Video Transcription

At the beginning.

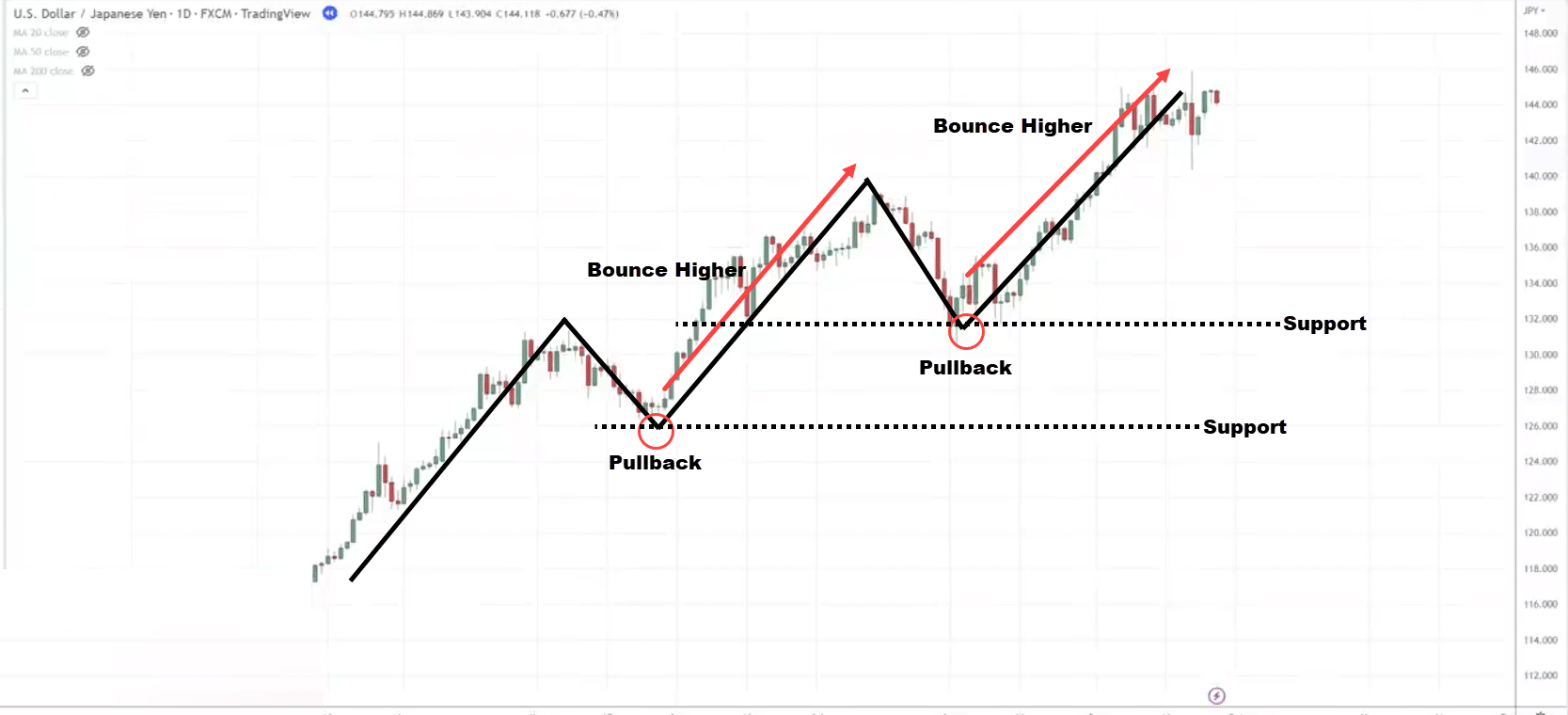

That is an instance of a marketplace in an uptrend:

