Bitcoin’s Recent Surge: Understanding the Market Dynamics

Bitcoin (BTC) price experienced a brief surge above $92,000 on Monday following the announcement of a criminal investigation into Federal Reserve Chair Jerome Powell by US federal prosecutors. However, despite this development, Bitcoin traders remain cautious due to significant outflows from exchange-traded funds (ETFs) and weak demand for bullish leveraged BTC positions.

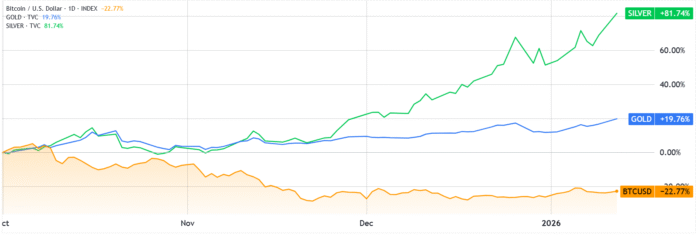

Bitcoin/USD vs. gold and silver. Source: TradingView

Bitcoin/USD vs. gold and silver. Source: TradingView

Notably, Bitcoin has underperformed compared to traditional store-of-value assets like gold and silver, which have reached all-time highs in 2026. This divergence has led to questions about the strength of the digital store-of-value narrative. Even if Bitcoin were to rally another 14% towards $105,000, investors may remain hesitant to turn bullish, especially given the diminishing expectations of further economic stimulus in the near term.

Key Factors Influencing Bitcoin’s Price

Goldman Sachs has revised its forecast, no longer expecting an interest rate cut in March, citing persistent inflation and a resilient labor market. This decision comes despite temporary slowdowns and US President Donald Trump’s criticism of the Fed for maintaining elevated interest rates. The investigation into Powell, whose term as Fed chair ends in April, has sparked concerns about central bank independence and the potential for a successor with a more dovish stance on monetary policy.

BTC 2-month futures basis rate. Source: Laevitas.ch

BTC 2-month futures basis rate. Source: Laevitas.ch

The Bitcoin futures annualized premium, or basis rate, remains near a neutral-to-bearish 5%, indicating a lack of strong bullish sentiment. Typically, periods of bullishness are characterized by BTC futures trading at a 10% premium or more relative to spot markets. Furthermore, Bitcoin spot ETFs have recorded significant net outflows, totaling $1.38 billion across four consecutive trading days, suggesting a lack of confidence among investors.

Market Indicators and Trends

Despite the recent rebound, Bitcoin’s risk profile appears largely unchanged by the power struggle between the Fed and the Trump administration. The US Dollar Strength Index has rebounded, and yields on the 5-year Treasury have remained below 3.8%, indicating no clear evidence of a debasement trade or imminent economic downturn.  US Dollar Strength Index (left) vs. US 5-year Treasury Yield. Source: TradingView

US Dollar Strength Index (left) vs. US 5-year Treasury Yield. Source: TradingView

Ultimately, the appeal of Bitcoin and cryptocurrencies remains subdued, as reflected in ETF flows and muted demand for leveraged BTC positions, suggesting relatively low odds of a surprise rally toward $105,000 in the near term. For more information and to stay up-to-date on the latest developments, visit the original source: https://cointelegraph.com/news/bitcoin-shows-strength-as-us-doj-mulls-fed-chair-investigation-will-btc-price-hold