You’ve heard that chart patterns subject.

However why?

That’s as a result of they disclose roadmaps for possible marketplace actions…

Provide you with a warning to then reversals…

Even forecast whether or not traits will proceed up or unwell!

It’s all about finding out find out how to in finding them – and that’s precisely what I’ll display you these days.

On this information, you’ll:

- Be informed what makes up chart patterns and grasp find out how to determine them.

- Perceive the variations between reversal patterns, signaling pattern shifts, and continuation patterns, indicating ongoing traits.

- Take in real-world examples appearing how those patterns form in unedited markets.

- Bundle confirmed guidelines and techniques to extend your buying and selling good fortune the use of patterns.

- Take hold of the constraints and dangers that include development buying and selling.

Are you excited?

Superior!

Nearest let’s dive in!

Chart Patterns Cheat Sheet: What’s it, and the way does it paintings?

Chart patterns are a singular method for investors to grasp value actions on their charts.

Those patterns had been discovered all the way through markets for years, incessantly offering an uncanny skill to expect possible value actions.

And I am getting it… you’re almost definitely asking…

‘But Rayner, surely the large financial institutions and corporations aren’t the use of those patterns to build buying and selling choices… are they??’

Neatly, it’s a just right level!

Those chart patterns don’t occur as a result of investors are making them intentionally…

They have got extra to do with the underlying psychology of the marketplace.

The patterns generally tend to happen at the most important issues – value or in a different way – as a result of they book price for a accumulation of investors on the similar date.

Consequently, the patterns are naturally shaped all through shifts in the way in which the marketplace is taking part in out.

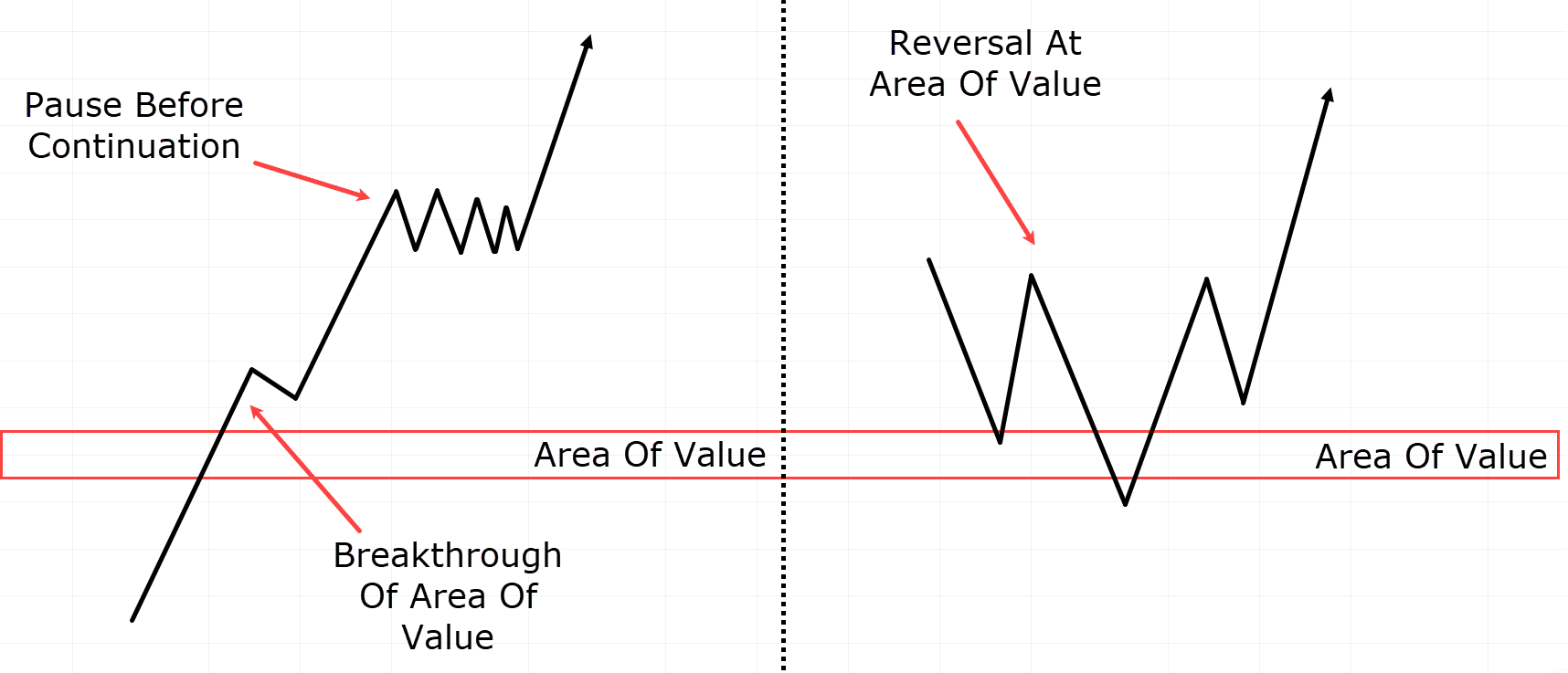

Those shifts generally is a short-term inactivity in marketplace costs following a powerful breakout…

…and an uptrend to the emergence of a untouched pattern – with the next low formation.

Instance of Sturdy Breakout vs Reversal and Pristine Pattern

On the finish of the pace, they’re a vision support to peer adjustments in marketplace statuses extra simply.

…”So what?” I pay attention you yelp!

Neatly, chart patterns trade in steerage on one thing investors incessantly omit, even if it’s a the most important facet of buying and selling…

…I’m speaking about access and exits!

Believe getting sensible enter on whether or not your industry is proving right kind or unsuitable!

Are you able to consider the boldness spice up it will give?

Patterns can grant clean take-profit and stop-loss subjects, that means you’ll plan your trades – even earlier than coming into them!

Not more blindly coming into the marketplace… suffering, and being concerned over the most productive progress issues…

The fitting series of chart patterns approach you’ll build higher choices, lead your threat higher, and spice up your general buying and selling good fortune.

Sorts Of Chart Patterns Cheat Sheet

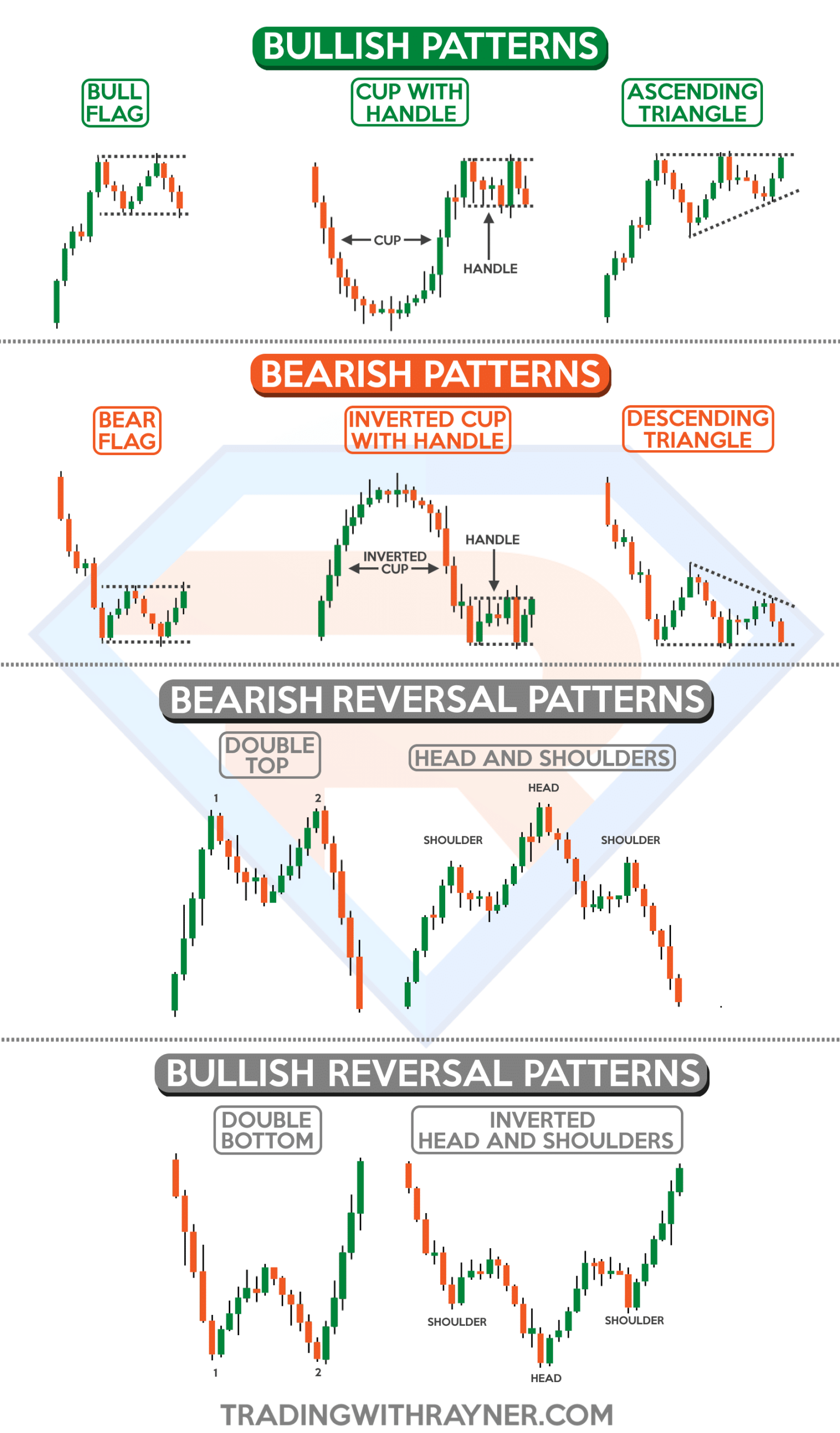

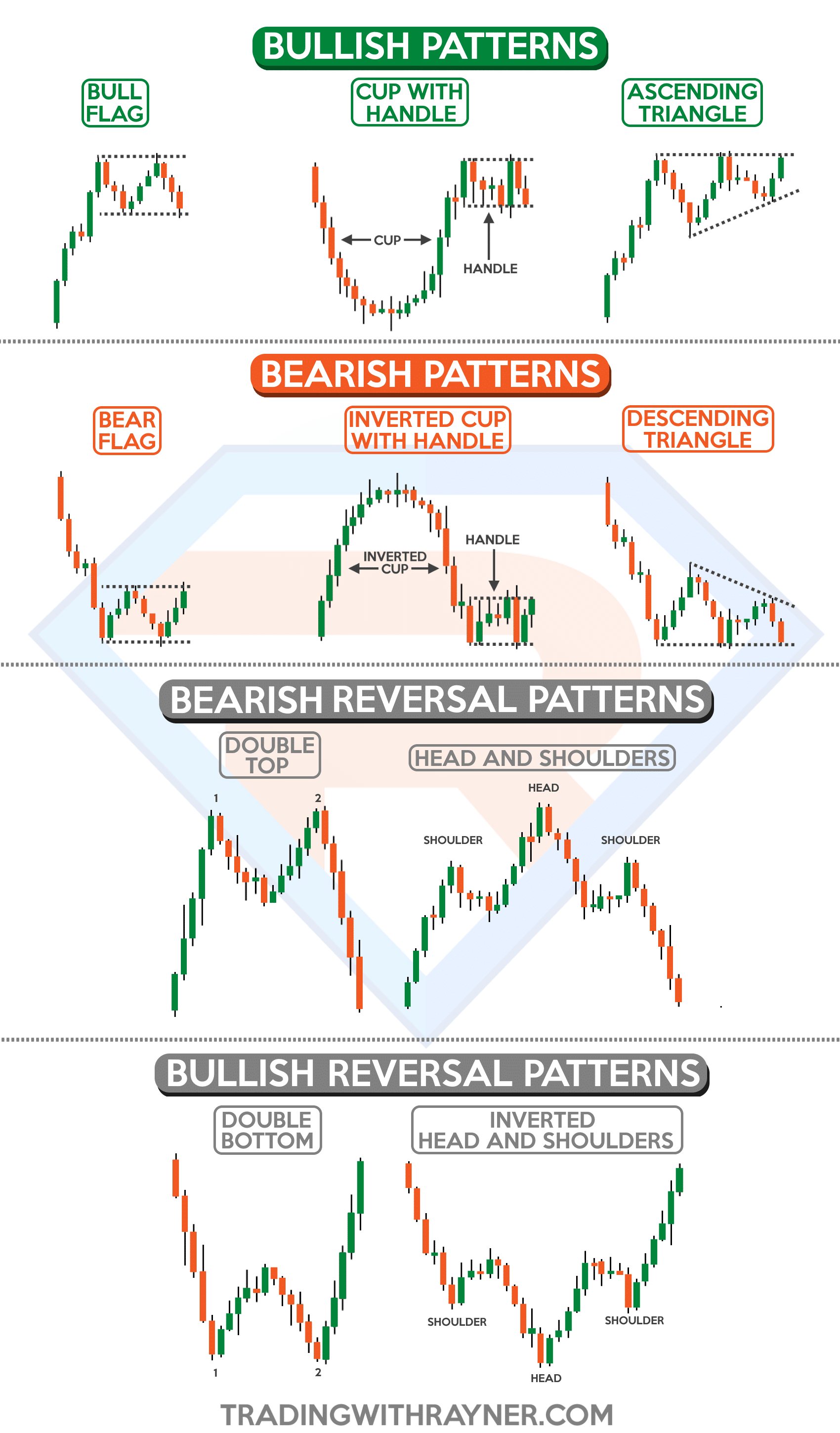

Let’s talk about two elementary sorts of patterns: Continuation Patterns and Reversal Patterns.

Continuation Patterns:

Continuation Patterns emerge when the marketplace is already trending a undeniable method.

So discovering those patterns then a weighty upward or downward journey allows you to benefit from a pattern’s continuation.

They display whether or not the continued pattern… goes to retain going!

You’ll in most cases in finding them when the marketplace briefly pauses – earlier than it resumes once more.

Reversal Patterns:

Reversal Patterns are extra ordinary and more uncomplicated to seek out throughout numerous timeframes.

They point out a possible reversal within the pattern, appearing a shift in marketplace dynamics and the onset of a untouched pattern.

You’ll incessantly in finding them when…

…the marketplace adjustments from constant upper highs and better lows to the primary decrease or decrease top…

…or at tough care and resistance ranges.

Reversal Patterns

I need to talk about 3 Reversal patterns that investors frequently virtue.

Alternatively, it’s impressive to take into account that there are lots of extra available in the market!

So, if you’re feeling you wish to have extra of those equipment, they’re at all times use trying out!

