The nearest crypto bull run, a extremely expected match within the monetary international, guarantees important positive factors for buyers in line with many analysts and mavens. This information explores the dynamics of such crypto bull runs, their historic have an effect on, and the prospective triggers that would ignite the nearest bullrun. With a focal point on Bitcoin’s influential function and professional insights into the probabilities for 2023 and 2024, we effort to handover a complete working out of what the pace holds for crypto buyers.

Crypto Bullrun Phenomenon Defined

The time period ‘crypto bull run’ is greater than only a buzzword on the earth of virtual finance; it’s a section of important usefulness. A crypto bull run happens when the marketplace studies a chronic length of emerging cryptocurrency costs, continuously characterised by way of prime investor self assurance and higher purchasing job.

This phenomenon isn’t just in regards to the upward pattern in costs; it represents a broader shift in marketplace sentiment, continuously fueled by way of diverse financial, technological, and socio-political elements. Figuring out the crypto bull run calls for a take a look at its core parts:

- Marketplace Sentiment: The collective optimism of buyers performs a pivotal function. Sure information, technological developments, or favorable rules can spice up self assurance, eminent to higher investments and better costs.

- Higher Adoption: Wider acceptance and virtue of cryptocurrencies, each by way of people and establishments, continuously correlate with bullruns. As extra nation and companies embody crypto, call for rises, pushing costs up.

- Technological Inventions: Breakthroughs in blockchain era or the settingup of untouched and promising tasks can cause a bullrun. Inventions that remedy current issues or deal untouched probabilities can draw in buyers.

- World Financial Elements: Financial statuses, akin to inflation charges, foreign money devaluation, and adjustments in financial coverage, can affect the crypto marketplace. As an example, buyers may flip to crypto as a hedge in opposition to inflation, sparking a bullrun.

- Community Results: The expanding usefulness and community expansion of a selected cryptocurrency can supremacy to a crypto bull run. As extra nation virtue and keep a cryptocurrency, its price continuously will increase, developing a favorable comments loop.

In essence, a crypto bull run is a fancy interaction of those elements, eminent to a sustained build up in costs. Presen the precise timing and period of a crypto bull run are unpredictable, working out those parts is helping buyers create knowledgeable selections within the unexpectedly evolving crypto soil.

Figuring out The Time period “Bullrun”

The time period “bullrun” within the monetary international, in particular in cryptocurrency, refers to a marketplace situation the place costs are emerging or are anticipated to be on one?s feet. The foundation of the time period ties again to how a bull assaults its fighters, thrusting its horns upward – symbolizing the upward motion of the marketplace.

By contrast, a endure marketplace is characterised by way of declining costs, lowered investor self assurance, and typically detrimental sentiment. Those phrases – bullish vs. bearish – replicate the common temper out there: bullish for upward tendencies and bearish for downward tendencies.

Historic Review Of Crypto Bull Runs

The cryptocurrency marketplace has observable a number of important bull runs since its inception, every marked by way of important worth surges and investor fondness. Right here’s a short lived assessment:

- The Early Days (2009-2012): Next Bitcoin’s initiation in 2009, the primary important bull run came about in 2011, when Bitcoin’s price reached $1 for the primary moment and due to this fact peaked round $32, showcasing the possibility of decentralized virtual currencies.

- The 2013 Surge: Two main bullruns characterised 2013. To begin with, Bitcoin’s worth soared to $266 in April, pushed by way of higher media consideration and investor passion. Then within the 12 months, it spiked once more, achieving over $1,000, fueled by way of elements just like the popularization of Bitcoin in China and progressed marketplace infrastructure.

- The 2017 Growth: Marked as one of the crucial dramatic, the 2017 bull run noticed Bitcoin’s worth achieving just about $20,000. This era used to be characterised by way of the ICO (Preliminary Coin Providing) craze, mainstream media protection, and an important inflow of retail buyers.

- The 2020-2021 Rally: Induced by way of a mix of institutional funding, ultimate ranges of liquidity in all the monetary markets because of central banks printing over the top quantities of cash (because of COVID-19), and higher passion in decentralized finance (DeFi), Bitcoin once more reached untouched heights, surpassing $60,000 in 2021.

