According to Arthur Hayes, co-founder of Bitmex, investors in Bitcoin need to be more patient and stop worrying about the performance of stocks and gold, which have recently hit record highs. The question of why Bitcoin’s price is not higher misses the point, Hayes argued in a recent interview. Hayes emphasized that investors should not expect overnight success, stating, “If you thought you had bought Bitcoin and bought a Lamborghini the next day, you will probably be liquidated because it is not the right way to think about things.”

Hayes expressed frustration with newer investors who are wondering why Bitcoin’s price is not yet at $150,000. He pointed out that those who bought Bitcoin two, three, five, or 10 years ago are likely to be pleased with their investment. Curvo data shows that Bitcoin has achieved an average annualized return of 82.4% over the past ten years, demonstrating its long-term potential.

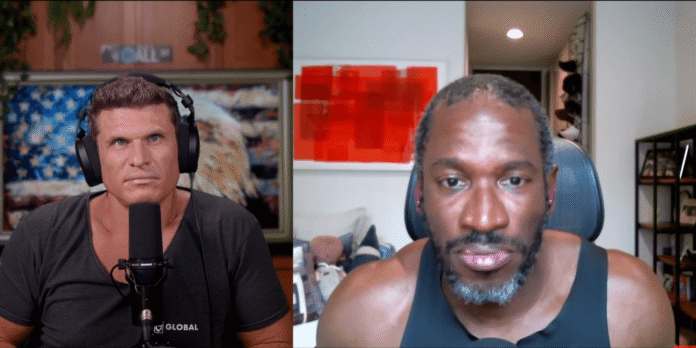

Kyle Chase (left) interviewed Arthur Hayes (right) for his YouTube channel. Source: Kyle Chase

Bitcoin’s Performance in Perspective

Hayes’ comments come as Bitcoin’s price continues to trade below its all-time high of $124,100, reached on August 14th. At the time of publication, Bitcoin’s price was $115,890, according to CoinmarketCap. In contrast, gold reached a new all-time high of $3,674, and the S&P 500 set a record high of 6,587 this week.

Bitcoin has dropped by 6.09% in the last 30 days. Source: Coinmarketcap

Hayes Dismisses Comparison to Traditional Markets

Hayes dismissed the idea that Bitcoin’s price should be compared to the performance of traditional markets, such as stocks and gold. He argued that Bitcoin is a unique asset with its own characteristics and should not be judged solely on its price. “I think the premise of this question is incorrect,” Hayes said. “Bitcoin is the best representation if you have ever thought about currency decoupling.”

Hayes pointed out that while the S&P 500 is still below its 2008 high in terms of gold price, Bitcoin’s performance has been exceptional. “The real estate market with gold again and not near where it was empty,” he added. Hayes also noted that big US tech companies are one of the few assets that have kept pace with gold, but even they pale in comparison to Bitcoin’s performance. “If you empty things after Bitcoin, you can’t even see it on the table. It’s just so ridiculous how well Bitcoin has done,” he said.

In April 2025, Hayes predicted that Bitcoin’s price would reach $250,000 by the end of the year. This prediction was echoed by Joe Burnett, research director of Unchained Market, a month later. As the cryptocurrency market continues to evolve, investors would do well to take a long-term view and consider the unique characteristics of Bitcoin.

For more information on Bitcoin and the cryptocurrency market, visit https://cointelegraph.com/news/bitcoin-price-relevance-stock-gold-markets-arthur-hayes?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound