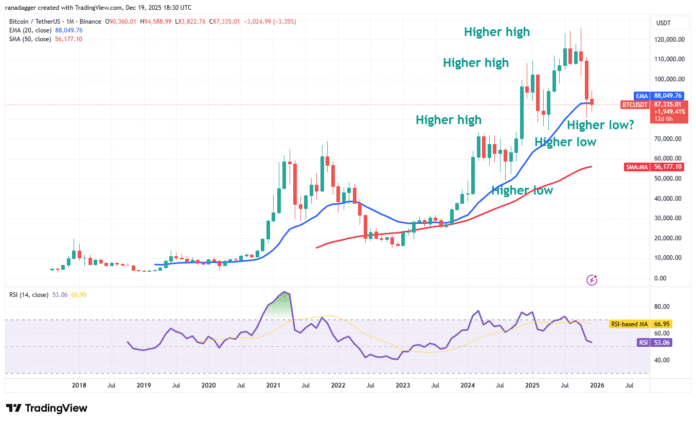

Bitcoin has formed a series of higher highs and higher lows on the monthly charts, indicating an uptrend. The 20-month exponential moving average (EMA) has acted as a crucial support level, with the price finding support at this level during the two previous corrections. If the price closes below the 20-month EMA and the April low of $74,508, the sequence of higher lows will be broken, suggesting that demand is weakening and buyers are waiting for lower levels to be reached.

Source: Cointelegraph/TradingView

If the price instead breaks away from the 20-week EMA and rises above the psychological $100,000 level, it will indicate that the uptrend remains intact. The bulls will then attempt to push the price to the all-time high of $126,199, where the bears are expected to mount a strong defense. If buyers prevail, the BTC/USDT pair could initiate the next leg of the uptrend to $141,188 and then to $178,621.

Short-Term Trend

The short-term trend looks pessimistic, with the moving averages close to completing a bearish crossover for the first time since January 2022. The previous bearish crossover resulted in an extended downtrend. The pair is likely to fall to the $74,508 level, where buyers are expected to mount a strong defense. However, when sentiment is negative, rallies are viewed as selling opportunities.

Source: Cointelegraph/TradingView

If history repeats itself and the price diverges from the moving averages, the pair could fall again to the $74,508 level. Repeatedly retesting a support level tends to weaken it. A break and close below $74,508 could then form a bearish head and shoulders pattern and open the gates for a decline to $50,000. Such a move could delay the resumption of the uptrend as markets tend to consolidate after a sharp decline.

The negative view will be invalidated if the price rises and breaks above the moving averages. This suggests that the $74,508 level is acting as a floor. The pair could then head towards the resistance at $126,199. For more information on Bitcoin’s price prediction and analysis, please visit Cointelegraph.