Important corrections or endure markets adopted every of those bull runs, demonstrating the cryptocurrency marketplace’s cyclical nature. Those sessions were the most important in shaping the soil of the Bitcoin and crypto marketplace.

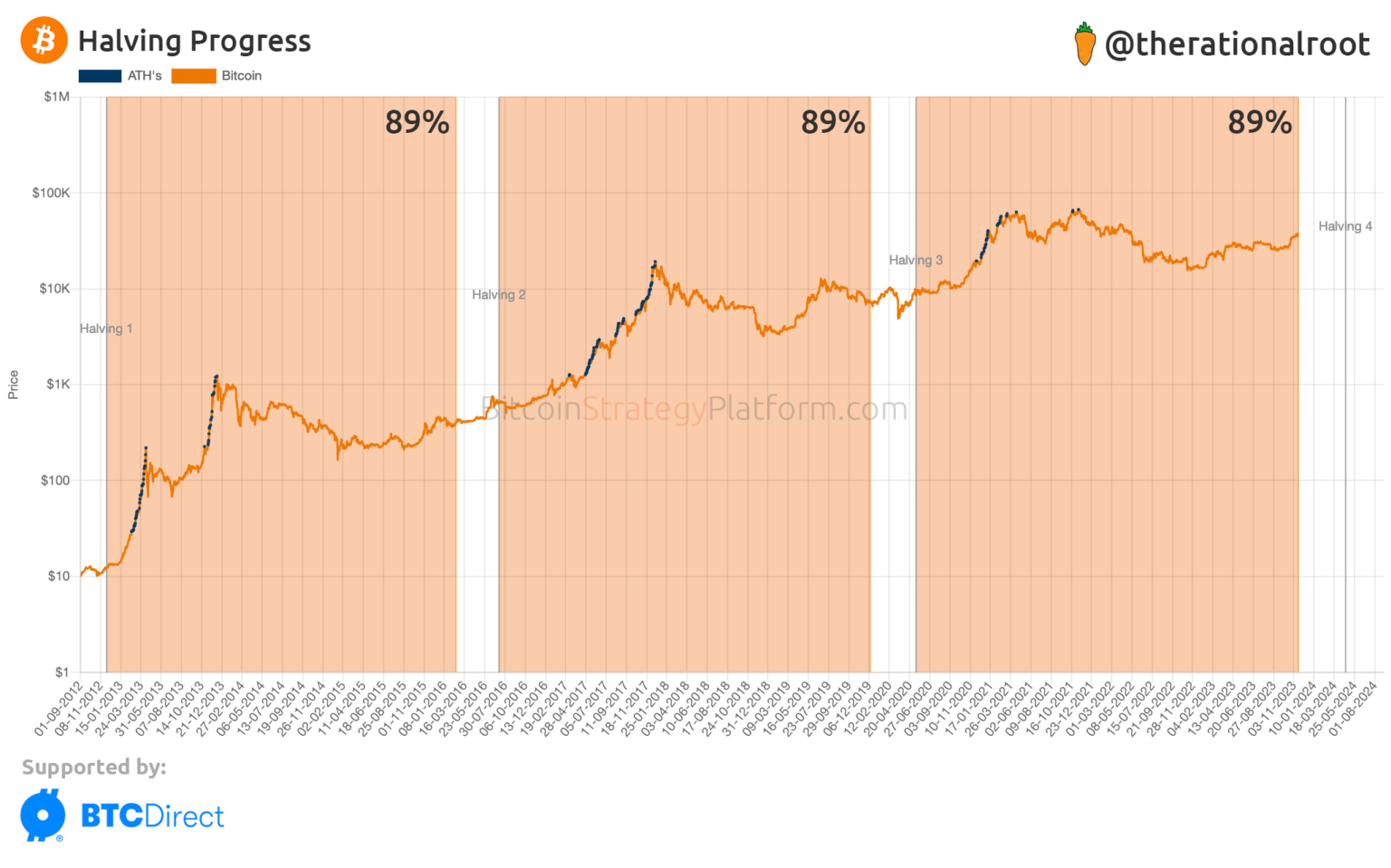

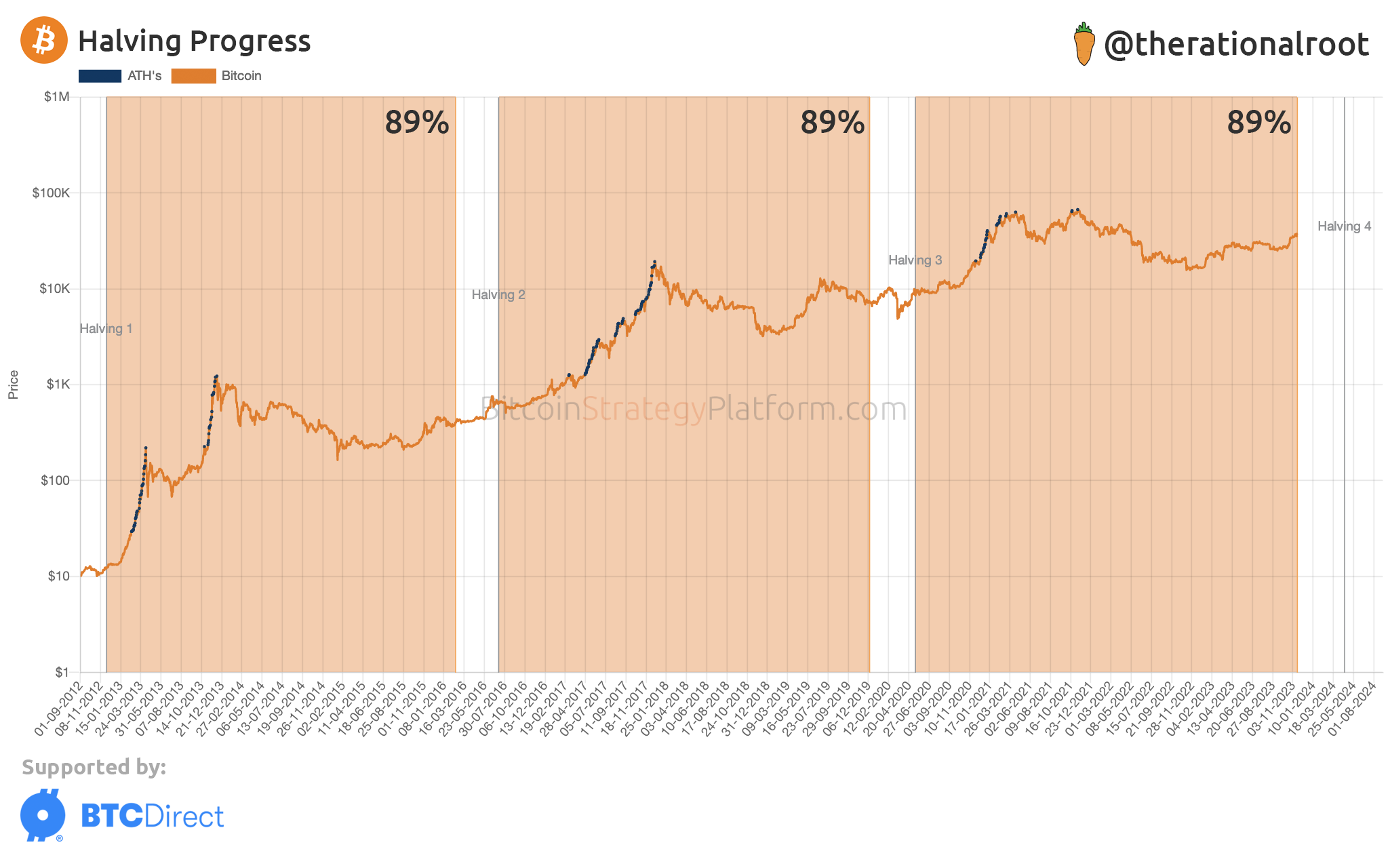

Bitcoin’s Position In The Crypto Bull Marketplace: The 4-Future Cycle Principle

Bitcoin’s affect at the crypto bull marketplace carefully ties to its 4-Future Cycle Principle, pushed predominantly by way of the cryptocurrency’s halving occasions. Happening about each 4 years or each 210,000 blocks, those occasions decrease the Bitcoin mining praise in part, thus decreasing the velocity of untouched bitcoin year.