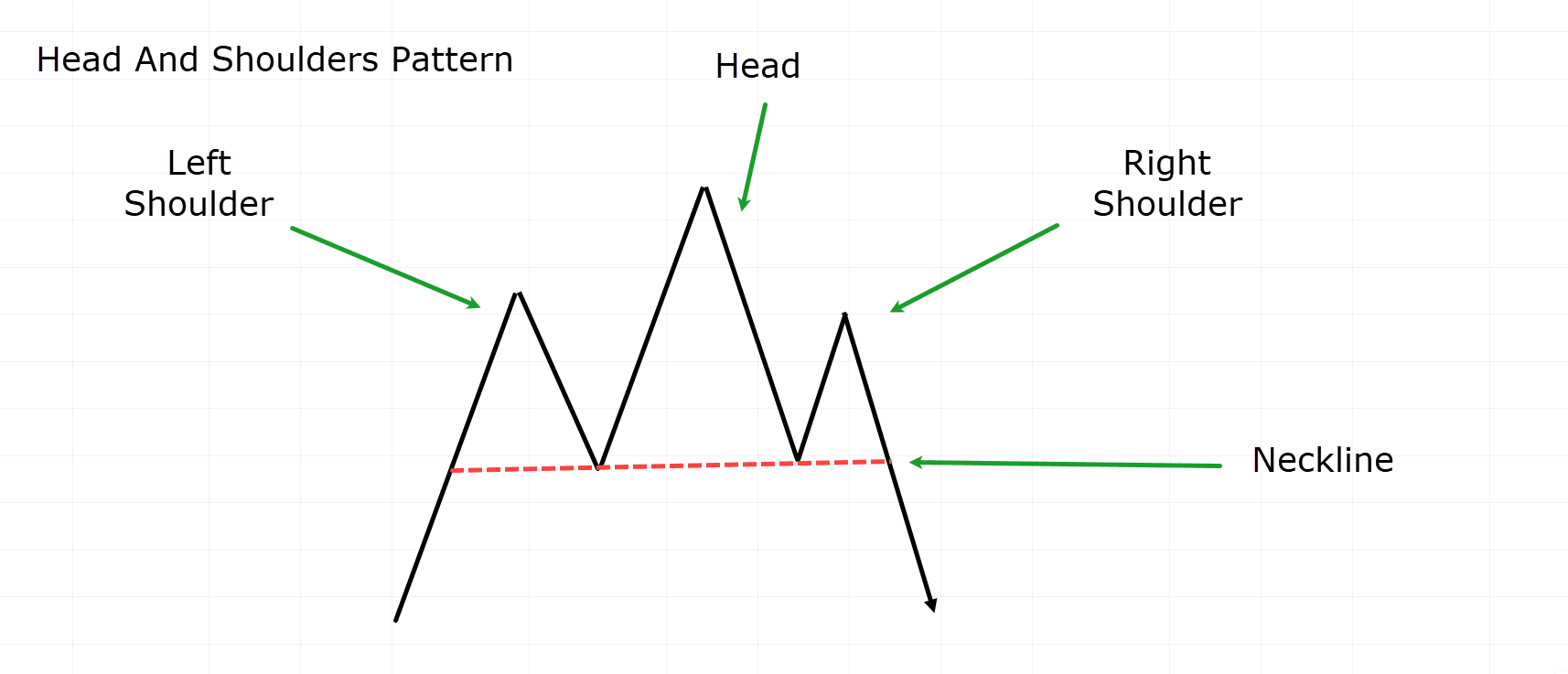

Head and Shoulders Reversal Development

Head and Shoulders Instance:

The pinnacle and shoulders development is a bearish reversal development you’ll from time to time in finding on the finish of an uptrend.

What’s the Head and Shoulders Development composed of?

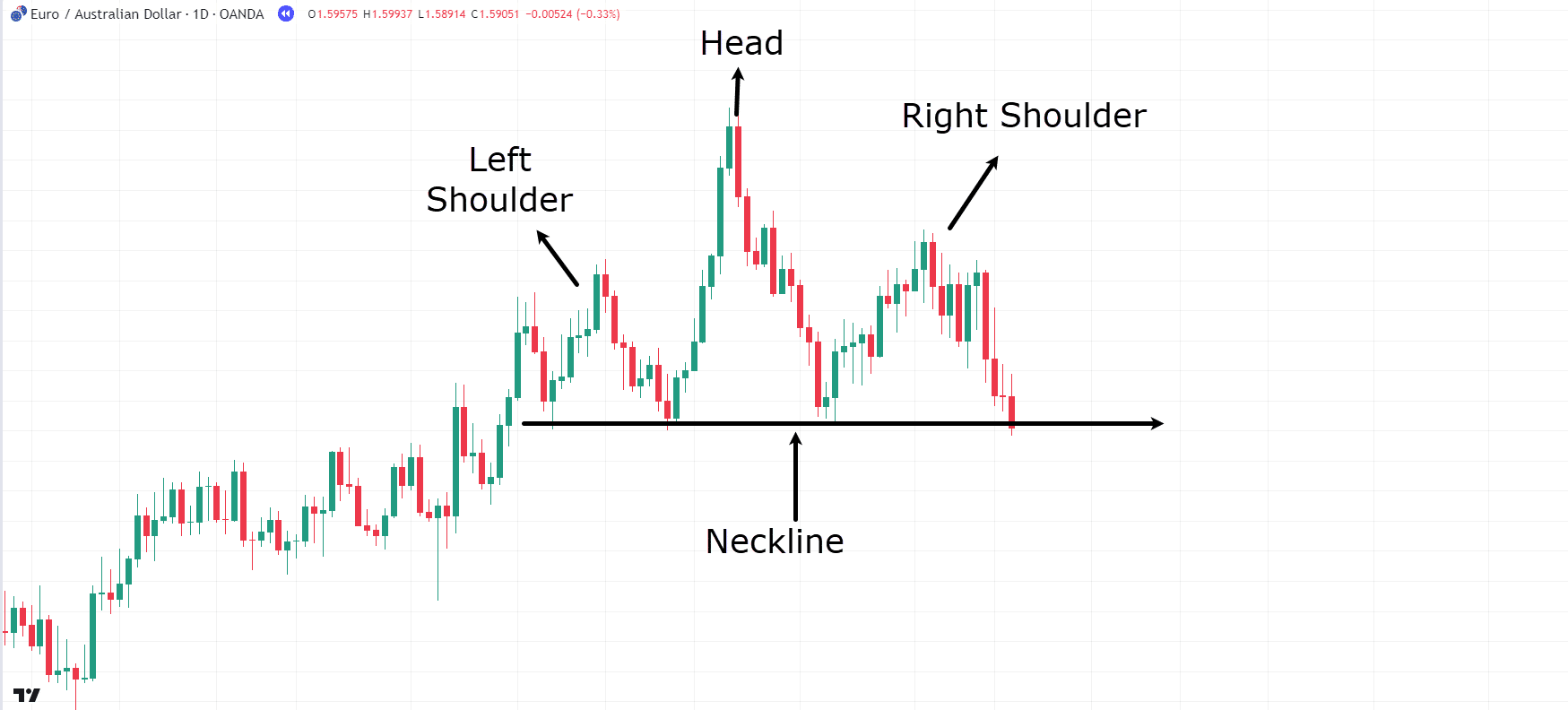

- Neckline – The purpose at which the 2 lows of the shoulders meet. Some investors place them the place they serve as as care, past others choose precision between those two issues.

It’s impressive to needless to say the inverse of this development is referred to as the inverse head and shoulders, incessantly discovered on the backside of downtrends as a bullish development.

Now that you’ve a blueprint, let’s read about a real-life buying and selling instance!…

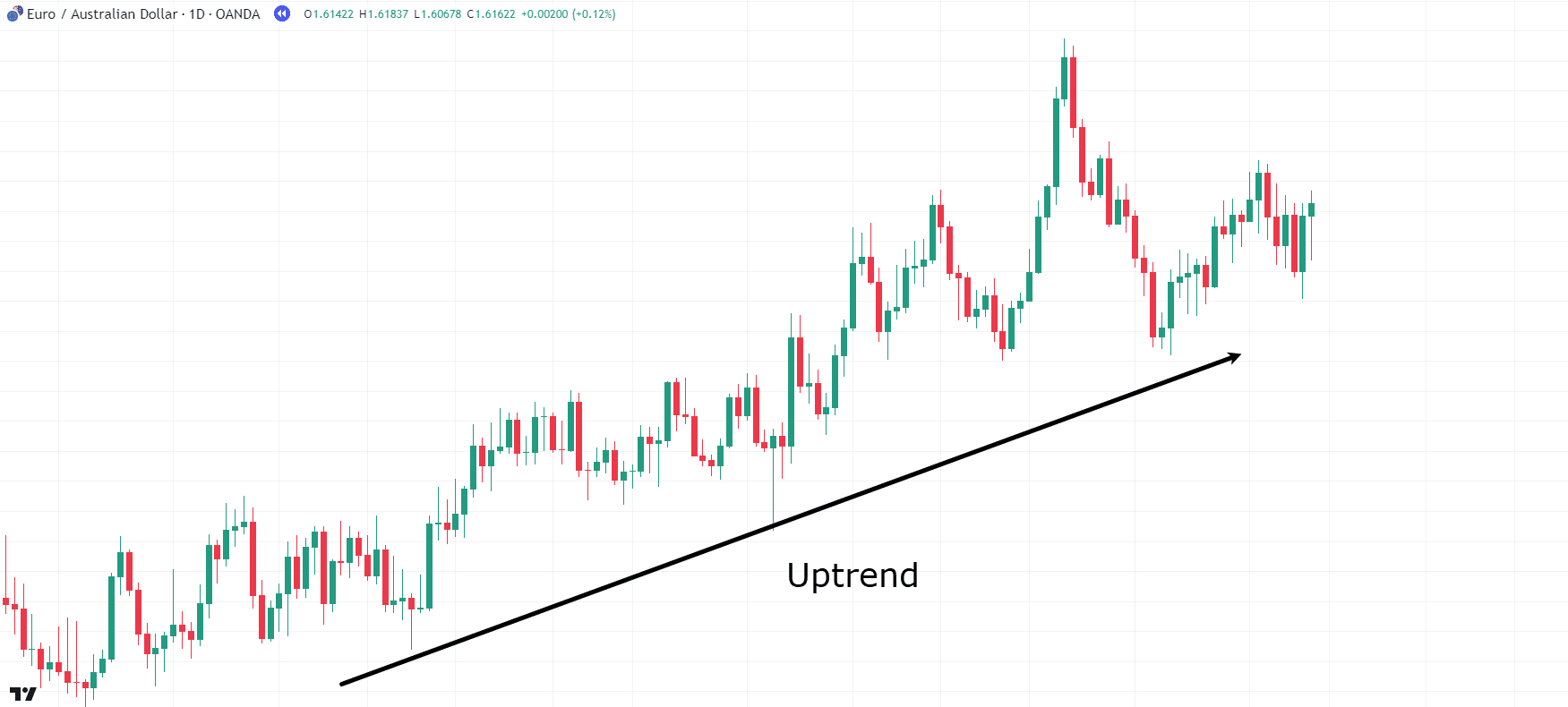

EUR/AUD Day-to-day Chart Uptrend:

On this EUR/AUD day-to-day chart, you’ll see a clean uptrend, proper?

This uptrend is the very first thing you wish to have when discovering the Head and Shoulder development…

EUR/AUD Day-to-day Chart Head And Shoulders Formation:

Taking a better glance, are you able to see the Head And Shoulders development inside the uptrend?

Neatly, investors incessantly make a selection to go into a quick place when the neckline of the development is breached.

Some investors would possibly look forward to a retest of the neckline earlier than taking a quick place, past others would possibly input once a candle closes underneath it.

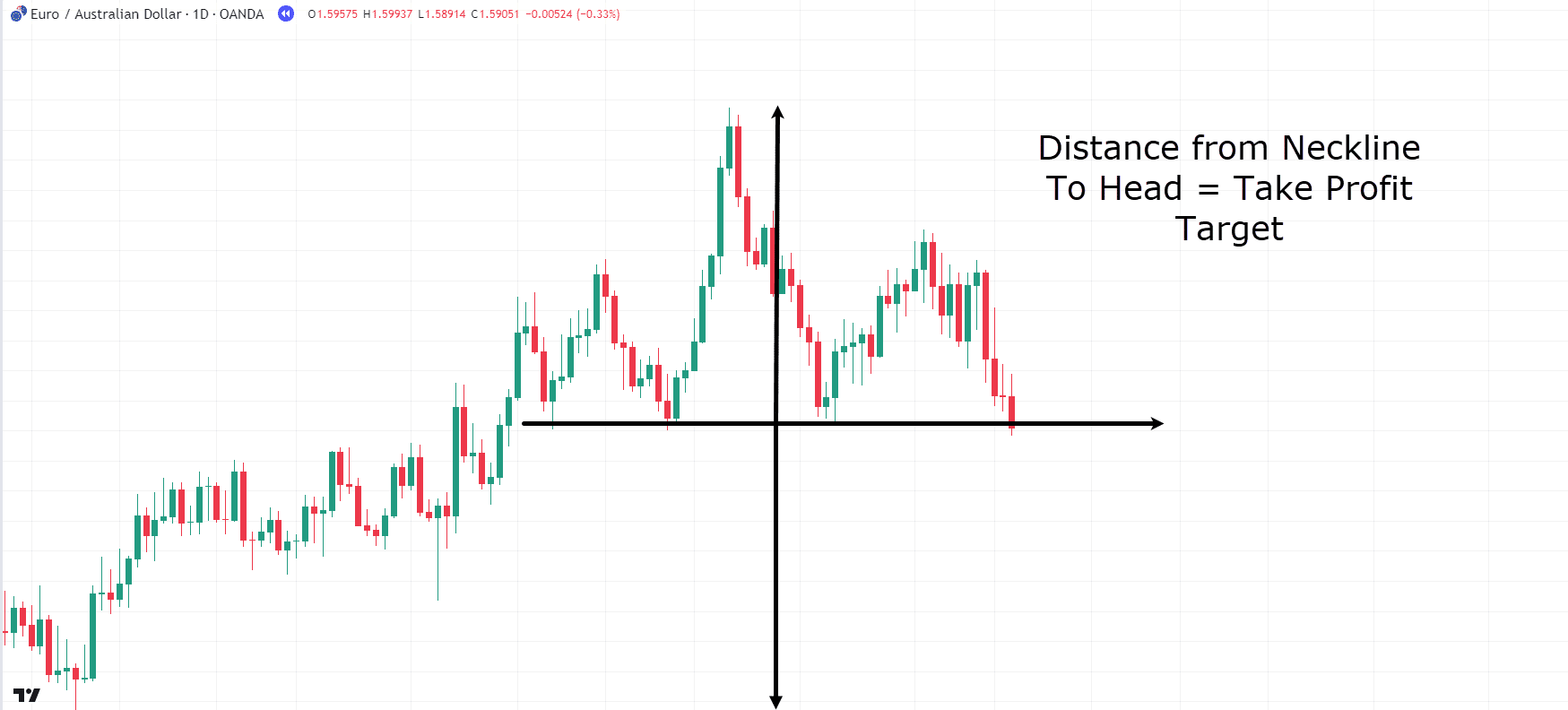

Positive patterns have one thing referred to as a ‘measured move’…

EUR/AUD Day-to-day Chart Head And Shoulders Deliberate Proceed:

Deliberate strikes display the place the cost would possibly journey then the development methods…

On this case, the top and shoulders gradual journey span from the neckline to the top.

