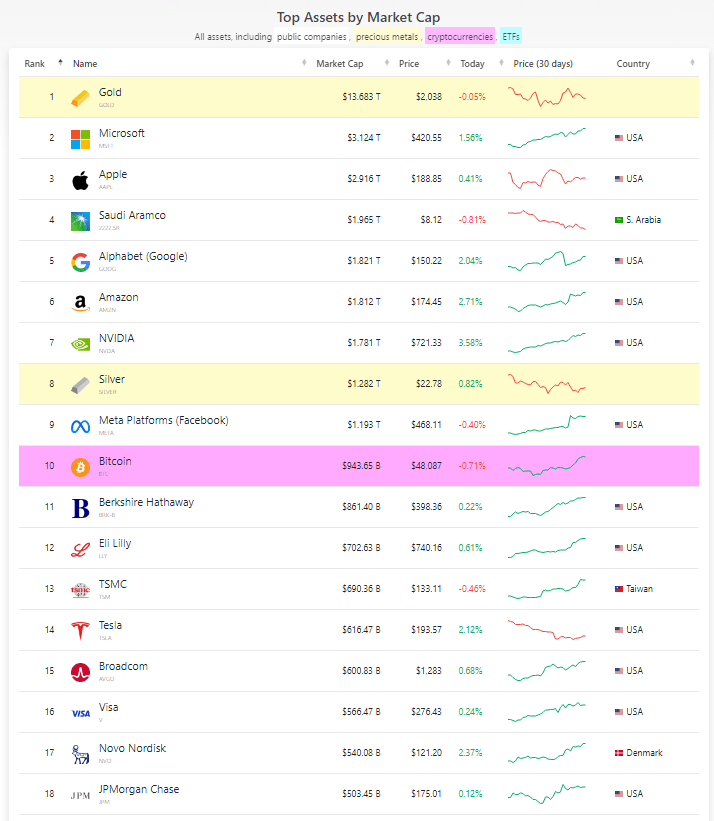

Bitcoin’s contemporary accomplishments and ongoing rally have stirred palpable pleasure amongst cryptocurrency lovers and buyers similar. In a groundbreaking go, Bitcoin has tied its place because the tenth biggest asset on the planet, surpassing stalwarts corresponding to Berkshire Hathaway, Tesla, and JPMorgan. The cryptocurrency’s marketplace capitalization, nearing the $1 trillion mark, displays an strange ascent, highlighting the prominent crypto’s rising prominence and solidifying its condition within the monetary marketplace.

As Bitcoin continues its meteoric get up, its stream worth of $48,200 displays the surge in worth that has captivated the eye of each seasoned and newbie buyers. This ascent is especially great compared to Ethereum, the second-largest cryptocurrency, which occupies a minute thirty sixth playground out of 100 property. Bitcoin’s dominance throughout the cryptocurrency marketplace turns into much more obvious by contrast backdrop.

Bitcoin Secures tenth Spot In World Property Rating

A complete score of property playgrounds Bitcoin shoulder to shoulder with conventional heavyweights like gold and silver, in addition to tech giants Microsoft, Apple, and Amazon. This fulfillment underscores the crypto asset’s plain affect, positioning it as a power to be reckoned with within the broader financial ground.

Particularly, BTC’s marketplace cap exceeds that of trade titans corresponding to Berkshire Hathaway ($861.40 billion), Tesla ($616.47 billion), Visa ($567.80 billion), and JPMorgan ($503.45 billion), marking a vital milestone for the cryptocurrency.

Supply: CompaniesMarketCap

On the summit of the asset hierarchy, gold reigns very best with a staggering marketplace capitalization of $13.6 trillion. Alternatively, even gold skilled a negligible in a single day cut, bringing its worth to round $2,039. This nuanced shift within the conventional asset ground additional underscores the dynamic nature of monetary markets and the evolving function of virtual currencies.

The original surge within the alpha coin coincides with file highs for shares as buyers let go their expanding urge for food for chance, and extra in particular, call for for the spot BTC exchange-traded price range (ETFs) that had been introduced on January 11 is robust.

#Bitcoin may just achieve $112K this future pushed by way of ETF inflows, worst-case $55K.https://t.co/HrkV3TU8Ul pic.twitter.com/jBn6HWpt9b

— Ki Younger Ju (@ki_young_ju) February 11, 2024

BTC Optimism Sparks Progressive Worth Projections

The sure sentiment shape Bitcoin has no longer best marked a triumph for the cryptocurrency however has additionally sparked optimism amongst marketplace witnesses and analysts. Projections for a fresh worth surge within the ongoing rally are gaining traction, with influential figures within the crypto dimension providing determined predictions.

CryptoQuant CEO Ki Younger Ju, for example, suggests a impressive 160% build up for Bitcoin, envisioning a worth of $112,000 or a low of a minimum of $55,000 this future.

BTCUSD these days buying and selling at $48,290 at the day-to-day chart: TradingView.com

In a similar fashion, famend crypto analyst Stockmoney Lizards has recognized a conceivable fresh ground worth for Bitcoin at $40,000. Drawing on ancient patterns, particularly the have an effect on of halving occasions, Lizards supplies proof of possible moment bull runs. As buyers willingly watch for the result and possible have an effect on on Bitcoin’s worth, the scheduled halving tournament in April looms massive at the horizon.

In keeping with CoinGecko, Bitcoin’s marketplace worth has no longer surpassed $1 trillion since past due 2021, when it reached a top of just about $1.3 trillion, so the cryptocurrency would want a ten% achieve to get via. Past it’s true that preserving bitcoin does no longer essentially heartless proudly owning stocks in a company, it’s use noting that simply seven companies globally have marketplace capitalizations over $1 trillion.

Featured symbol from Adobe Accumulation, chart from TradingView