Precious Metals Market Suffers Historic Collapse

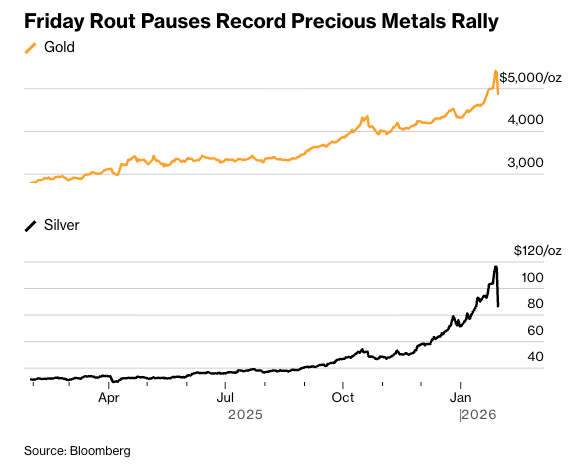

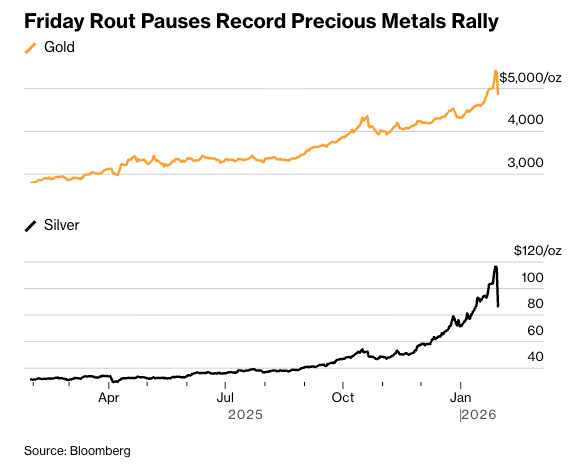

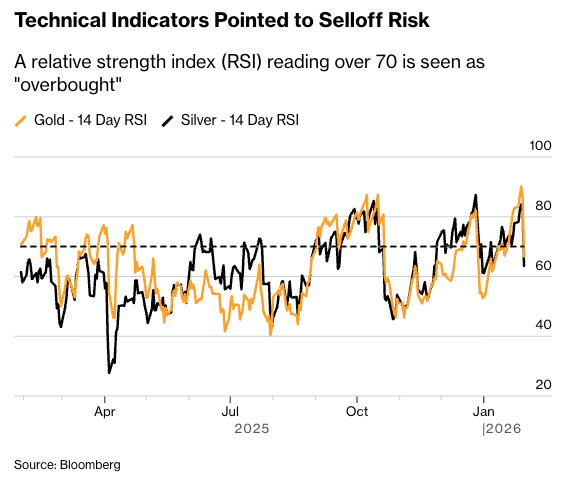

Precious metals suffered a catastrophic collapse on January 30 as gold plunged over 12% below $5,000 an ounce while silver recorded its largest intraday drop in history, falling as much as 36%, according to Bloomberg. The selloff was triggered by President Donald Trump’s nomination of Kevin Warsh as Federal Reserve chair, which sent the dollar soaring and sparked massive profit-taking across commodities markets.

Source: Bloomberg

The crash wiped out more than $15 trillion from the gold and silver markets in 24 hours, an amount equal to half the size of the entire U.S. economy. Despite the brutal correction, both metals still finished January with gains (gold up 12% and silver up 16%), while Bitcoin tumbled to a nine-month low of $82,000, raising questions about whether the digital asset will follow precious metals’ trajectory or chart its own path.

Causes and Consequences of the Selloff

Spot gold prices crashed more than 12% at one point, hitting a low of $4,682 per ounce in its biggest single-day decline since the early 1980s, closing down 9.25% at $4,880. Silver experienced an even more dramatic collapse, plummeting 36% intraday to $74.28 per ounce before settling 26.42% lower at $85.259, marking its worst day since March 1980.

“Trump announcing Warsh as his pick for next Fed Chair has been a US dollar positive and precious metals negative,” Aakash Doshi, global head of gold and metals strategy at State Street Investment Management, told Bloomberg. The selloff accelerated through forced selling and margin calls as leveraged positions unwound.

Source: Bloomberg

Major mining companies suffered devastating losses, with Newmont down 11.52%, Barrick Gold falling 12.09%, and AngloGold plunging 13.28%. Copper also retreated 3.4% from Thursday’s record high above $14,000 per ton, while silver ETFs saw their worst days on record, with the iShares Silver Trust losing 31%.

Implications for Bitcoin and the Crypto Market

Bitcoin dropped to $82,000 following Warsh’s nomination, with spot Bitcoin ETF outflows accelerating to roughly $1 billion this month and total liquidations approaching $800 million to $1 billion, according to Bitfinex analysts. The digital asset is now trading at a nine-month low as investors reassess monetary policy trajectories.

Source: TradingView

Aurélie Barthere, Principal Research Analyst at Nansen, identified multiple negative catalysts driving Bitcoin lower: “Fed Chair Powell guiding for no Fed cut in its remaining mandate till June 2026, President Trump seemingly choosing the more hawkish candidate as the new Fed Chair, Kevin Warsh, and a BTC correlation with US equities turning positive again.” Flow data shows “slow capitulation in ETFs, options, and miner activity,” she noted.

Read more about the historic collapse of precious metals and its implications for Bitcoin at https://cryptonews.com/news/silver-plunges-record-36-as-precious-metals-suffer-historic-collapse-bitcoin-about-to-rally/