XRP Funding Conditions Suggest Potential for Strong Price Rally

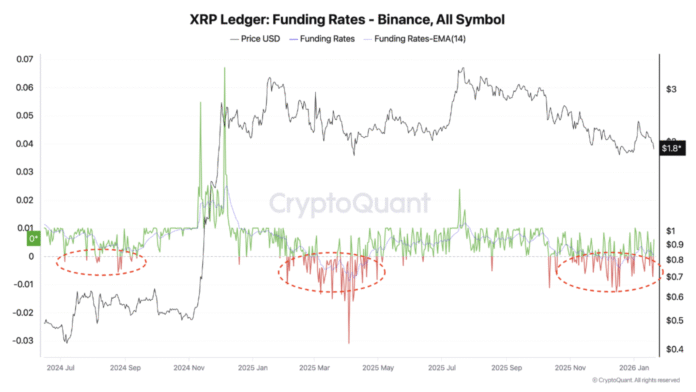

XRP (XRP) funding rates on Binance have been reflecting behavior seen prior to strong price rallies since 2024, with negative financing leading to short squeezes. This phenomenon has been observed in the past, where sustained negative funding rates have preceded significant price increases, including a 50% rally in August and September 2024 and a 100% gain in April 2025.

XRP Ledger funding rates on Binance. Source: CryptoQuant/Darkfrost

XRP Ledger funding rates on Binance. Source: CryptoQuant/Darkfrost

The current bearish consensus among derivatives traders, which formed after a roughly 50% decline in XRP spot prices from its multi-year high of $3.66 reached in July 2025, could potentially hurt bears in the coming weeks. On-chain analyst Darkfrost points to the period of sustained funding rates since 2024, each of which led to strong price recoveries.

Historical Precedent for Price Recoveries

XRP Ledger funding rates vs. price. Source: CryptoQuant

XRP Ledger funding rates vs. price. Source: CryptoQuant

Darkfrost notes that the accumulation of short positions creates short-term selling pressure but also latent buying pressure. If the price starts to rise, these positions could be liquidated, fueling the uptrend. This phenomenon has been observed in the past, with BTC’s 50% increase in August-September 2025 and over 100% gains in April-July 2025.

XRP Bulls Need to Recover the $2 Level as Support

In January, XRP had recovered slightly after testing the lower trendline of its one-year sideways trend and approaching the $1.80-$2.00 support area. This zone served as the launching pad for a 100% rally to $3.66 in April 2025.

XRP/USD three-day chart. Source: TradingView

XRP/USD three-day chart. Source: TradingView

The $2 level remains an important psychological line for XRP in the short to medium term. According to Glassnode, each retest of the $2 area since the start of 2025 coincided with around $500 billion to $1.2 billion in weekly realized losses, suggesting that many holders used these moves to exit and cut their losses rather than increase their exposure.

XRP realized loss against price. Source: Glassnode

XRP realized loss against price. Source: Glassnode

Technical Perspective

From a technical perspective, XRP bears are trying to pull the price towards its 200-week exponential moving average (blue wave of 200-week EMA) at around $1.40 if it fails to reclaim its 50-week EMA (red wave) at $2.22 as support.

XRP/USD weekly chart. Source: TradingView

XRP/USD weekly chart. Source: TradingView

Darkfrost’s “latent buying pressure” thesis will weaken significantly if the XRP price decisively loses the $1.80-$2.00 support zone. For more information, read the full article on Cointelegraph.