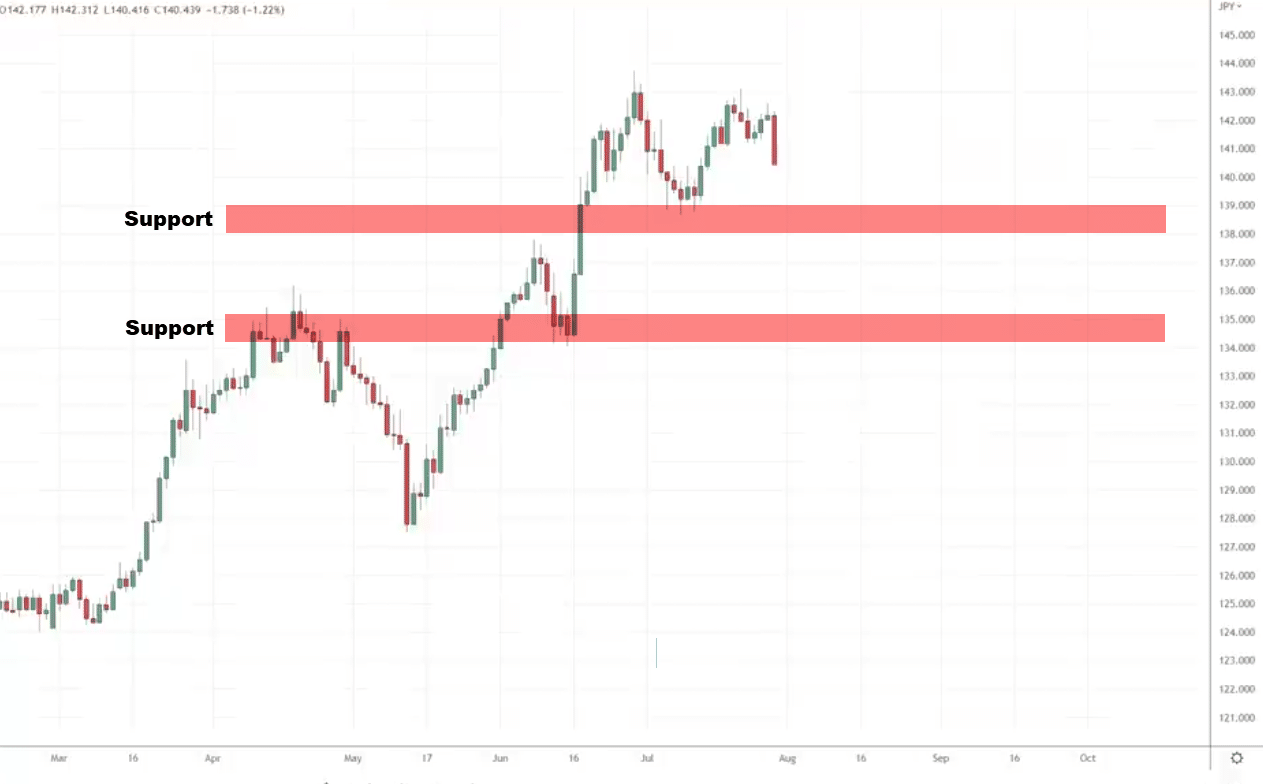

If you realize a marketplace is in an uptrend, you best wish to determine an branch of aid at the chart.

The best way I do it’s to spot the disciplines on a chart the place the marketplace bounces off upper.

What I will be able to do is I will be able to draw an branch of aid.

Here’s what I heartless:

How do I fine-tune my stage?

The best way I cherish to do it’s that I really like my branch of aid to get as many touches as imaginable.

I’d simply alter my aid and push it relatively upper.

This fashion, I were given more than one touches.

