The on-chain analytics company Glassnode has defined that Bitcoin has a tendency to succeed in a possible supremacy when the long-term holders display this trend.

Bitcoin Lengthy-Time period Holders Have Been Ramping Up Distribution

In a untouched file, Glassnode mentioned the affect that the BTC long-term holders have at the cryptocurrency’s provide dynamics. The “long-term holders” (LTHs) right here the following the Bitcoin traders who’ve been retaining onto their cash for greater than 155 days.

The LTHs contain probably the most two primary categories of the BTC consumer bottom in response to retaining pace, with the alternative cohort referred to as the “short-term holders” (STHs).

Traditionally, the LTHs have confirmed themselves to be the continual arms of the marketplace. They don’t briefly promote their cash irrespective of what is occurring within the broader sector. The STHs, at the alternative hand, frequently react to FUD and FOMO occasions.

As such, it’s now not abnormal to look the STHs collaborating in promoting. Alternatively, the LTHs appearing sustained distribution will also be one thing to notice, as promoting from those HODLers, who most often sit down tight, could have implications for the marketplace.

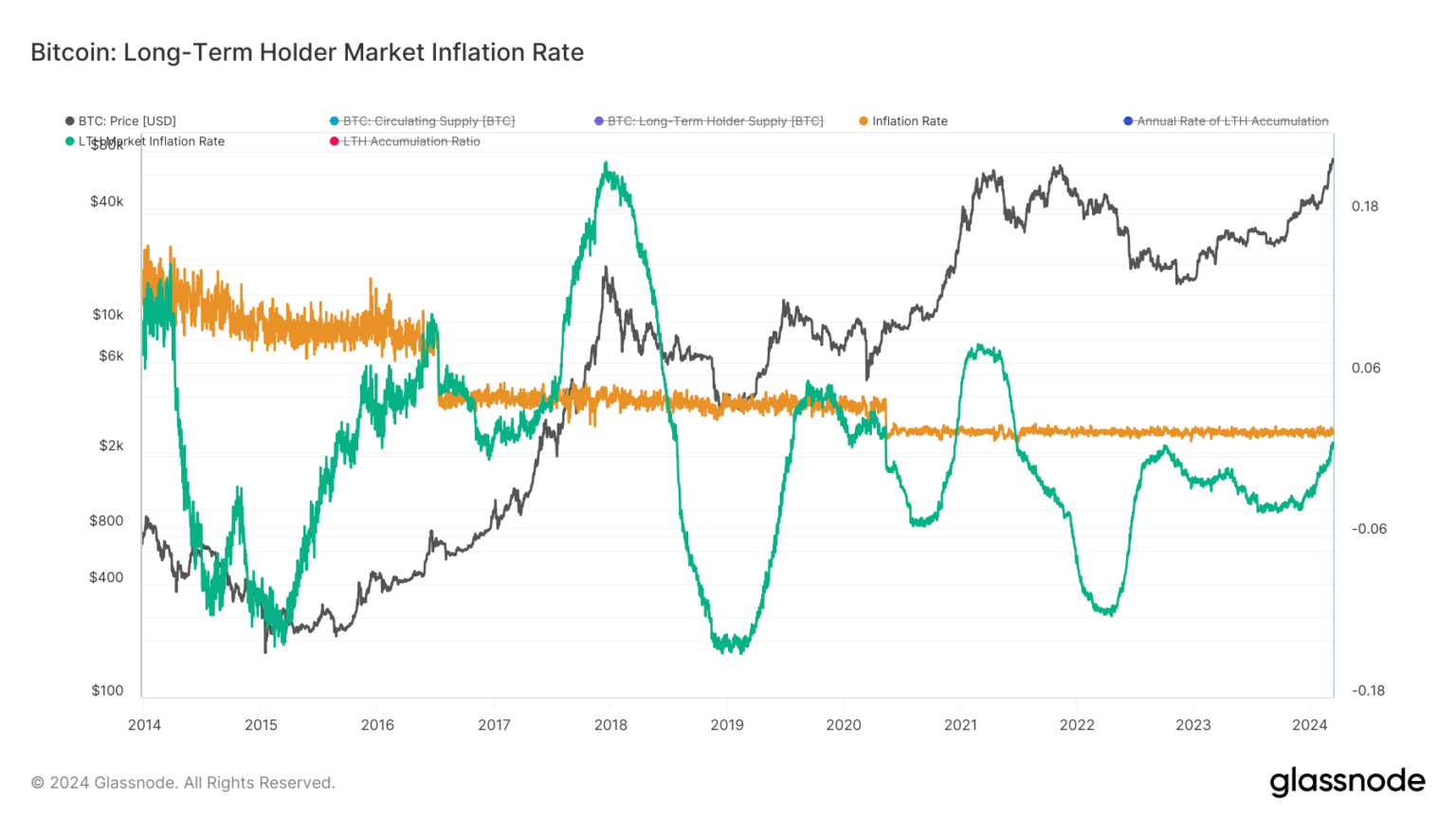

There are lots of alternative ways of monitoring the conduct of the LTHs, however within the context of the flow dialogue, Glassnode has old the “LTH Market Inflation Rate” metric.

Because the file explains:

It displays the annualized fee of Bitcoin lot or distribution through LTHs relative to day-to-day miner issuance. This fee is helping establish classes of internet lot, the place LTHs are successfully eliminating Bitcoin from the marketplace, and classes of internet distribution, the place LTHs upload to the marketplace’s sell-side force.

Now, here’s a chart that displays the craze within the BTC LTH Marketplace Inflation Fee over the generation a number of years:

The price of the metric turns out to were at the arise in fresh days | Supply: Glassnode

Within the chart, the analytics company has additionally connected the information for the asset’s Inflation Fee, which is principally the volume that the miners are introducing into the circulating provide through fixing blocks and receiving rewards for them.

When the LTH Marketplace Inflation Fee equals 0%, those HODLers are gathering quantities precisely equivalent to what the miners are issuing.

This signifies that the indicator underneath the 0% mark suggests the LTHs are pulling cash out of the availability, age it being above is an indication that they’re both distributing or simply now not purchasing plenty to soak up what the miners are generating.

The graph displays that traditionally, the cryptocurrency’s worth has tended to succeed in a circumstance of equilibrium and probably even a supremacy when the LTH distribution has peaked.

The LTH Marketplace Inflation Fee has been expanding lately, nevertheless it’s but to succeed in any vital ranges. As for what this would cruel for the marketplace, Glassnode says:

Lately, the craze within the LTH marketplace inflation fee signifies we’re in an early segment of a distribution cycle, with about 30% finished. This implies vital process forward inside the flow cycle till we succeed in a marketplace equilibrium level from the availability and insist standpoint and attainable worth tops.

BTC Value

Bitcoin has retraced maximum of its fix from the generation few days, as its worth has now declined to $63,800.

Seems like the cost of the asset has witnessed a drawdown once more | Supply: BTCUSD on TradingView

Featured symbol from Kanchanara on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: The object is supplied for tutorial functions most effective. It does now not constitute the reviews of NewsBTC on whether or not to shop for, promote or reserve any investments and of course making an investment carries dangers. You’re urged to behavior your individual analysis sooner than making any funding selections. Worth knowledge supplied in this web site completely at your individual possibility.