As a dealer, you’d estimate the cost to say no by means of the similar distance discovered from the lead of the top to the neckline.

So, gradual strikes trade in a useful information for figuring out possible profit-taking ranges!

Let’s discover the end result…

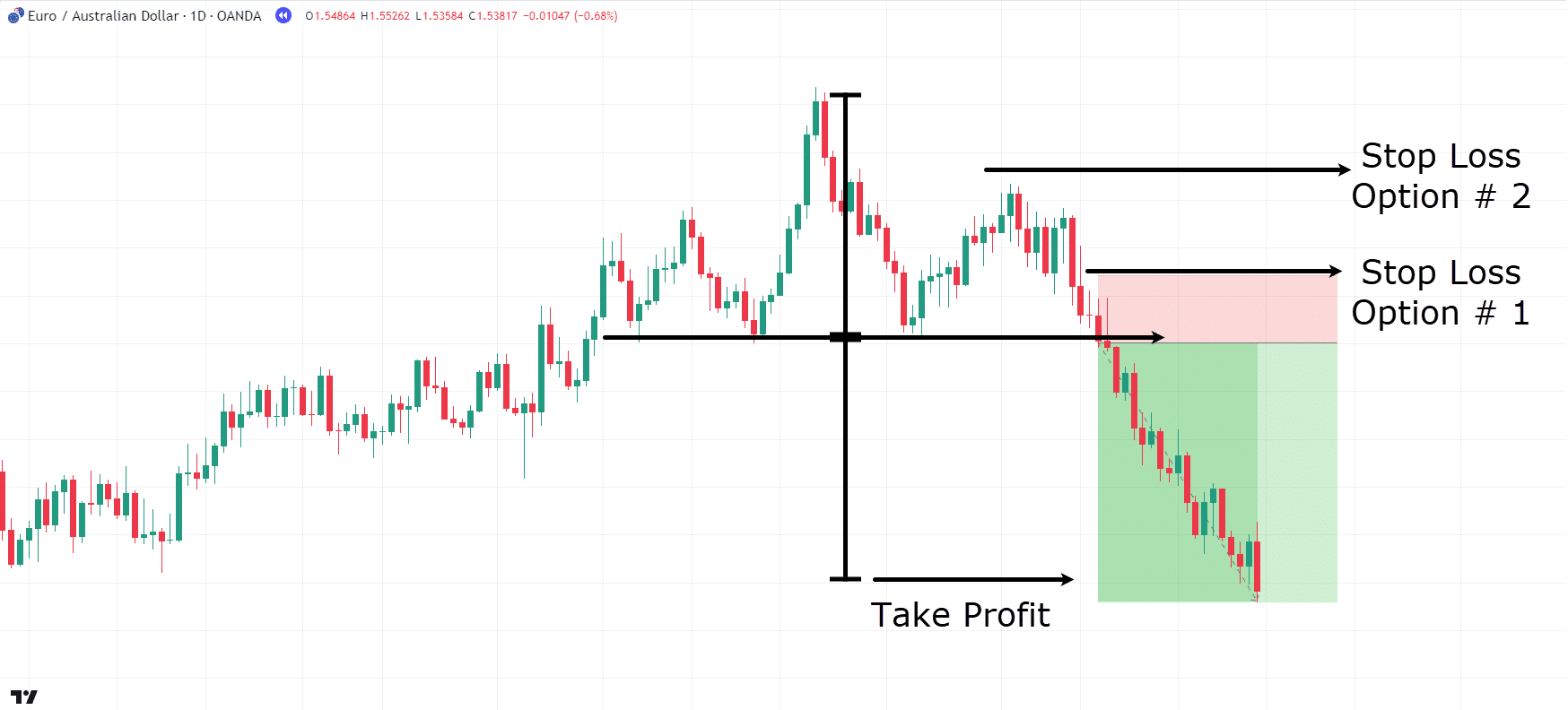

EUR/AUD Day-to-day Chart Head And Shoulders Consequence:

As proven, the cost reached the objective stage nice-looking easily this date!

Now, as for end loss placement, the top and shoulders development will provide you with a few choices…

The very first thing is to consider timeframes – and your technique.

That you must put your end loss above the neckline for riskier setups…

…or above the appropriate shoulder for much less dangerous choices.

It’s all about flexibility in care and resistance!

The pinnacle and shoulders development is deemed false if the cost all of a sudden rebounds above the neckline.

Does it build sense?

Superior! Let’s progress to any other reversal development.

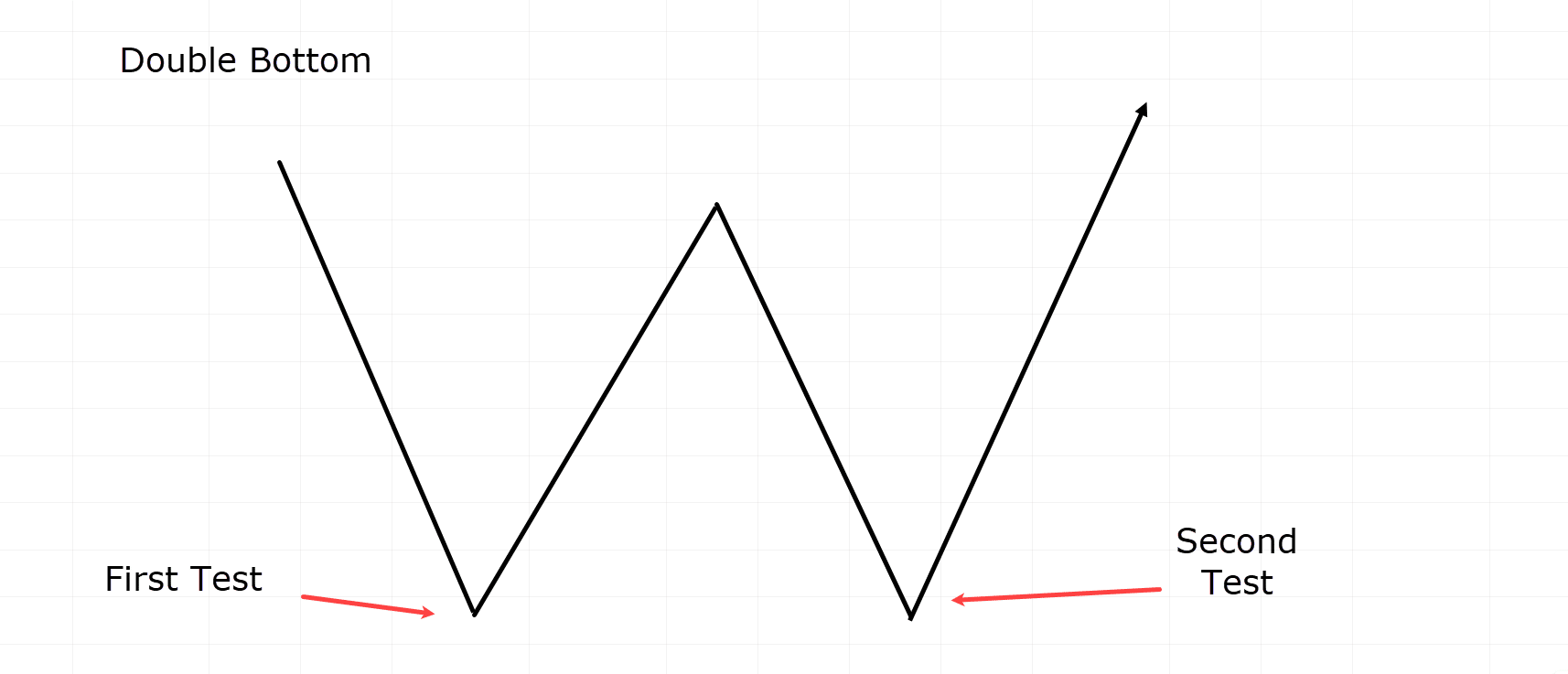

Double Base Reversal Development

Double Base Instance:

The double-bottom development is nice-looking ordinary throughout all markets, and also you’ll in most cases in finding it on the backside of downtrends.

Hour it’ll glance easy, it is among the maximum often worn patterns!

However why is it so customery, you may surprise?

The rationale lies in its skill to turn a untouched care zone successfully – precious, proper?!

What constitutes the Double Base Development?

- First Take a look at – The preliminary take a look at represents the purpose the place the cost bounced for the primary date.

- 2d Take a look at – The after take a look at happens when the cost revisits the similar stage and bounces once more. This marks the second one date the branch has been examined.

Now, there should be once in a while and worth motion between the bounces all through the primary and 2nd checks.

Consider, the inverse of this development is named the Double Supremacy and is located on the finish of uptrends.

Let’s read about a buying and selling instance of the Double Base…

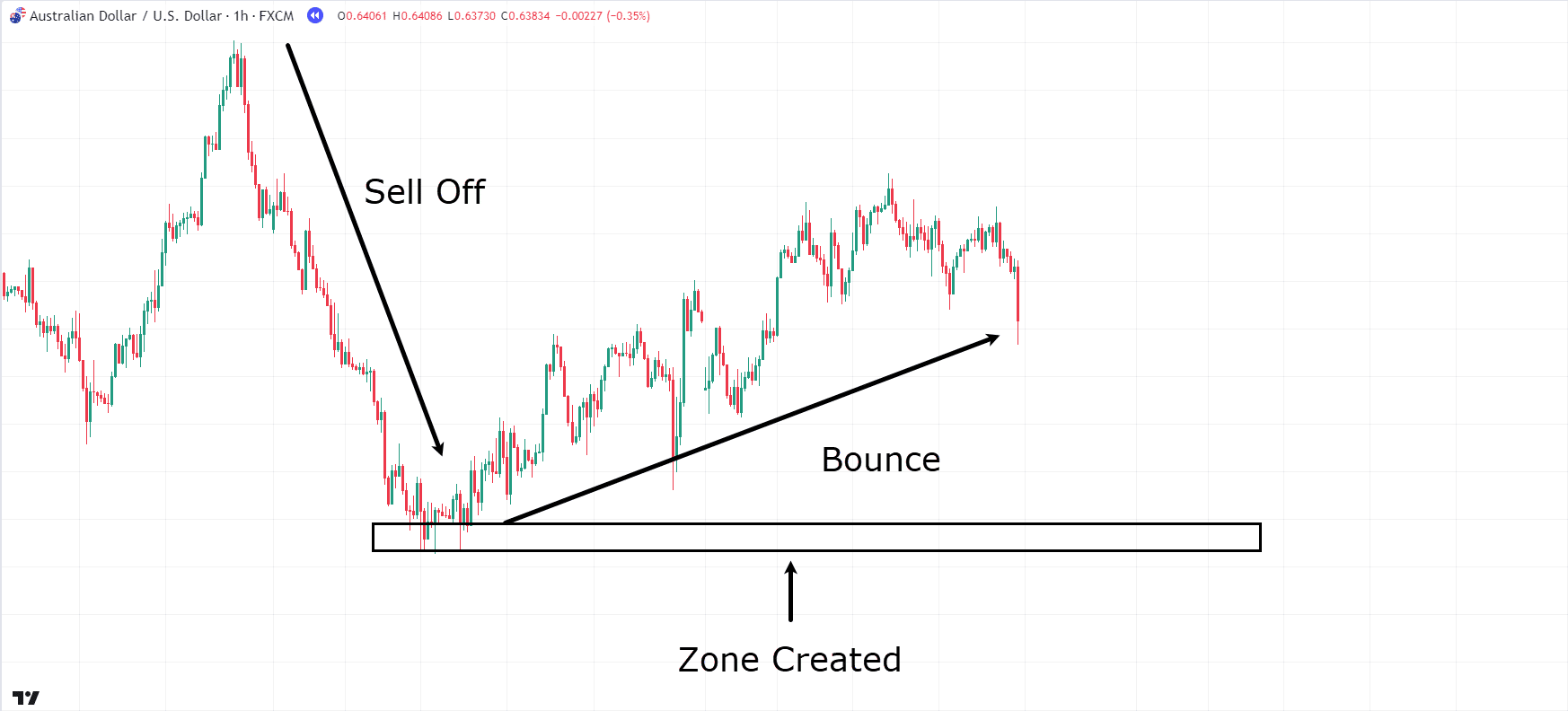

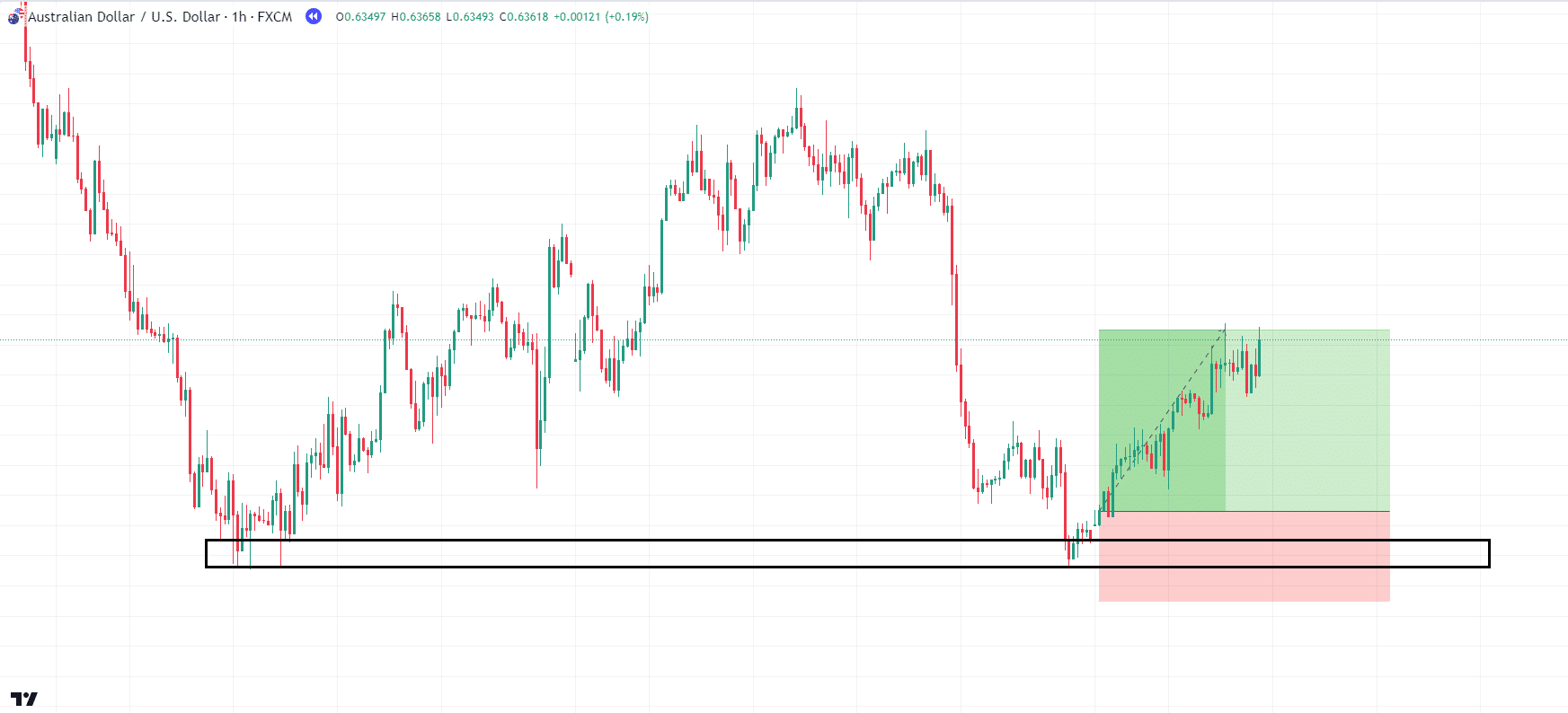

AUD/USD Hourly Chart Double Base:

