Australia’s corporate regulator, the Australian Securities and Investments Commission (ASIC), has released updated guidance on digital assets, which has been welcomed by blockchain executives as a step towards clarity and regulatory certainty. However, concerns have been raised about the potential for “structural bottlenecks” in the implementation of these guidelines, particularly with regards to the speedy issuance of licenses. According to the updated Information Sheet 225, companies offering crypto services classified as financial products must become members of the Australian Financial Complaints Authority and apply for an Australian financial services license by June 30.

Defining Financial Products in the Digital Asset Space

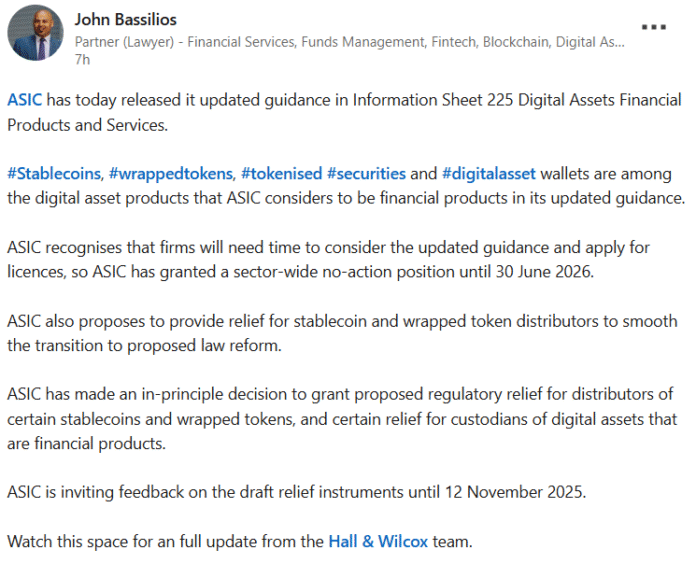

John Bassilios, a crypto lawyer and partner at Hall & Wilcox, notes that tokens such as Bitcoin (BTC), non-fungible gaming tokens, and tokenized concert tickets are unlikely to be considered financial products under the new guidance. “If you are an exchange and only trade Bitcoin, you do not need to apply for a license based on these guidelines,” he explained. This distinction is crucial for exchanges and service providers, as it determines the regulatory requirements they must adhere to.

Source: John Bassilios

In contrast, stablecoins, wrapped tokens, tokenized securities, and digital asset wallets are among the financial products considered by ASIC in its updated guidance. Bassilios further clarifies that this could also include high-yield stablecoins, tokenized real estate, tokenized bonds, and staking as a service, where there are restrictions such as a minimum staking balance or lock-up period. This comprehensive approach aims to provide a clear framework for the digital asset industry in Australia.

Implementation Challenges and Regulatory Relief

Steve Vallas, the CEO of consulting firm Blockchain APAC, observes that the updated guidelines set a demanding standard that requires significant coordination across policies, laws, and industries to implement. “ASIC has chosen to operationalize policy ahead of legislative reform. This approach brings certainty in the short term, but also highlights how much interpretation now does the work of legislation,” he said. Vallas also notes that the real test will now be in implementation, with “structural bottlenecks” likely to cause problems, including limited recognized local expertise, access to banking, and insurance capacity.

Source: Steve Vallas

Amy-Rose Goodey, CEO of advocacy group Digital Economy Council of Australia, welcomes the clarity provided by the updated guidelines, which the industry has been waiting for. “It gives us an indication and insight into ASIC’s position and how they will deal with the digital asset companies, which we have not been fully informed about up to this point,” she said. However, Goody also expresses concerns about ASIC’s resourcing and ability to process large numbers of licenses in a timely manner to ensure companies comply with regulations, highlighting the need for efficient implementation to support the growth of the digital asset sector in Australia.

Regulatory Framework and Industry Response

The Albanian government’s proposal of a new crypto framework in March, aiming to regulate exchanges within existing financial services laws, underscores the evolving regulatory landscape for digital assets. The Treasury’s conclusion of a consultation on a draft law that would extend financial sector laws to crypto service providers further indicates the efforts towards creating a comprehensive legal framework for the industry. As the digital asset space continues to evolve, the interplay between regulatory guidance, industry adaptation, and technological innovation will be crucial in shaping its future.

For more information on ASIC’s crypto guidance and its implications for the digital asset industry in Australia, visit the source link.