Grayscale Takes First Step Towards Expanding Crypto Investment Offerings

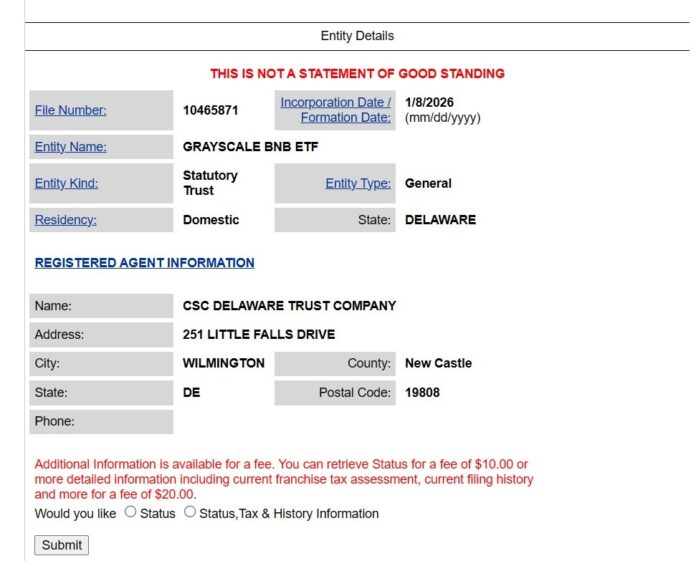

According to state records, asset manager Grayscale has taken a first step toward expanding its crypto investment offerings by establishing new statutory trusts in Delaware tied to potential BNB and HYPE-related products. This move is seen as a preparatory step for the company, which may be considering launching exchange-traded funds (ETFs) in the future. The trusts were registered on Thursday and list CSC Delaware Trust Company as their registered agent.

While the registration of these trusts does not constitute government approval and does not confirm that applications have been submitted, it is a common step taken by asset managers before filing formal applications with the U.S. Securities and Exchange Commission. The inclusion of BNB (BNB) and Hyperliquid (HYPE) is notable, as most US-listed crypto ETFs tend to focus on Bitcoin (BTC) and Ether (ETH), with only a handful of altcoin-related products gaining traction.

Grayscale BNB ETF Registration. Source: Delaware.gov

Grayscale BNB ETF Registration. Source: Delaware.gov

Early Groundwork, No Application

The creation of a Delaware trust is often viewed as more of an administrative agreement than a regulatory milestone. Issuers typically establish such entities to streamline future filings as market conditions and regulatory clarity improve. Grayscale has not publicly confirmed whether it intends to file ETF applications related to the newly formed trusts, and the company did not respond to requests for further information.

Despite the lack of confirmation, the move comes as the asset manager has expressed optimism for the coming year. On Monday, Grayscale released a research report saying ETF outflows are largely tax-related. The asset manager expressed a positive outlook for 2026, citing expectations of improved regulatory clarity and renewed institutional demand.

Source: Grayscale

Source: Grayscale

Expanding Beyond Bitcoin and Ether

The possible addition of BNB and HYPE to Grayscale’s ETF pipeline suggests a gradual expansion of institutional crypto exposure. The inclusion of HYPE also suggests that there is interest in capturing demand for new crypto narratives that go beyond established large-cap tokens. Hyperliquid, the protocol behind HYPE, is one of the largest decentralized perpetual exchanges in the crypto market.

For more information on this development, read the full article on Cointelegraph.