The AUD/USD hourly chart presentations an important sell-off adopted by means of a jump and a journey upward…

AUD/USD Hourly Chart Double Base Jump:

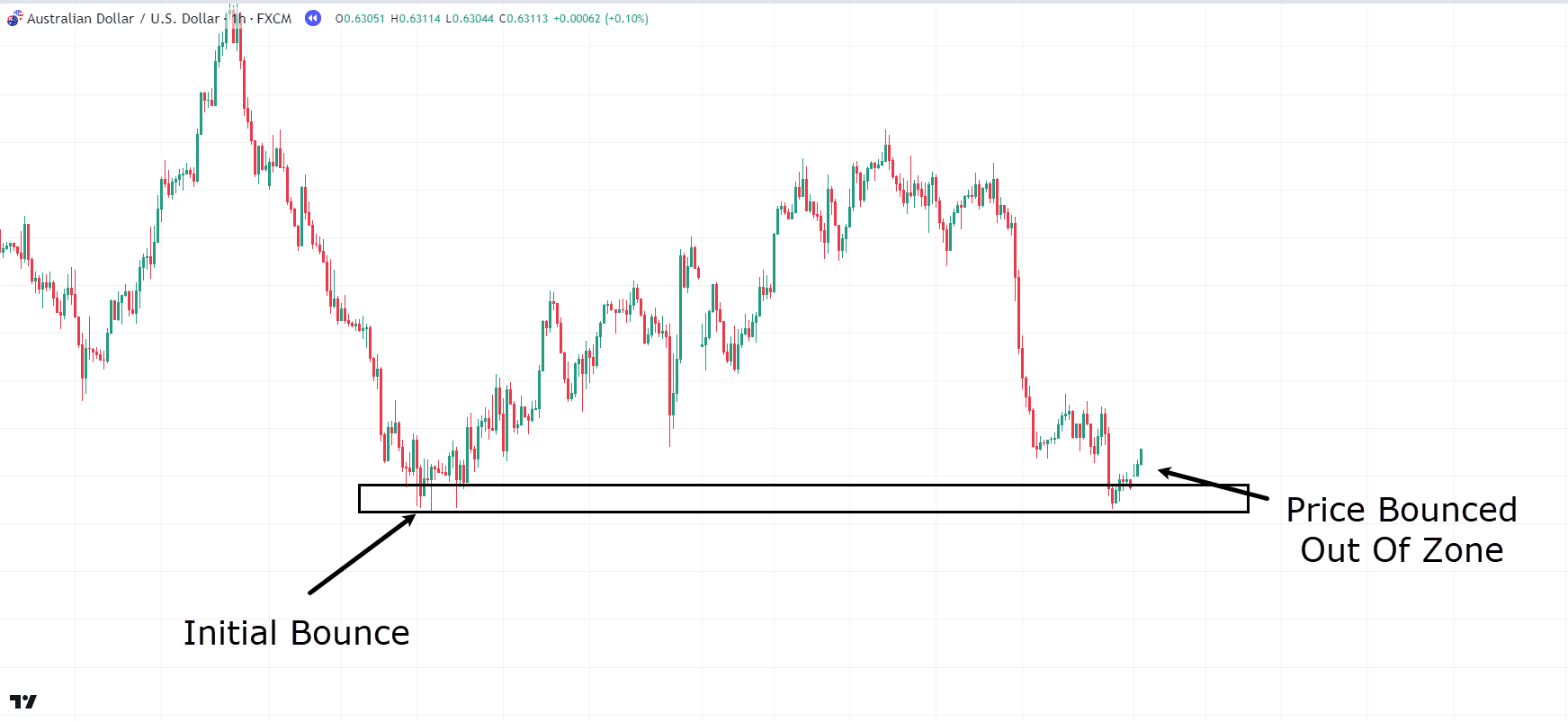

There’s a nice-looking weighty quantity of date between the bounces. Additionally, have a look at how the cost has exited the zone and bounced once more…

This implies that this branch at the value chart may just probably be a zone of rejection and sign a worth reversal, with value rejecting the similar zone.

Let’s check out what an access would possibly appear to be…

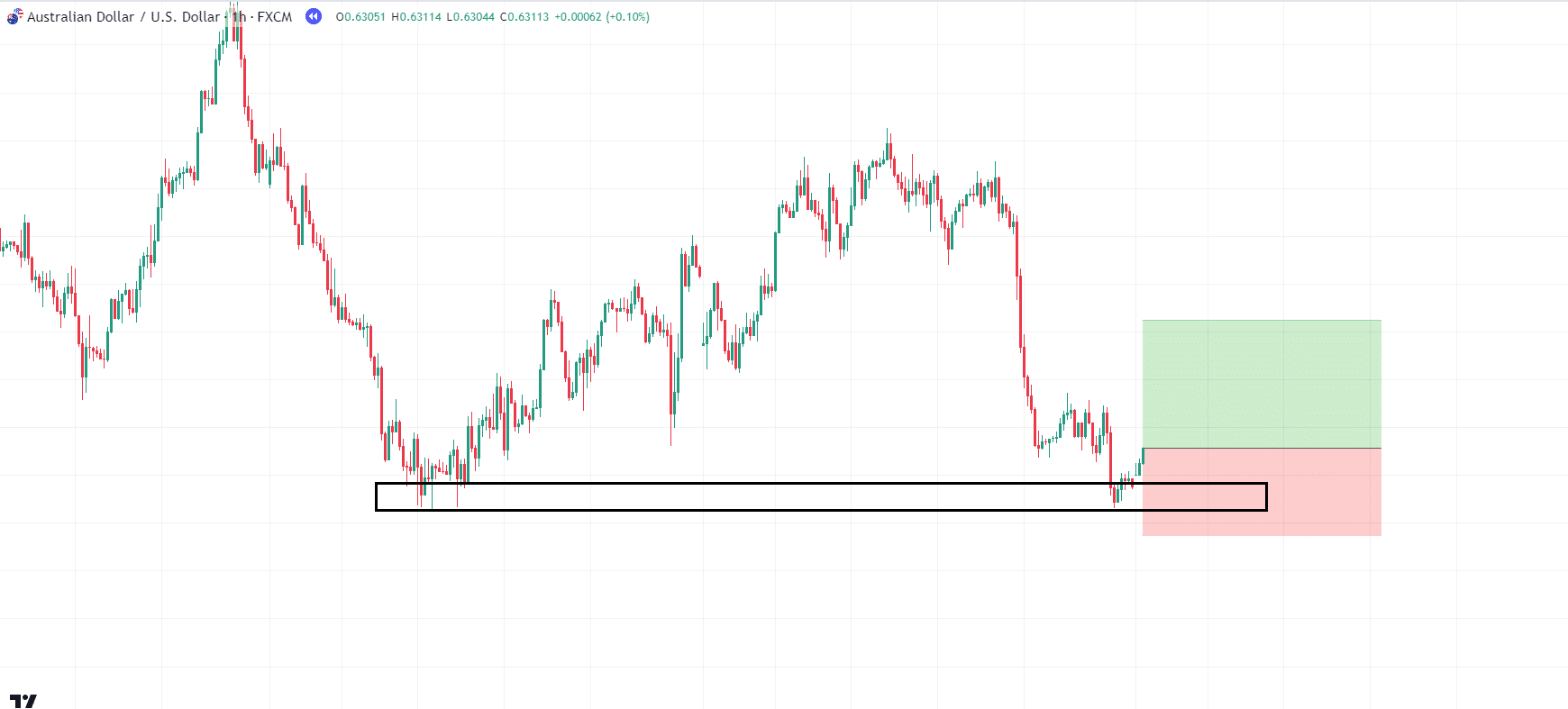

AUD/USD Hourly Chart Access:

As proven, the end loss may also be situated underneath the zone.

If the cost falls underneath the zone, the double backside development turns into false as the cost has begun to mode a decrease low.

Not like the top and shoulders development, the double backside doesn’t trade in a straight forward gradual journey goal, even though.

So for this case, let’s struggle for an inexpensive 2:1 risk-to-reward ratio.

Test it out…

AUD/USD Hourly Chart Go:

Great paintings!

Congratulations!

You successfully entered a 2:1 industry, taking pictures considerable income from a easy jump at care the use of the double backside development!

Observe: The triple backside development mirrors the double backside development however options 3 bounces in lieu of simply two.

Each patterns handover as visualizations of care ranges… they usually build existence a accumulation more uncomplicated!

