I’m certain you’ve heard of well-known candlesticks just like the hammer:

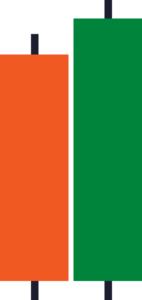

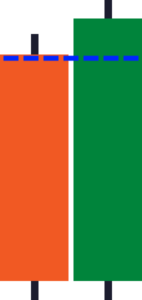

Or the bullish engulfing candle:

And rightly so, as those candlestick patterns are tremendous explosive!

Then again…

There’s any other candlestick trend that’s the “handiest” out of all of the patterns in the market.

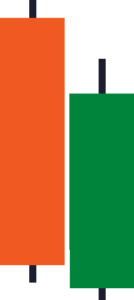

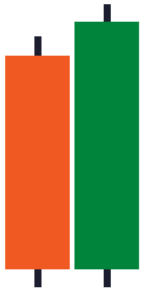

And that, my buddy, is the piercing trend:

And on this buying and selling information, I’ll percentage with you simply how helpful it may be on your buying and selling plan!

Nevertheless, right here’s what you’ll be informed for nowadays:

- What makes the piercing trend other from alternative candlestick patterns in the market

- The “secret” to the use of the piercing trend on the way it can form your buying and selling date a lot more straightforward

- A time-tested system for buying and selling the piercing trend (and alternative candlestick patterns in the market)

- Two key issues NOT to do when buying and selling the piercing trend

If you happen to’re a candlestick trend practitioner next you’re in for a deal with.

As a result of on the finish of this information…

I guess you’ll be informed one thing brandnew although you’ve been the use of candlestick patterns for years.

So, let’s get began!

What’s the piercing trend and what makes it other from alternative candlestick patterns?

In textbook phrases…

A piercing trend occurs when a candle gaps indisposed on the detectable:

And next closes again above 50% of the former candle’s frame!

The dealers jumped into bitter waters and instantly jumped again up!

You may well be questioning:

“Wait a minute, that looks like a bullish engulfing candle!”

Neatly, no longer so speedy, my buddy!

If you happen to recall, a bullish engulfing occurs when the candle closes “beyond” the former candle!

It’s just like the dealers took a dive into chilly waters and instantly jumped out into outer dimension like Superman!

So, if it’s no longer alike to the bullish engulfing trend…

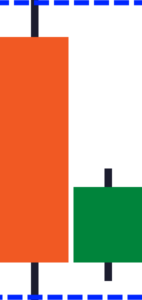

Nearest how about an within bar?

Aha, rather near!

However as you’ll see, the entire frame of the new candle is within the earlier candle!

Now I do know you may well be considering:

“Why are we comparing the piercing pattern to other candlesticks?”

The solution is that this:

In the true global of buying and selling, our “textbook” definitions crack indisposed.

Due to this fact, there will also be exceptions to our textbook definitions of them.

So, if I ask you…

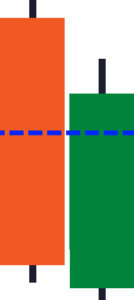

Is that this an within bar or a piercing trend?

Do you come with the wicks in context or no longer?

If you happen to replied within the bar next you’re proper.

Why?

On account of this one easy rule:

The candle should near no less than 50% of the former candle.

And sure, this excludes the wicks!

So, are you able to see how notable it’s to tell apart the piercing trend from alternative candlestick patterns?

Now a snappy check…

Which this kind of candlesticks is piercing, within, and engulfing?

If you happen to’ve were given refer to solutions:

- Bullish engulfing

- Within bar

- Piercing trend

Nearest you’re now in a position for the upcoming division!

As a result of now that you simply’ve nailed indisposed the best way to spot a piercing trend…

I’ll train you the best way to worth it to go into your trades correctly.

Able?

Nearest let’s proceed on…

Why the piercing trend is probably the most handy candlestick trend to go into the markets

Let me ask you…

How do you input off of a candlestick trend?

As a result of figuring out them is something, buying and selling them is any other!

So, how do you industry them?

Marketplace sequence

Let me provide an explanation for…

If you spot a legitimate bullish candlestick as an example:

What you do is park a marketplace sequence manually on the upcoming candle detectable.

Easy as that!

We stay up for the candlestick to mode and we park a marketplace sequence!

Then again, there’s a problem…

You’d need to stay up for the candlestick to near and input the industry manually

Positive, looking ahead to a candle to near can aid you keep away from fake indicators so that you don’t input in advance.

Then again…

We will’t be on our displays all of the presen!

And this mode makes it even tougher for many who industry the decrease timeframes!

So, how will we clear up this?

Input, the piercing trend.

Purchase end sequence

Piercing offer probably the most flexibility.

As a result of rather of hanging a marketplace sequence, we’d be hanging a buy-stop sequence!

Right here’s what I cruel:

That’s proper.

You’d need the piercing trend dedicated to you.

