Geopolitical Tensions Between the US and EU: The Risk of Selling US Debt

The United States’ recent actions regarding Greenland have led to a significant shift in its economic relationship with the European Union. The EU is now considering various options to counter US belligerence, including the possibility of selling off US debt. This move, often referred to as the “nuclear option,” could have far-reaching consequences for the global economy.

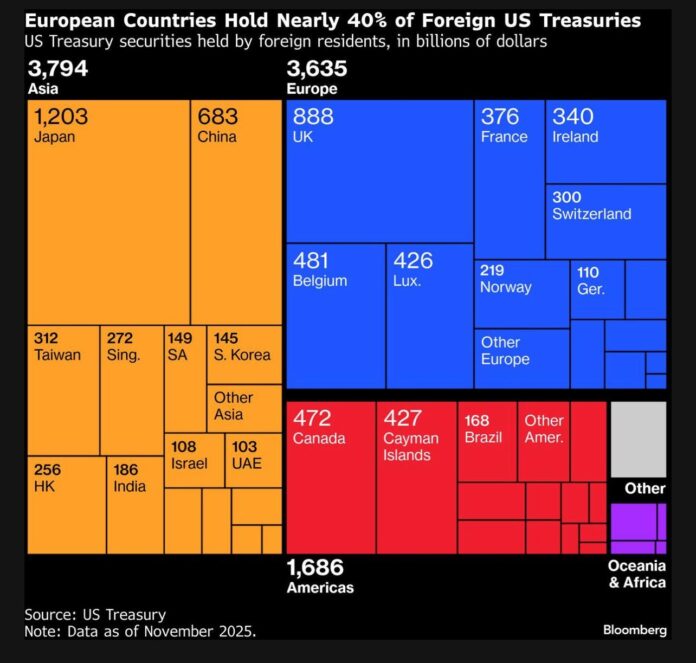

Following a supposed “framework agreement” in Davos, the tone has changed, and US ambitions to take over Greenland have cooled for the time being. However, EU leaders are still preparing for possible responses to further escalation. One option on the table is to cut off access to US markets through the so-called “trade bazooka.” If implemented, this would cut US companies off from the EU market, resulting in significant financial losses. Another option is to sell off the trillions of dollars of US assets held in Europe.

However, questions remain regarding the feasibility of selling off US debt. Dumping US assets could drastically alter the global economic landscape and have knock-on effects on the US financial system’s dependence on stablecoins. The EU’s ability to force a sale and find potential buyers in an increasingly de-dollarized world is also uncertain.

Can the EU Actually Sell Off US Debt?

Before January 21, European leaders were considering possible answers to counter US aggression. While Denmark sent special forces to Greenland, other leaders proposed the introduction of a trade bazooka that would deny the US access to EU markets. Others, including former Dutch defense minister Dick Berlijn, suggested that Europe could use US debt as leverage. Berlijn said: “If Europe decides to sell off these bonds, it will create a big problem in the US. The dollar crashes, high inflation. The US voter won’t like that.”

George Saravelos, chief foreign exchange strategist at Deutsche Bank, wrote in a note: “For all its military and economic strength, the United States has one key weakness: It relies on others to pay its bills through large balance of payments deficits.”  Source: Reddit/Bloomberg

Source: Reddit/Bloomberg

Saravelos noted that the US currently owns $8 trillion in US bonds and stocks, which is “twice as much as the rest of the world combined.” However, the question remains whether Europe can actually pay off this debt. The issue is not only how the EU could force a sale but also who the potential buyers are in an increasingly de-dollarized world.

Yesha Yadav, a law professor and associate dean at Vanderbilt University, told Cointelegraph: “Foreign government buyers tend to remain stubborn, meaning they will not easily move their holdings unless there is a serious need to do so.” Furthermore, according to the Financial Times, much US debt in Europe is held not by governments themselves but by private entities such as pension funds, banks, and other institutional investors.

Stablecoins Are Becoming Major Buyers of US Debt

One emerging major buyer of US debt is stablecoin issuers. According to the GENIUS Act, the US’s landmark legislation establishing a framework for stablecoins, issuers of these assets operating in the country must have dollars and US treasuries in reserves to back their coins.

Yadav noted that stablecoin issuers are growing rapidly, and their need for government bonds is correspondingly high. “To the extent that this trend continues, it provides a major benefit to U.S. policymakers, but also deepens the connection between the continuity of stablecoin issuers and the ability of U.S. Treasury markets to remain liquid and popular,” Yadav said.

The proliferation of stablecoin issuers as buyers of US debt is not without risks. This, combined with a reduction in the number of buyers of US debt, particularly in the event of dumping or even a significant reduction in EU commitment, could cause problems for US Treasury markets. Yadav and Brendan Malone, who previously worked in payments and clearing at the Federal Reserve Board, have already identified liquidity shocks in US debt markets in March 2020 and April 2025.

In the event of a run on stablecoin issuers, this lack of liquidity and the increasing lack of counterparties to sell to could prevent the issuer from selling its securities. It would become insolvent and also significantly impact the credibility of the U.S. Treasury bond markets. Economic and military escalation in an increasingly multipolar world has caused divisions between former allies.

While there is hope for dialogue between the EU and the US, Latvian President Edgars Rinkēvičs said: “We are not out of the woods yet […] Are we in an irreversible divide? No. But there is a clear and present danger.” The danger is not only to the sovereignty of Europe and Greenland but also to the US debt markets. Read more about the situation at https://cointelegraph.com/news/could-europe-sell-us-debt-greenland-deal?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound