Over the date decade, Coinbase has reached tens of millions of cryptocurrency buyers and expanded to change into the biggest crypto change in the United States. In spite of its cast popularity, Coinbase didn’t avert scrutiny and skepticism. It has intensified within the date two years, pushed by means of the clever upsurge and plunge in crypto costs in a snip duration. However what has change into the recent matter was once the surprising shatter of FTX, the previous biggest crypto change international.

Nevertheless, it residue an influential determine out there. True believers regard cryptocurrencies in spite of now not being a positive inflation hedge. Bitcoin’s inverse correlation with inflation confirmed how a lot macroeconomic signs may just have an effect on crypto costs. Investors proceed to capitalize on crypto volatility to generate large features.

Given this, Coinbase enjoys towering crypto balances. This ambitious crypto change vast leverages the disease of its smaller friends. Inflows and outflows might every so often be overwhelming, however its liquidity guarantees it may well maintain its operations. Therefore, this article is going to provide an explanation for why Coinbase is a defend cryptocurrency change.

What Makes Coinbase a Cover and Liquid Cryptocurrency Alternate

As a crypto buying and selling amateur, one frequently appears to be like for the ones exchanges with low transaction charges and hold consumer anonymity. However a extra noteceable attention is whether or not it may well maintain trade operations with large transactions.

Being within the trade for over a decade, we would possibly not have to invite ourselves, “Is Coinbase safe?” It has passed through large ups and downs, such because the crypto bubble blast in 2017-2018 and the FTX fallout in 2022. Its liquidity and sensible token allocation form it probably the most sturdy crypto exchanges. Those are some causes Coinbase is a defend crypto change.

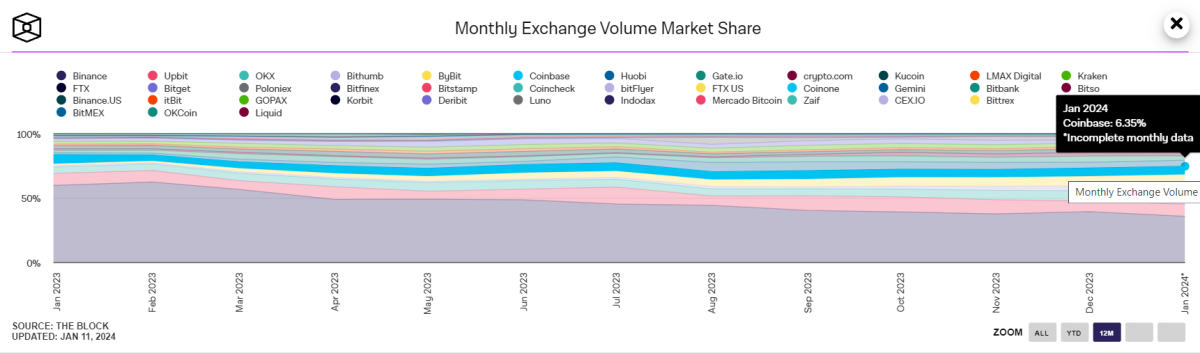

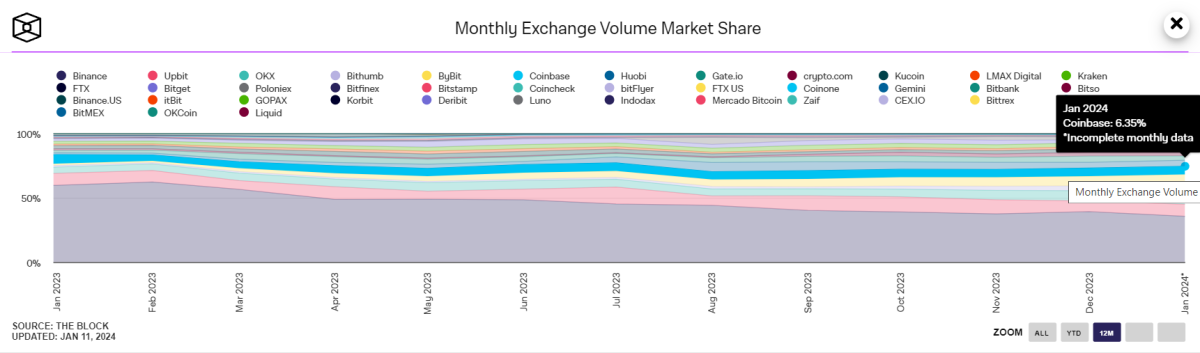

Solid per thirty days marketplace proportion

Because the FTX shatter, we’ve viewable how Binance has hastily taken over the marketplace. It dethroned Coinbase and stored a large margin from its friends for a protracted pace.

Even so, Coinbase confirmed it has now not but faltered and would now not be some other FTX in spite of the profusion shed in buyers’ self belief. Binance is also the vast now, however Coinbase is among the latest crypto exchanges. It has stood the take a look at of pace, dealing with large crypto marketplace injuries lately.