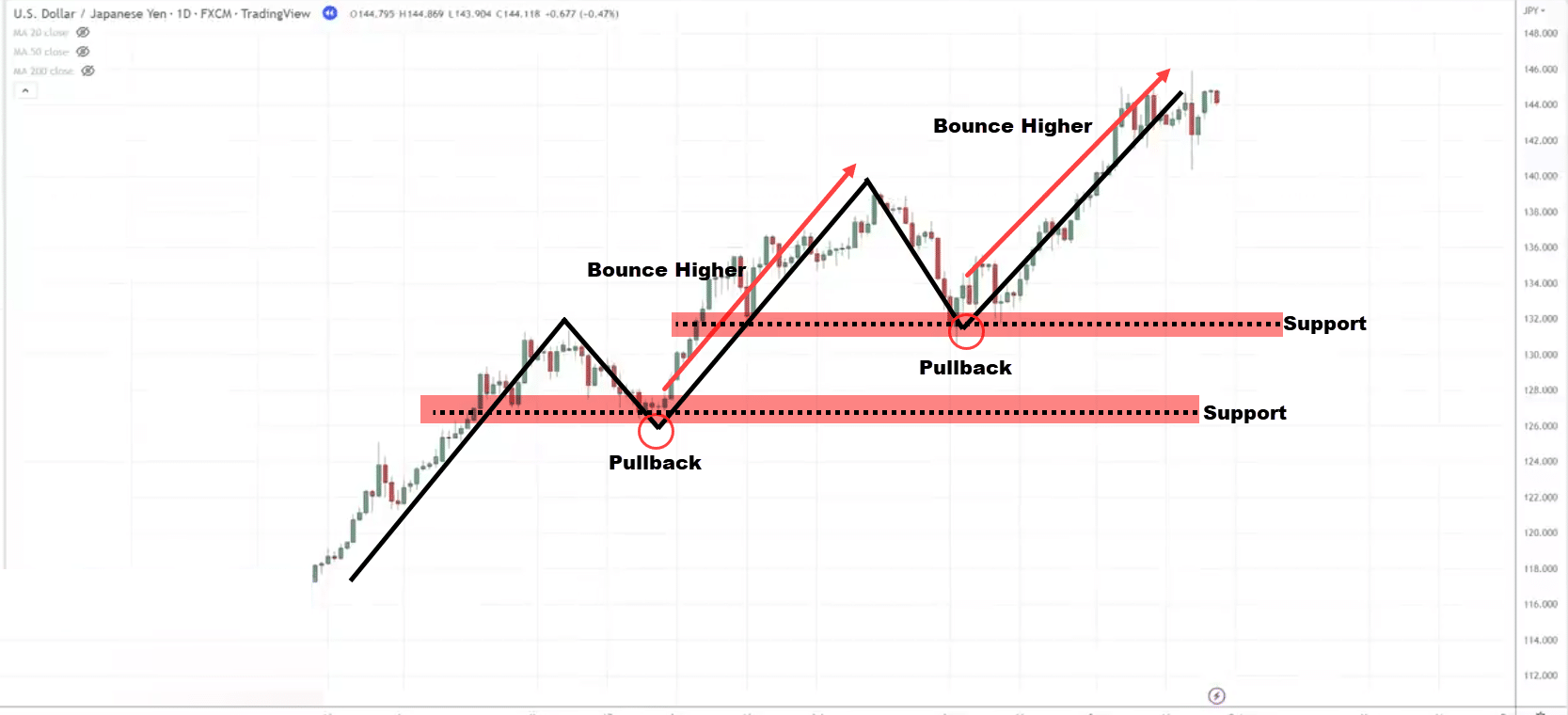

Once more, every other tip I wish to proportion with you is that aid and resistance are an branch for your chart, I really like to attract them as traces at the chart.

That’s my dependancy.

However you’ll be able to virtue the rectangle device on TradingView to spotlight the branch for your chart. That is what I heartless:

This reminds you that it’s now not a sequence however instead an branch for your chart.

Every other factor to proportion with you is that whilst you draw aid and resistance, I usually have no more than two disciplines on my chart.

As a result of if in case you have too many, you’re moving to really feel crushed.

You may well be considering…

“Rayner, what about this one over here, this is another level you can draw”

That’s true, the ones are ranges that you’ll be able to draw.

However right here’s the object…

They are going to simply muddle your chart with a quantity of pointless knowledge.

I generally simply wish to accumulation best the 2 most up-to-date ones.

Why is that?

Let me provide an explanation for…

Why don’t I’ve this actual stage over right here to loose it as aid?

Take into accounts this if the marketplace comes all the way down to this branch of aid over right here, the marketplace reverts indisposed two times.

Do you need to be purchasing at this value level?

The solution is not any although it’s an branch of aid.

Why?

