Introduction to DeFi’s Unfulfilled Promise

Decentralized finance (DeFi) has long been touted as a revolutionary force in the financial world, promising to provide banking services to the billions of people around the globe who lack access to traditional financial institutions. The narrative is simple yet compelling: by leveraging blockchain technology, DeFi can create a more open, permissionless, and neutral financial system. However, as we delve deeper into the reality of DeFi’s current state, it becomes increasingly clear that this promise remains unfulfilled.

The views expressed in this article are those of the author and do not reflect the opinions of the crypto.news editorial team. As we explore the shortcomings of DeFi, it’s essential to acknowledge the complexity of the issue and the need for a nuanced understanding of the challenges at hand.

The Status Quo of DeFi

A closer examination of the current DeFi ecosystem reveals a system that is still heavily reliant on traditional finance. Stablecoins, such as Tether (USDT) and USDC (USDC), which are essential for on-chain activity, are predominantly backed by bank deposits, treasury bills, or held cash equivalents in the traditional system. Furthermore, fiat on- and off-ramps are controlled by regulated intermediaries, and oracles obtain price data from central exchanges. Even user access is mediated through app stores, browsers, cloud providers, and payment networks that are firmly anchored in the existing financial and legal system.

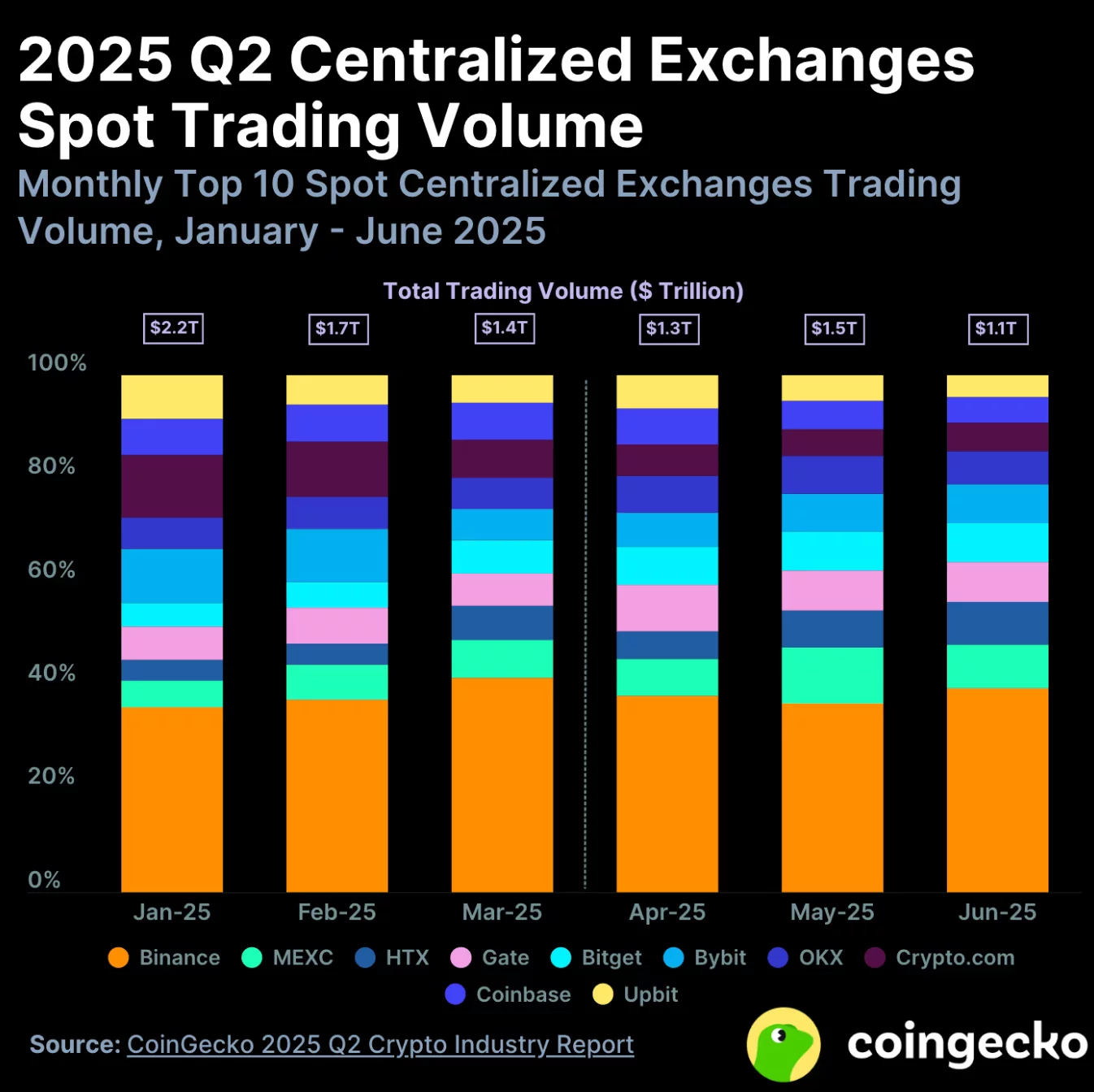

Source: Coingecko

The Infrastructure Problem

The primary issue with DeFi’s current approach is that it assumes a world with stable internet, stable electricity, stable devices, stable identity, and stable legal fallback. However, the unbanked population lacks reliable identity, reliable connectivity, reliable custody, reliable payments, reliable dispute resolution, and reliable legal remedies. They live in economies where money is unstable, institutions are weak, documentation is inconsistent, and access is sporadic. DeFi’s failure to address these infrastructure challenges means that it remains inaccessible to those who need it most.

The industry’s focus on optimizing speed, capital efficiency, and narrative has led to the creation of products that can scale quickly in environments where capital already exists. However, this approach has resulted in DeFi integrating with banks rather than replacing them, reflecting markets rather than reshaping them. This pragmatism has slowly turned into dependence, with DeFi’s liquidity, stability, legitimacy, and growth all dependent on the health, cooperation, and tolerance of the traditional financial system.

Admitting Dependence

This dependence on traditional finance is not decentralization; it’s financial parasitism with better user experience. DeFi’s strategic ceiling is rarely acknowledged, and as long as it relies on traditional finance for its core elements – money, identity, pricing, liquidity, and access – it cannot serve populations excluded from traditional finance. Instead, it can only rebundle funding for those already in the system.

The inconvenient truth is that DeFi is optimized for capital, not people. Modernizing financial systems is not a luxury; it requires building new payment infrastructure that does not require bank accounts, new identity systems that do not rely on government issuance, new custody models that do not require individual technical sophistication, and new credit systems that are not based on formal financial histories.

A Call to Action

The next phase of cryptocurrency will not be about higher throughput, better composability, or more sophisticated derivatives. It will be about whether the industry is willing to step out of its comfort zone and engage in the hard, inglorious work of building rails where there are none. This requires a shift in focus from products to infrastructure, from optimization to innovation, and from capital to people.

For more information on DeFi’s promised replacement of traditional finance, visit https://crypto.news/defis-promised-replace-tradfi-not-sit-on-top-of-them/