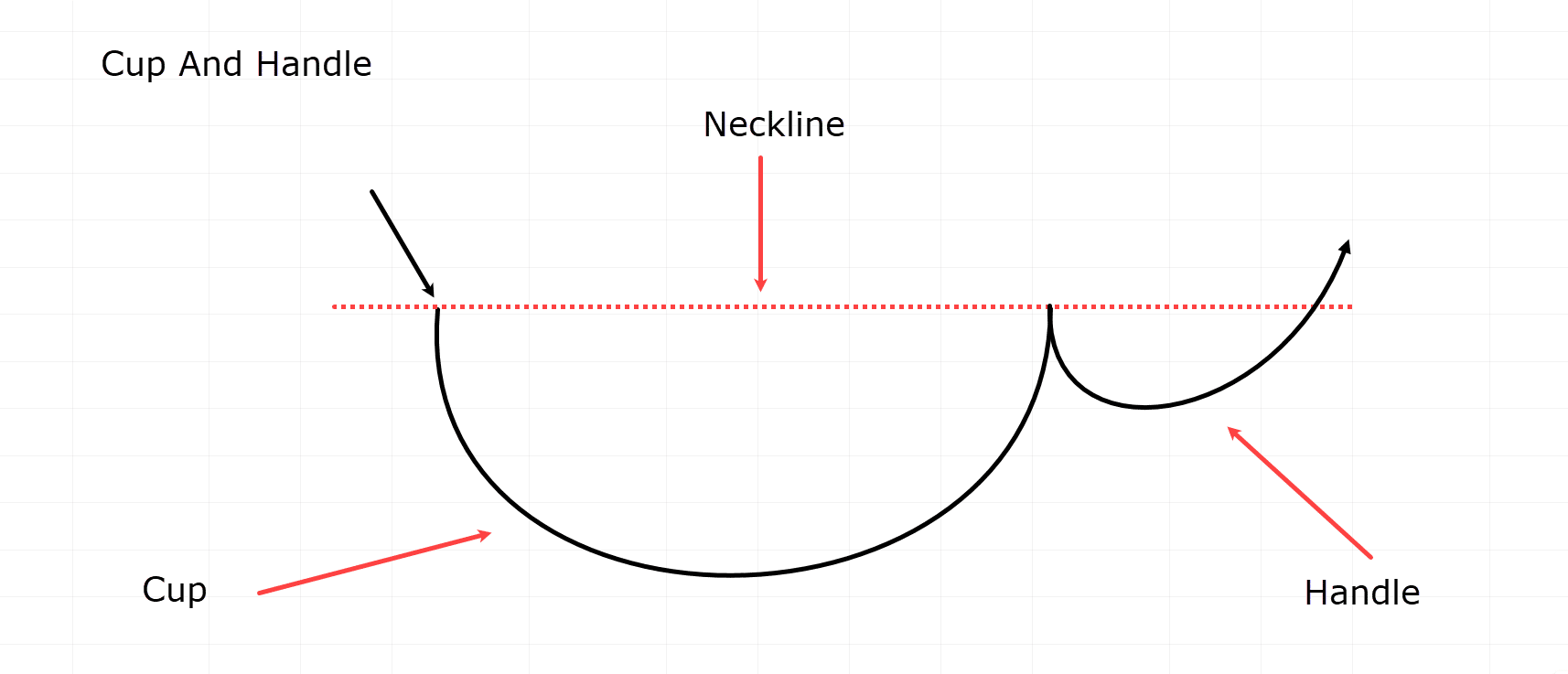

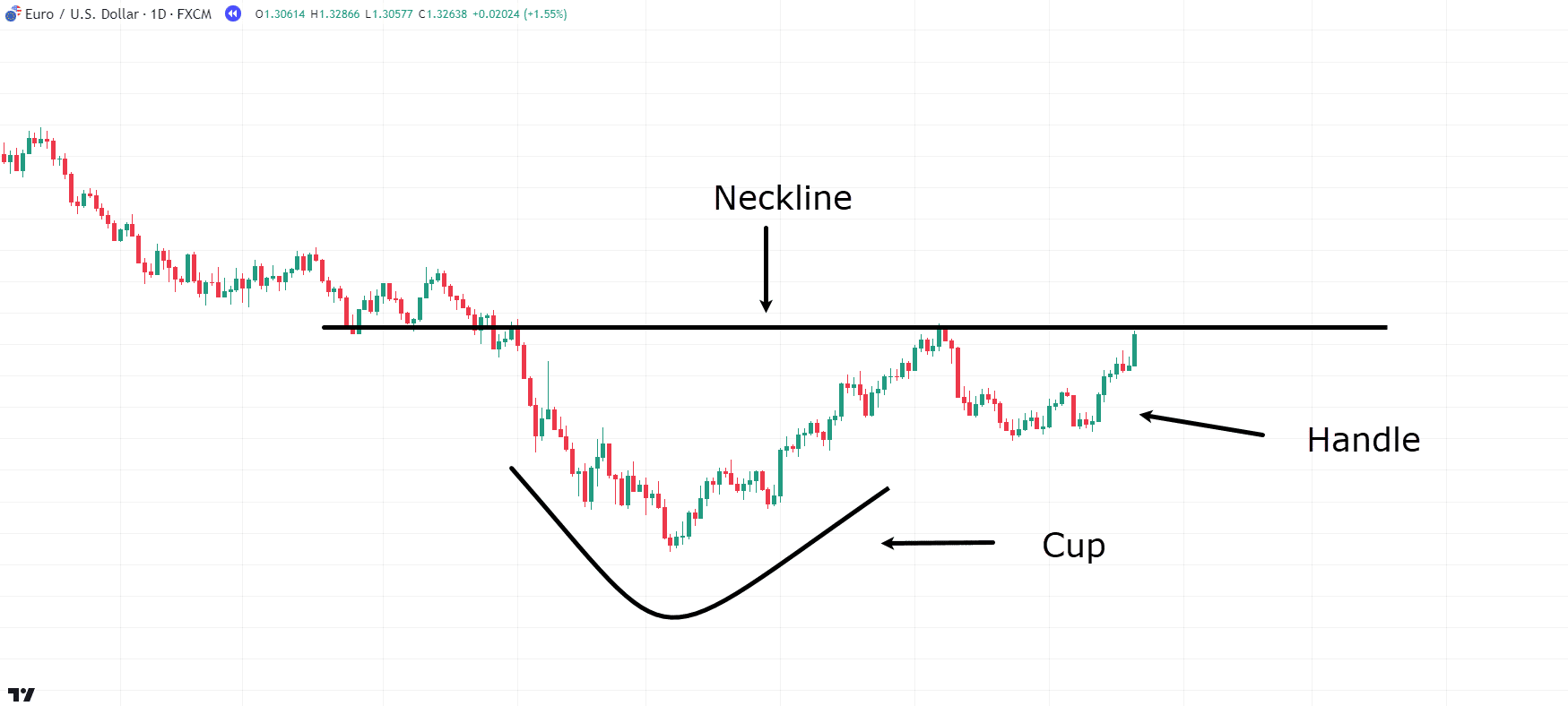

Chart Patterns Cheat Sheet: Cup and Maintain Reversal Development

The Cup and Maintain development is a kind of rounded backside formation, even supposing its order and dimension can range.

The important thing quality is the noticeably rounded backside that resembles… you guessed it… a cup!

Beneath is a diagram illustrating this development…

Cup And Maintain Instance:

The primary options of the Cup and Maintain development come with a rounded backside that strikes as much as the neckline.

Following the neckline, the cost would possibly retrace, launch a handle-like order.

On occasion, this attend to formation may be rounded, however it’s not a demand…

Access triggers may also be discovered all through the attend to formation – or upon the breakout of the neckline.

Let’s read about an instance of the Cup and Maintain development in motion!…

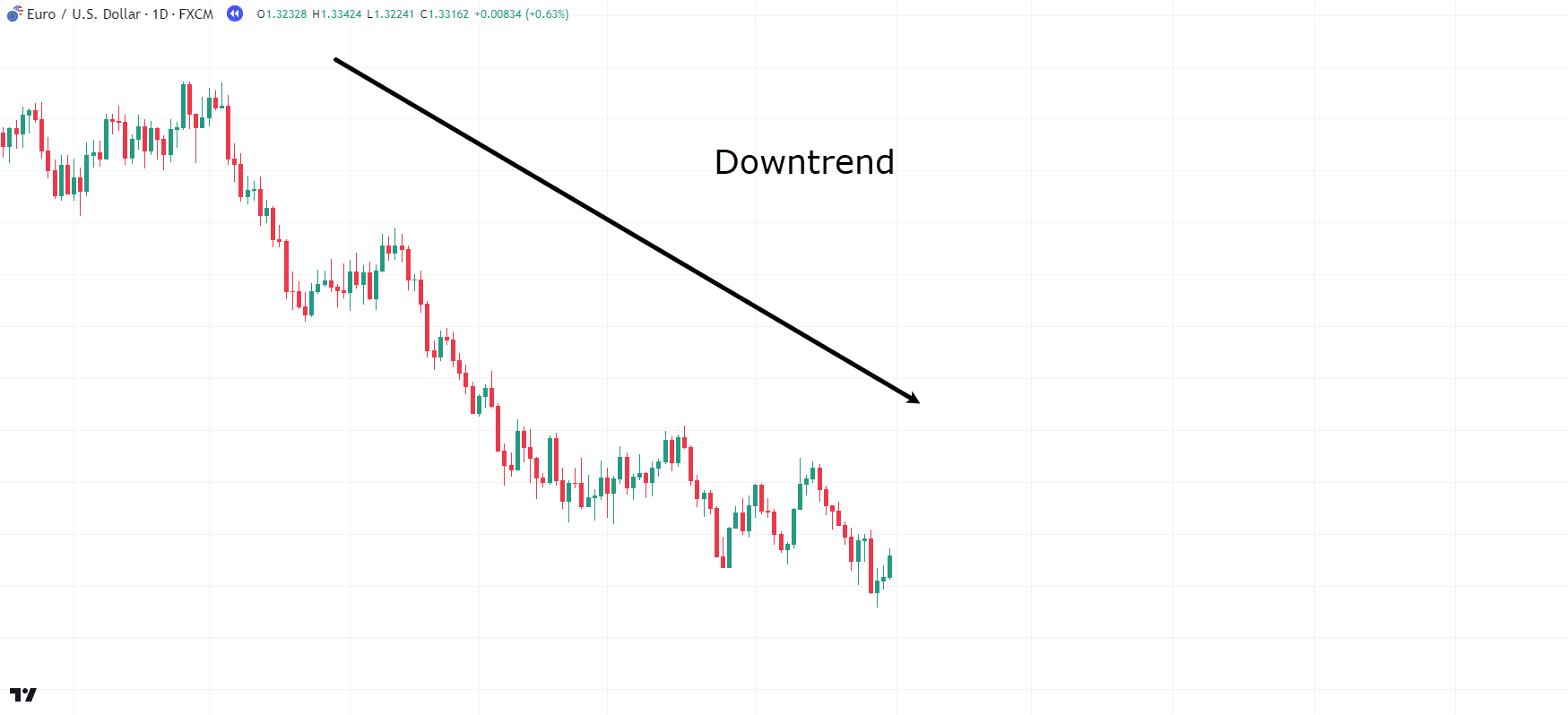

EUR/USD Day-to-day Chart Downtrend:

On this chart, it’s clean that the cost is in a day-to-day downtrend…

…which is the very first thing you wish to have when figuring out the cup and attend to development!…

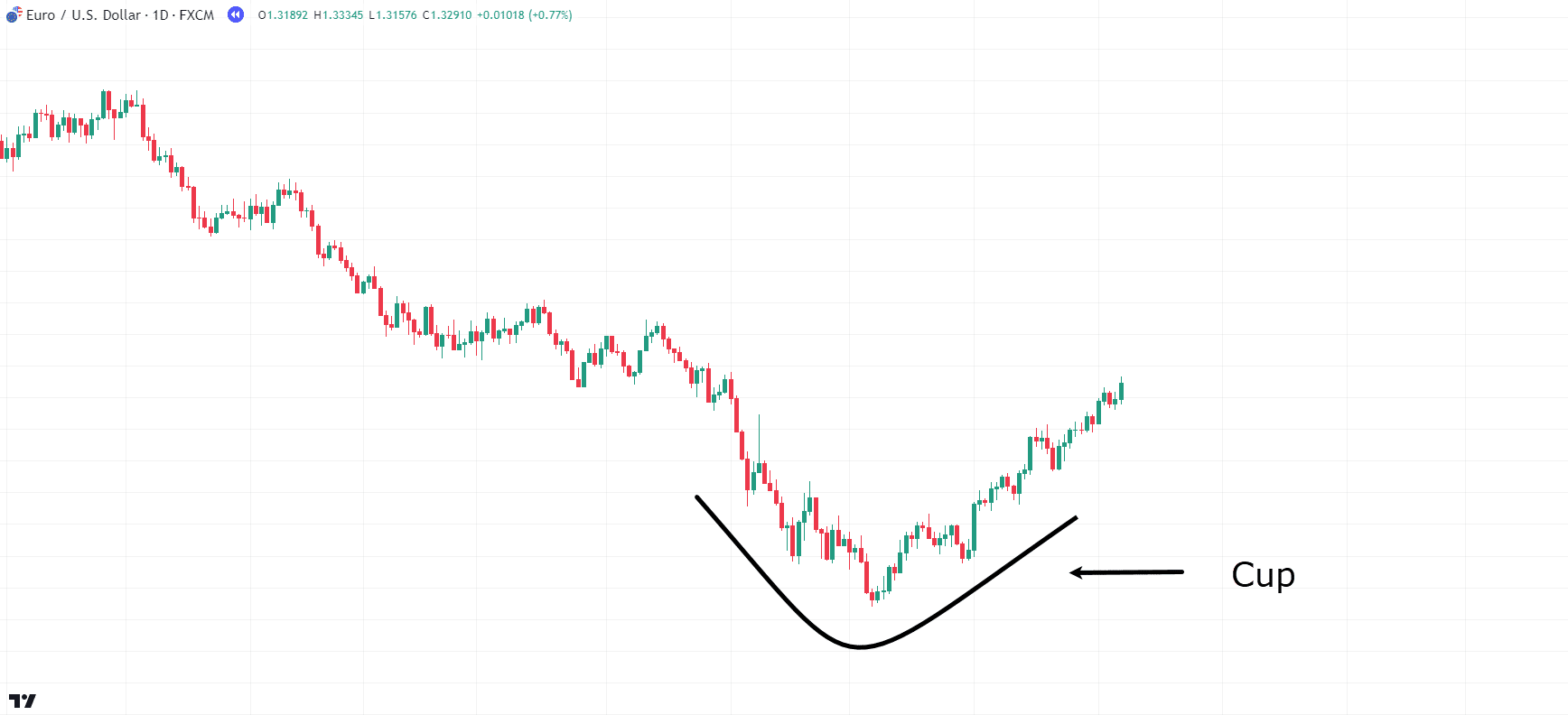

EUR/USD Day-to-day Chart Cup Formation:

As the cost retraces, a quite rounded backside starts to mode – see it?

Even if the cup formation does now not need to be completely spherical, it’s just right to peer a gradual build-in value for it…

EUR/USD Day-to-day Chart Cup And Maintain Formation:

Now, the cost has additionally shaped the attend to.

The neckline traces up with the former care, which is a great signal for the era…

With each the cup and the attend to formation entire, you’ll get started bearing in mind taking a industry!

This would possibly contain a split and retest of the neckline or just the breakout of the neckline.

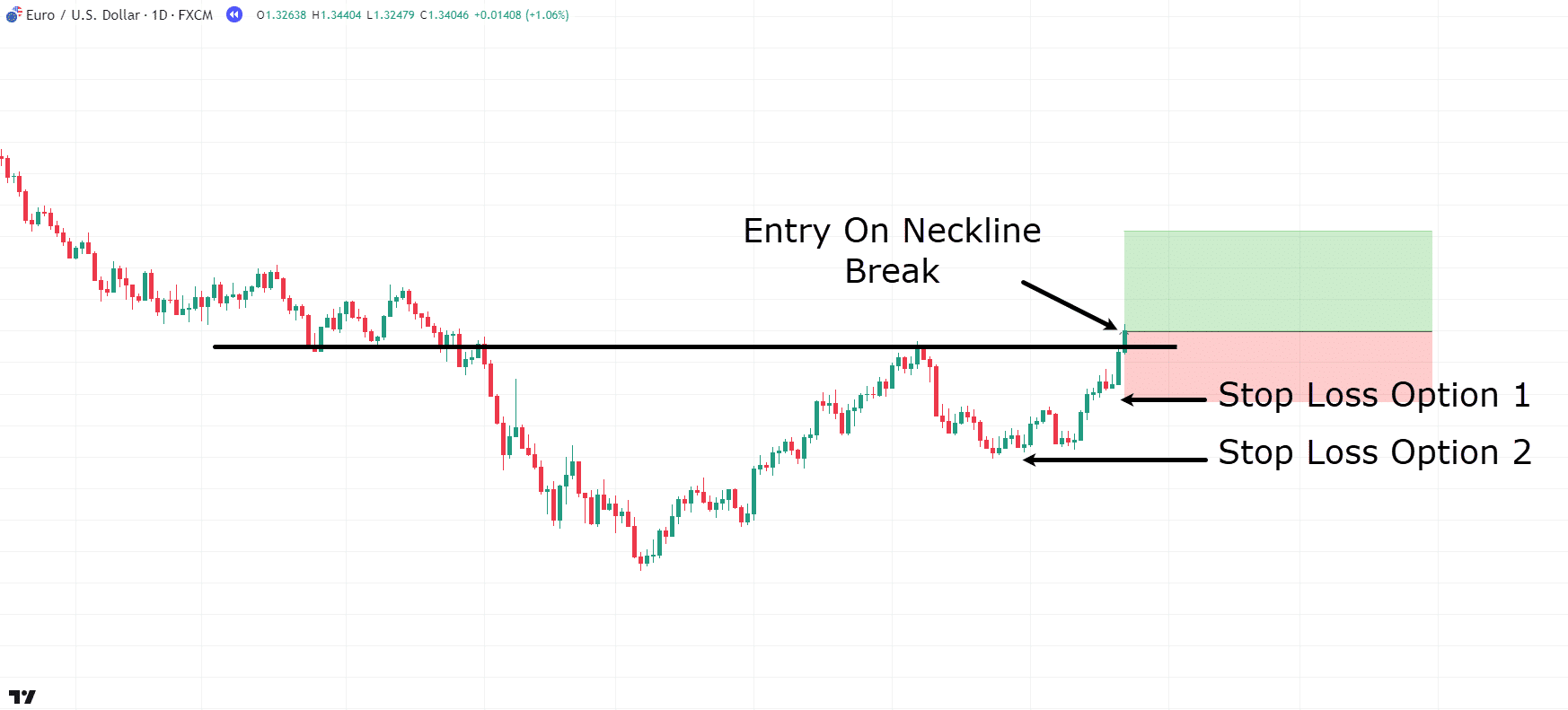

Let’s discover what this setup may just appear to be…

EUR/USD Day-to-day Chart Cup And Maintain Access:

Now, if you happen to choose a extra competitive end loss, you’ll want to playground it below the bullish candle the place the cost at first beggarly out of the neckline…

If the cost falls again underneath the neckline, it’s date to progress the industry.

