Bitcoin (BTC) has closed its weekly candle at $76,931 on Sunday, marking a significant milestone as it loses its 100-week moving average for the first time since October 2023. This development has sparked intense debate among analysts, who are now pondering whether this move signals the early stages of a bear market and what implications this shift could have on Bitcoin’s long-term recovery.

Key Takeaways:

-

Bitcoin closed a weekly candle below the 100-week simple moving average, a trend associated with multi-month drawdowns.

-

Previous bearish breakouts below the weekly trend lasted between 182 and 532 days.

-

High spot volume between $85,000 and $95,000 could turn this level into major resistance.

Bitcoin is slipping below a long-term weekly trend

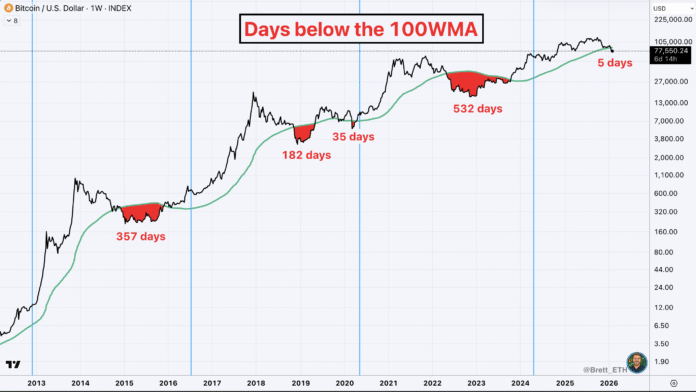

Bitcoin closed a weekly candle below its 100-week simple moving average (SMA), which is around $87,500. This marks the loss of a key macro trend level for BTC. Crypto advocate Brett pointed out that, aside from the COVID-19 flash crash in 2020, Bitcoin has been below the 100-week SMA for an extended period of time. In the 2014-2015 cycle, BTC remained below this level for 357 days as prices fluctuated between $200 and $600 after the 2013 bull market high.

Bitcoin days below the 100W SMA. Source: Brett/X

In 2018-2019, this period lasted 182 days and coincided with the bear market bottom between $3,000 and $6,000. In 2022, Bitcoin was below the 100-week SMA for 532 days after the FTX plunge, consolidating between $16,000 and $25,000. Each fall resulted in an accumulation phase rather than a quick recovery, suggesting that time could once again be the key factor ahead of the next bullish phase.

USDT dominance and resistance at $85,000 increase bear market risk

Crypto analyst Sherlock said a bear market could emerge after the USDT dominance chart recorded a weekly close above 7.2%. In past cycles, a close above 6.7% confirmed bearish conditions, which is why the latest breakout, the first in more than two and a half years, is particularly significant.

USDT dominance chart analysis by Sherlock. Source: X

The analyst highlighted $85,000 as a key resistance zone. In the fourth quarter of 2025, more than $120 billion in spot volume traded between $85,000 and $95,000, putting pressure on many BTC holders. With BTC close to $78,000, any rally towards $85,000 could face steady selling pressure as traders could look to exit at breakeven, with the realized price currently at $91,500 for one- to three-month holders.

Bitcoin realized the price by cohorts of 1 to 3 million holders. Source: CryptoQuant

BTC’s fractal structure levels are declining starting in 2022

Bitcoin’s weekly structure shows similarities to the 2022 decline. At this point, BTC formed lower highs, lost the 100-week SMA and failed to sustain the recovery before entering a deeper correction.

BTC/USDT 1-week chart with head and shoulders pattern. Source: TradingView

A similar pattern is now visible in 2026. If the fractal continues, Bitcoin could return to the $40,000-$45,000 range, an established demand zone. While fractals are not predictive, the setup suggests that downside risk remains elevated unless Bitcoin decisively reclaims the 100-week SMA.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks and readers should conduct their own research when making their decision. For more information on Bitcoin’s market trends and analysis, visit Cointelegraph.