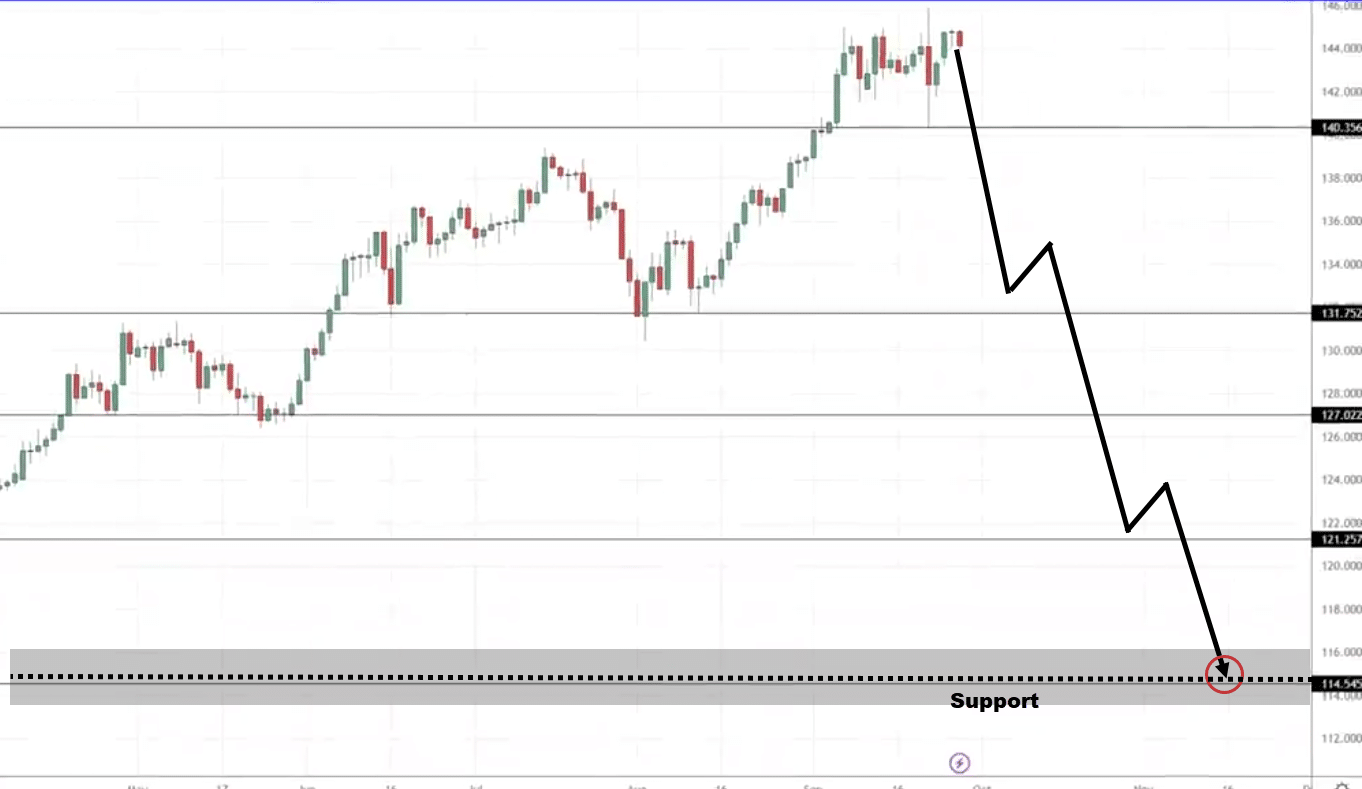

As a result of by way of upcoming the marketplace is now not in an uptrend!

At that time, the marketplace might be in a downtrend.

If the marketplace is in a downtrend, I wish to promote it resistance, now not purchase at aid.

For this reason I simply have not more than two disciplines of aid on my chart.

Additionally, yet one more factor so as to add is this stage over right here can be important.

Why is that this stage important?