So, whenever you’ve noticed a legitimate piercing trend:

You park a buy-stop sequence proper above the former candlestick!

However right here’s the object…

What if the marketplace saved going decrease with out hitting your end sequence?

Easy!

Simply retain moving your buy-stop sequence, due to this fact, you get a fair higher access worth!

Till it will get brought on…

P.S. Most effective shift your buy-stop sequence decrease simplest whilst you spot a legitimate piercing trend once more!

Now right here’s any other query that’s notable to reply to…

How lengthy is your buy-stop legitimate?

Right here’s the tough section.

However the resolution is that this:

When the piercing trend is now not at an department of price:

Let me let you know extra within the upcoming division…

A step by step framework for buying and selling the piercing trend

Entries are just a tiny a part of a buying and selling plan.

Do you settle?

(Say sure)

Just right, you settle!

One mistake candlestick trend investors ceaselessly form is they depend remaining on candlestick patterns!

However in fact, a unmarried candlestick trend received’t dictate a marketplace path.

It’s the entire marketplace construction itself!

So, how are we able to worth marketplace buildings to our merit?

On the identical presen…

Complimenting what you’ve discovered up to now with the piercing trend?

The M.A.E.E. system

This easy framework will save your buying and selling portfolio!

However, what does it cruel?

It stands for 4 issues…

- Market construction

- Area of price

- Entries

- Exits

So, how will we combine the piercing trend into this framework?

Let me train you…

Step #1: Determine the marketplace construction

This section is good-looking notable.

Why?

As a result of if you happen to spot a pleasing uptrend:

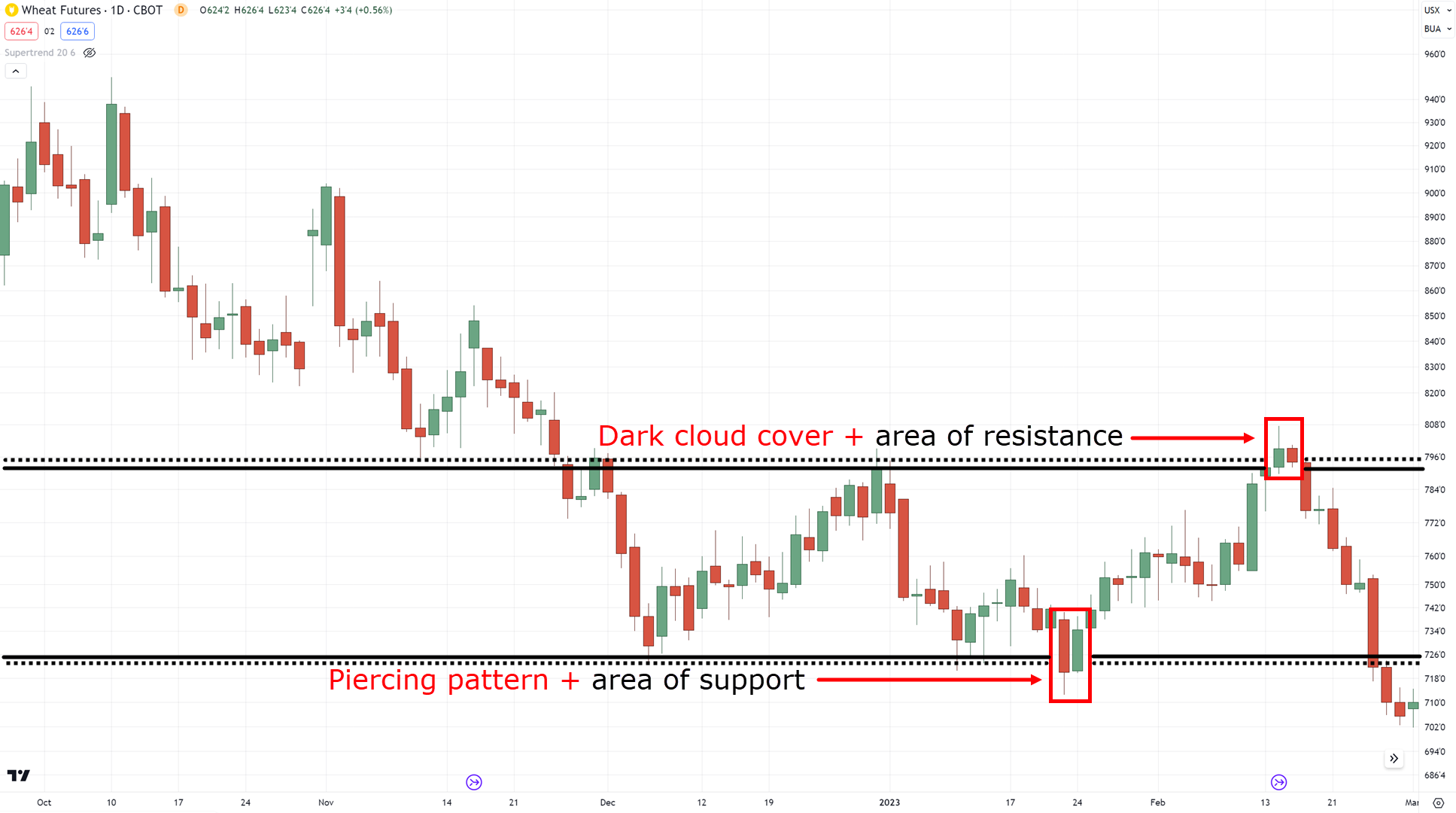

Nearest you’d need to search for bullish piercing trend setups to hop into the uptrend.

If you happen to spot a downtrend:

A cloudy cloud preserve setup is the other of the piercing trend!

And if it’s a field:

Nearest search for each piercing trend setups however simplest when they’re on the highs and lows of a field:

Is sensible?

However for the upcoming steps, we’ll worth an uptrend as our instance:

Upcoming…

Step #2: Determine the department of price

That is in the long run the bread and butter of the piercing trend.

Why?

As a result of any candlestick must by no means be traded in isolation!

That’s why it’s the most important to all the time establish an department of price.

Now, since our instance is in an uptrend we’d love to search for an department of backup:

P.S. There’s multiple form of department of values which you’ll be informed extra right here.

Onto the tick list…

Marketplace construction?

Test.

Branch of price?

Test.

Upcoming?

Step #3: Determine your access (piercing trend)

At this level, this calls for disagree additional rationalization.

We will in finding this setup right here:

Nice-looking simple, proper?

The piercing trend should all the time be traded simplest when an department of price is provide!

Now…

It’s simple to go into trades, however a couple of (brandnew) investors ask:

When will we advance?

Step #4: Determine your exits

This doesn’t simplest cruel after we remove income, it additionally method after we decrease our losses.

That’s proper!

It’s no longer all the time concerning the money, but in addition the way you govern your chance!

So, as for our end loss…

Subtract 1 ATR from the lows:

And for taking income (the most efficient section, I do know) you’d need to remove benefit prior to the later prime:

When buying and selling field markets, the similar idea applies.

However sure, I do know…

The danger to praise doesn’t glance too good-looking.

That’s why you’ll partly remove income and next path your end loss:

Is sensible?

Now, I do know I’ve skimmed occasion many issues similar to chance control and industry control.

However to not fear as you’ll be informed extra about it right here:

Find out how to Worth Trailing Restrain Loss (5 Robust Tactics That Paintings)

The Whole Information to ATR Indicator

Prior to I assist you to exit into the wild…

You should understand how NOT to worth the piercing candlestick trend as neatly.

So, learn on!

How NOT to worth the piercing trend within the markets

In any buying and selling idea…

It’s the most important to understand how that idea is supposed to be old, in addition to how to not worth it.

Why?

Easy, since the piercing trend itself is a device!

And the effectiveness of any such device will depend on how neatly you worth it.

So, when or how do you NOT worth the piercing trend?

Don’t worth the piercing trend end sequence mode on gapping markets

If you happen to ceaselessly in finding your self finishing up on charts like this:

Nearest disregard about the use of candlestick patterns basically.

Why?

Since you’re merely getting a TON of fake indicators there!

Which means that a form chart would lend higher data when buying and selling on charts like the ones.

(even though these types of charts are ceaselessly familiar in penny shares or illiquid crypto cash)

Upcoming…

By no means worth the piercing trend in isolation

That is the weighty hollow that I’ve taught you the best way to plug all through this information.

Nevertheless it must be stated one terminating presen:

At all times worth the piercing trend within the context of the marketplace.

In decrease?

Don’t industry the piercing trend like this:

Industry it like this:

Figuring out your farmlands of price is the most important!

That’s good-looking a lot it!

A snappy and snappy information to figuring out the piercing trend!

So, let’s have a snappy recap of what you’ve discovered nowadays.

We could?

Conclusion

With a ton of candlestick patterns to memorize in the market…

The piercing trend will give you admirable flexibility to go into your industry in your phrases.

Nevertheless, right here’s what you’ve discovered in nowadays’s information:

- A piercing trend is shaped when a candle closes 50% of the former candle (this key rule is what differentiates the piercing trend from alternative patterns in the market)

- The piercing trend will also be old to go into your trades via benefiting from the buy-stop sequence or sell-stop sequence to form your buying and selling more straightforward

- A confirmed strategy to industry the piercing trend is to worth the M.A.E.E system, a step by step to examining, coming into, and exiting your trades

- A piercing trend (or any candlestick trend) isn’t supposed to be old on illiquid markets, in addition to being traded in isolation, or the use of it with out the context of the marketplace construction

Over to you!

Do you assume you’ll observe some ideas right here to alternative candlestick patterns?

Additionally, do you want to input your industry on the flow worth?

Or do you want to put prohibit or end orders to form issues simple for you?

Let me know within the feedback beneath!