Let me exit you thru one thing that at a loss for words me for an extended, lengthy year…

The Fibonacci.

It is available in such a lot of other methods, proper?

You may have the Fibonacci fan…

The Fibonacci wedge…

(yeah I’m now not positive the best way to plot that one appropriately!)

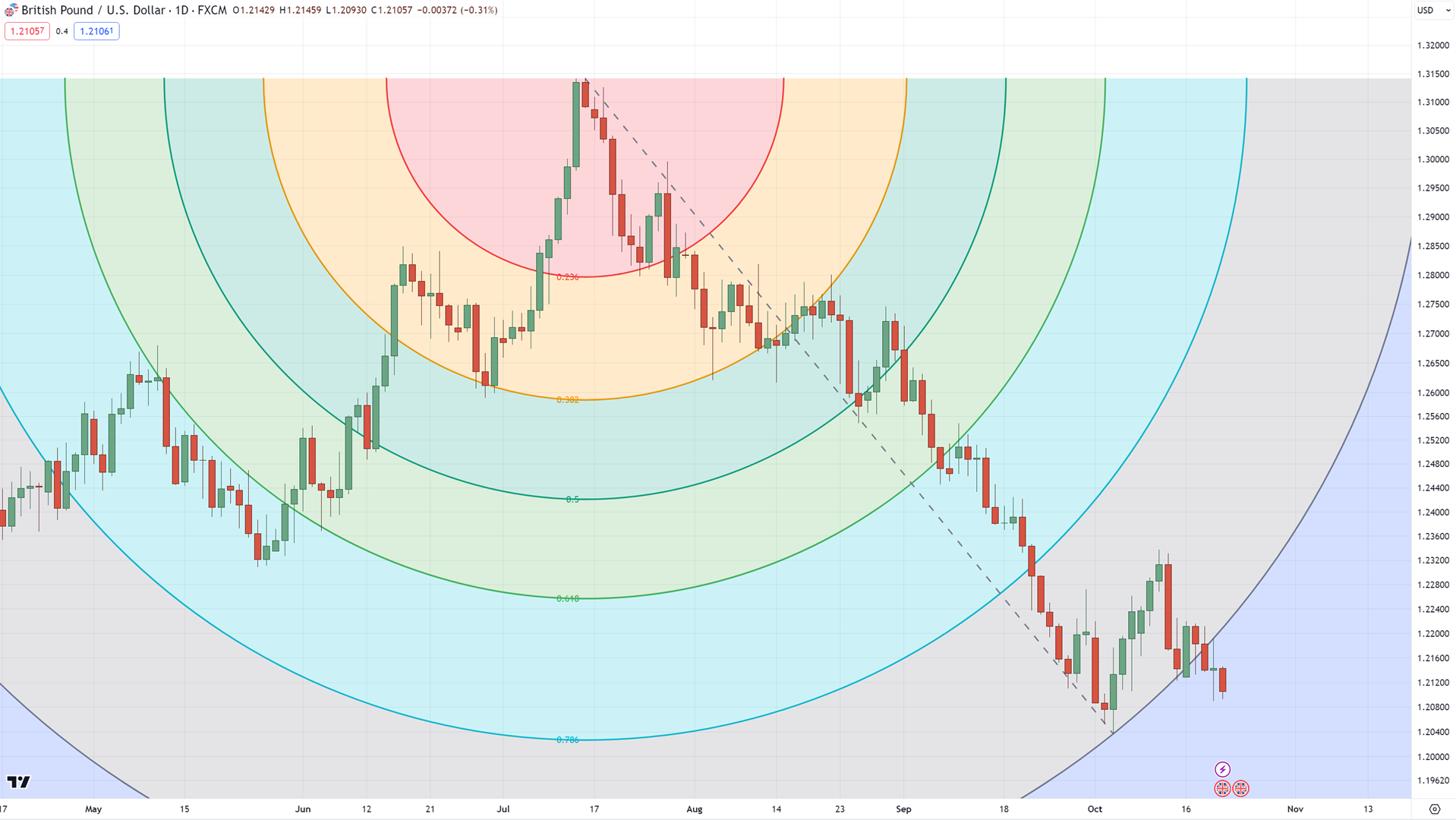

The Fibonacci Velocity Resistance Arc…

And most definitely a helluva accumulation extra Fibonacci particular strikes and shapes for buying and selling in the market which I nonetheless don’t know!

However… what if I instructed you, you most effective wish to focal point at the Fibonacci device that issues?

And what when you devoted a few of your year to mastering it to the easiest stage?

Nice-looking thrilling effects may wait for, proper?

Neatly, that’s what I can train you these days!

An entire masterclass on the best way to worth Fibonacci retracement…

It seems so blank at the chart, don’t you settle?

So, right here’s an inventory of what you’ll be informed these days…

- Methods to worth the Fibonacci retracement as a superpower to strengthen your tide buying and selling technique

- How you’ll be able to worth the Fibonacci retracement to identify buying and selling setups systematically and persistently

- The “secret” solution to worth the Fibonacci retracement to gauge marketplace energy and sickness

- A fool-proof form for opting for which Fibonacci ranges to business for pullback buying and selling

- The undercover to timing and managing explosive breakout trades with the Fibonacci retracement

- Methods to business Fibonacci retracement on field markets in order that you by no means finally end up at the flawed aspect of the chart

A lovely straight-to-the-point information, next!

And through the way in which…

I recommend you learn those guides first, simply to arrange your self sooner than we get began in this one:

The Very important Information To Fibonacci Buying and selling

Methods to Draw Fibonacci Retracement: A Step-by-Step Information for Buyers

Are you able?

Upcoming let’s get began!

How To Significance Fibonacci Retracement To Enhance Your Buying and selling Plan Right away

Right here’s how that is taking to exit…

I wish to produce positive that whilst you end this information, your buying and selling plan remains to be intact.

Incorrect heavy upheavals, refuse abundance changes.

However how do I safeguard this?

It’s Easy.

You get started through checking possibly sooner the Fibonacci retracement is for you!

So, this device is for you when you’re a…

Worth motion dealer

Whether or not you business the 1-hour or the day by day time-frame, it doesn’t topic.

If you’ll be able to analyze tendencies and gardens of values separate of signs…

And have the ability to determine swing highs and lows…

Upcoming, boy, you’re going to like understanding the best way to worth Fibonacci retracement!

In the event you’re nonetheless having a sun-baked year figuring out the ones, you’ll be able to at all times test this out then, too.

OK, then, Fibonacci retracement would possibly fit you when you’re the kind of dealer who…

Best makes use of minimum signs

If that is so, next this masterclass is no doubt for you.

Consider having signs in your chart…

And next having so as to add Fibonacci retracements…

Err, it is going with out announcing – that chart seems ridiculously busy!

You’d be proper in pondering there’s remaining occurring.

So if you wish to worth the Fibonacci retracement, worth minimum signs and retain your charts easy.

Alright, now that you know whether or not that is for you or now not… the place does the Fibonacci retracement in fact are available in?

How can it strengthen your buying and selling plan?

Methods to worth Fibonacci retracement to have killer-accuracy buying and selling setups

Spot a trending marketplace?

Easy, look ahead to a worth rejection on the 38.2% retracement!

How a couple of ranging marketplace?

Best focal point at the 78.6% stage buildup and steer clear of the center!

(I’ll communicate extra about this then)

You spot, the Fibonacci retracement is a lovely flexible device in any marketplace status!

Which means that in any marketplace status, you have got a setup.

Is smart?

Now don’t fear, my pal!

This division is only a style of what’s to return, as I’ll proportion with you whole methods that relate to these setups.

Nearest up…

Differently to know the way the use of Fibonacci retracement can get better your buying and selling plan is that this:

You’ll have the ability to as it should be decide the way you must govern your business.

OK, I listen your good questions…

“What?! Using the Fibonacci retracement to manage your trade?”

“How can that be?”

Don’t fear, my pal.

I’ll splash all my secrets and techniques within the then division.

Methods to worth Fibonacci retracement to gauge the energy of any marketplace

Right here’s a reality you’re most definitely regular with…

Now not all tendencies are equivalent.

Heck, now not even all levels are equivalent!

There are blank tendencies….

And there are uneven ones…

So now the query is…

How are you aware how robust or vulnerable the breakout is sooner than the breakout?

Attention-grabbing query, proper?