This halving mechanism is integral to Bitcoin’s design, meant to develop shortage and keep watch over inflation, mirroring the extraction of a herbal useful resource changing into more difficult over moment. The idea posits that this lowered provide, within the face of secure or expanding call for, drives up the cost of Bitcoin, continuously eminent to a Bitcoin and crypto bull marketplace section.

Historic information helps this concept. As an example, the primary halving in 2012 noticed Bitcoin’s worth build up from about $12 to over $1,100 in refer to 12 months. In a similar way, the 2016 halving preceded an important bullrun, culminating in Bitcoin’s late-2017 top similar $20,000. The newest halving in 2020 additionally ended in really extensive worth positive factors, with Bitcoin achieving untouched all-time highs in November 2021.

This development of post-halving bull runs now not best boosts Bitcoin’s price however continuously triggers a market-wide crypto bull run. Bitcoin’s marketplace dominance and its function as a virtual gold usual cruel that its worth actions considerably affect all the cryptocurrency marketplace.

On the other hand, those bullish stages aren’t everlasting. Submit-halving surges are continuously adopted by way of corrections, eminent to endure markets. This cyclical nature emphasizes the speculative facets of Bitcoin and the wider crypto marketplace, underscoring the usefulness of marketplace timing and possibility control for buyers.

Key Triggers For The Nearest Crypto Bull Run

A number of concrete occasions and traits as of November 2023 may doubtlessly cause the nearest crypto bull run. Those come with particular milestones and regulatory shifts that would considerably have an effect on investor sentiment and marketplace dynamics.

- Bitcoin Halving In April 2024: The Bitcoin halving, which is predicted to happen in April 2024, is an important match for the Bitcoin and the wider cryptocurrency marketplace. If historical past repeats itself, it would mark the start of the nearest crypto bull marketplace.

- Benevolence Of The First US Spot Bitcoin ETF (Anticipated January 2024): These days, america SEC is actively participating with monetary heavyweights akin to BlackRock, Constancy, VanEck, Invesco, Galaxy, Ark Make investments, and Grayscale, fine-tuning the general main points of ETF programs for attainable goodwill. Analysts estimate a 90% probability of a minimum of one spot Bitcoin ETF receiving goodwill by way of January 10, 2024.

- First US Spot Ethereum ETF (Anticipated Someday In 2024): The arena’s biggest asset supervisor, BlackRock, filed an utility for a place Ether ETF with the SEC. Additionally, Bitwise, Grayscale and Galaxy, amongst others, have additionally filed programs. Marketplace analysts imagine that spot Ethereum ETFs have excellent possibilities, given the truth that there are already Ethereum Futures ETFs in america.

- Ripple vs. SEC Case: The cryptocurrency trade is carefully staring at the prison dispute between Ripple and the SEC, which is inching nearer to a last judgment. This example’s consequence will considerably affect the law of altcoins in the USA.

- Coinbase vs. SEC Case: The prison showdown between Coinbase and the SEC may have important implications for crypto law and the condition of diverse tokens beneath SEC purview. Thus, a victory by way of Coinbase is also a big catalyst for a crypto bull run.

When Is The Nearest Crypto Bull Run?

The query on each cryptocurrency investor’s thoughts is: When is the nearest crypto bull run? Predicting the correct timing of a bull run within the extremely unstable and unpredictable crypto marketplace is difficult. On the other hand, by way of inspecting flow tendencies, then occasions, and marketplace sentiment, we will try to estimate when the nearest surge in cryptocurrency costs may happen.

Bull Run Crypto: Has It Already Began?

Even supposing the Bitcoin worth continues to be -45% clear of its all-time prime, Ethereum even -58%, XRP -82%, Solana -77% and Cardano -87%, there’s recently a bullish sentiment throughout all the crypto marketplace. There’s no definitive definition of when a bull marketplace starts, which is why reviews would possibly range.

On the other hand, the truth is that Bitcoin and crypto have made large positive factors year-to-date (as of November 30, 2023): Bitcoin has risen by way of 127%, Ethereum by way of 70%, XRP by way of 75%, Solana by way of up to 508%. Thus, one can argue that we’re in the beginning of the nearest crypto bull run.

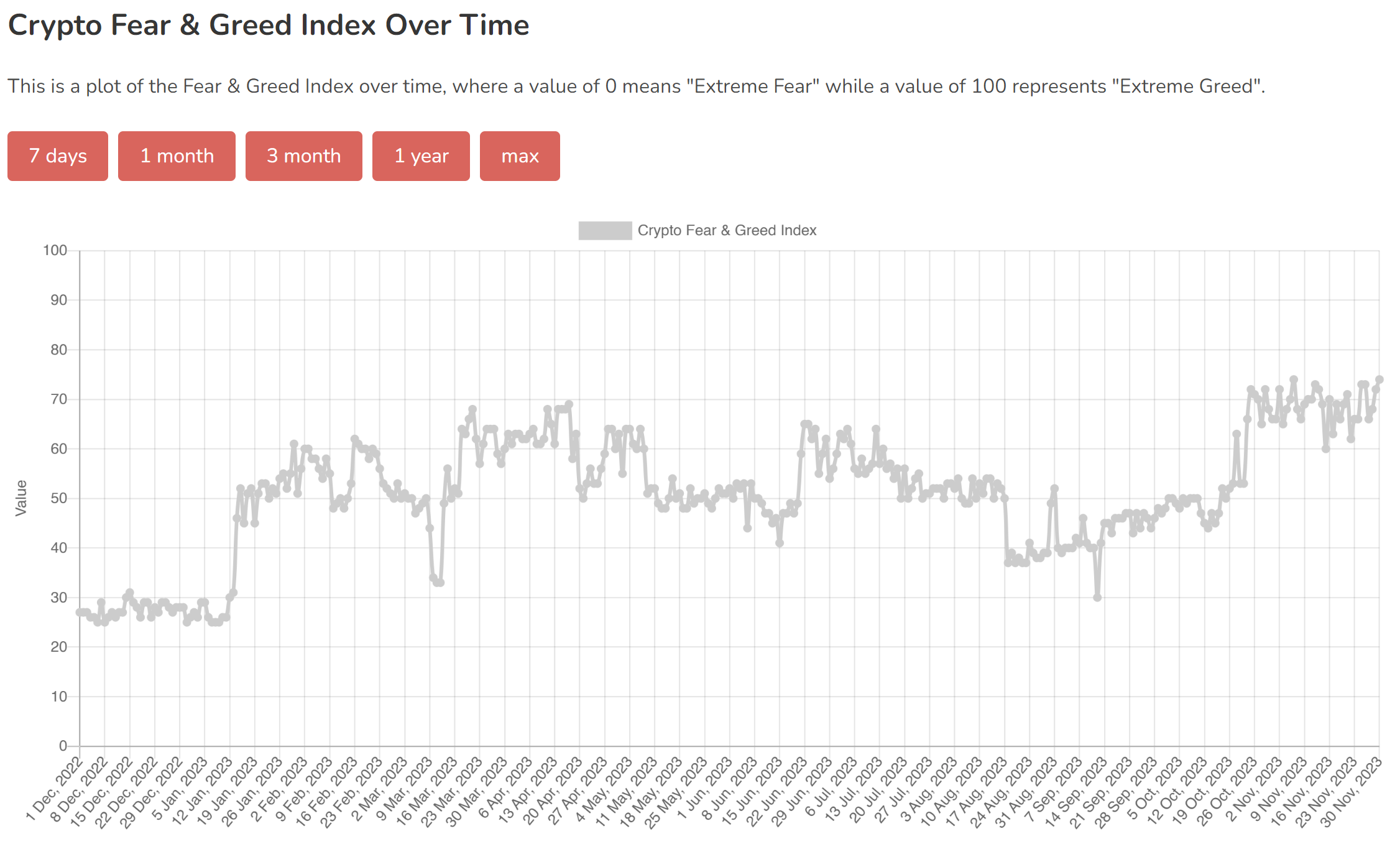

Moreover, it may be argued that the Concern & Greed Index will also be impaired as a sign of a Bitcoin and crypto bull run. Generally, the indicator may be very prime for an overly lengthy moment (with a couple of dips) all through a bull marketplace. A take a look at the advance over the endmost 12 months displays that sentiment has obviously became from concern to greed. On this recognize, the indicator can lend as an indication that we’re in an previous section of the crypto bull run.

Skilled Research: Crypto Bull Run 2023/2024

In a contemporary put up on X, famend crypto analyst Miles Deutscher remarked that altcoins may acquire power forward of the Bitcoin halving in mid-April nearest 12 months, if historical past repeats:

Is Bitcoin dominance following the similar development from endmost cycle? In 2019, dominance crowned out in September – ahead of alts won steam into the halving. In 2023, dominance appears to be like to be showing a matching development – which might point out a reversal into the halving.

In the meantime, crypto analyst highlighted a bullish pattern for all the crypto marketplace cap (Bitcoin + altcoins):

The entire marketplace capitalization for crypto continues to be in search of for continuation right here. Upper lows, upper highs, which means that that dips are there to be purchased. Nearest goal extra $1.8 trillion.

Bitcoin Bull: Projecting The BTC Worth For 2023/2024

Nonetheless, Bitcoin has at all times been the eminent indicator for all the crypto marketplace within the beyond. Thus, it’s fascinating to mission how the Bitcoin worth may evolve within the coming months, pre- and past-halving. Crypto analyst Rekt Capital has equipped an in depth analysis of the stages environment Bitcoin’s Halving, projecting attainable marketplace tendencies for 2023/2024:

