Cardano Price Stabilization: A Potential Trend Reversal on the Horizon

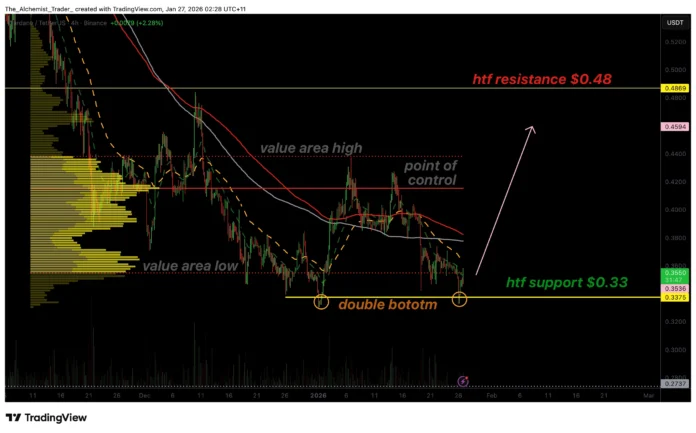

Cardano (ADA) has been exhibiting signs of stabilization after an extended period of correction, with its price action repeatedly defending the crucial support level at $0.33. This area has become a focal point for buyers, as multiple reactions at this level begin to form a double bottom pattern. Although confirmation is still pending, the current structure suggests that the bearish momentum may be weakening, potentially paving the way for a trend reversal.

The coming sessions will be pivotal in determining whether this formation develops into a confirmed reversal or remains a temporary pause within a larger range. The development of a double bottom pattern is a significant technical indicator, often signaling a potential shift in market sentiment. As ADA has defended the $0.33 support level twice, it has formed a potential double bottom, with buyers attempting to recapture the low of the value range, an important confirmation level.

Key Technical Points of Cardano Price

Several key technical points are worth noting in the current Cardano price action. Firstly, the $0.33 support level in the high time frame has seen strong demand, with several reactions suggesting that this level is crucial for buyers. Secondly, the development of a raised floor structure, potentially forming a double bottom, is a significant reversal pattern. Lastly, the recovery of the low value is key, as acceptance above this level would strengthen the bullish case for ADA.

- $0.33 support in high time frame: Several reactions suggest strong demand at this level.

- Development of the raised floor structure: A possible reversal pattern is emerging.

- Low value recovery is key: Acceptance above this level would strengthen the bullish case.

ADAUSDT (4H) chart, source: TradingView

ADAUSDT (4H) chart, source: TradingView

Initial Reaction and Double Bottom Formation

The initial reaction to the $0.33 support level resulted in a strong bounce, with Cardano executing a decisive uptrend that pushed the price towards the high in the value area. This reaction confirmed that buyers were active at this level and ready to defend it aggressively. The strength of this first jump is important because double bottom formations are more reliable when the first reaction shows clear demand rather than a weak or superficial reaction.

From a structural perspective, this bounce was the first sign that selling pressure was starting to lose control after the previous downtrend. The development of a double bottom pattern is a significant technical indicator, often signaling a potential shift in market sentiment.

A Rejection Results in a Retest of Support

After testing the high of the value range, Cardano faced rejection, which resulted in a pullback towards previous support. Instead of collapsing, the price returned to the $0.33-$0.34 area, effectively testing the same support on the upper time frame that triggered the initial upswing. This second test defines the possible raised floor structure.

Crucially, the retest did not result in a lower low. Instead, the price stabilized again, suggesting that sellers failed to decisively push ADA below support. This behavior often reflects the absorption of sell-side pressure and increases the likelihood of a base forming.

Bullish Reaction Near the Value Range Low

Currently, Cardano is showing a bullish reaction as the price attempts to reclaim the low of the value range. This level acts as an important threshold between bearish and bullish control within the range. An acceptance above the low of the value range would indicate that buyers are regaining influence and the price is moving back into a fair value range.

From a price action perspective, consecutive candlestick closes above the low of the value range would significantly increase the likelihood that the double bottom pattern is valid and not random.

Checkpoint as Next Destination

If Cardano successfully reclaims the low of the value range, the next key upside target will be the Point of Control (POC). The POC represents the price level that saw the highest trading volume in the most recent range and often acts as a magnet during reversals.

A move towards POC would signal that the market is accepting higher prices and could pave the way for a broader rotation higher. This would also represent a significant improvement in market structure and relieve ADA from ongoing bearish pressure.

Market Structure Remains Neutral but is Improving

While the potential double bottom is constructive, it is essential to note that Cardano’s broader market structure remains neutral to slightly bearish until key resistance levels are reclaimed. A confirmed reversal requires more than just holding support; it requires acceptance and enforcement beyond value.

However, the current setup represents one of the more technically compelling areas that ADA has seen in recent weeks, given the bias towards near-term support, repeated buyer protection, and improving near-term momentum.

Upcoming Price Development

Cardano is approaching a critical decision point. As long as the support at $0.33 holds, the likelihood of a confirmed double bottom remains high. A rebound and close above the low of the value range would significantly strengthen the reversal thesis and open the door for a rally towards the control point and higher resistance levels.

However, failure to regain value will leave ADA rangebound and vulnerable to further consolidation. In the short term, price behavior around the low of the value area will determine whether this developing double bottom turns into a meaningful trend reversal.

For more information and updates on Cardano’s price, visit https://crypto.news/cardano-price-stabilizes-at-0-33-as-double-bottom-takes-shape/