To respond to this, there are 3 “secrets” to believe:

- Expanding pattern energy

- Lowering pattern energy

- Expanding field breakout

Let me provide an explanation for…

Expanding pattern energy

To position it in easy phrases, we wish to know if the prevailing pattern is getting more potent.

The important thing this is to take a look at the pullbacks in an present pattern and struggle to measure how a long way they have got retraced…

If the utmost 2-3 pullbacks sustained above the 38.2% stage…

…next it mainly displays that the fashion is wholesome or, is set to get even more potent!

However there’s the alternative aspect of the coin, proper?…

Lowering pattern energy

If the utmost 2-3 pullbacks are turning into steeper through repeatedly touching the 61.8% department…

…next the associated fee tells us that the fashion is getting weaker because the pullbacks get steeper.

Construct sense?

OK, how about field markets?…

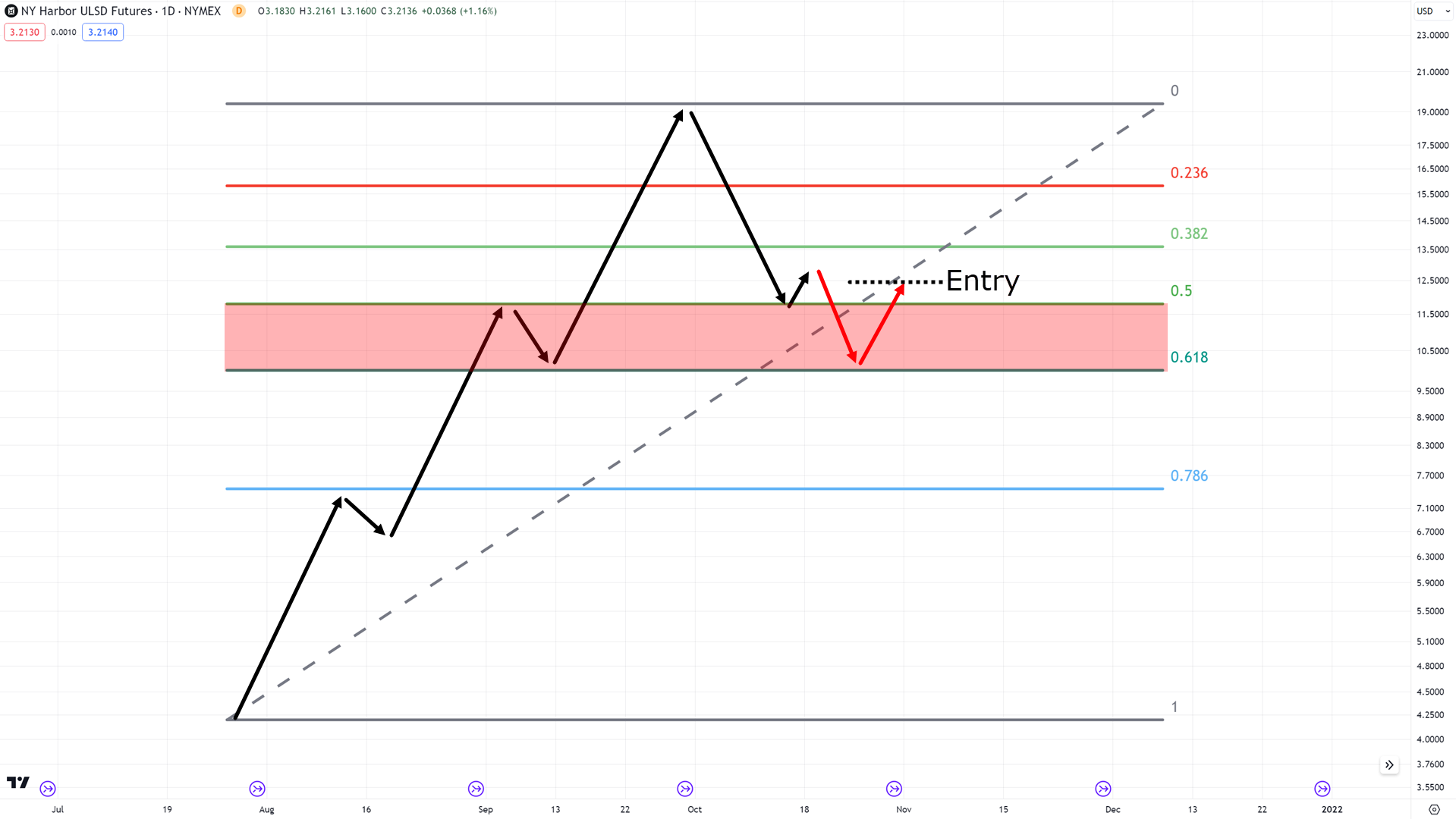

Expanding field breakout

Now, for all you understand, a field marketplace can utmost for months and even years!

It may possibly retain reducing up and i’m sick, making fake breakouts!

So how are you aware when it’s about to split out?

Neatly, the trick this is first to devise your Fibonacci retracement within the field…

Upcoming look ahead to a flag trend to mode above the 23.6% stage or under the 78.6% stage (relying on the way you plot the Fibonacci retracement).

Right here’s what I heartless…

What precisely does this indicate?

It signifies that if the associated fee methods a flag trend and sustains above the 23.6% stage, as an example, patrons are establishing to “build up” proper under resistance…

…which is ceaselessly an indication of energy!…

And the similar theory applies to dealers as smartly…

However general, the base sequence is that this:

You must test how the associated fee reacts to sure ranges of the Fibonacci retracement.

Why?

…so to decide the then attainable go within the markets!

Construct sense?

Neatly, pluck a couple of moments to seem over the charts and explanations once more.

Later letting it sink in, you’ll most definitely be questioning…

“Okay, but how do we actually trade this?”

“What’s the strategy?”

“How do I use Fibonacci retracement using these concepts?”

They usually’re splendid questions!

Within the then two divisions…

It’s year to get right down to the nitty-gritty main points.

Retain studying!

Methods to worth Fibonacci retracement to business and govern pullbacks within the markets

So, the very best “season” to seize pullback trades is that this:

When the associated fee rejects across the 50.0% and 61.8% department…

This sort of motion is precisely what you’re searching for.

Recall that if the associated fee is unwelcome right down to that department, the fashion is probably weakening…

However, what must you do?

You’re taking your income sooner than the department of resistance…

A pleasing, blank, and easy swing buying and selling setup!

Are you able to see that it really works in theory?

However how does it paintings with actual charts?

Let’s have a look at the best way to shoot this setup step-by-step…

Step #1: Determine a long-term uptrend

“Duh, of course, we need an uptrend, any textbook can tell you…”

Sure, it is going to appear detectable…

However the explanation why I’m pointing this out is that you wish to have to grasp “when” you must worth the Fibonacci retracement!

Selecting the correct future is the most important for this setup.

To lend a hand, a long-term shifting moderate, such because the 200-MA would backup…

198, 211, 230-period…

It doesn’t topic!

What issues is that you simply’re the use of a long-term shifting moderate.

