The Securities and Exchange Commission (SEC) Crypto Task Force has received two new filings focused on self-custody rights and the regulation of proprietary trading in tokenized and decentralized finance (DeFi) markets. These submissions add to the growing pressure on regulators to establish clear guidelines for the crypto industry. Coinbase CEO Brian Armstrong has called for a compromise to pass market structure laws, emphasizing the need for a collaborative approach to find a “win-win scenario” for all stakeholders.

Self-Custody and DeFi Regulation

A filing from “DK Willard” highlights the importance of self-custody rights for retail users in Louisiana, citing state law HB 488, which affirms residents’ right to self-custody of digital assets. The submission argues that upcoming state laws governing the structure of the crypto market should maintain strict registration, transparency, and fraud and anti-manipulation requirements. This is crucial to prevent developers and platforms from circumventing basic investor protection obligations, which could increase the risk of fraud and financial crime for consumers.

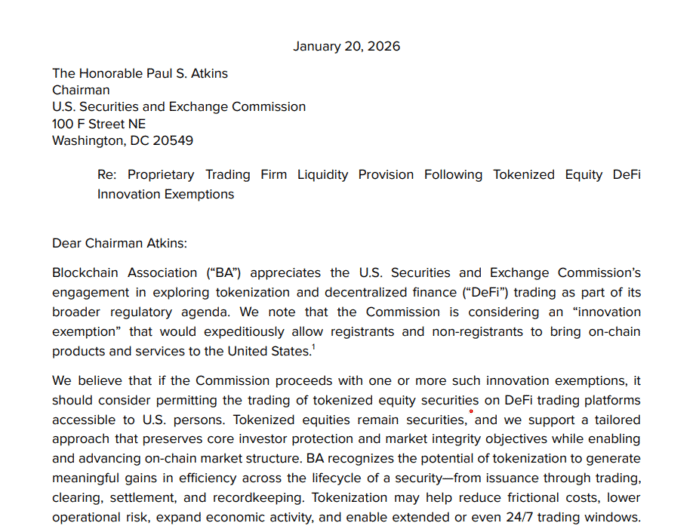

The Blockchain Association’s letter to the SEC focuses on the regulation of proprietary trading in tokenized and DeFi markets. The association requests clarification on whether companies that trade tokenized stocks and DeFi assets on their own account, without solicitation, custody, or execution by an agency, should be treated as “dealers” required to register under the Exchange Act. The letter notes that existing broker-dealer rules were designed for traditional markets and may need to be adapted for smart contract settlement.

Industry Response and CLARITY Compromises

The Blockchain Association letter. Source: SEC

The Blockchain Association letter. Source: SEC

The submissions come as negotiations on the federal crypto market structure bill, CLARITY, continue in Congress. White House senior crypto adviser Patrick Witt has urged the industry to accept compromises to pass the bill, highlighting the need to balance issues around stablecoin yield, DeFi liquidity, and investor protection concerns. Coinbase CEO Brian Armstrong has acknowledged the progress made so far in developing CLARITY, stating, “We are all working together to find a win-win scenario for everyone, especially the American people.”

As the crypto industry continues to evolve, it is essential to establish clear regulations that balance innovation with investor protection. The SEC’s Crypto Task Force is playing a crucial role in shaping the future of the industry, and these new filings demonstrate the ongoing efforts to find a compromise that works for all stakeholders. For more information on the latest developments in crypto regulation, visit Cointelegraph.