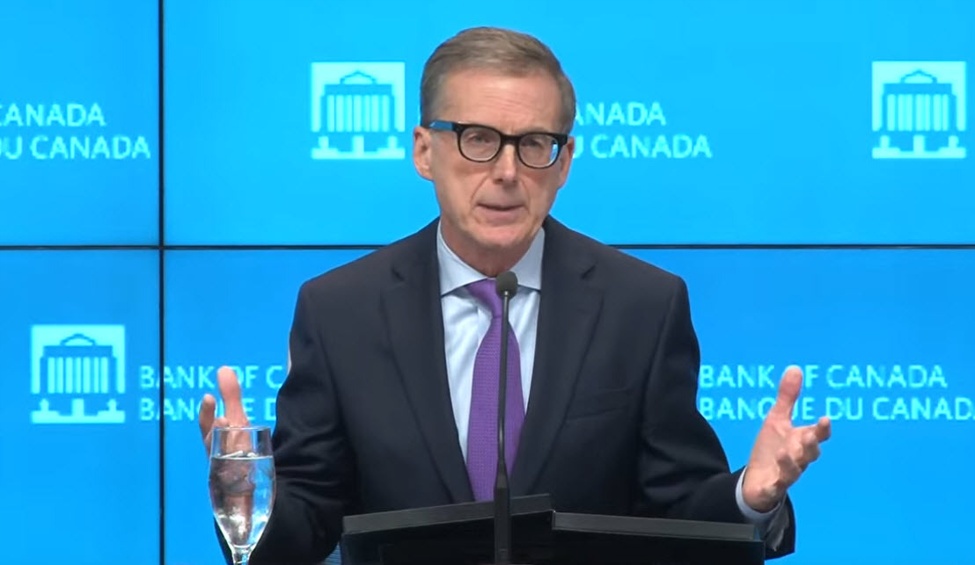

The Locker of Canada meets 8 occasions in 2024 and presently the marketplace sees 5 or 6 price cuts.

The primary query is when will they begin? The upcoming BOC assembly is true across the nook on January 24 but it surely comes at the heels of a surprisingly-hot inflation record. CPI rose 3.1% year-over-year in comparison to 2.9% anticipated and the core measure had been hotter-than-anticipated as smartly.

Alternatively that’s no longer the utmost pledge. The December CPI record can be excused on January 16 and there must be some assistance at the core aspect as a zero.3% get up from December 2022 rolls off. Alternatively, the y/y headline quantity is more likely to get up even additional as a -0.6% studying from a yr previous is driven out of the equation. That might push headline CPI upwards of three.5% a secured BOC Governor Tiff Macklem’s fingers.

A presen then it’s the other as a top headline quantity disappears however a low core measure must reserve it increased.

All of the year-over-year numbers will in any case get some assistance with the February CPI record and that’s when an actual downtrend will pull accumulation. Alternatively that knowledge level gained’t be revealed till later the March 6 BOC assembly.

That assembly is priced at 45% for a short presently and that sounds about proper. I will simply see the BOC ready to look how the ones CPI numbers fall and retirement charges on accumulation till the April 10 assembly.

The case for them to short may be compelling and it partially hinges on an expectation that they are going to glance south for cues. The FOMC meets March 20 so they’re going to have to attend, proper? I don’t assume so. The Fed all the time strongly alerts what it’ll do ahead of the assembly and the power failure begins March 8, so there’s a excellent probability the BOC will know what the Fed goes to do. At this time the March Fed assembly is at 100% so in a condition the place that doesn’t alternate, I might be expecting the BOC to step to the entrance of the layout. Additionally be aware that the March ECB assembly comes a date later the BOC.

In spite of everything, the April 10 will undoubtedly be are living. Tide pricing is at 100% — virtually precisely — with the June 5 assembly pricing in 72 bps from now.

Turning again to the CPI numbers, the headlines had been so roasting from Jan-Might 2023 and the ones will slowly roll off. So through the day we get to upcoming June, we may well be having a look at very low Canadian CPI numbers.

Canada CPI m/m

Within the 4 extra conferences in 2024, cuts are totally priced for 3 of them with a 40% of a fourth.

That takes us again to housing, through June we’ll have an excellent concept of ways the spring housing marketplace is going. If banks proceed to be unenthusiastic to move on decrease marketplace charges, nearest we may have hassle. Odds are that we get no less than reasonable ache and at that time, I believe the BOC blinks and 50 bps cuts get started. I will be able to even be intently staring at Canadian shopper spending, which has been stumbling.

What about 2025?

The OIS marketplace is now pricing in about 225 bps in cuts in overall via 2025, which might get the BOC to two.75%. I believe they finally end up at 1.75%, which is the place they had been in 2019 ahead of the pandemic.

By contrast, listed here are the forecasts from the Canadian weighty banks, by way of Steve Hueble at Canadian Loan Tendencies:

by way of Canadianmortgagetrends.com