Despite boasting impressive on-chain metrics, the Solana price has experienced a decline, reaching its lowest level since January 2nd. This downturn has sparked interest among investors and analysts, who are eager to understand the factors contributing to this trend.

Network Performance and User Growth

The Solana network has demonstrated remarkable performance, with data from Nansen indicating that it has processed over 2 billion transactions in the last 30 days. This surpasses the combined transaction volume of other popular Layer 1 and Layer 2 networks, such as Ethereum and BSC Network, which have transacted 63 million and 438 million, respectively. Furthermore, the number of Solana users has increased by 34% to 81.2 million over the same period, with network fees rising by 42% to over $20 million.

The growth in user base and network activity is also reflected in the stablecoin transaction volume, which has reached over $312 billion, accompanied by a rise in transaction count to over 260 million. The Solana ecosystem is home to over 4.5 million stablecoin addresses, underscoring the network’s expanding presence in the cryptocurrency market. Decentralized exchange volumes and stablecoin volumes have remained stable, with Solana’s DEX protocols processing over $107 billion in volume, outpacing Ethereum, Base, and BSC combined.

Technical Analysis of Solana Price

A closer examination of the daily time chart reveals that the SOL price has declined over the past few days, moving from the year-to-date high of $148 to the current level of $126. However, the formation of a bullish chart pattern, specifically an inverted head and shoulders pattern, suggests a possible recovery. Additionally, the token has formed a cup and handle pattern, which is currently situated in the right shoulder area.

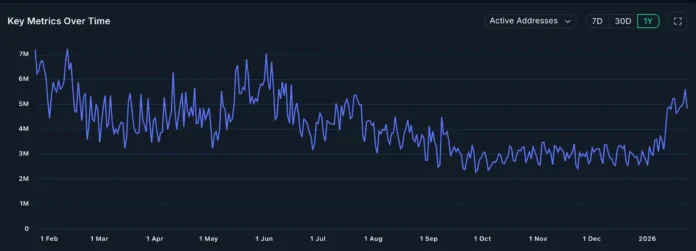

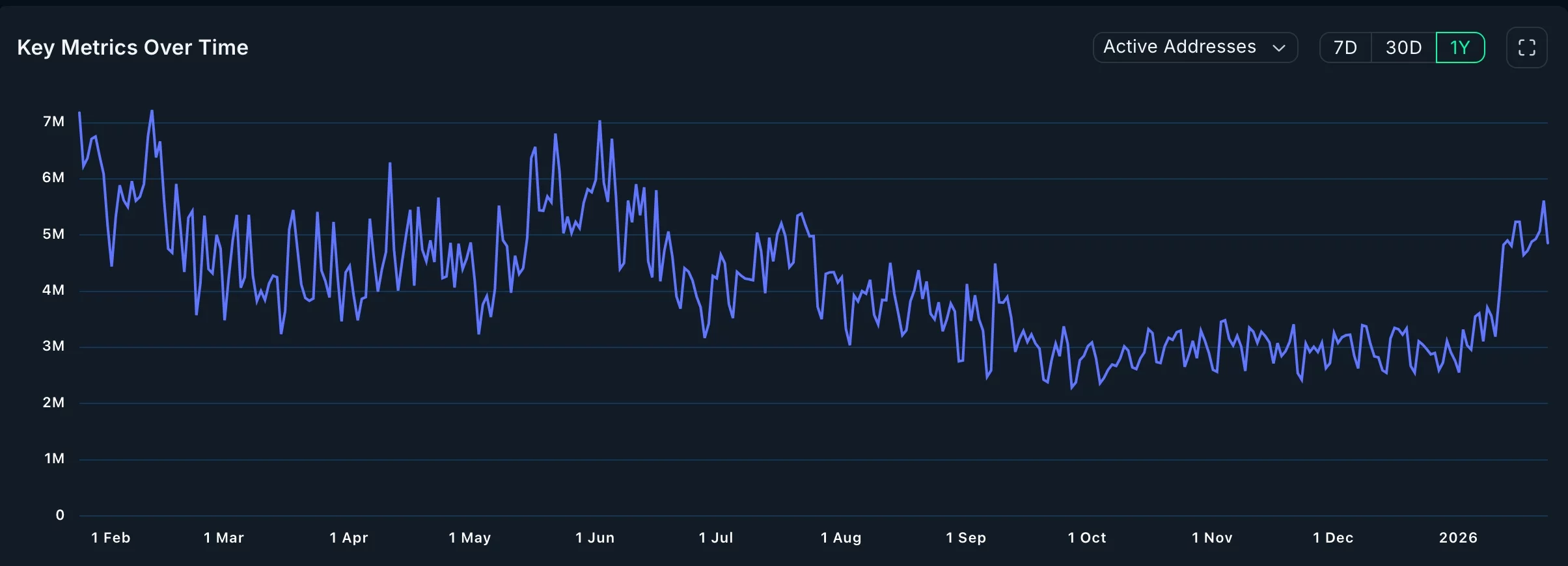

Active Solana Addresses | Source: Nansen

Active Solana Addresses | Source: Nansen

Technical analysis indicates that the most likely scenario is a recovery in the coming weeks, potentially reaching the year-to-date high of $148. A move above this level could suggest further gains, possibly to the psychological level of $200. Nevertheless, a break below the key support level at $118 would invalidate the bullish outlook and indicate near-term bearishness.

SOL price chart | Source: crypto.news

SOL price chart | Source: crypto.news

Future Prospects and Upgrades

Solana’s growth is expected to continue in the coming years, driven by the highly anticipated Alpenglow upgrade, which will significantly enhance performance. As developers work on this upgrade, the network’s expanding user base, increasing transaction volume, and growing stablecoin adoption are likely to contribute to its long-term success. For more information on Solana’s price prediction and network developments, visit https://crypto.news/solana-price-prediction-as-network-fees-transactions-and-users-soar/