Tether’s $182 Million USDT Freeze: A Coordinated Effort to Combat Sanctions Evasion

According to on-chain data and alerts collected by Whale Alert, on January 11, Tether froze more than $182 million worth of USDT at five wallet addresses on the Tron blockchain. The bans actually occurred on the same day and affected individual wallet balances with amounts ranging from about $12 million to about $50 million, making the move one of the largest synchronized wallet blacklists on Tron in recent months.

A Tether spokesperson said in a report that the funds were frozen following a formal law enforcement request as part of an ongoing investigation. The company added that authorities had been working on the case for months and reiterated its policy of cooperating with global authorities by freezing illegal or sanctioned addresses when required by law.

Tether’s Policy of Cooperating with Law Enforcement

Tether’s move is in line with its policy of voluntarily freezing wallets, which the company officially launched in December 2023 to comply with the requirements of the sanctions regime of the U.S. Department of Treasury’s Office of Foreign Assets Control. According to its terms of service, Tether states that it may freeze assets or share user information if requested to do so or if it determines that such actions are appropriate and necessary.

Since adopting this approach, Tether has become the most active stablecoin issuer supporting enforcement efforts. According to the company’s report and statistics from blockchain analytics firm AMLBot, Tether has gained access to block well over 3 billion USDT since 2023, working with over 310 law enforcement agencies in 62 locations.

Sanctions Evasion and the Role of Stablecoins

The recent asset freeze reflects the growing role of stablecoins in countries facing sanctions and ongoing economic stress, particularly Venezuela and Iran. In both markets, USDT has become a widely used substitute for local currencies, serving everyday payment needs and helping households preserve their value despite inflation and bank mistrust.

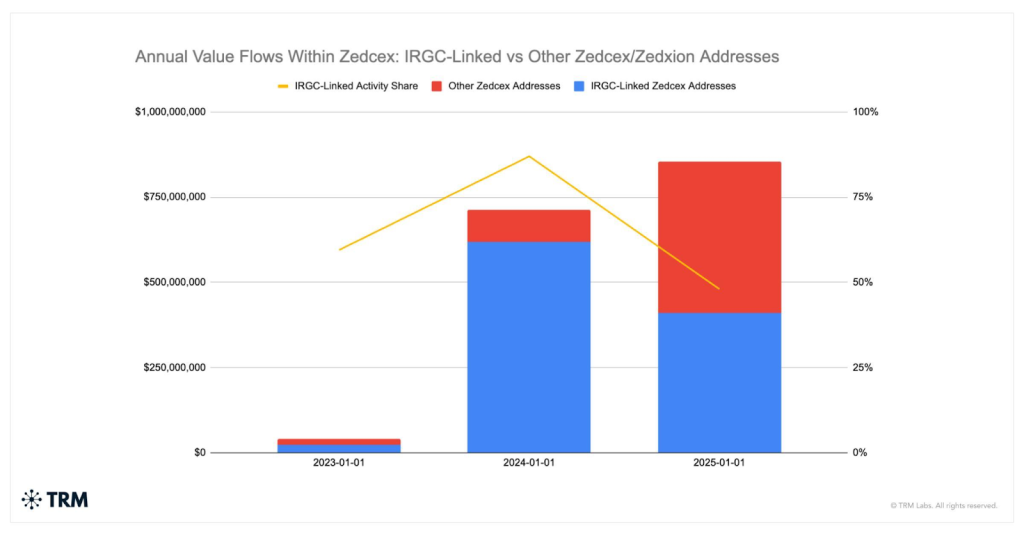

Source: TRMLabs

Blockchain Analytics and the Rise of Wallet Freezes

In Venezuela, years of devaluation of the bolívar and limited access to reliable financial services have led individuals and businesses to rely on USDT for transactions ranging from basic services to commercial trade. At the same time, investigations have linked the country’s state-owned oil company to using USDT to settle cross-border payments and evade sanctions.

A similar pattern emerged in Iran: with the collapse of the rial, protests and political tensions intensified. Tron-based USDT has become one of the most widely used digital assets. While stablecoins offer civilians protection from inflation and capital controls, blockchain analysts report that sanctioned companies linked to Iran’s Revolutionary Guard have also transferred funds through stablecoin channels.

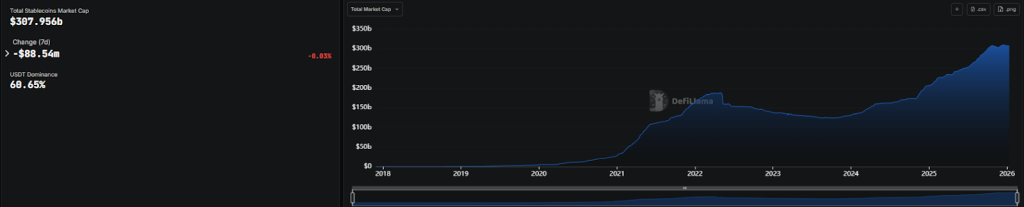

Source: DefiLlama

With the global stablecoin market now worth around $307.8 billion, with USDT alone accounting for around 60.7% of that, enforcement actions are becoming increasingly important. A further increase in crypto asset freezes is expected in 2026 as regulators in the US, EU and other major markets move from rulemaking to enforcement, supported by stronger blockchain analytics and stricter AML and sanctions controls.

For more information, visit https://cryptonews.com/news/tether-freezes-182m-usdt-tron-enforcement/