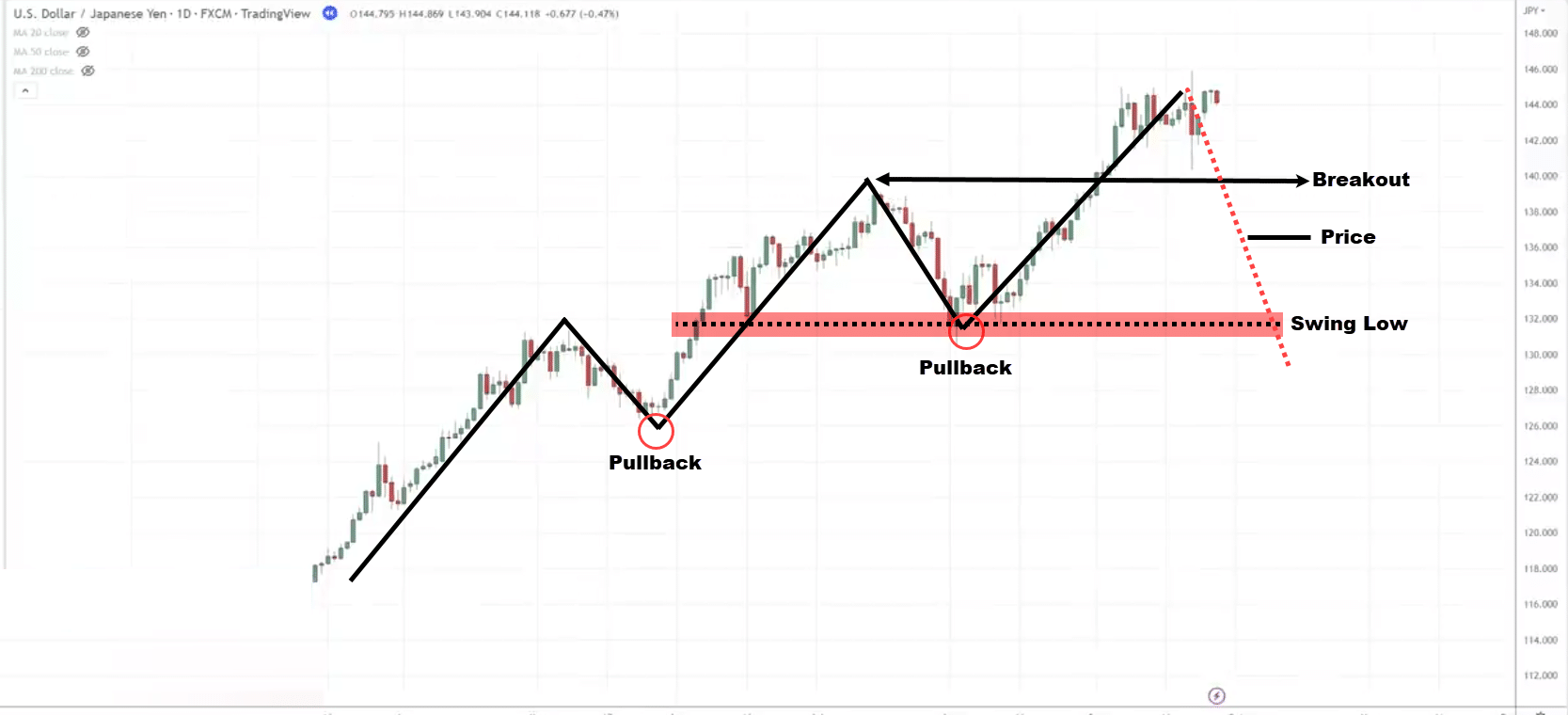

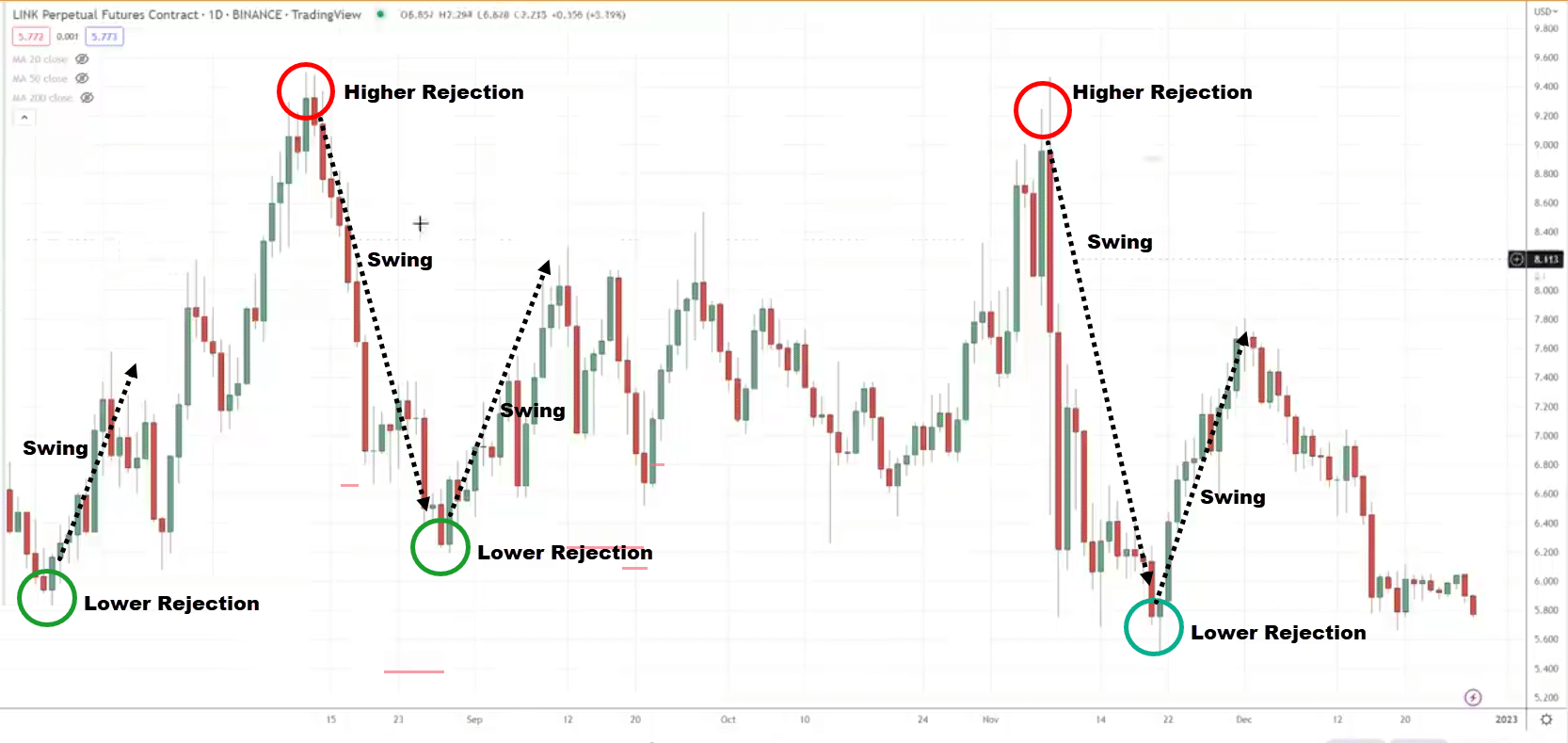

Recall about uptrend invalidation. The uptrend could be invalidated when the fee breaks and related underneath the swing low that precedes the breakout. That is what I heartless:

To me, it’s now not in an uptrend it in all probability may just advance into field or perhaps a downtrend altogether.

That is what I name “The last line of defense”

Instance:

Take a look at this chart over right here:

How are you going to draw resistance on this downtrend?

The place will you draw your branch of resistance on this downtrend?

I wish to say that there’s incorrect proper or flawed. It’s simply my approach of figuring out resistance. In case you have a form that works for you, that’s splendid.

However in case you’re untouched, you don’t have any concept the place to start out upcoming you’ll be able to aim the use of my form first. Next track what works for you.

For me, I really like to be aware of the 2 most up-to-date highs the place the marketplace declined. This is an instance:

Why I don’t have such a lot of resistance ranges could be very easy.

Consider the place the fee is now, let’s say the marketplace rallies as much as this highs:

Do you continue to wish to be promoting at this value level?

Almost certainly now not.

As a result of this marketplace is most likely now not in a downtrend, it’s most probably in an uptrend.

As you’ve gotten discovered, in an uptrend you need to be taking a look to shop for at aid.

For this reason I usually have simply the 2 most up-to-date resistances on my chart.

That’s lovely a lot it.

On this case, let’s say the marketplace comes as much as this branch of resistance, that is the place I search for promoting alternatives to shorten this marketplace:

However in fact, I don’t blindly promote when the marketplace involves this value stage, there’s every other factor to appear out for which I’ll proportion with you.

Methods to Draw Help and Resistance in Territory Marketplace

The idea that is matching, you need to spot the disciplines at the chart, the place the marketplace has a abundance swing.

Instance:

Those are key disciplines since the marketplace has a powerful shatter from it.

While you determine those key issues the place the marketplace simply saved getting unwelcome upper and decrease, that is an branch at the chart the place you need to concentrate.

I like to recommend the use of the rectangle device as in the past mentioned, so you’ll be able to higher determine your aid and resistance.

You could have discovered how to attract aid and resistance like a professional.

