Bitcoin Price Prediction: Will BTC Reach $100,000 in 2026?

The Bitcoin (BTC) market is facing a challenging time, with the price struggling to break the $100,000 barrier. According to prediction markets, there is less than a 10% chance of BTC reaching $100,000 before February 1st. This pessimistic outlook is shared by traders on Polymarket and Kalshi, who believe that the market lacks bullish catalysts amid macroeconomic uncertainties.

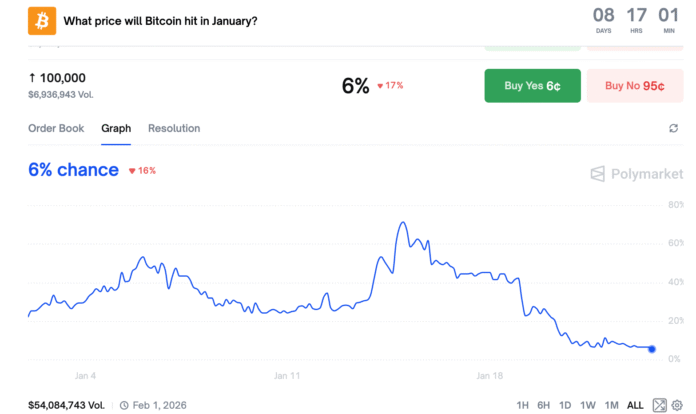

As of Thursday, Polymarket bettors expect about a 6% chance of BTC breaking $100,000 before January 31. Similarly, Kalshi puts a 7% chance of BTC reaching the psychological $100,000 mark before the end of January.

Bitcoin’s Price History and Market Sentiment

Bitcoin’s 2026 high is $97,900, reached on January 14th. The last time the BTC/USD pair traded above $100,000 was on November 13th. Despite this, Bitcoiners dismiss fears of quantum computers as the cause of the price drop. The last time BTC/USD fell below $100,000, it regained this level after a 25.5% decline after 93 days.

If a similar scenario occurs, BTC price could reach $100,000 again in mid-February, as shown in the chart below. However, traders on Kalshi say this could take longer, estimating the likelihood of Bitcoin breaking $100,000 before June at 65%.

Bitcoin Price Projections and Market Expectations

In fact, traders on Polymarket see a 65% chance of BTC initially falling to $80,000 before falling back to $100,000 in 2026. Kalshi bettors are pricing in a 54% chance that Bitcoin will bottom at $70,000 this year. In addition, the probability of the price falling to $65,000 is 50% and the probability of it falling to $60,000 is 42%.

There are increasing signs that Bitcoin has entered a bear market, with targets as low as $58,000. Traders on Polymarket estimate a 75% chance that Bitcoin will trade below Strategy’s average BTC cost price in 2026, which was $75,979 at the time of writing.

Despite the expected price decline, Polymarket’s odds for the strategy to sell Bitcoin in 2026 remain below 26%, while expectations for routine small purchases remain high. Polymarket traders still consider routine strategy purchases a high probability event throughout the year, with an 84% chance of the company holding over $800,000 BTC by December 31st.

Last week, Strategy expanded its Bitcoin holdings to 709,715 BTC after purchasing 22,305 coins for around $2.13 billion. For more information on Bitcoin price predictions and market analysis, visit Cointelegraph.