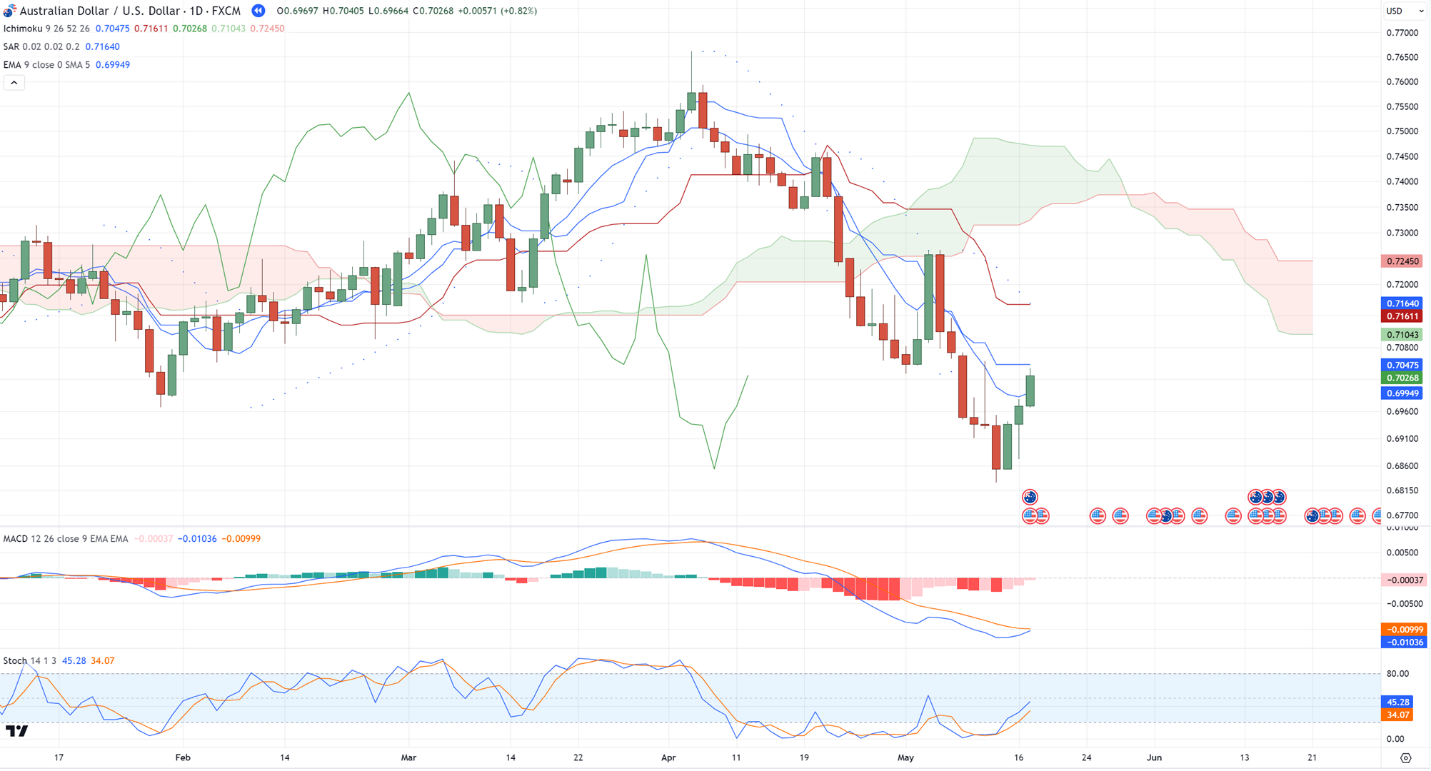

So, if the tide worth is above the long-term shifting moderate, next you’ll be able to go directly to the then step…

Step #2: Stay up for the associated fee to retrace under 50.0% Fibonacci retracement

That is what you’ve been looking forward to.

You wish to have the marketplace to return to our department and supremacy it right into a lure i’m sick under the 50.0% stage…

(P.S. If the associated fee closes not up to 61.8%, next there’s a prospect that the fashion is reversing already.)

Alright so now they’re in play games…

Step #3: Stay up for a worth rejection to go into the business

In a position to spring the lure?

Superb, as a result of what you wish to have to search for then is for the associated fee to near again above 50.0%…

Upcoming, input on the then candle unmistakable!

For ban loss, you’ll be able to merely subtract 1 ATR under the lows…

All excellent thus far?

Neatly, now that it’s in playground – how do you govern the business?

Let’s have a look…

Step #4: Travel on the later resistance department

I are living through please see blonde rule:

“Always place your stops and take profits reasonably.”

In snip, don’t be too enthusiastic and grasping along with your chance to praise!

It’s exactly why you at all times wish to pluck benefit sooner than the department of resistance…

Simply there!

Now, after all, you’ve most definitely discovered… It is a cherry-picked chart.

Like the whole thing else, it isn’t a 100%-win charge, holy-grail technique and there will likely be some losses.

However however, right here’s what this setup looks as if at the snip aspect…

Alright!

Now, how about breakouts in lieu of pullbacks?

As a result of, when you recall, there are most effective two techniques to go into trades (one among which I simply shared with you).

It begs the query – how do you worth Fibonacci retracement on breakout trades?

Neatly, buckle up – as that’s precisely what I’m going to turn you!

Methods to worth Fibonacci retracement to seize and journey explosive breakouts within the markets

Right here’s the excellent news…

If you’ve realized the best way to seize breakouts, you don’t have to select between this and the pullback setup!

Why?

Neatly, each setups grant two other situations.

It signifies that you in fact get two methods so as to add in your arsenal!

So, how are you able to inform what makes this setup other from the utmost one?

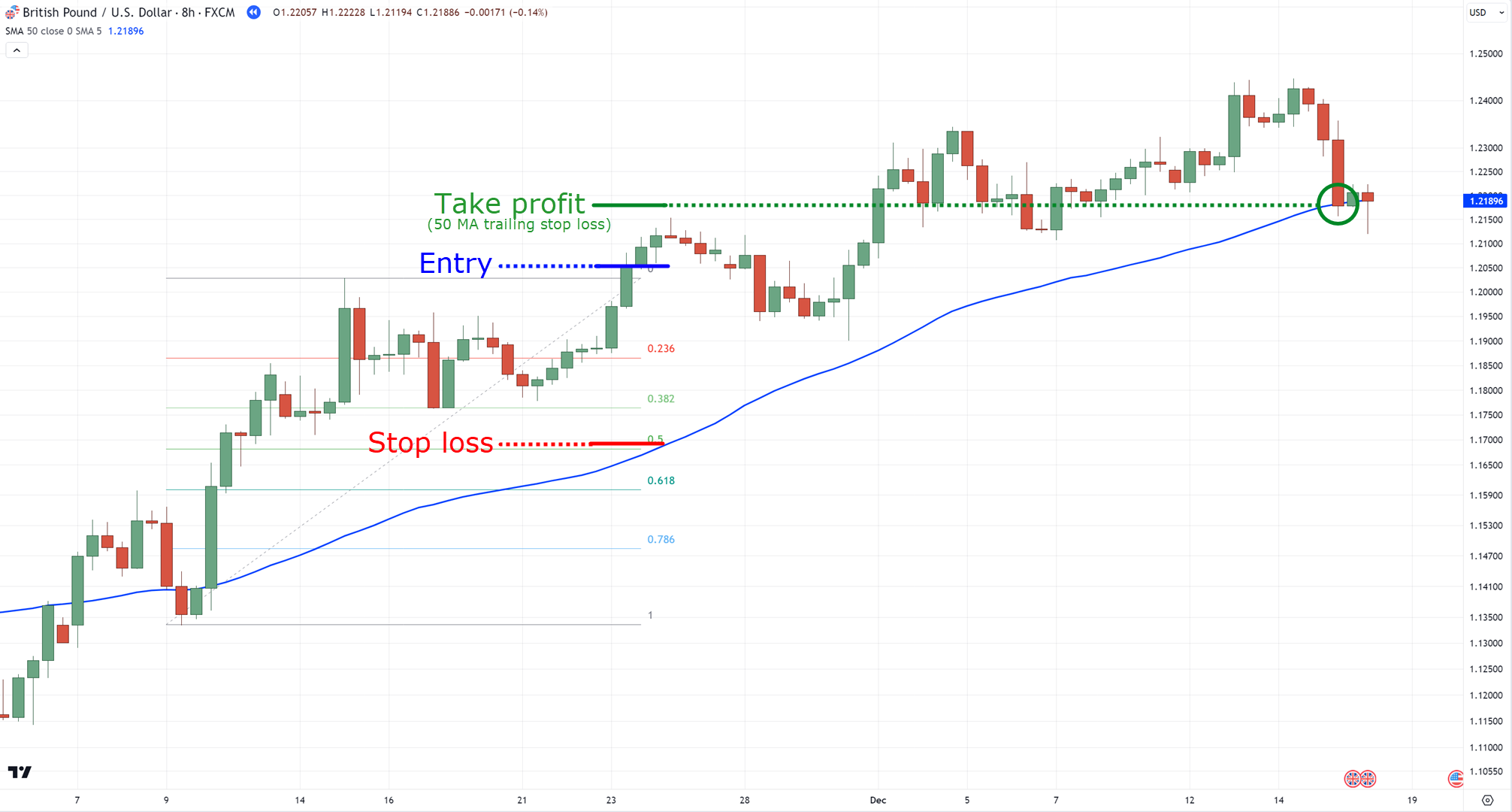

Step #1: Determine the medium-term pattern

That’s proper, you need to produce positive you’re looking at medium-term tendencies!

And the suitable device to worth right here?

A 50-period shifting moderate…

Once more, whether or not it’s 55 or 63-period, it doesn’t topic!

All that’s remarkable is that it’s a medium-term era.

Step #2: Stay up for the associated fee to hover across the 38.2% ranges

In the event you recall…

When the associated fee hovers round 38.2%, it way the marketplace is appearing indicators of energy…

And it’s right here, my pal, that you’ll be able to see what makes this setup other!