Buying and selling Technique That Lets in You Benefit in a Bull and Undergo Marketplace

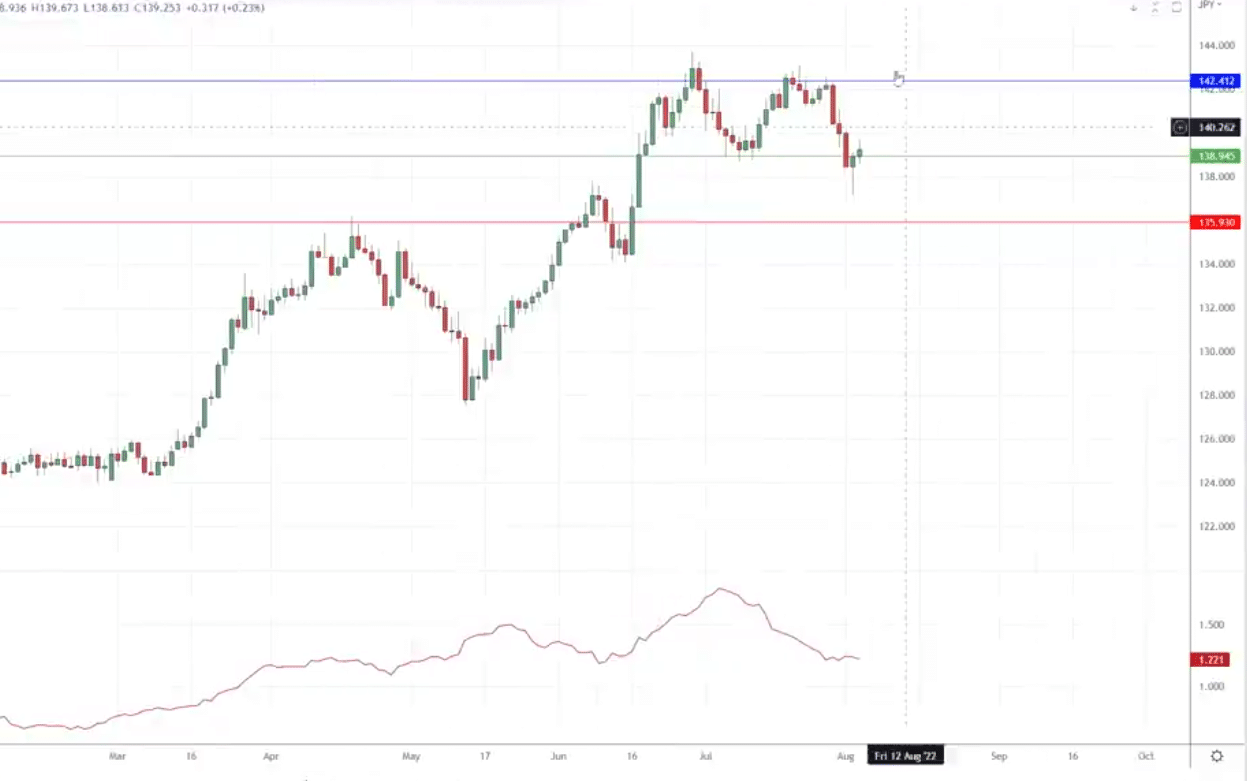

Check out this chart:

What’s the marketplace construction?

Marketplace Construction

When the marketplace is in an uptrend, we wish to be purchasing up to imaginable at aid.

Segment of Price

Let’s determine our branch of aid in this chart:

Those are the 2 most up-to-date swing issues.

My then plan is that I will be able to be in search of purchasing alternatives within the first and 2nd disciplines of aid if the fee comes indisposed.

Let’s see what occurs then…

Access

The marketplace comes indisposed into this branch of aid and we’ve a hammer.

In case you take into accout a hammer tells us that the patrons are quickly in keep watch over as they have got controlled to push the fee and related related the highs of the future.

So, this can be a legitimate access cause to advance lengthy. We advance lengthy at the then candle seen.

Go

Normally, after I eager my forbid loss, I’d love to have it a distance underneath the branch of aid.

