Crypto Market Enters Stabilization Phase, Altcoins Await Bitcoin’s Lead

According to Jasper De Maere, OTC desk strategist at Wintermute, the crypto market has entered a stabilization phase, characterized by a cautious mood and a lack of optimism. This means that a broader altcoin rally is unlikely to occur unless Bitcoin (BTC) rises first. De Maere’s analysis suggests that Bitcoin’s resilience, currently trading in the $105,000 to $107,000 range, is a positive sign, but the cryptocurrency still needs to reach new all-time highs (ATH) for altcoins to recover.

Bitcoin is currently trading about 16% below its record levels, indicating that the ongoing consolidation could lead to a new rally. De Maere wrote in Wintermute’s weekly report, published on November 10, “This looks less like stagnation and more like a turning point. The structure is cleaner, the macroeconomics are supportive, and the market feels ready to rebuild.” This assessment implies that the crypto market is poised for a potential uptrend, but it is waiting for Bitcoin to gain momentum.

Altcoins’ Inconsistent Performance

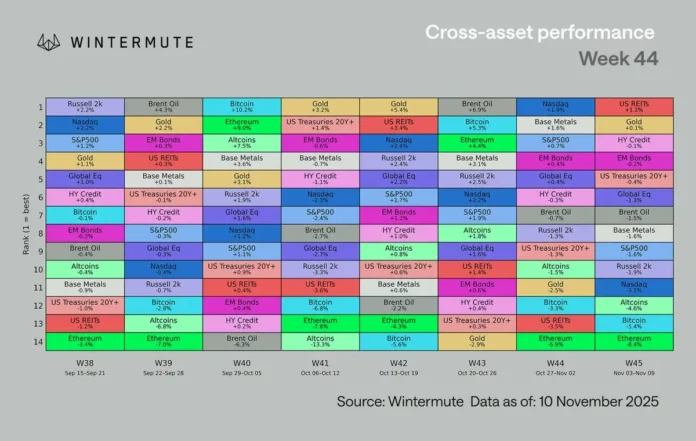

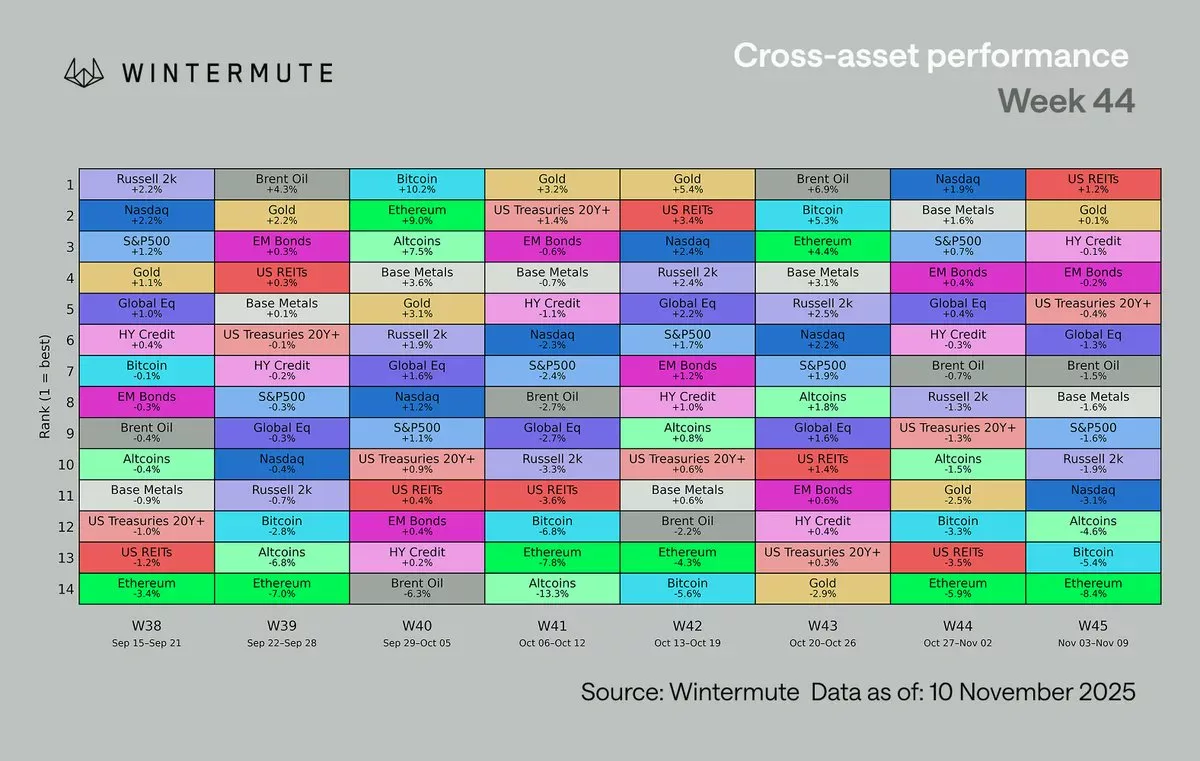

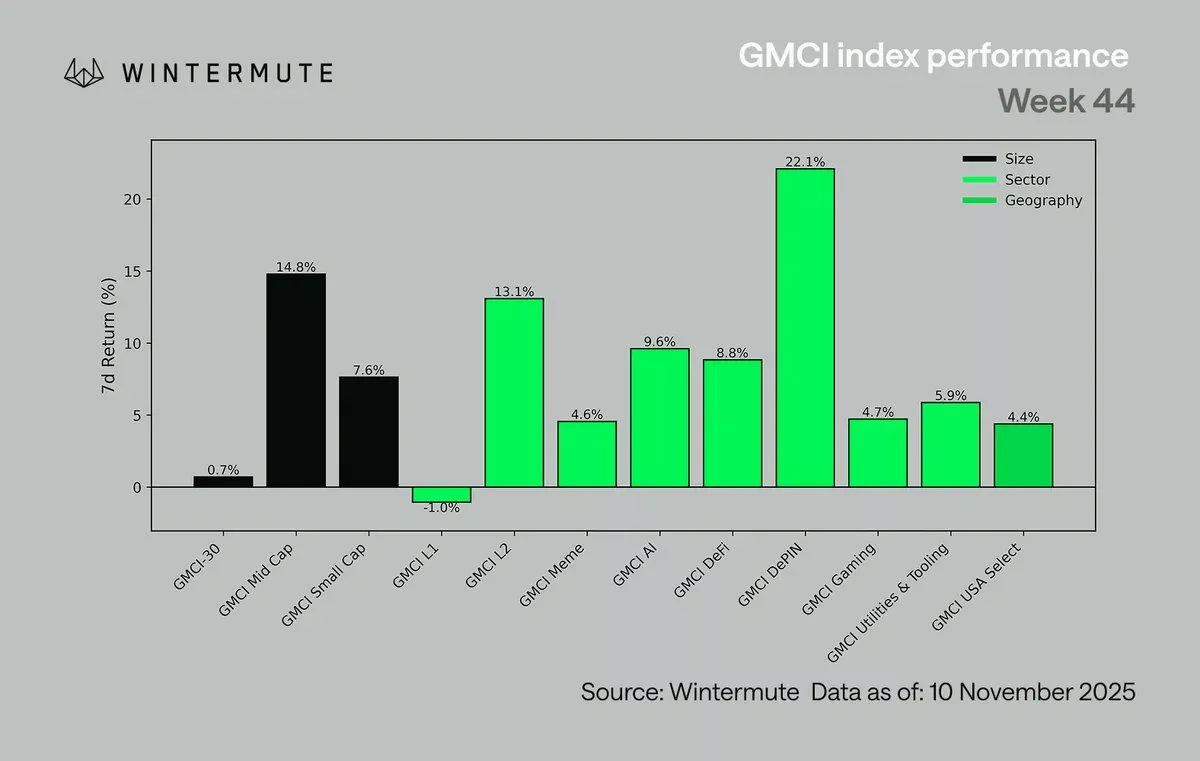

Despite the positive change in the macroeconomic environment, cryptocurrencies have underperformed other major asset classes. Just four weeks ago, Bitcoin was the best-performing asset, up 10.2%, followed by Ethereum (ETH) and altcoins. However, last week, the three asset classes were the worst performers. The performance of altcoins has been inconsistent, with large-cap tokens rising just 0.7% in the week ending November 2nd, while mid-cap tokens were the best performers with a gain of 14.8%.

By sector, DePIN saw the biggest gains, while Layer 1 networks saw the worst. Gaming and memecoins also lagged behind other segments of the crypto industry. The inconsistent performance of altcoins suggests that they are waiting for Bitcoin’s lead before making a significant move. As De Maere noted, a new altcoin rally is unlikely unless Bitcoin rises to new all-time highs.

Weekly Performance of Crypto and Traditional Assets | Source: Wintermute

Weekly Performance of Crypto and Traditional Assets | Source: Wintermute

The weekly performance of multiple crypto asset classes, by size, sector, and geography, also highlights the inconsistent nature of the altcoin market.  Weekly performance of multiple crypto asset classes, by size, sector and geography | Source: Wintermute

Weekly performance of multiple crypto asset classes, by size, sector and geography | Source: Wintermute

Conclusion

In conclusion, the crypto market has entered a stabilization phase, and altcoins are poised for an uptrend once Bitcoin gains momentum. However, for this to happen, Bitcoin needs to reach new all-time highs, which would likely trigger a broader altcoin rally. As De Maere noted, the structure is cleaner, the macroeconomics are supportive, and the market feels ready to rebuild. For more information, visit https://crypto.news/altcoin-season-unlikely-bitcoins-new-ath-wintermute/