The dot-com bubble of the late 1990s was a time of great excitement and speculation in the stock market. Investors, both retail and institutional, were eager to buy shares of any internet startup they could get their hands on, with the general consensus being that the internet was the future and these new online companies were on the verge of disrupting traditional industries. However, as we now know, this hype was not sustainable, and the market eventually crashed, leaving many investors with significant losses.

Parallels with the Crypto Market

Today, many analysts are drawing parallels between the dot-com bubble and the current crypto market. The crypto market has experienced a significant surge in recent years, with the price of Bitcoin and other cryptocurrencies reaching new heights. However, this growth has been accompanied by a sense of hype and speculation, with many investors buying into cryptocurrencies without fully understanding their underlying value or potential for growth. This has led to concerns that the crypto market may be experiencing a similar bubble to the dot-com era.

The crypto market’s valuation calculation is becoming more mature, with many tokens generating measurable income and resembling bets for 100x-plus returns. This has exposed overvaluation in some cases, similar to the dot-com bust. As the market continues to evolve, it is likely that we will see a period of consolidation, with weaker projects failing and more robust protocols surviving and potentially laying the foundation for a lasting Web3 era.

The Dot-Com Era’s Legacy

Despite the crash of the dot-com bubble, the era laid the foundation for the development of the internet and the growth of companies like Amazon and Google, which are now among the most valuable in the world. Similarly, the crypto market’s current downturn may be an opportunity for stronger projects to emerge and lay the foundation for the Web3 era. As the market continues to mature, it is likely that we will see a shift towards more sustainable and meaningful growth, rather than speculation and hype.

The current state of the crypto market, with its emphasis on speculation and hype, is reminiscent of the dot-com era. However, as the market continues to evolve, it is likely that we will see a shift towards more sustainable and meaningful growth. The prospect of a true bear market grows by the day, and further declines will likely kill any token that lacks real utility or purpose. Heading into 2026, it looks like we will see a year of consolidation for crypto, with the strong surviving and potentially laying the foundation for the long-awaited Web3 era.

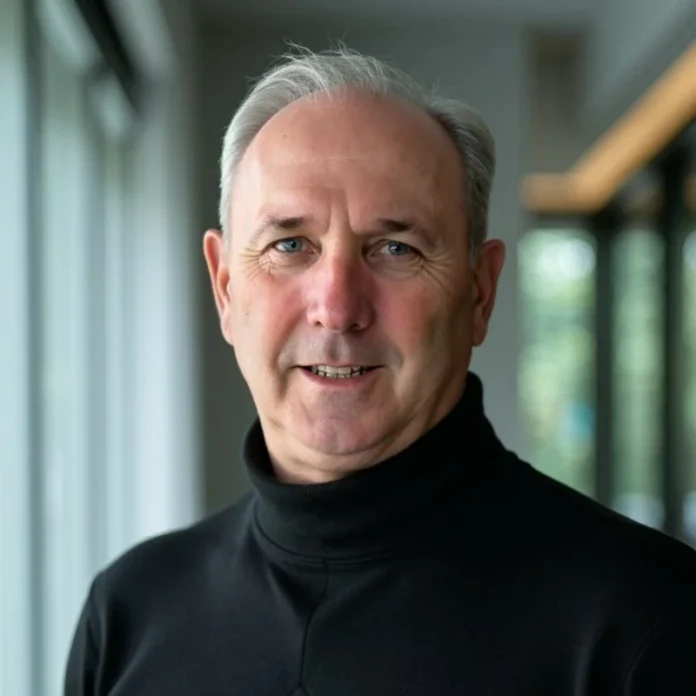

According to Stephen Wundke, strategy and sales director at Algoz Technologies, the crypto industry is currently at a similar crossroads to the dot-com era. The most unprofitable startups quickly failed, resulting in massive losses for investors, but those with solid business models not only survived but also thrived. Wundke notes that the crypto market’s current downturn may be an opportunity for stronger projects to emerge and lay the foundation for the Web3 era.

Stephen Wundke is the strategy and sales director at Algoz Technologies. He joined Algoz in late 2022 and pioneered the unique SMA structure for an over-the-counter settlement product called Quant Pro using Zodia Custody and Bitfinex.

For more information on the crypto market and its parallels with the dot-com era, visit https://crypto.news/cryptos-downward-spiral-echoes-of-the-dot-com-era/