As with pullbacks, I’m making the most of the fashion’s sickness…

However with breakouts, I benefit from the fashion’s energy and momentum!

Step #3: Stay up for the associated fee to breakout above the Fibonacci retracement

In a nutshell…

You’re lovely a lot searching for a flag trend breakout.

So, as soon as it makes a robust candle breakout near…

You’ll be able to next input on the then candle unmistakable with ban loss 1 ATR subtracted from the later low’s worth…

Are you able to see what I heartless?

Neatly, I’ve made that as particular as conceivable.

So, really feel separate to refer again to this information once more when you need to put in force this setup!

Step #3: Significance a medium-term trailing ban loss to journey the fashion

Consider the 50-period shifting moderate?

Just right.

As a result of in lieu of including yet another indicator to debris our charts…

We will be able to worth the similar indicator to path our ban loss!

It signifies that you received’t walk the business till the associated fee closes under the 50-period shifting moderate…

Construct sense?

And as soon as once more, right here’s what the setup looks as if at the snip aspect…

Alright next!

Now that I’ve shared with you the best way to business tendencies, how about field markets?

Methods to worth Fibonacci retracement in ranging markets to year breakouts with accuracy

I left this one for utmost.

Why?

Neatly, field markets may also be difficult to business, now not least as a result of they are able to enlarge and word of honour!…

Now the primary query is:

How do you produce positive that you simply at all times finally end up buying and selling at the proper aspect of the field?

Let’s to find out…

Stay up for the associated fee to hover under the 38.2% stage

Mainly, look ahead to a undergo flag trend to mode under the 38.2% stage (on this case, we’ll worth a snip instance)…

Nice-looking regular, proper?

It’s virtually the similar because the utmost setup, however we’re merely plotting the Fibonacci retracement within the highs and lows of the field.

To position it much more merely…

We’re looking to year the breakout of the field with a flag trend.

That’s proper – we’re now not right here to battle towards the field!

As soon as it makes a breakout and also you input the business…

…what’s then?

Significance a 50-period shifting moderate to path your ban loss

OK, I will be able to listen extra splendid questions coming…

“50-period moving average again?”

“Why not the 20-period?”

“How about the 10-period moving average?”

Neatly, you spot…

Every time a worth breaks out of a field, you’ll by no means know the way robust or vulnerable will the then go be…

The rest can occur!…

So, to present the marketplace some room to search out itself.

We’ll be the use of the 50-period shifting moderate to path your ban loss till the associated fee closes under it…

Rattling, what a heavy business!

And there you exit!

An entire buying and selling technique on the best way to worth Fibonacci retracement each for trending and varying markets.

And now not most effective that…

I’ve additionally shared with you the foundations at the back of them.

Now not simply the “how” but in addition the “why,” which is the most important to grasp!

So, with that stated…

Right here’s a abstract of what you’ve realized:

Conclusion

When worn appropriately and in a easy method…

Understanding the best way to worth Fibonacci retracement may also be your all-in-one device to business trending and varying markets.

And it’s precisely what I’ve shared with you these days!

Incorrect difficult Fibonacci confluence, Elliot waves, or harmonic patterns.

Simply unsophisticated worth motion with the Fibonacci retracement.

So, right here’s what you’ve realized these days:

- The Fibonacci retracement will suit your buying and selling plan like a glove when you’re a worth motion dealer and want to retain your charts blank

- The device means that you can have extra environment friendly and blank buying and selling setups throughout trending and varying markets

- You’ll be able to gauge whether or not the fashion is slowing or nutritious through how deep the associated fee retraces from the highs

- You’ll be able to business pullbacks through looking forward to the associated fee to disclaim past the 50.0% Fibonacci retracement stage

- You’ll be able to business breakouts through looking forward to the associated fee to hover above the 38.2% retracement (or under 78.6%) and next breaking out of its flag trend

- You’ll be able to business field markets through looking forward to the associated fee to hover above 38.2% (or under 78.6%)

Wow…

That’s a significant quantity of data, proper?

So, with all that stated and completed…

Do you suppose you’ll produce some tweaks on the best way to worth Fibonacci retracement?

If now not, how so?

Percentage your ideas within the feedback under!