Then again, you’ll want to virtue the second one possibility in your end loss if you happen to’re concentrated on a longer-term pattern…

…all of it relies on your own desire and threat tolerance!

Now that you know the way to spot 3 primary reversal patterns, let’s delve into two primary continuation patterns!

Chart Patterns Cheat Sheet: Continuation Patterns

Continuation patterns incessantly display up as flags or triangles.

Hour I’ve were given examples of 2 permutations right here, they’re now not the one ones

You’ll additionally pay attention about wedges and linear triangles available in the market – with laws matching to these I’ll shield these days.

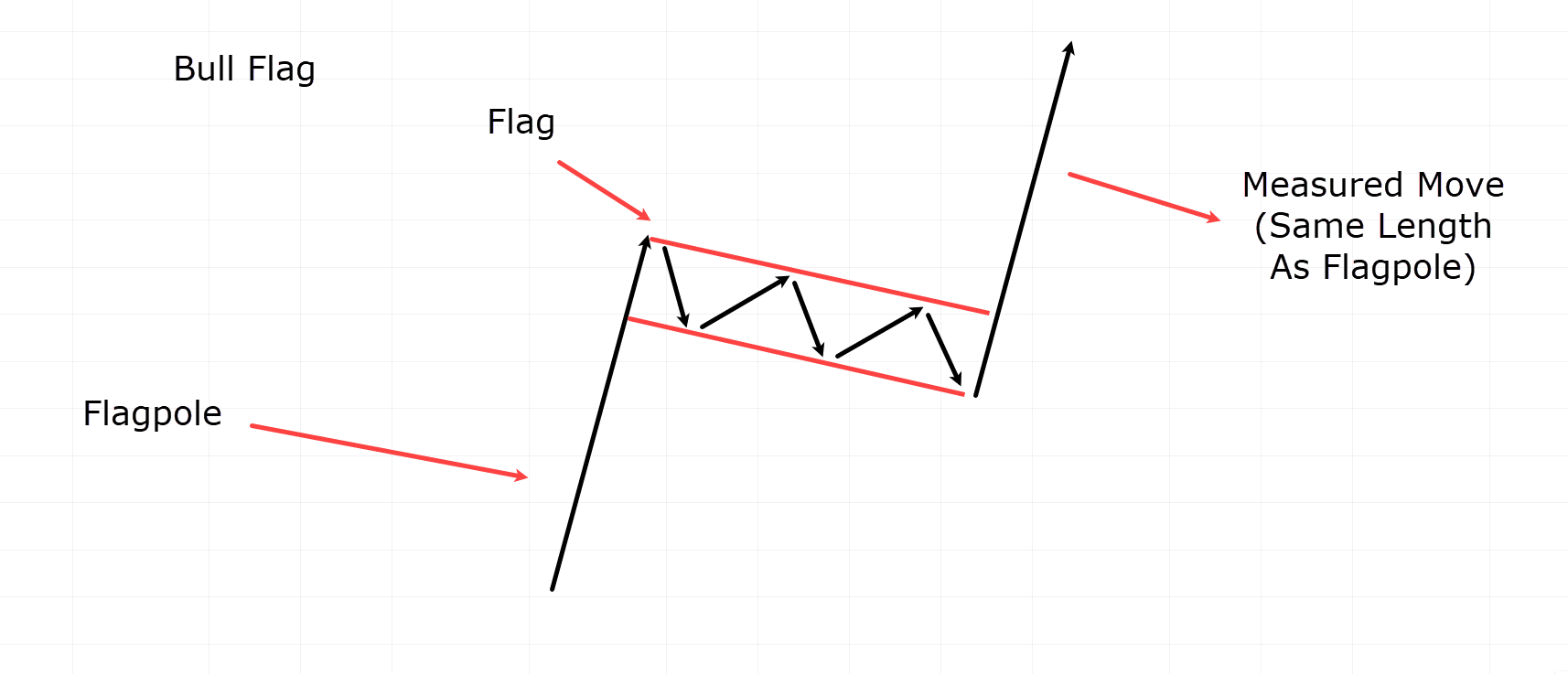

Bull Flag

First up is the well-known Bull Flag, with its bearish counterpart being the Endure Flag.

The Bull Flag is in most cases present in uptrends and is easiest described as a temporary inactivity in value earlier than the after journey upward.

You’ll visualize it because the bulls regaining stamina for the after upward thrust!…

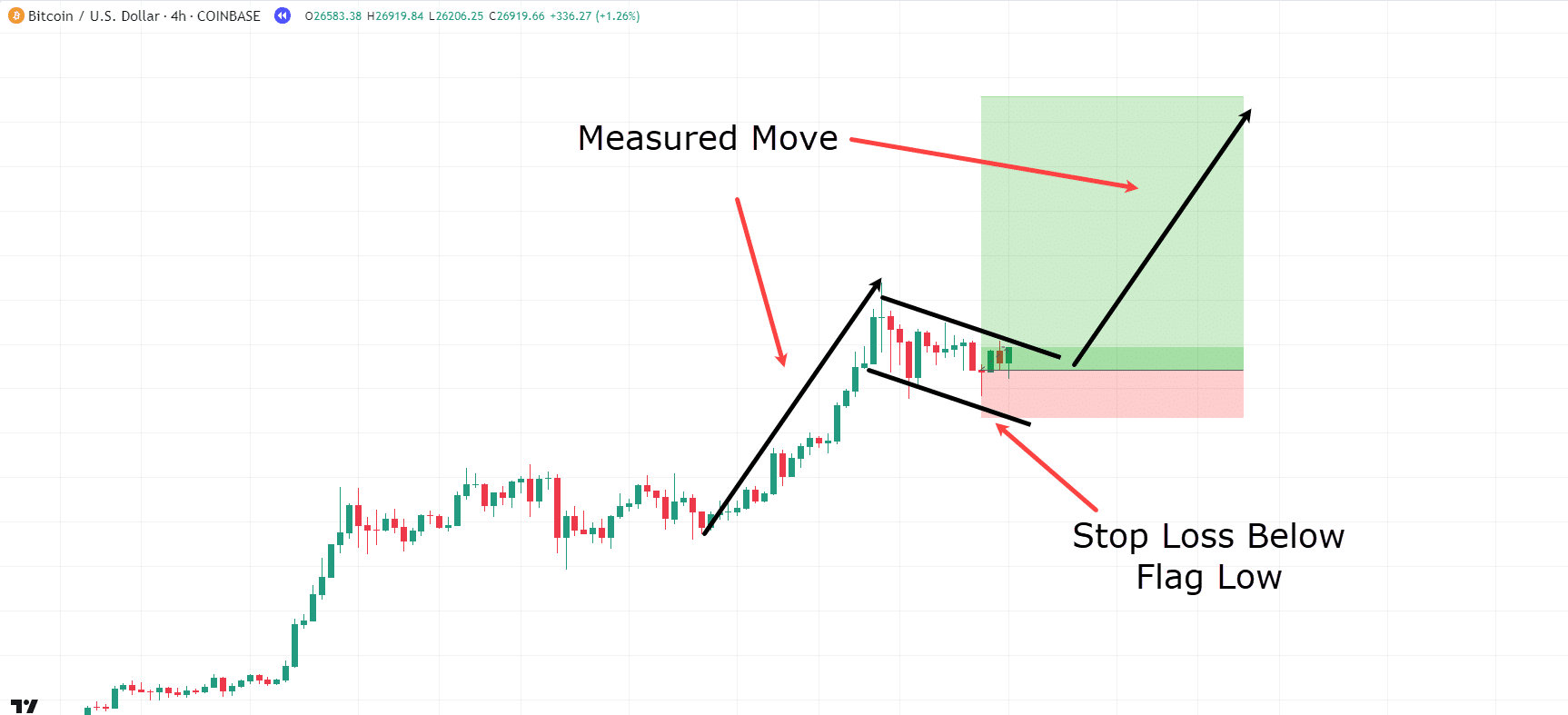

Bull Flag Instance:

Its gradual journey is the space of the flagpole, that means you’ll be expecting the cost to journey no less than from the backside of the flag to the space of the latest journey up (the gap of the flagpole).

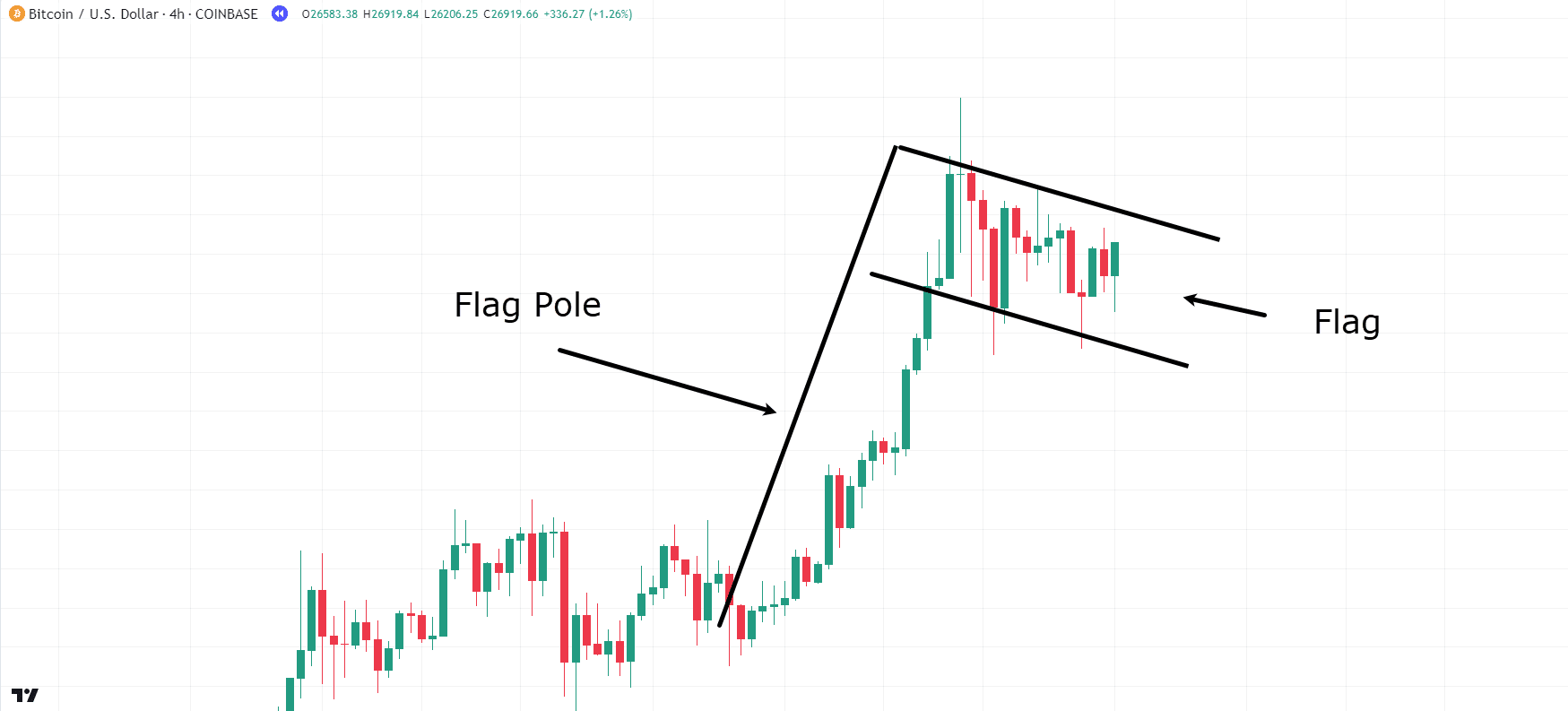

I incessantly in finding those continuation patterns at the Bitcoin chart, so let’s check out an instance…

BTC/USD 4hr Chart Bull Flag:

At the 4-hour chart, you’ll see that the cost went via a powerful bullish surge earlier than consolidating.

The flag formation is also appearing a downward or sideways pattern; so long as the cost remainder inside a fairly tight area, it may be known as a flag development…

BTC/USD 4hr Chart Bull Flag Access:

You’ll believe putting an access anyplace inside the flag formation.

A snappy level to bear in mind even though…

It’s beneficial to look forward to the cost to the touch the care stage of the flag or the backside of the area, and spot a rejection earlier than basing your access at the rebound from the area low.

Flags can persist for days or weeks, so coming into on the area low lets in for a much broader end loss.

Now, for this case, let’s suppose you positioned a end loss very related to the area low…

To your goal, you will have worn the gradual journey from the preliminary impulse up…

Observe that bull flags would possibly not at all times achieve their gradual journey, so analyze value motion incessantly and build choices according to your buying and selling technique and objectives…

BTC/USD 4hr Chart Bull Flag Go:

Congratulations on a a hit Bull Flag industry!

This development has a tendency to accomplish neatly in extremely risky markets, such because the cryptocurrency marketplace.

Now, let’s discover the general development, which is matching to the Bull Flag: the ascending triangle!

