Arthur Hayes’ Aggressive ENA Accumulation Sparks Interest in Hyperliquid Stablecoin Vote

The former CEO of Bitmex, Arthur Hayes, has been on a buying spree, accumulating nearly $1 million worth of ENA tokens in the past 48 hours. This move has sparked interest in the upcoming Hyperliquid stablecoin vote, scheduled to take place on September 14. Hayes’ timing coincides with the competitive offer from Ethena to grant Hyperliquid’s native stablecoin using USDTB collateralization by BlackRock’s BuIDL fund.

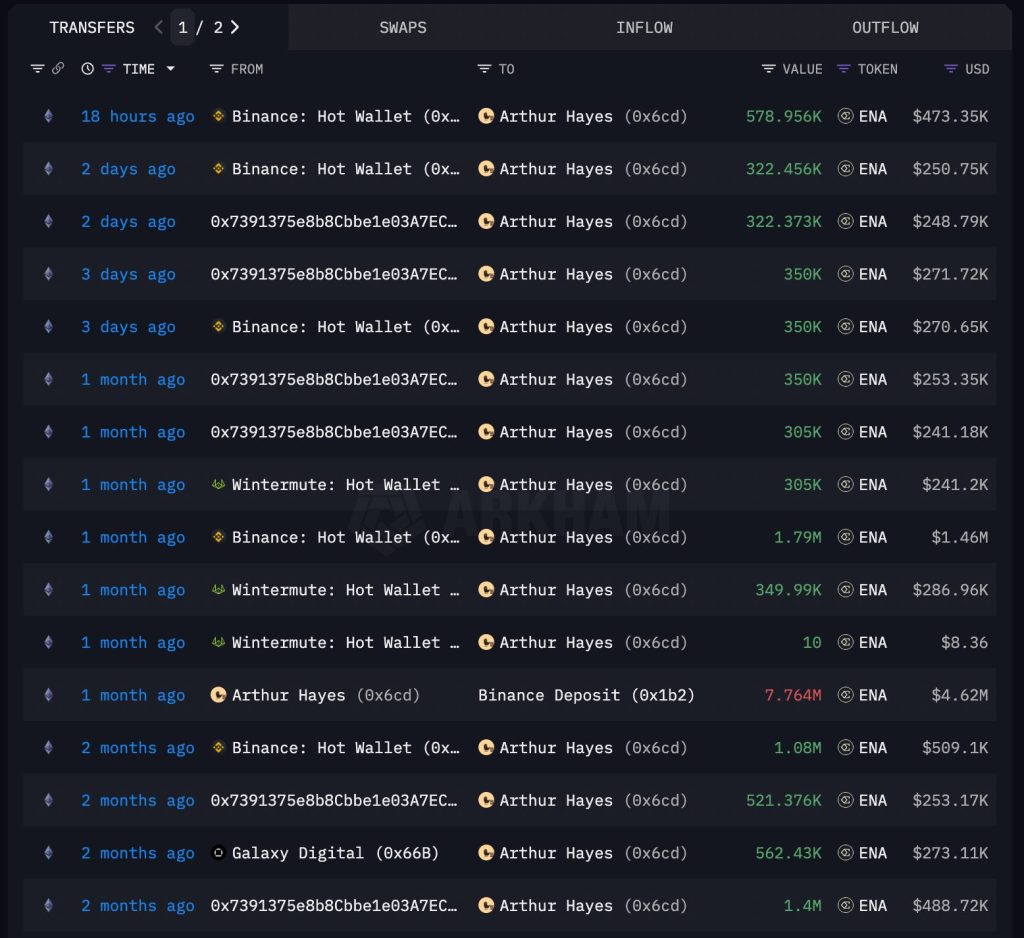

According to Arkham Intelligence data, Hayes’ purchases follow a systematic accumulation pattern, with several buys from Binance, Wintermute, and Galaxy Digital in recent months. His analysis focuses on the trade strategy of Ethena and Cash and Carry’s trading strategy, which generates returns over financial prices through crypto derivatives. Hayes projects that Ethena could capture a market share of 25% as the stablecoin infrastructure absorbs trillions of global deposits.