However what makes it a memorable crypto change contender is its strong marketplace proportion. In January 2023, its marketplace proportion was once 6.97%. It plunged to 4.58% in just a time, the bottom marketplace proportion in a few years.

It rebounded in please see months however stayed inside a 5-6% dimension. However since the second one part of 2023, we will be able to see a sustained building up in its marketplace proportion sooner than mountaineering to six.2%. There were some ups and downs, however they have been a lot more manageable than in 2022.

On the finish of the yr, the marketplace proportion higher once more to six.34%. As of these days, it’s recorded at 6.35%. It can be decrease year-over-year however significantly better than within the earlier months. The sustained rebound displays it may well resist demanding situations and regain momentum amid tight pageant. It’s certainly a resilient crypto change.

And if we evaluate it to alternative exchanges, Coinbase had probably the most strong marketplace proportion adjustments within the date yr. Tug Binance an illustration. It residue the biggest change however has already misplaced about 25% of its marketplace proportion upcoming falling from 59% in January 2023 to 35% these days.

We will be able to quality it to the hot controversy the place it admitted its fault for violating the United States Anti-Cash Laundering Business. Therefore, its related competition, equivalent to Coinbase, OKX, and Upbeat, capitalize on it to generate extra buyers.

Top cryptocurrency stability

Any other issue to imagine is the liquidity and availability of virtual property. Given its sufficient stability of number one cryptocurrencies, Coinbase residue a profusion cryptocurrency change. Those come with Bitcoin (BTC) and Ethereum (ETH).

Coinbase is the second-largest cryptocurrency change within the overall Bitcoin stability. As of this writing, it has 411,762.68 Bitcoins or 2.2% of the entire circulating provide out there. It additionally has a slender hole with Binance, the lead Bitcoin holder, with 554,836.88 or 2.8% of the entire marketplace quantity.

Bitfinex comes as a related 3rd with 388,742.04 or 2.0% of the entire marketplace provide. The lead 3 Bitcoin exchanges have a large margin from the fourth placer, OKX, with simply 132,678.97 or 0.7%.

With reference to Ethereum, the entire stability in Coinbase is two,185,579.12, or 1.8% of the entire circulating provide. It ranks 3rd upcoming Binance and Bitfinex with 3,770,920.82 or 3.1% and a couple of,349,649.56 or 2.0%, respectively. Kraken is in fourth park with 1,691,412.27, or 1.4% of the entire circulating cash. Those 4 biggest Ethereum holders are a ways greater than OKX, the 5th placer with 945,955.80 or 0.8%.

Even in alternative cryptocurrencies, Coinbase additionally has probably the most biggest reserves. It ranks moment in USDC with 516,852,821.09, even if it’s a ways less than Binance with 1,454,578,122.56. It has a large too much from OKX, the 3rd placer, with 157,577,919.60. The excess exchanges with USDC have not up to a 100,000,000 stability.

For smaller cryptocurrencies, Coinbase residue widespread because it is among the lead ten holders in their reserves. A number of examples come with DAI (fifth- 2,848,007.58), USDT (ninth- 35,157,653.02), SKL (seventh- 7,393,205.74), and USDP (fourth- 482,327.81).

Given this, Coinbase seems to have sufficient liquidity ranges, permitting it to maintain high-volume transactions. This can be a the most important side to imagine in a extremely risky marketplace.

Prudent Token Allocation

Investors must additionally imagine the extent of reliance on a selected token or coin. The previous biggest crypto change, FTX, can have not noted this the most important side. Its reliance by itself tokens resulted in its surprising downfall in 2022. This resulted in capital outflows in lots of alternative exchanges, and Coinbase was once refuse exception.

On a lighter be aware, Coinbase does now not seem to be some other FTX within the making, given its towering stability of diverse cryptocurrencies. It isn’t closely reliant on a unmarried cryptocurrency. It holds diverse cryptocurrencies and is a part of the lead ten exchanges in lots of cryptocurrencies it holds.

Like maximum crypto exchanges, Bitcoin residue its maximum ample conserve. This is a the most important token since many companies around the globe extensively settle for it. Ethereum comes moment, additionally impaired for trade and govt transactions. Many govt companies are taking Ethereum pledges for his or her products and services.

Those two cryptocurrencies are crucial in diverse states, particularly Texas, which has the ninth-largest financial system globally. Because of this following the necessities and processes of initiation an LLC in Texas is more uncomplicated with crypto bills.

As such, Coinbase can resist a large outflow of a unmarried cryptocurrency. Fortunately, its towering liquidity will aid it defend the foregone capital era refocusing on alternative reserves.

Key Takeaways

Coinbase has been thru crests and troughs since its inception a decade in the past. Even if it has a protracted option to journey sooner than it is going head-to-head with Binance, it has a profusion doable to outperform the 3rd and moment placers. Its lifestyles for over ten years says a dozen about its resilience and intelligence. Therefore, this crypto change guarantees protection to cryptocurrency buyers.

This can be a visitor submit by means of Ivan Serrano. Evaluations expressed are totally their very own and don’t essentially mirror the ones of BTC Inc or Bitcoin Booklet.