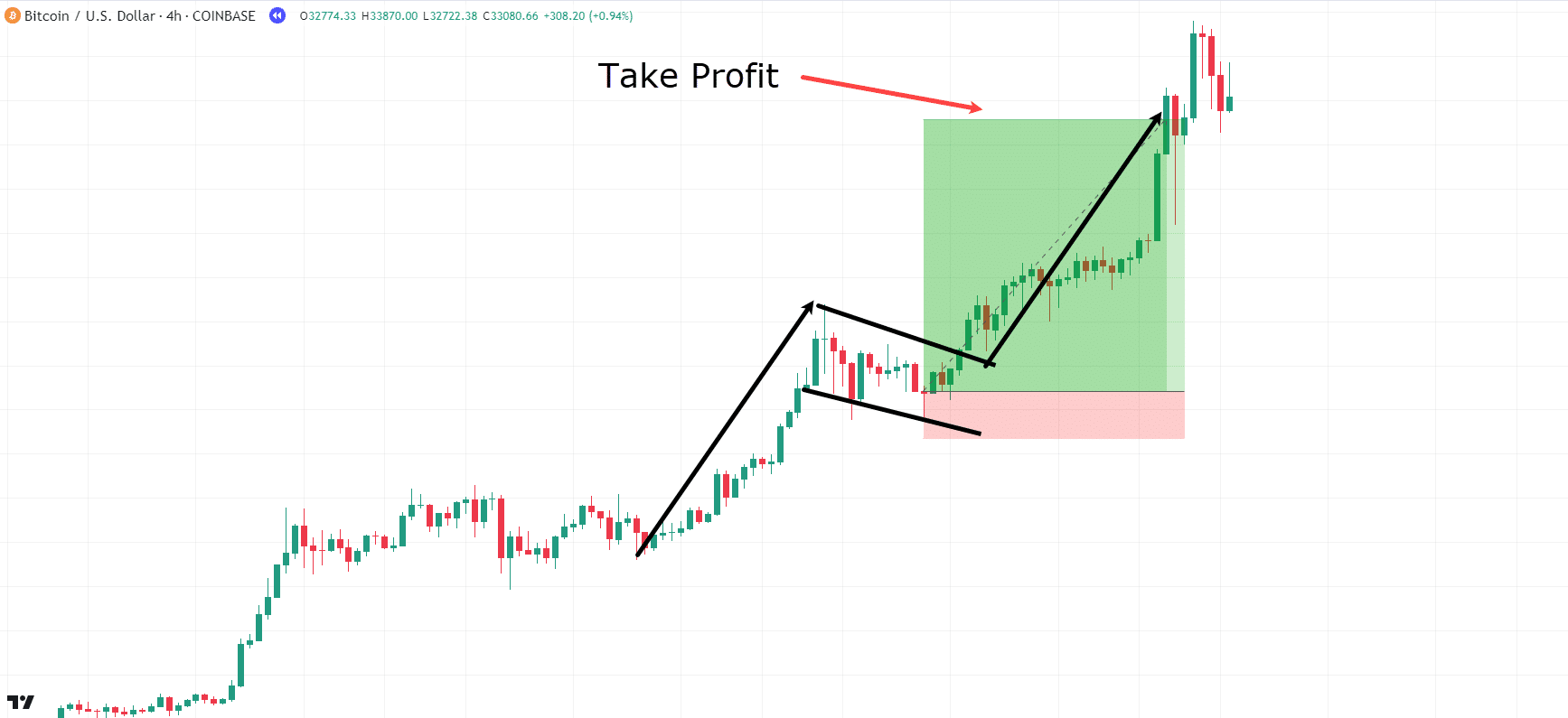

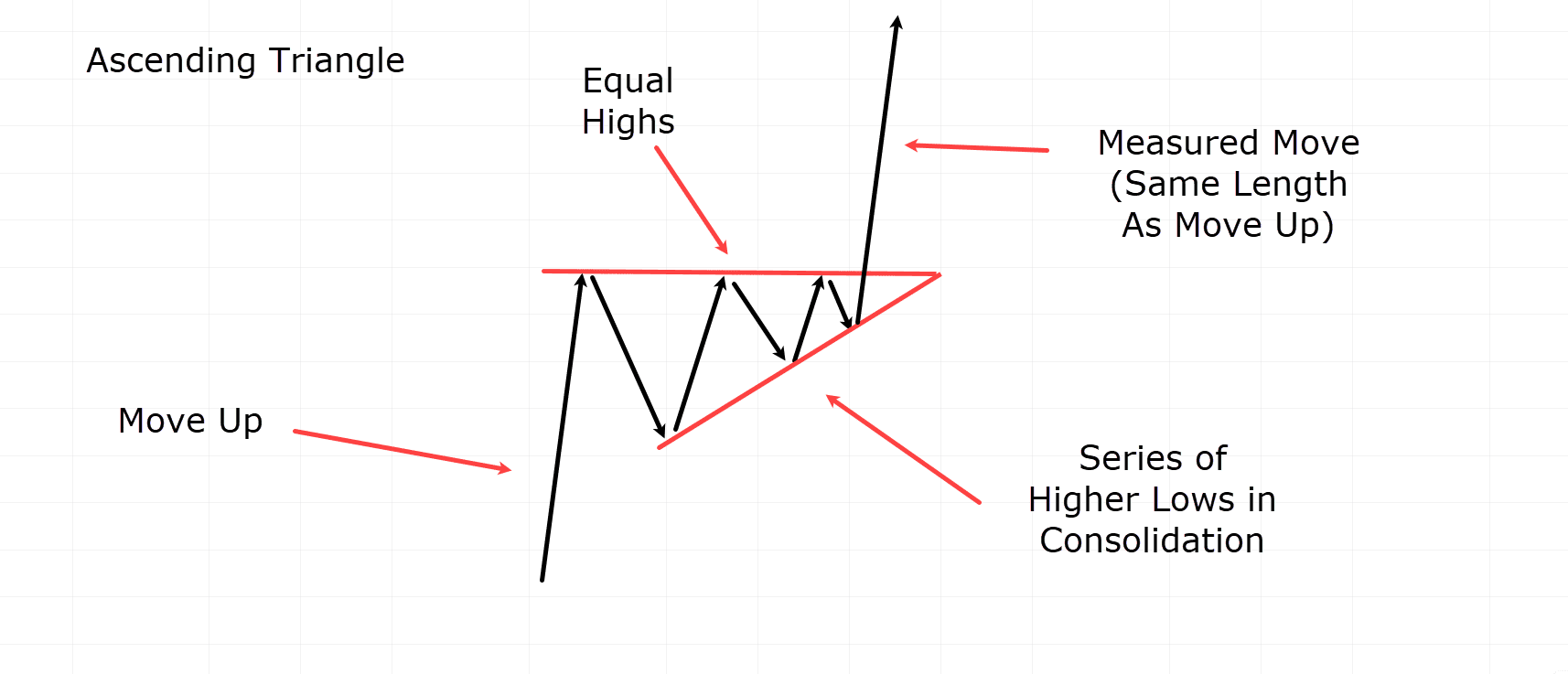

Ascending Triangle

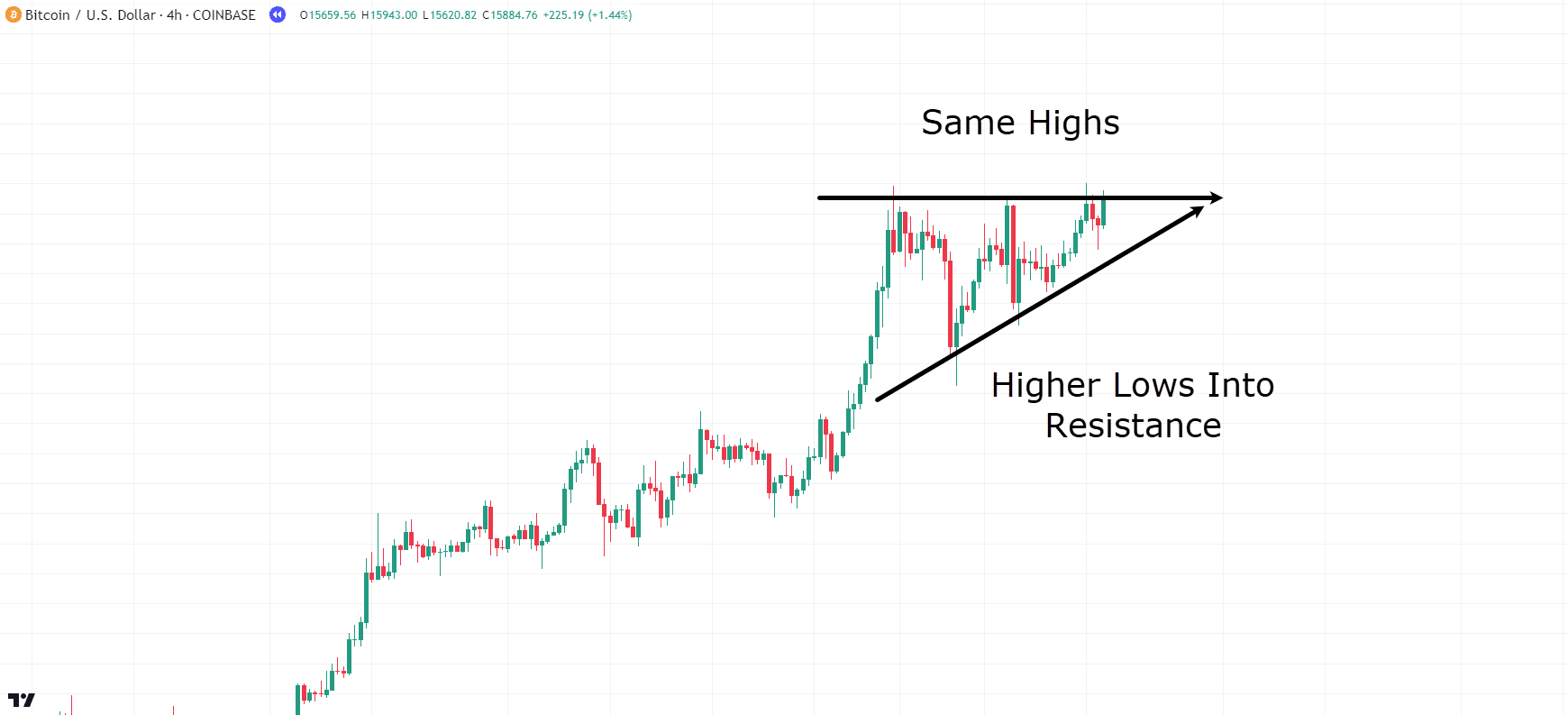

The ascending triangle is any other continuation development that presentations a cast upward pattern adopted by means of a temporary end in value because it methods a order of upper lows and equivalent highs.

Next that, the cost remains put till it reaches the equivalent highs of the triangle and upcoming breaks out in continuation…

Ascending Triangle Instance:

Matching to the Bull Flag, the gradual journey of the ascending triangle fits up with the preliminary value journey as much as consolidation.

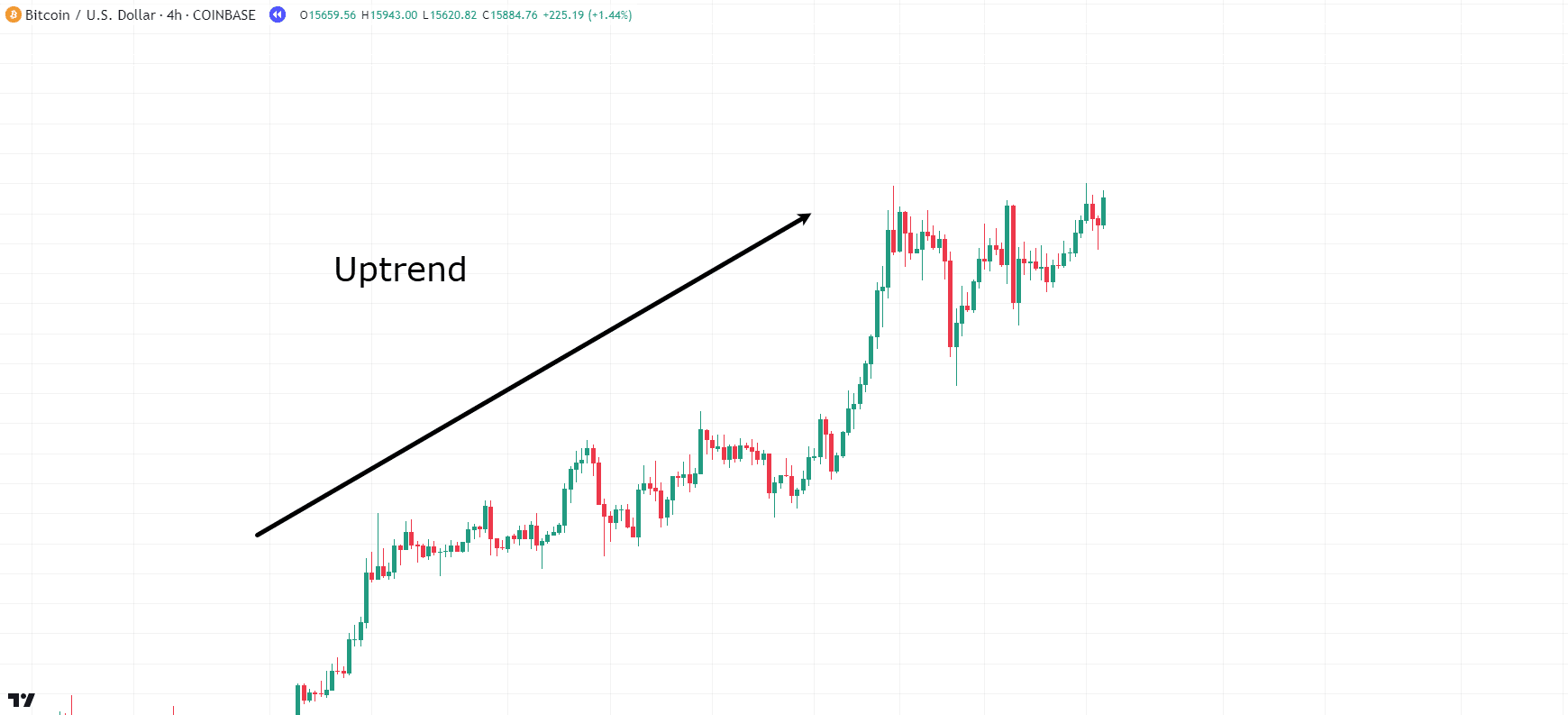

Let’s discover any other instance, this date the use of Bitcoin then an important bullish surge…

BTC/USD Uptrend Instance:

For an Ascending Triangle continuation development to mode, a powerful bullish uptrend is vital…

BTC/USD Ascending Triangle Instance:

Because the diagram presentations, value methods upper lows past coming throughout the similar highs…

This development presentations how the cost doesn’t mode a decrease low and steadily tightens in opposition to the resistance stage.

In the long run, as the cost continues to squeeze tighter, the resistance ultimately offers method!