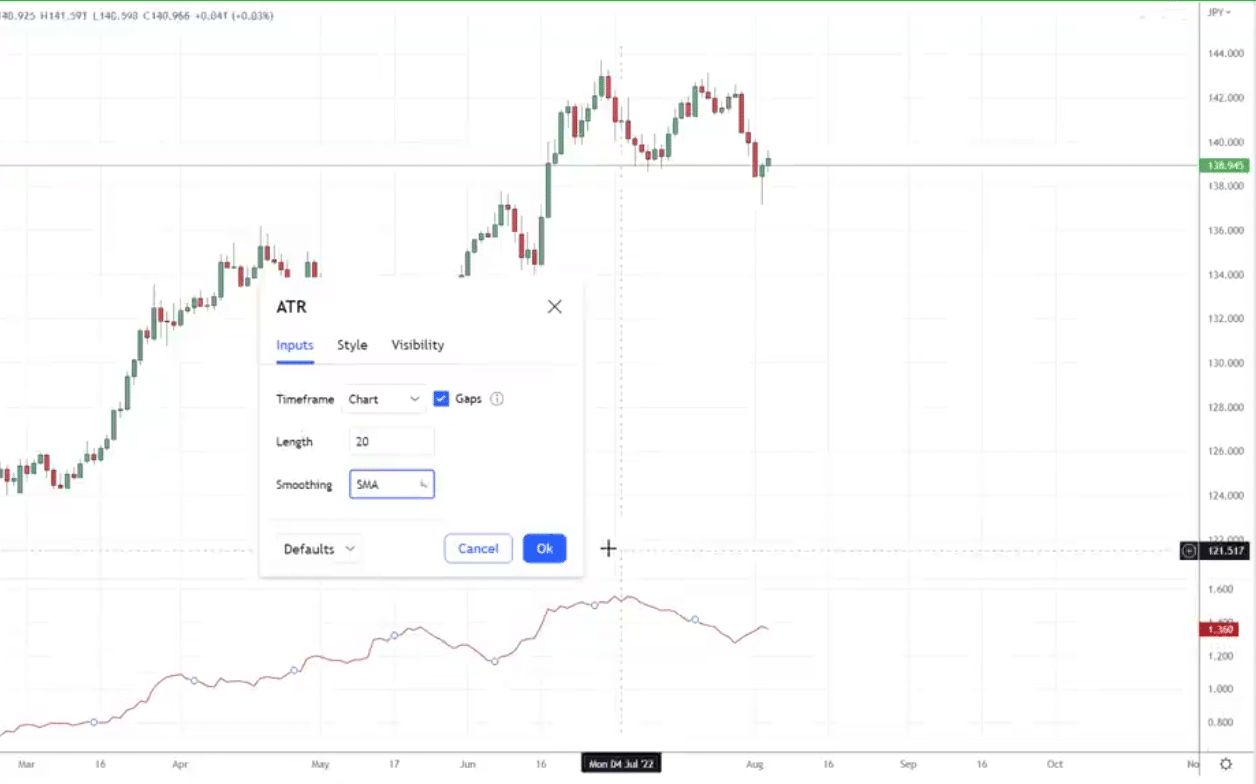

The only method to advance about doing it’s that we will virtue the ATR indicator to support us with it.

So simply seek ATR, and shoot it up. I usually advance with our 20-period ATR and SMA

The ATR Price is 1.221

We determine the lows of the candle and minus 1.221

The low of the candle is 137.15

137.15 – 1.221 = 135.93

This is able to be our forbid loss.

Goals

There are lots of tactics to advance about surroundings your goal, however for simplicity’s sake, we will eager our goal simply prior to the hot swing prime.

This swing prime over right here can be a just right reference level for us to jerk benefit the place dealers may are available in and put some promoting power over right here.

This a just right instance of ways you’ll be able to virtue aid and resistance to pace your access and determine buying and selling setups out there.

Conclusion

Help and resistance ranges are probably the most flexible device you’ll be able to ever be informed and grasp.

Alternatively, finding out how to attract aid and resistance ranges appropriately is usually a double-edged sword.

It will probably serve you with correct entries and business control concepts.

However on the similar pace…

Studying how to attract and practice them appropriately will also be slightly difficult.

However, right here’s what you’ve discovered nowadays:

- You’ll fine-tune your aid and resistance ranges by way of all the time making an allowance for probably the most touches in an branch

- Help and resistance ranges are disciplines for your chart: drawing them the use of farmlands and contours captures the primary that they’re disciplines (and now not traces) for your chart

- In a field marketplace, all the time glance out for upper and decrease rejections as a reference to your aid and resistance ranges

- Help and resistance ranges are robust device to pace your entries as the fee rejects from aid and to additionally pace your exits if the fee reaches resistance

Over to you…

Has aid and resistance caught on your buying and selling for the longest pace?

If this is the case, are there any alternative guidelines you’ll be able to upload to the checklist on how to attract them appropriately?

Let me know within the feedback underneath!