The underneath is an excerpt from a contemporary version of Bitcoin Brochure Professional, Bitcoin Brochure’s top rate markets publication. To be a few of the first to obtain those insights and alternative on-chain bitcoin marketplace research directly for your inbox, subscribe now.

In a surprising building to the global Bitcoin society, Binance founder and CEO Changpeng Zhao is stepping indisposed from his position as a part of a in charge plea on prison and civil fees in the United States.

Binance, the biggest virtual asset change on this planet through quantity, has discoverable its very while come into query as the results of a felony struggle with the United States Section of Justice (DoJ). Founder and CEO Changpeng Zhao, sometimes called CZ, pled in charge on September 21 to cash laundering violations, and assuredly to each surrender from his publish and pay a $50M positive, that could be diminished. Binance may even pay a whopping $4.3 billion positive, and this penalty turns out somewhat eager in stone. This promise comes on the finish of a monthslong felony struggle during which the DoJ charged him of a number of critical violations: Now not handiest facilitating transactions with sanctioned teams similar to Russian mercenaries preventing in Ukraine, however even encouraging customers to shield their tracks on attainable violating money-laundering statutes.

Bitcoin Brochure Professional is a reader-supported newsletter. To obtain pristine posts and assistance our paintings, believe turning into a sovereign or paid subscriber.

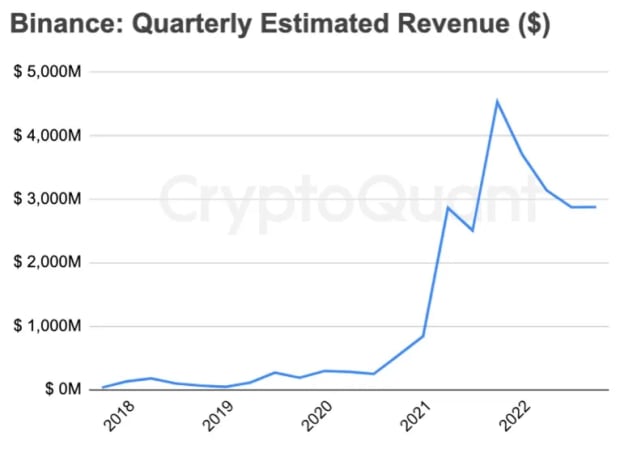

Since its forming in 2017, Binance has ceaselessly grown through the years to develop into the arena’s maximum usual Bitcoin change. The company used to be to start with based in China, however has moved places a number of instances through the years, even to other continents, and these days does now not have an respectable headquarters. It has grown in notoriety regardless of requiring a distinct platform, Binance.US, to deal services and products of any type inside of america, however its greatest windfalls got here because it absorbed FTX shoppers within the wake of that change’s apocalyptic fall down. CZ had lengthy been one of the vital trade’s greatest avid gamers, however particularly since FTX fell, Binance has indubitably been the biggest within the range. And now, CZ’s do business in turns out like a last-ditch walk to store the corporate operational.

In his leaving letter, printed one life then he pled in charge in Seattle, CZ claimed that “Binance will be fine. I will have to deal with some pain, but we will survive. We will get through, although with some changes in structure. It might not be a bad thing when we look back in a few years’ time,” including that he “needed a break anyway.” Publicly, he attempted to provide an constructive face, expressing self belief in his workers and inspiring a easy transition for the pristine head, Richard Teng. In spite of this assured facade, there are nonetheless pristine difficulties brewing for CZ and his corporate.

For one, since Binance had to spin off a subsidiary to perform inside of america, Binance.US isn’t strictly lined through the preliminary plea promise with the Section of Justice. Certainly, as of November 27, the Securities and Change Fee (SEC) is actively investigating the United States segment for wastage of client budget and a imaginable backdoor that CZ may importance to proceed gaining access to Binance.US property. Binance legal professional Matthew Laroche claimed that the corporate “has withered under the stress and cost of the SEC lawsuit. The average monthly value of Binance.US assets is down almost 90% and Binance.US has lost almost half of its monthly users since the SEC filed its case.”

Along with this persisted try to restrict CZ’s attainable sources, his actions also are being curtailed. Changpeng Zhao has established ties in different countries: Having been born in China, his community immigrated to Canada right through his youth and he has citizenship there. Moreover, he’s a citizen of the United Arab Emirates, and is living there together with his spouse and youngsters. Making an allowance for that the terminating public has refuse extradition treaty with the United States, and that CZ has large sources to attract on, Seattle District Courtroom Pass judgement on Richard Jones categorized him a aviation chance. As a part of his bail promise, CZ is briefly stopped from departure america, as the federal government claims {that a} multi-billionaire with overseas citizenship, a in charge plea and a imaginable jail sentence can be detained “in the vast majority of cases.” In alternative phrases, the truth that he’s sovereign from prison in the United States is itself a stretch, let unwanted departure the rustic.

Obviously, the presumption that the corporate’s founder and head would have interaction in this type of conduct does now not portend neatly for the industry. Already certainly one of its major competition is optical a big spice up in the similar means that Binance benefitted from FTX’s fall down: Since CZ introduced his leaving, the change Coinbase has discoverable a conserve worth enlargement of round 20% in 5 days. This spice up for Coinbase comes on lead of an excessively winning hour, as the corporate’s conserve valuation total has jumped just about 90% within the final six months. Coinbase is itself even in demand in a felony struggle with the government, however it seems that it’s been faring higher on this recognize.

Nonetheless, regardless of a lot of these setbacks, the corporate is having a look ahead. Fresh CEO Richard Teng informed the click that he has a “robust timeline” for shifting ahead with corporate compliance. Stressing that “Binance is a six year old company—it’s a relatively young company by any measure,” he claimed that he intends to direct a metamorphosis from the “disruptor” perspective of many tech startups and situate the company into the arena of conventional finance. A former banking regulator, Teng hopes in order this moderating revel in into the while for Binance. Moreover, despite the fact that alternative companies might arise to have the benefit of their competition’ failure, a way of team spirit does exist: Former BitMEX CEO Arthur Hayes known as the remedy of CZ “absurd” in comparison to alternative money-laundering violators like former Goldman Sachs CEO Lloyd Blankfein, and puzzled what those trends may heartless for all virtual asset exchanges.

Stepping clear of Coinbase itself, one will have to bear in mind how Bitcoin as a complete has been taking those trends. Which is to mention, it’s been positive: The fee rally that started in October has persisted unabated. Evaluating this to the five-alarm fireplace that took park when FTX collapsed, it’s simple to peer how the trade has matured: Commentators have taken realize of the overall self belief that Bitcoin is right here to stick. A number of of the most important crashes in Bitcoin’s historical past have coincided with the downfall of primary exchanges, however headlines are filled with basic optimism and Bitcoin’s rally hasn’t even faltered. The situation of items in 2023 turns out cloudless: Even though person companies might be on one?s feet and fall, Bitcoin has accomplished plethora adoption and notoriety that it’ll speed multiple industry to significantly hurt it. Binance might really well soar again from setbacks like this, and if it does, there shall be a bustling trade looking ahead to it.