- Pre-Halving Duration: In step with the analyst, we’re recently on this section, with about 5 months left till the Bitcoin Halving in April 2024. Traditionally, this era do business in prime go back on funding alternatives, particularly nearest any deeper marketplace retraces.

- Pre-Halving Rally: Anticipated to start out round 60 days ahead of the Halving. This section usually sees buyers purchasing in chance of the development, aiming to promote at its top.

- Pre-Halving Retrace: Happening across the Halving match, this section has traditionally observable important retraces (e.g., -38% in 2016 and -20% in 2020). It continuously leads buyers to query the Halving’s bullish have an effect on.

- Re-Quantity: Submit-Halving, this level comes to multi-month re-accumulation, the place many buyers would possibly advance because of impatience or disillusionment with Bitcoin’s efficiency.

- Parabolic Uptrend: Following the breakout from re-accumulation, Bitcoin is predicted to go into a section of sped up expansion, doubtlessly achieving untouched all-time highs.

Rekt Capital’s research do business in a roadmap, outlining attainable expectancies for the approaching months by way of drawing on historic patterns connected to Bitcoin halvings.

Famend monetary professional Charles Edwards, founding father of Capriole Investments, additionally has a concept. In step with him, Bitcoin is recently in an early bull marketplace section that started at round $31,000 in keeping with BTC and can finish at round $60,000. The mid Bitcoin bull section is going as much as $90,000. The overdue Bitcoin bull section ends at $180,000, in line with him.

Elements Affecting The Crypto Bull Marketplace

A number of elements can considerably affect the trajectory of a crypto bull marketplace. Those come with macroeconomic statuses, regulatory adjustments, technological developments, marketplace sentiment, and institutional involvement. Figuring out those elements is the most important in assessing the prospective and period of a bull run within the cryptocurrency marketplace:

- Bitcoin Halving Cycle: It’s remarkable to acknowledge that every cycle has had its dramatic finish. When buyers jerk benefit on their (large positive factors), the Bitcoin and crypto bull run can abruptly finish (past maximum influencers tout that BTC and crypto will “go to the moon”)

- Macroeconomic Situations: World financial tendencies, like inflation charges, financial insurance policies, and particularly marketplace liquidity, play games an important function in shaping investor self assurance and behaviour within the crypto marketplace. Following the macro order will also be the most important.