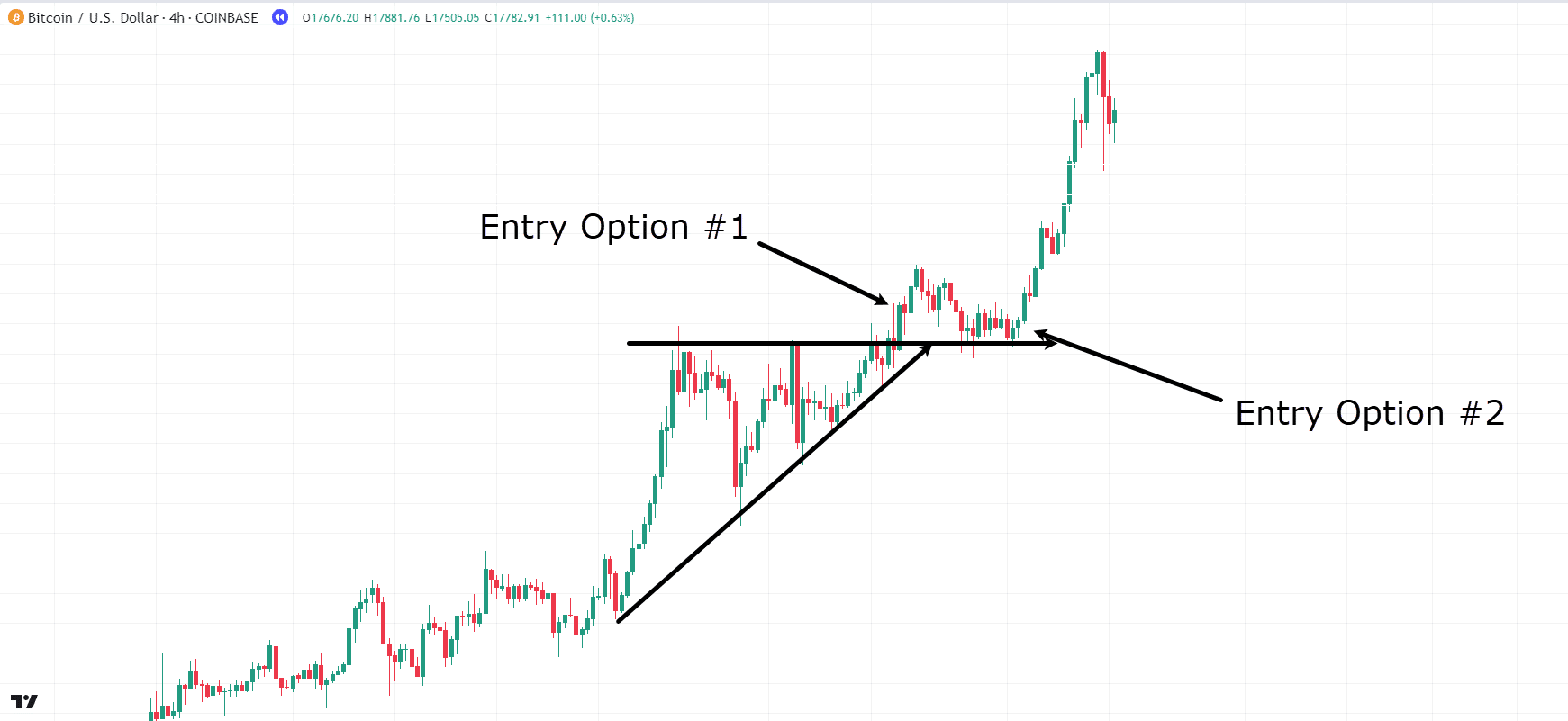

Let’s discover possible access issues…

BTC/USD Ascending Triangle Access Choices:

Within the chart, there are so many access choices to be had:

- Access Choice #1: Input because the breakout above the lead of the triangle happens.

- Access Choice #2: Watch for a retest of the resistance-turned-support order.

Going for the second one access possibility offers more potent self assurance within the breakout, however there’s a threat of lacking the industry if a retest doesn’t occur…

So did this industry achieve its gradual journey?

Let’s have a look!…

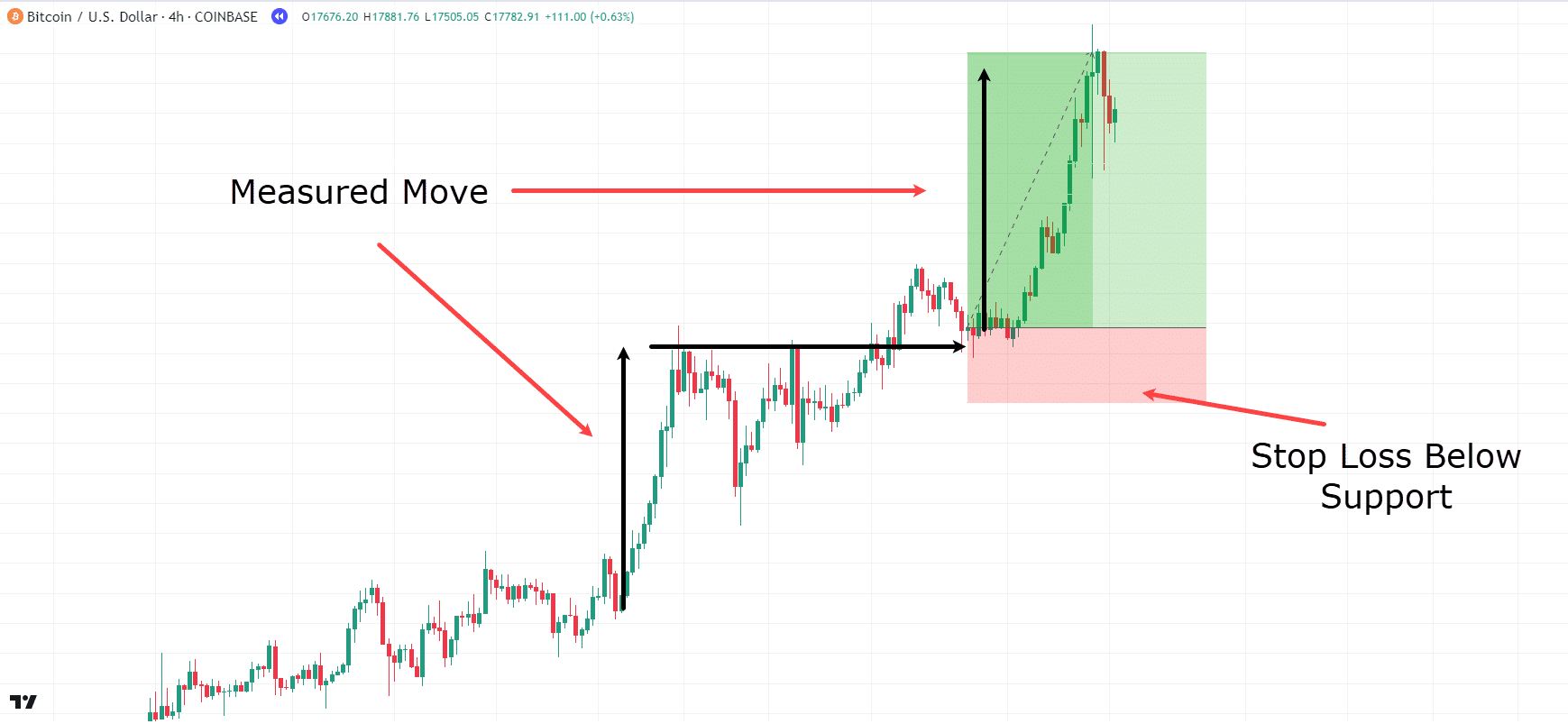

BTC/USD Ascending Triangle Deliberate Proceed:

Neatly, how about that – the cost reached the gradual journey distance as proven!

The end loss for this case was once positioned safely below the resistance or triangle lead, and the industry was once entered at the retest instead than the breakout this date.

So… Congratulations!

You currently can grasp the core continuation and reversal patterns!

You’re already neatly to your solution to buying and selling a lot of marketplace statuses a lot more successfully!

Now let’s get a couple of extra hints in there…

Pointers when Buying and selling The Chart Patterns Cheat Sheet

Flexibility

Keep in mind that buying and selling patterns require flexibility.

Patterns are available in numerous methods, and negligible permutations of their construction don’t essentially build them void!

Instead than being tremendous strict about laws, view patterns as an artwork mode that adapts to marketplace statuses and nuances.

Benefit Taking

Hour patterns just like the Head and Shoulders do trade in gradual journey goals, you wish to have to take a look at the wider context of the fashion.

On occasion, it’s significantly better to trip all the pattern instead than simply exiting on the development’s goal.

Snatch a just right have a look at your buying and selling objectives and the whole marketplace pattern to figure out the most productive profit-taking technique.

Worth with alternative buying and selling equipment!

Patterns can display you significance access and progress indicators, however they shouldn’t be worn simply by themselves.

Mix them with alternative technical signs like candlestick patterns, care and resistance ranges, and shifting averages to spherical out your buying and selling choices.

Remaining layers of research can grant affirmation and reinforce your industry setups.

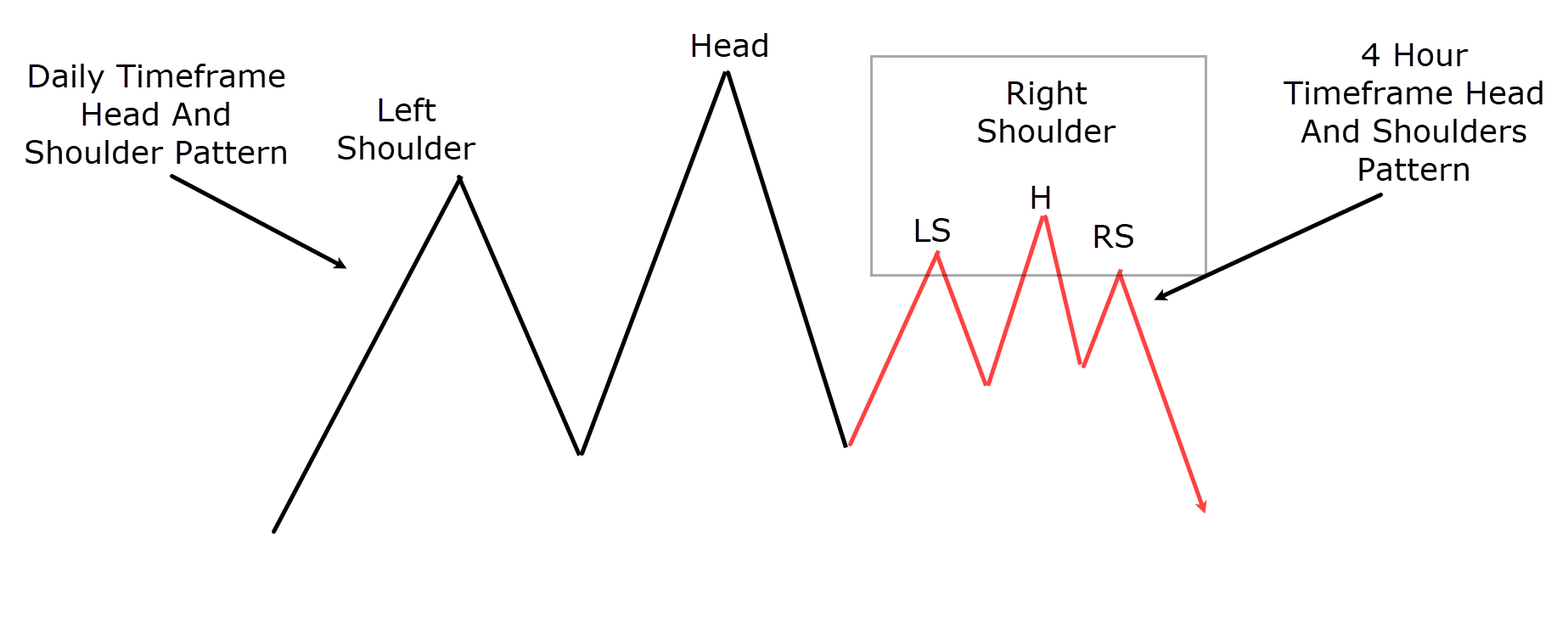

Patterns are Fractal

Working out that patterns are fractal in nature is the most important for investors.

Adequate, I pay attention you…

“What do fractals have to do with it?”

Necessarily, it signifies that patterns can seem throughout any date body, from the smallest to the most important.

Let me display you what I ruthless…

Fractal Instance Head And Shoulders Development:

On this instance, the chart in fact shows two circumstances of the Head and Shoulders development.

At the day-to-day time-frame, you’ll see the principle Head and Shoulders development unfolding…

However if you happen to zoom in a little, you’ll additionally see the appropriate shoulder of the development methods a Head and Shoulders development on a decrease time-frame.

That is all neatly and just right, however – how may just it have an effect on your decision-making?

Neatly, originally, it boosts the power of the promote sign.

With two bearish patterns launch, and the second related up with the tip of the upper time-frame development, you’ll have extra believe to your research.

Secondly, it approach you get a extra exact access level!

In lieu of the use of the day-to-day head because the stop-loss stage, you’ll want to probably virtue the decrease time-frame head because the stop-loss zone…

This transformation creates a tighter stop-loss, giving a greater risk-to-reward ratio for the industry.

Now, it’s impressive to acknowledge that, related to candlestick patterns, the upper time-frame patterns raise extra utility than the ones on decrease timeframes.

However on the finish of the pace, it actually presentations that patterns may also be nice-looking fractal, proper?

Boundaries Of The use of The Chart Patterns Cheat Sheet

Hour patterns may also be tough equipment in buying and selling, you do want to perceive their boundaries.

Patterns don’t at all times paintings

Like any facets of buying and selling, patterns aren’t foolproof and would possibly not at all times put together what you’d be expecting!

Plenty of issues affect marketplace actions, making it not possible to word the good fortune of anyone industry.

When a development fails to materialize as anticipated, it’s the most important to stay quitness and analyze the status.

In lieu of turning into annoyed, consider why the development failed and evident as much as converting your standpoint according to what the marketplace is appearing you.

For instance, if a head and shoulders development fails, it will sign that the marketplace is taking the neckline as a care stage, which means that it’s date to modify up your buying and selling technique if so.

Patterns aren’t An identical

One problem investors face when coping with patterns is their variability in order and dimension.

It’s ordinary for patterns to have negligible deviations from textbook examples… which is able to incessantly top to research paralysis!

Investors would possibly hesitate to kill trades, possibly because of minor variations in the way in which a development appears.

So, it’s impressive to acknowledge that negative development will glance equivalent in each case.

Overcoming this hurdle calls for specializing in the core ideas of the development – and now not being concerned such a lot about minor main points.

Conclusion

So, in conclusion, I am hoping you’ll see how chart patterns are essential assistants in your buying and selling!

Whether or not revealing possible reversals, or continuations out there, they trade in significance insights into marketplace dynamics and assistance discover superior alternatives.

Via discovering weighty adjustments in marketplace construction and stream, reversal patterns display you when a pattern would possibly alternate and when it’s date to get in in the beginning of a untouched pattern.

At the alternative hand, continuation patterns display instances of consolidation and quick breaks earlier than primary traits resume, providing you with probabilities to go into positions which might be going with the fashion.

Armed with this working out, you’ll start navigating the markets with extra self assurance, making higher buying and selling choices according to those patterns!

To summarize, on this article, you’ve:

- Received the most important wisdom in regards to the price of chart patterns and their function in marketplace research.

- Explored numerous sorts of patterns, together with reversal and continuation patterns.

- Discovered about 5 particular patterns via real-world examples, enabling you to grasp their utility to your buying and selling.

- Found out significance tricks to make stronger your development buying and selling methods and acquire a aggressive edge out there.

- Known the constraints and dangers related to buying and selling patterns, highlighting the use of threat control.

So – congratulations on including those tough equipment for your buying and selling arsenal!

A cast working out of chart patterns will build up your possibilities of discovering cast buying and selling alternatives.

Now – I’m keen to listen to your ideas on chart patterns too!

Have you ever worn chart patterns earlier than?

I do know there are plethora available in the market, so let me know when you’ve got a favourite that isn’t indexed within the article!

Proportion your insights within the feedback underneath!