The cryptocurrency market is experiencing a significant shift, with altcoins emerging as the primary beneficiaries of potential Federal Reserve rate cuts, while Bitcoin’s dominance is waning. According to a recent report by Binance Research, the market is witnessing a rotation into altcoins, driven by expectations of a change in the Fed’s policy.

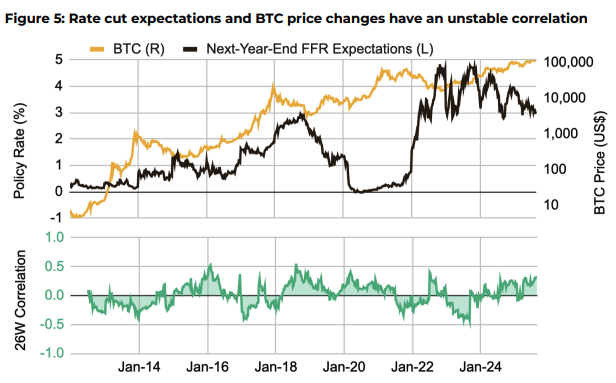

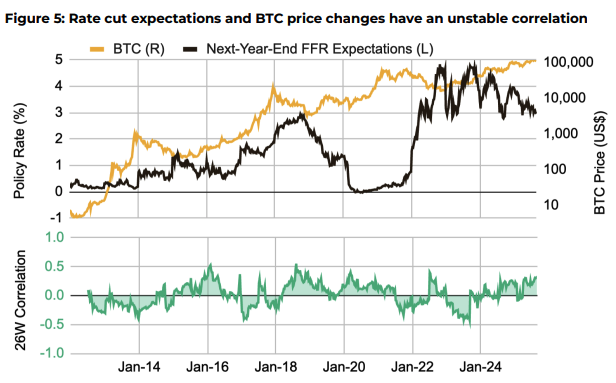

A closer examination of the market trends reveals that Bitcoin’s dominance has fallen to 57.3%, while Ethereum’s dominance has risen to 14.2%. This change in market dynamics is likely caused by the anticipation of September rate cuts by the Federal Reserve. The report highlights that the correlation between Bitcoin’s price and Fed interest-rate expectations is low and highly volatile, contradicting the common perception that rate cuts are a bullish sign for Bitcoin.

BTC price and rate cut expectations historical correlation | Source: Binance Research

BTC price and rate cut expectations historical correlation | Source: Binance Research

The relationship between BTC price and interest rates is more complex, with the driver for Bitcoin’s price being how these expectations change. The market will react to whether the Fed’s decision differs from what is already priced in. This complexity is reflected in the historical data, which does not support the view that rate cuts are a bullish sign for Bitcoin.

Altcoins Outperform Bitcoin

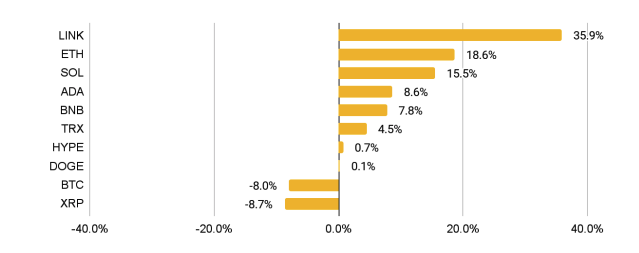

The relative price performance between Bitcoin and altcoins in August further illustrates this trend. Out of the top ten altcoins, only one underperformed Bitcoin, which declined 8% in that period. In contrast, Ethereum (ETH) rose 18.6%, driven by accumulation from both institutions and retail. The main contributing factors to Ethereum’s performance were ETF inflows and corporate treasury accumulations.

Monthly price performance for the top 10 crypto assets by market cap for August | Source: Binance Research

Monthly price performance for the top 10 crypto assets by market cap for August | Source: Binance Research

Solana (SOL) also experienced a significant increase, rising 15.5% due to a mix of institutional interest and technical updates. The momentum in SOL corporate treasuries and the Alpenglow upgrade boosted overall market sentiment, contributing to its strong performance. These developments suggest that altcoins are gaining traction, while Bitcoin’s dominance is fading.

Market Implications

The shift in market dynamics has significant implications for investors and market participants. As the Fed’s policy change approaches, the market is likely to react to whether the decision differs from what is already priced in. The low correlation between Bitcoin’s price and Fed interest-rate expectations highlights the complexity of the relationship between the two. As the cryptocurrency market continues to evolve, it is essential to consider the potential impact of macroeconomic changes on the performance of altcoins and Bitcoin.

For more information on the current state of the cryptocurrency market and the potential impact of the Fed’s policy change, visit the original source: https://crypto.news/altcoins-gain-as-bitcoin-dominance-falls-to-57-fed-narrative-fading/