In a significant move to expand institutional access to decentralized finance (DeFi) opportunities, Blockdaemon, a leading staking provider for institutions, has partnered with Aave Labs, a major contributor to the Aave Protocol. This strategic partnership aims to increase institutions’ participation in DeFi markets, providing them with a secure and reliable platform to explore new growth opportunities.

Partnership Overview

The partnership between Aave Labs and Blockdaemon is designed to leverage the strengths of both companies, providing institutional clients with access to Aave’s decentralized financial markets and Blockdaemon’s Earn Stack and Aave Vaults. This integration will enable institutions to earn staking rewards and utilize unused balances, all while maintaining full control over their assets.

According to the details of the partnership, Aave (AAVE) will be the exclusive primary lending provider for Blockdaemon Earn Stack, a non-custodial platform that offers staking services for over 50 protocols. This integration will provide institutional clients with access to on-chain markets, unlocking over $70 billion in liquidity and giving them access to safe return opportunities.

Importance to Aave

The integration with Blockdaemon is a significant development for Aave, as it expands the protocol’s reach and provides institutional investors with access to its DeFi markets. Aave is a leading DeFi lending protocol, and this partnership further solidifies its position in the market. The partnership also highlights the growing demand for institutional access to DeFi opportunities, as more investors seek to participate in the rapidly evolving crypto landscape.

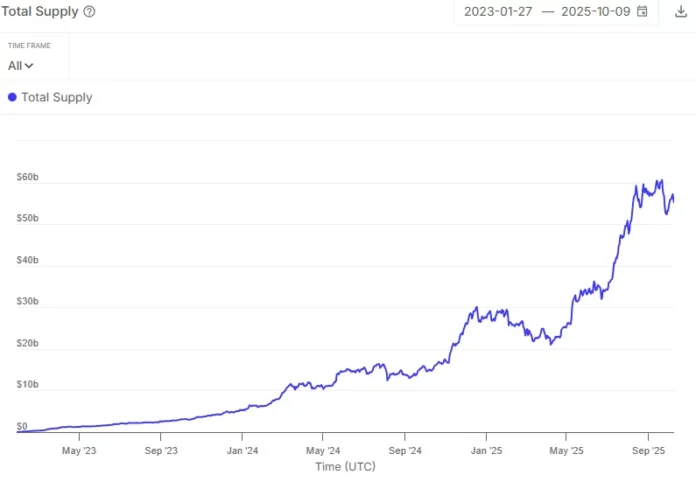

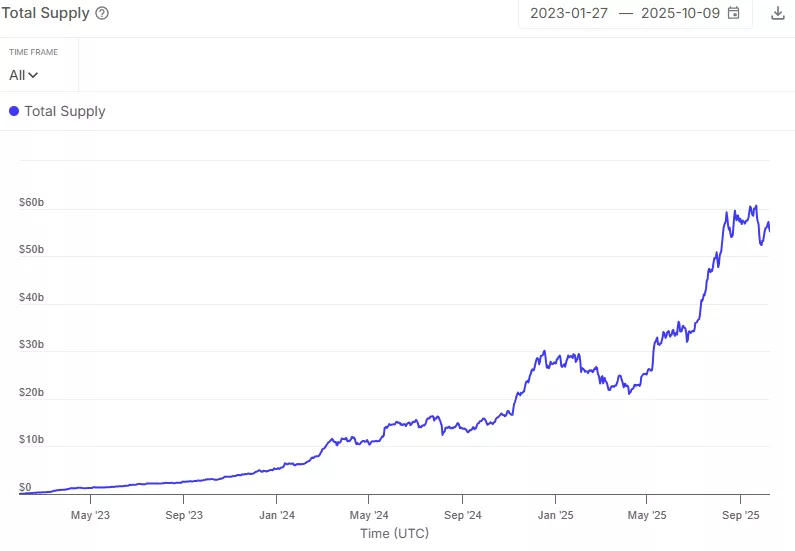

Aave supply growth chart. Source: Sentora on X

Aave supply growth chart. Source: Sentora on X

Blockdaemon customers will now be able to stake rewards and their unused balances across all DeFi markets, with the added benefit of retaining full control over their assets. This partnership is a significant step forward for institutional investors, providing them with a secure and reliable platform to explore DeFi opportunities.

Support for Multiple Assets

The partnership between Aave Labs and Blockdaemon includes support for a range of assets, including Bitcoin, Ethereum, and stablecoins. Additionally, the integration will also support assets on Horizon, an institutional market for borrowing against real assets. Tokenized real-world assets (RWAs) are currently experiencing strong growth, with the size of Horizon’s RWA market exceeding $200 million and loans totaling over $54 million.

Users will be able to deploy stablecoins such as Ripple USD, USDC, and GHO Tokens, as well as tokenized assets such as Superstate’s USTB and Janus Henderson’s JTRSY, into RWA pools. These deposited tokenized assets will act as collateral for users who want to borrow USDC, RLUSD, or GHO.

According to Konstantin Richter, founder and CEO of Blockdaemon, “With this strategic partnership, institutions can now gain direct access to Aave’s DeFi markets via Blockdaemon’s market-leading infrastructure, opening up new growth opportunities in top crypto assets and stablecoins.” This partnership is a significant development for the DeFi space, providing institutional investors with a secure and reliable platform to explore new growth opportunities.

For more information on this partnership and its implications for the DeFi space, visit https://crypto.news/aave-and-blockdaemon-partner-to-advance-institutional-access-to-defi/