Crypto Billionaires Threaten to Leave California Over Proposed Wealth Tax

A proposed 5% wealth tax on California residents with assets over $1 billion has sparked a heated debate, with some of the state’s wealthiest individuals, including crypto billionaires, threatening to leave. The Service Employees International Union-United Healthcare Workers West proposed the tax in November 2025, aiming to raise up to $100 billion from 200 state residents to offset cuts in federal funding for California’s public health care program.

The proposal has been met with resistance from prominent investors and California-based billionaires, such as PayPal co-founder Peter Thiel and Google co-founder Larry Page. They argue that the tax would be a disincentive for wealthy individuals to stay in the state, potentially depriving California of important sources of tax revenue. However, experts suggest that the threat of a mass exodus may be exaggerated, citing past experiences where similar taxes have been introduced without significant migration of the wealthy.

The Proposed Tax and Its Implications

The proposed tax would impose a 5% levy on wealth, rather than income, which would constitute a tax on unrealized gains. Additionally, it would introduce a one-time tax of $1 billion on citizens with assets exceeding $20 billion. The measure requires 850,000 signatures to be approved for the popular vote in the November 2026 election. Crypto industry leaders, such as Jesse Powell, co-founder and chairman of cryptocurrency exchange Kraken, have called the measure a “theft” and warned that it would drive billionaires away, taking their spending, hobbies, philanthropy, and jobs with them.

Bitwise CEO Hunter Horsley stated that many who have made California great are “quietly discussing leaving the state or have decided to leave in the next 12 months.” He believes that billionaires are likely to follow a growing trend of “people not giving their views at the ballot box” and migrate to other jurisdictions. Chamath Palihapitiya, a former Facebook executive and prominent venture capital investor, claimed that people with a total net worth of $500 billion have already fled the state due to the proposed wealth confiscation tax.

Will the Rich Actually Leave?

Research suggests that the threat of a mass exodus of the wealthy may be overstated. A working paper by the Tax Justice Network found that after wealth tax reforms were introduced in Norway, Sweden, and Denmark, less than 0.01% of the richest households moved. Similarly, a study by the London School of Economics found that the super-rich are quite localized and unlikely to leave their home country. Inequality.org, an advocacy group that studies wealth distribution in the U.S., noted that top earners tend not to move because of their family, social networks, and local business knowledge.

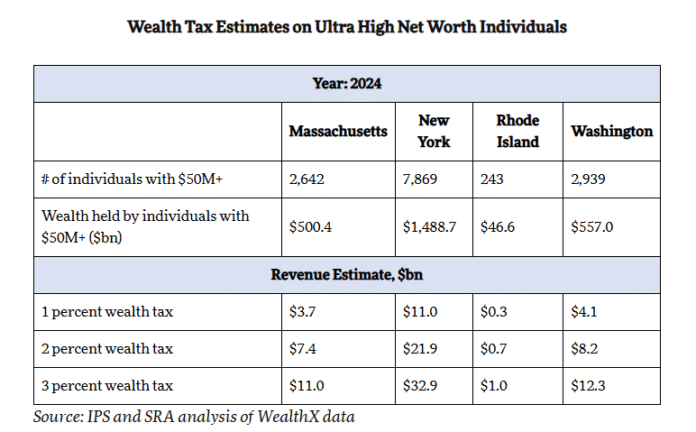

Despite tax increases in Washington state and Massachusetts, the number of people with a net worth in at least seven figures continued to rise, and each state was able to generate significant revenue to fund state programs.  Source: Inequality.org

Source: Inequality.org

Conclusion

The proposed wealth tax in California has sparked a heated debate, with some crypto billionaires threatening to leave the state. However, research suggests that the threat of a mass exodus may be exaggerated. While some degree of tax migration is inevitable, the rich who avoid taxes represent only a tiny percentage of their own social class. The revenue benefits of the proposed tax could be worth it, even if California loses some of its crypto wealth.  Source: Cato Institute

Source: Cato Institute

For more information on the proposed wealth tax and its implications, visit https://cointelegraph.com/news/crypto-rich-leave-california-new-tax-bluff