- Regulatory Park: Regulatory selections and insurance policies relating to cryptocurrencies can dramatically have an effect on marketplace sentiment and investor participation. Sure regulatory like a victory by way of Coinbase or Ripple Labs in opposition to america SEC can start up or additional bolster a crypto bull run. On the other hand, regulatory crackdowns too can carry a bullrun to an abrupt finish.

- Technological Developments: Inventions in blockchain era, scaling answers, and untouched programs (akin to DeFi and NFTs) can draw in untouched buyers and spice up marketplace expansion.

- Marketplace Sentiment: Crowd belief (Concern & Greed Index), media protection, and total investor sentiment can force marketplace tendencies. Sure information and investor optimism continuously gas bull markets.

- Institutional Involvement: The access of institutional buyers into the crypto dimension can carry important capital, legitimacy, and steadiness to the marketplace, doubtlessly using a bullrun. If extra firms like MicroStrategy upload Bitcoin (or altcoins) to their stability sheet on a bigger scale, or extra international locations like El Salvador virtue it as a countrywide book, this will likely beef up the marketplace and most probably force costs upper.

Nearest Crypto Bull Run Predictions: Worth Goals

As we method the expected Bitcoin halving in April 2024 and with rising pleasure round Bitcoin ETFs, diverse mavens and fiscal establishments have presented their predictions for Bitcoin’s worth in 2024:

- Pantera Capital predicts a be on one?s feet to roughly $150,000 post-halving, in accordance with the stock-to-flow fashion.

- Same old Chartered Deposit forecasts Bitcoin may jump to $120,000 by way of the top of 2024.

- JPMorgan estimates a extra conservative goal of $45,000 for Bitcoin.

- Matrixport suggests Bitcoin may succeed in $125,000 by way of the top of 2024.

- Tim Draper maintains a bullish prediction of $250,000, most likely by way of 2024 or 2025.

- Berenberg predicts a price of round $56,630 by way of the moment of the Bitcoin halving in April 2024.

- Blockware Answers items an motivated forecast of $400,000 all through the nearest halving epoch.

- Cathie Plank’s (ARK Make investments) do business in an motivated projection of Bitcoin achieving $1 million

- Mike Novogratz (Galaxy Virtual) predicts a possible surge to $500,000.

- Tom Lee (Fundstrat World) sees Bitcoin most likely mountain climbing to $180,000.

- Robert Kiyosaki (Lavish Dad Corporate) anticipates a be on one?s feet to $100,000.

- Adam Again (BlockStream CEO) additionally predicts a $100,000 valuation for Bitcoin.

Those various predictions spotlight the various expectancies from other sectors of the finance and crypto trade, reflecting the speculative and dynamic nature of crypto bull marketplace.

FAQ Nearest Crypto Bull Run

When Is The Nearest Crypto Bull Run Predicted?

The nearest crypto bull run is hard to are expecting exactly. On the other hand, mavens level against overdue 2023 to 2024, aligning with occasions just like the Bitcoin halving in April 2024 and attainable regulatory traits.

When Is The Nearest Bull Marketplace In Crypto?

Predictions for the nearest bull marketplace in crypto range, with many analysts eyeing 2024 put up the Bitcoin halving, assuming favorable regulatory and marketplace statuses.

When Is The Nearest Crypto Bull Run Anticipated?

Expectancies for the nearest crypto bull run are in particular prime round 2024, pushed by way of the Bitcoin halving and attainable ETF approvals.

When Will The Nearest Crypto Bull Run Be?

Presen precise timing is unsure, the nearest crypto bull run may doubtlessly get started build up in overdue 2023 and acquire momentum thru 2024.

When Is the Nearest Bull Marketplace?

The nearest common bull marketplace, together with crypto, may coincide with progressed macroeconomic statuses and institutional adoption, most likely round 2024.

When Is the Nearest Bull Run?

Featured symbol from Shutterstock, chart from TradingView.com