VanEck Launches US-Listed Avalanche ETF, Expanding Institutional Access to AVAX

Global asset manager VanEck has made a significant move in the cryptocurrency space by launching a U.S.-listed exchange-traded product (ETP) that provides exposure to Avalanche’s native token, AVAX. This development marks a notable milestone for Avalanche, as it is the first spot ETF to trade in the United States, offering investors a new avenue to engage with the AVAX token.

According to the announcement made on Monday, the product is not registered under the Investment Company Act of 1940 but may be subject to other U.S. securities laws. The fund trades under the ticker symbol VAVX and is designed to track the price of Avalanche’s AVAX token. Additionally, it has the potential to generate returns through staking, providing investors with a unique opportunity to earn network returns. VanEck has announced that it will waive sponsorship fees on the ETF’s first $500 million of assets through February 28, after which assets over $500 million will be subject to a 0.20% sponsorship fee.

Kyle DaCruz, Digital Assets Product Director at VanEck, highlighted the significance of this ETF wrapper in opening up access to the RIA and asset management market. He noted that institutions can now “earn network returns through a standard exchange-traded product without the risk or complexity of managing the infrastructure itself.” This statement underscores the potential of the ETF to simplify institutional investment in AVAX and provide a more streamlined experience for investors.

Crypto ETFs Evolve Beyond Simple Price Risk

The launch of the VanEck Avalanche ETF reflects a broader shift in the crypto exchange-traded product landscape. Issuers are increasingly designing ETFs that combine digital assets with portfolio strategies and risk management features, rather than just offering simple price risk. This evolution is evident in recent launches, such as Amplify ETFs’ blockchain-focused ETFs on NYSE Arca, which track diversified indices of companies building infrastructure and generating revenue from stablecoins and tokenized assets.

Bitwise Asset Management has also filed with the U.S. Securities and Exchange Commission to launch 11 single-token “strategy” crypto ETFs, expanding its product range with regulated exposure to major altcoins. Furthermore, asset manager 21Shares has launched its Bitcoin Gold ETP, BOLD, on the London Stock Exchange, offering a single exchange-traded product that combines exposure to Bitcoin and gold.

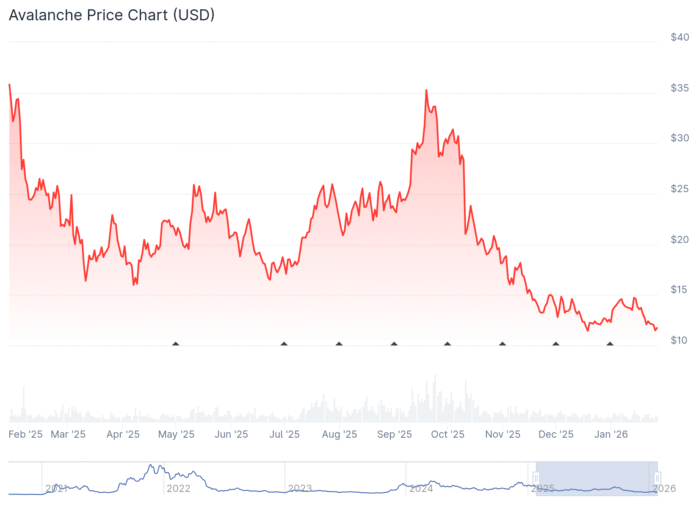

The AVAX token, which is the native token of the Avalanche blockchain network, had a market cap of $5.1 billion at the time of writing and was trading at $11.76. According to CoinGecko data, the token is down about 92% from its November 2021 all-time high of $144.96 and about 69% over the past year.  AVAX price development over the past year. Source: CoinGecko

AVAX price development over the past year. Source: CoinGecko

VanEck first attempted to launch an Avalanche ETF in March 2025 when it filed an S-1 registration statement with US regulators. The launch of the fund could pave the way for additional Avalanche spot ETFs already in the regulatory pipeline. Grayscale Investments currently operates an Avalanche Trust and filed to convert the product to a spot ETF in August 2025, while Bitwise Asset Management filed an S-1 registration for an AVAX spot ETF in September 2025.

For more information on this development and its implications for the cryptocurrency market, visit https://cointelegraph.com/news/vaneck-us-avalanche-etf-avax-spot?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound