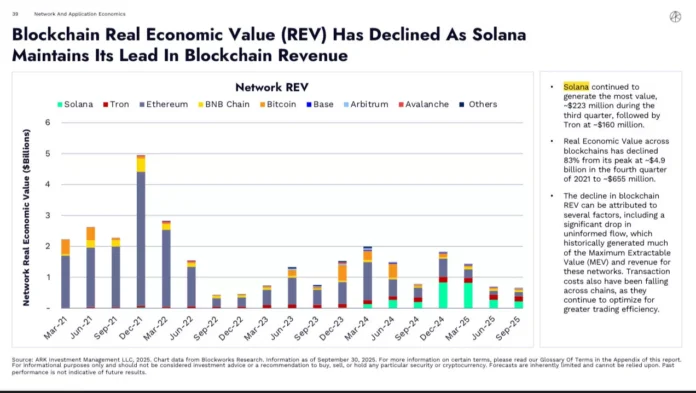

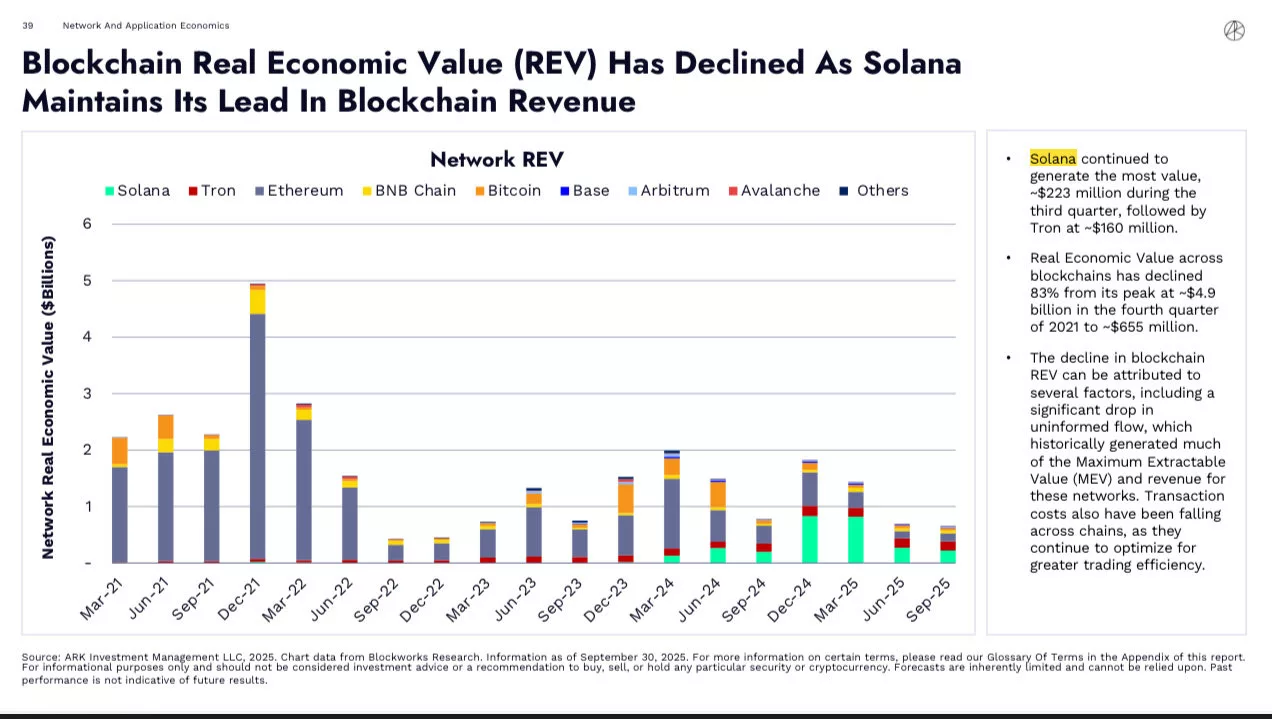

The latest quarterly report from ARK Invest has revealed that Solana is leading the pack in terms of blockchain revenue, generating an impressive $223 million in the third quarter of 2025. This figure surpasses that of other prominent networks, with Tron coming in second at $160 million.

Blockchain Revenue Trends

According to the report, Solana’s revenue is a notable highlight in an otherwise challenging period for the blockchain industry. The total real economic value (REV) of all on-chain networks has declined by 83% since its peak of $4.9 billion in the fourth quarter of 2021, reaching $655 million in the third quarter of 2025. ARK Invest attributes this decline to lower uninformed capital flows and falling transaction costs across multiple chains.

The report also provides insight into the performance of various blockchain networks. Solana’s $223 million in revenue is a significant achievement, followed by Tron’s $160 million. The data suggests that Solana’s ecosystem is showing resilience and growth, outperforming other networks in terms of revenue generation.

ARK Invest’s report highlights the importance of understanding the factors that contribute to the decline in REV. The reduction in uninformed data flow and decreasing transaction costs are cited as key reasons for this trend. As the blockchain industry continues to evolve, it is essential to monitor these changes and their impact on the overall ecosystem.

ARK Invest’s Investment in Solana

ARK Invest has demonstrated its confidence in Solana through significant investments in Solana-related ventures. In September 2025, the company purchased approximately $162 million worth of shares in Solmate, also known as BREA. This move follows its participation in the company’s $300 million funding round, resulting in ARK Invest holding around 6.5 million BREA shares.

Furthermore, ARK Invest has expanded its involvement in the Solana ecosystem by moving its validation activities for the Digital Asset Revolutions Fund to SOL Strategies, a Toronto-based company specializing in Solana. This strategic decision underscores ARK Invest’s commitment to the Solana network and its potential for growth.

In addition to these investments, ARK Invest made its first direct Solana investment in April 2025 through the SOLQ ETF, a Canada-based SOL stake ETF. This move marked a significant milestone, as ARKW and ARKF became the first US-listed ETFs to add Solana to their portfolios.

Conclusion and Future Outlook

The report from ARK Invest offers valuable insights into the current state of the blockchain industry, with Solana emerging as a leader in revenue generation. As the industry continues to navigate challenges and opportunities, it is essential to stay informed about the latest trends and developments. For more information on this topic and to stay up-to-date on the latest news, visit https://crypto.news/ark-invest-reports-solana-revenue-hits-223m-in-q3-2025/.