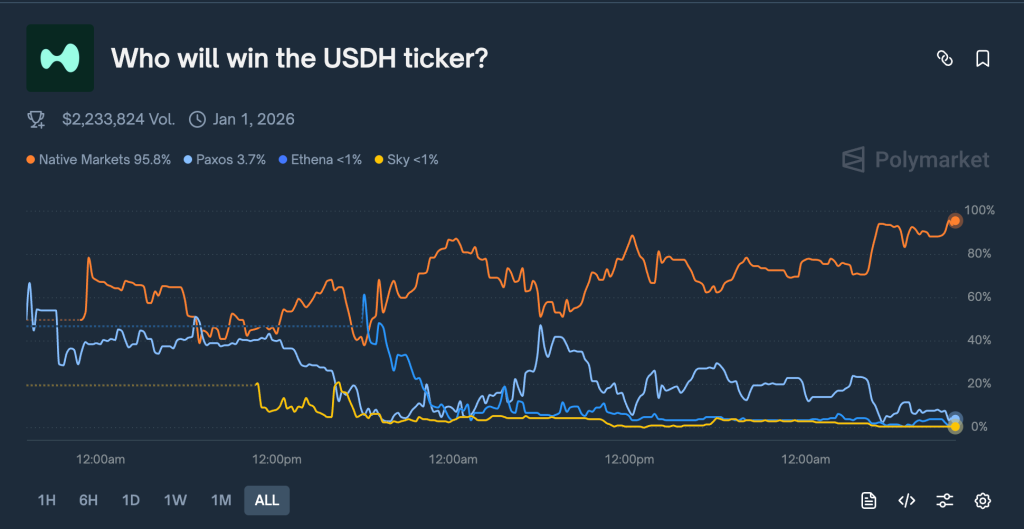

Hayes’ personal positioning through ENA accumulation matches his institutional investment strategy by the Maelstrom Fund, which has invested in Ethena. The timing indicates trust in the outcome of Ethena’s USDH proposal, although the market positioning of domestic markets dominates.

Competitive USDH Race Intensifies Before Validator Decision

Paxos revised its proposal on Tuesday, announcing a large PayPal integration, including USDH support in the purchase infrastructure, compatibility with Venmo, and the Hype token list. The partnership comprises $20 million in incentives for ecosystems and zero-cost one/off-ramps via PayPal’s payment rails. Similarly, the entry from Sky Protocol promised 4.85% returns and $25 million for the development of ecosystems through its $8 billion infrastructure, which manages USD and DAI stable coins.

The proposal for Stripe Partnership offers an ingenious act-compliant structure with BlackRock off-chain and superstate on-chain reserve management. Frax Finance provided Frxusd by the Blackrock Buidl Fund, while the Agora coalition promised full net turnover participation and claimed neutrality advantages. Overall, each proposal aims at various aspects of the StableCoin infrastructure, from compliance with regulation to earnings optimization.

Hayes’ 126x Hype Prediction Drives Strategic Positioning

Hayes published his bravest crypto forecast in August, saying that Hyperliquid’s hype token could increase by 126x by 2028, while the guidelines of Finance Minister Scott Bessent create the greatest DeFi bull market in history. The analysis assumes that Hyperliquid becomes a dominant crypto trader and processes daily volumes comparable to the current $73 billion from Binance.

For ENA, Hayes models Ethena achieving $2.5 trillion on USD offer, which will pay speculators about the financial sets to lend dollars for crypto leverage. The 20% fee structure of the protocol for interest income creates sustainable sources of income and delivers higher income than conventional banking alternatives.

Hyperliquid validators will begin voting on September 14, maintaining the neutrality of the foundation throughout the selection process. The result will determine the backbone of USDH, serving in the infrastructure for the monthly sales of $106 million and the trading volume of $383 billion. For more information, visit https://cryptonews.com/news/arthur-hayes-buys-nearly-1m-ena-ahead-of-hyperliquid-usdh-stablecoin-vote-what-does-he-know/