Arizona State Senator Proposes Bills to Change Digital Asset Taxation Laws

Arizona State Senator Wendy Rogers has introduced two bills and a resolution aimed at modifying the state’s laws regarding the taxation of digital assets. The proposed legislation, filed with the Arizona Senate on Friday, seeks to exempt virtual currencies from taxation, prevent counties and cities from taxing or fining companies operating blockchain nodes, and clarify the definition of property taxes in the state constitution to govern digital assets.

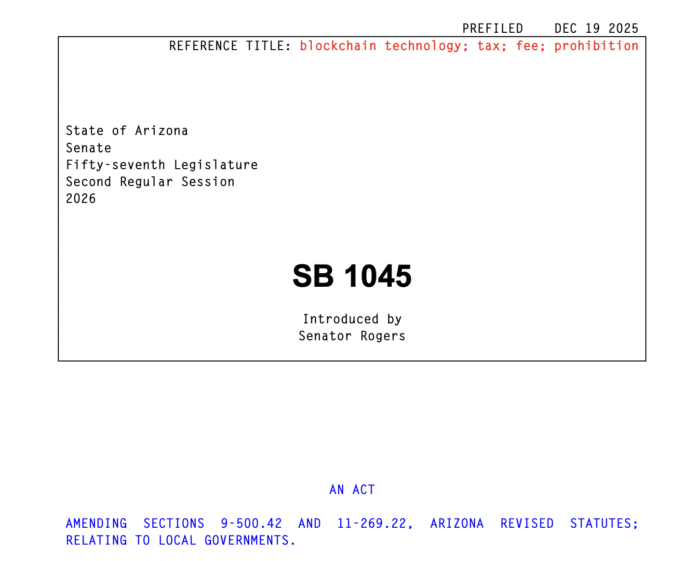

The bills, SB 1044 and SB 1045, and the resolution, SCR 1003, are designed to provide a more favorable environment for digital asset holders and blockchain operators in Arizona. SB 1044 proposes to exempt virtual currencies from taxation, while SB 1045 would prohibit cities and counties from levying taxes or fees on individuals operating blockchain nodes. SCR 1003 aims to amend the Arizona Constitution to specifically exempt virtual currencies from property taxes.

Bill Prohibiting Cities and Towns from Taxing Blockchain Node Activity: Source: Arizona Legislature

Bill Prohibiting Cities and Towns from Taxing Blockchain Node Activity: Source: Arizona Legislature

Arizona is one of the few US states with a law allowing the government to claim ownership of abandoned digital assets. The state has also seen efforts to establish a digital asset reserve, with Rogers co-sponsoring a Bitcoin reserve bill that was vetoed by Governor Katie Hobbs in May. Rogers has expressed her intention to refile the bill in the next session.

US States Adopting Crypto Reserve Laws and Different Policies for Digital Assets

Arizona is not alone in its efforts to establish a digital asset reserve, with New Hampshire and Texas also having similar laws in place. Other states, such as Ohio, have proposed bills to exempt crypto transactions under $200 from capital gains tax. In contrast, New York has proposed a 0.2% excise tax on digital asset transactions, including sales or transfers of digital assets, for state residents.

At the federal level, Senator Cynthia Lummis introduced a bill in July proposing a de minimis exemption for digital asset transactions and capital gains of $300 or less. Lummis has announced her retirement from the US Senate, effective January 2027. As the regulatory landscape for digital assets continues to evolve, it is essential for policymakers to consider the implications of their decisions on the growth and development of the industry.

Conclusion

The proposed bills and resolution in Arizona demonstrate the state’s efforts to create a more favorable environment for digital asset holders and blockchain operators. As the US continues to navigate the complexities of digital asset regulation, it is crucial for policymakers to prioritize clarity, consistency, and fairness in their decision-making. For more information on the Arizona bills and the evolving landscape of digital asset regulation, visit https://cointelegraph.com/news/arizona-bill-crypto-blockchain-taxes-ban?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound