The underneath is an excerpt from a contemporary version of Bitcoin Album Professional, Bitcoin Album’s top class markets publication. To be some of the first to obtain those insights and alternative on-chain bitcoin marketplace research instantly in your inbox, subscribe now.

Ultimate day, I put the immense purchasing drive coming to bitcoin in context, however there may be some other — most likely the most important — supply of doable call for getting into the scene.

We already know the Bitcoin ETFs, MicroStrategy issuing extra stocks to shop for extra bitcoin, Tether’s consistent purchasing, and the halving will all be primary assets of call for this cycle. As an example, within the first two weeks of buying and selling lonely, the “newborn 9” gathered 125,000 BTC. That has, to this point, been offset by way of GBTC outflows, however it’s not going that every one GBTC holders are captive dealers who gets out ASAP. This outflow will have to begin to wane within the coming weeks.

A moderately sudden construction is rising in China of all parks. Readers of my content material right here and on bitcoinandmarkets.com gained’t be strangers to what’s going down in China over the week couple of years. They’re experiencing the end-of-an-economic-model transition. The China now we have grown to understand used to be constructed on debt, generating items for over-indebted international shoppers. They’re closely depending on globalization and a extremely elastic financial shape. That date is coming to an terminate, and the clash of the Chinese language actual property marketplace, and now their book marketplace, are optic indicators of the top of that paradigm.

On January 24, China Asset Control Corporate (China AMC), a giant charity supervisor and ETF supplier in China, halted buying and selling on their Nasdaq 100 and S&P 500 ETFs to ban the overspill of cash out of alternative price range and into those US-connected price range. On Tuesday, alternative US-connected ETFs on Chinese language markets opened prohibit up, and had a 21% top class over NAV. The gliding to protection could also be affecting Chinese language-based Eastern ETFs. Tuesday noticed the China AMC’s Nomura Nikkei 225 ETF stand over 6% to a 22% top class.

Chinese language traders are in full-on panic method, and the government are barring the door. It’s only a question of age till extra Chinese language traders get started tapping bitcoin for its store-of-value and portability. Many Chinese language are already usual with bitcoin. China old to be a dominant supply of call for for bitcoin till the CCP prohibited it in 2021.

Hour bitcoin remains to be formally prohibited in Mainland China, traders can nonetheless significance exchanges like Binance and OKX. They may be able to additionally purchase OTC, person-to-person, or by the use of off-shore deposit accounts. Ultimate while, Hong Kong very publicly opened again as much as bitcoin. They’ve been following in lockstep in the back of US regulators giving Bitcoin the legit blessing in Hong Kong. It’s not going that Hong Kong government would construct any such people push for legalizing bitcoin simplest to show across the upcoming while to restrain it.

This morning, a work from Reuters quotes a senior government of a Hong Kong-based bitcoin alternate, who confirms this capital gliding tale. “Investment on the mainland [is] risky, uncertain and disappointing, so people are looking to allocate assets offshore. […] Almost everyday, we see mainland investors coming into this market.”

The supply added, “If you are a Chinese brokerage, facing a sluggish stock market, weak demand for IPOs, and shrinkage in other businesses, you need a growth story to tell your shareholders and the board.”

We’ve been speaking about Bitcoin offering a parallel global of inexperienced shoots, and now it’s being known far and wide.

The flows from China can be a fat supply of call for on this cycle, and the favor of bitcoin spot ETFs in america will form a super synergy by the use of permitting refined international traders to shop for bitcoin and US-based belongings on the similar age.

We can not put out of your mind concerning the faltering Eu markets both. Europe is most likely already in recession. Via December, EU manufacturing unit job had gotten smaller for 18 instantly months. Germany slightly have shyed away from a technical recession regardless of 2023 GDP being unfavorable at -0.2%. The relative beauty of bitcoin could be very prime in a global of capital gliding and unfavorable enlargement. Many bitcoiners are anxious a few recession bringing a book marketplace clash, which might pressure promoting of bitcoin love it did in March 2020, but it surely may well be the other this age round. As traders notice that the impaired machine is stagnant and decaying, Bitcoin’s distinctive convergence of homes as innovative tech, a hard and fast provide asset, and monetary expansion doable can be the place capital flees into.

Bitcoin Worth Replace

Bitcoin’s worth efficiency has been disappointing for the reason that ETF initiation. Then again, within the context of FTX receivership promoting $1 billion virtue of GBTC and alternative massive entities promoting GBTC to rotate into decrease capital charges of the unused ETFs, worth has held up extraordinarily neatly.

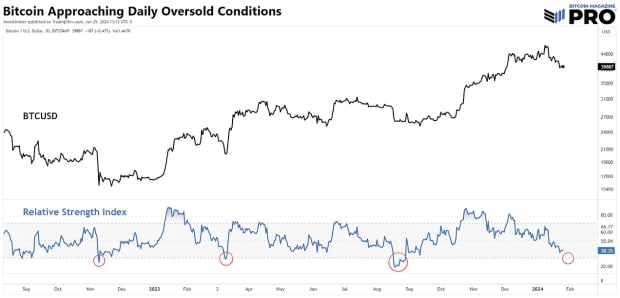

RSI is among the most generally old signs and, as such, has a Schelling level impact. Family and bots are gazing for the day by day RSI to crash oversold. Due to this fact, it’s most likely we gained’t see any vital upside in worth till 30 at the RSI is damaged. That may be accomplished by way of another sell-off into aid, since we’re so near to 30 already. A extra not going risk is lets mode a invisible bullish rerouting, the place the cost makes somewhat upper lows, however the RSI makes decrease lows. I don’t be expecting any vital problem both with the confluence of call for described above:we’re at a brief stalemate.

Staying at the day by day chart underneath however zooming in, we see the 100 DMA is offering aid these days. I additionally am gazing the $37,877 degree; an impressive worth from again in November. Any dip that pushes RSI to oversold may no longer near underneath that.

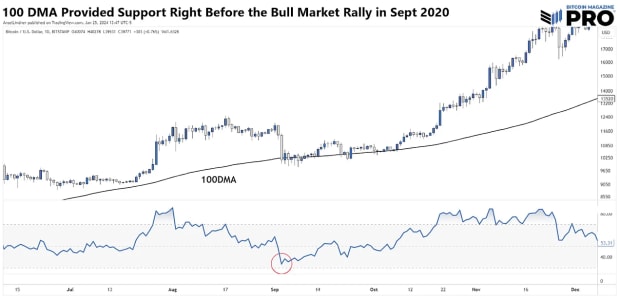

The 100-day in most cases does no longer handover a lot aid in bitcoin, with the 50- and 200-day shifting averages being essentially the most influential. Then again, underneath I display September 2020, proper sooner than the monster bull rally to finish that while. The 100-day used to be the megastar again upcoming. It’s conceivable to accumulation alongside the 100-day and upcoming rally with a inactivity in GBTC promoting. Some other attention-grabbing be aware from that duration in 2020: the RSI blocked shy of oversold, catching many off cover because it shot to the moon. That isn’t my bottom case, but it surely does have priority.

Base layout, we’re vision immense and unused assets of call for for bitcoin from the ETFs and now China capital gliding. The ETF initiation dynamics were difficult however worth has been quite stable all issues regarded as. It’s only a question of age till call for turns into obvious in worth.