Concerns Over AI Bubble Bursting in 2026 and Its Potential Impact on Bitcoin Price

As the world becomes increasingly enamored with the potential of artificial intelligence (AI), concerns are growing that global stock markets could be drifting into another bubble, fueled by unrelenting optimism around AI. If this bubble bursts in 2026, Bitcoin (BTC) and the broader crypto market could be among the first to feel the consequences. The risk of an AI bubble could first impact cryptocurrencies as congested, debt-fueled stock markets ease. Bitcoin could fall to $60,000-$75,000, but institutional support could help limit losses compared to previous crashes.

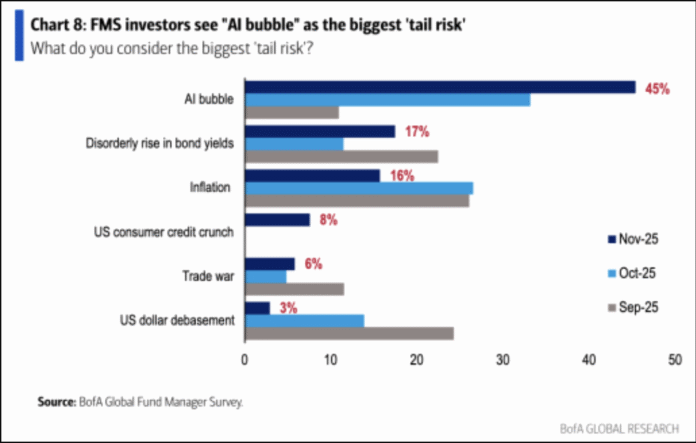

According to a survey by Bank of America, 45% of fund managers identified an “AI bubble” as the market’s biggest tail risk in November, up from just 11% in September.  This growing concern is fueled by huge spending and low returns on capital in the AI sector, with companies like Meta Platforms, Amazon, Microsoft, Alphabet, and Oracle increasing their spending on AI infrastructure in 2025.

This growing concern is fueled by huge spending and low returns on capital in the AI sector, with companies like Meta Platforms, Amazon, Microsoft, Alphabet, and Oracle increasing their spending on AI infrastructure in 2025.  Combined capital expenditure (capex) is expected to rise sharply, with a 64% year-on-year increase to over $500 billion by 2026.

Combined capital expenditure (capex) is expected to rise sharply, with a 64% year-on-year increase to over $500 billion by 2026.

An AI Bubble Can Trigger a Severe Collapse in Stocks

Alexander Joshi, head of behavioral finance at Barclays UK, warned that AI data centers are estimated to be among the largest infrastructure expansions in modern history. He stated, “AI data centers now drive a significant portion of U.S. GDP growth. While this dependence is not inherently bad, it is risky if AI momentum slows. If expectations collapse, the setback could be severe.” Financial analyst HedgieMarkets also warned that the AI boom risks a far harsher crash than the bursting of the dot-com bubble in the 2000s, arguing that the sector has spent about $400 billion to generate just $60 billion in revenue in 2025, with most companies failing to see a return.

Economic historian Carlota Perez warned that a collapse in AI and cryptocurrency could lead to a global economic collapse of “unimaginable proportions.” The AI expansion is debt-driven, increasing the risk of cascading failures among private equity, banks, insurance companies, and already-stressed consumers as growth expectations collapse.  The positive correlation between US stocks and Bitcoin price could also lead to a spill-over effect in crypto markets in 2026.

The positive correlation between US stocks and Bitcoin price could also lead to a spill-over effect in crypto markets in 2026.

Potential Impact on Bitcoin Price

Tether CEO Paolo Ardoino warned that a correction in the AI sector could spill over into crypto markets in 2026, calling it the “biggest risk to Bitcoin” of the year. He added that BTC’s correction will not be as severe as it was during the 2022 (-77%) and 2018 (-84%) bear markets due to its increasing institutional exposure. Analyst Nomad Bullstreet said Bitcoin price may not fall below its average production cost per coin in the range of $71,000 to $75,000.  A report from Fundstrat Global Advisors and Fidelity expects Bitcoin price to reach $60,000 to $65,000 in 2026.

A report from Fundstrat Global Advisors and Fidelity expects Bitcoin price to reach $60,000 to $65,000 in 2026.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/ai-bubble-risks-in-2026-whats-potential-impact-on-bitcoin-price?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound