Hyperliquid’s HYPE Token Sees 60% Surge: Understanding the Rally

The cryptocurrency market has witnessed a significant surge in the value of Hyperliquid’s HYPE token, with a 60% increase to $34.90. This substantial growth has been attributed to various factors, including institutional investor accumulation through Hyperliquid Strategies and reduced selling pressure following the unlocking of large shares. The rally has also been fueled by bearish liquidations of over $20 million and a bullish report from ARK Invest, which has sparked speculation about the token’s potential for further growth.

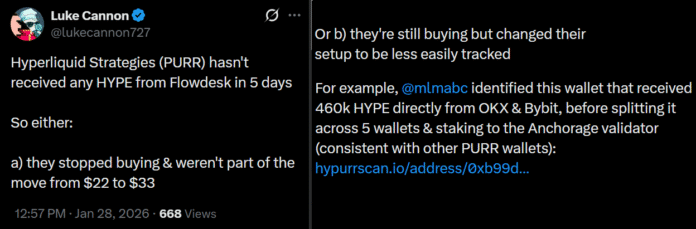

The increase in HYPE’s value began after a publicly traded company focused on digital asset reserves initiated the accumulation of 3.6 million HYPE tokens on December 12, 2025. These tokens were subsequently staked using Anchorage custody solutions, a move that has been linked to Hyperliquid Strategies’ operating methods. Additionally, 460,000 HYPE tokens were transferred from OKX and Bybit and staked via Anchorage, further solidifying the connection to Hyperliquid Strategies.

Source: X/lukecannon727

Hyperliquid’s Growth and Its Impact on the Market

The growth of Hyperliquid has led to speculation about its potential to surpass Binance, with some market participants attributing HYPE’s price increase to an rise in Hyperliquid’s on-chain activity. However, a closer examination of the data reveals that synthetic perpetual volumes and fees have not shown significant changes, and hyperliquid open interest has remained relatively stable at $8.5 billion. While there has been an increase in activity in silver contracts, there is little evidence to suggest a major shift in hyperliquid usage.

Hyperliquid daily fees and perpetual volumes, USD. Source: DefiLlama

Hyperliquid’s CEO Weighs In

Hyperliquid’s CEO, Jeff Yan, has reported an all-time high in open interest, driven by a surge in synthetic commodity volumes. Yan has also noted that Hyperliquid’s Bitcoin futures liquidity has surpassed that of Binance, citing a snapshot comparing the two platforms’ BTC perpetual futures order books.

Source: X/chameleon_jeff

While Yan’s analysis suggests that Hyperliquid has become a hub for “crypto price discovery,” it is essential to note that Binance’s total open interest in BTC futures remains significantly higher, standing at $12.3 billion. The centralized exchange also offers a broader range of contracts, including monthly contracts and contracts settled in both BTC and Tether (USDT).

Previous selling pressure on HYPE has been attributed to Continue Capital, which reportedly sold 297,000 HYPE tokens two weeks ago. However, the fund manager’s last large stake unlock was on January 21st, totaling 1.47 million HYPE. An additional 1.5 million HYPE tokens were recently unlocked through wallets associated with a “Tornado Cash cluster.”

A research report from ARK Invest, released on January 22nd, has also played a significant role in piquing investor interest in Hyperliquid. The report describes Hyperliquid as one of the “most revenue-efficient companies in the world,” using decentralized finance (DeFi) derivatives to directly compete with traditional exchanges. Analysts note that blockchain networks are evolving into monetary assets depending on their utility.

While HYPE’s failure to maintain levels above $34 on Wednesday may not be a definitive indicator of its future performance, it is essential to consider that recent gains may be attributed to one-off events, such as inflows from a digital asset reserve company and reduced selling pressure. As the market continues to evolve, it is crucial to monitor Hyperliquid’s long-term fundamentals and assess the potential for further growth.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, visit https://cointelegraph.com/news/hype-rallies-as-hyperliquid-dex-growth-grabs-traders-attention-will-it-last