Avantis’ recent price action has been characterized by a slowdown in momentum after an impulsive rally, with the price declining several times after reaching the 0.618 Fibonacci extension level of $2.60. Despite this, a bullish pennant formation may be setting the stage for a continuation of the upward trend, with a potential target of $3.30.

Key Technical Points

At the weekend, Avantis (AVT) experienced a sharp rally, driving the price to the 0.618 Fibonacci extension level of $2.60. This region has acted as a strong resistance, with the price being rejected multiple times despite several attempts to break through. The repeated rejections suggest that the impulsive phase of the move has been completed, and the market is now entering a consolidation phase.

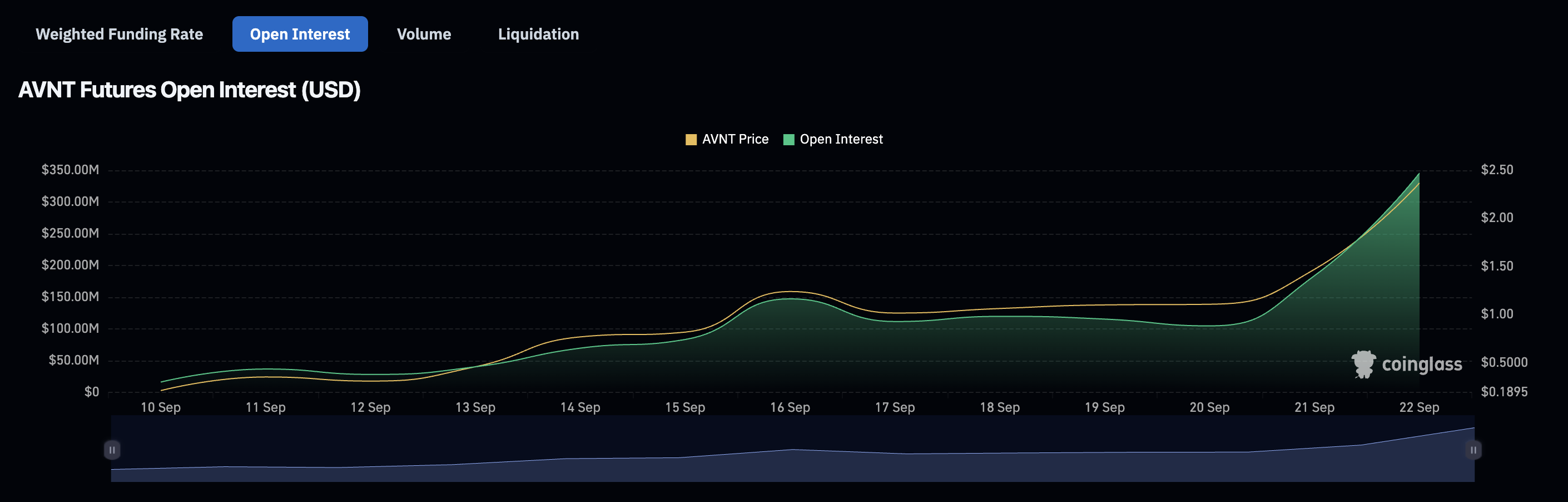

The price action is being influenced by the increasing demand for Avantis, reinforced by the growing market share of futures and the recent airdrop. The open interest in Avantis has also increased, confirming the demand and supporting the bullish bias. This is in line with the Elliot Wave 3 sequence, which suggests that the price is likely to continue its upward trend.

Pennant Formation and Breakout Target

After being rejected at $2.60, Avantis is now consolidating in a narrow area, forming a pennant shape. This setup is similar to a previous consolidation phase, where the price was raised to a apex before breaking out into a bullish expansion. The current pattern is a continuation structure that develops when higher lows and lower highs converge.

AVTUSDD (1H) -Dart, Source: Tradingview

AVTUSDD (1H) -Dart, Source: Tradingview

When the pennant breaks out to the upside, the target measured to $3.30 becomes visible, derived from the length of the previous rally that led to consolidation. This target is also in line with the potential completion of a larger Elliott wave 3, where the power correction can be interpreted as wave 2 withdrawal.

Open Interest and Derivative Data

Another bullish signal comes from derivative data, where open interest in Avantis has increased in tandem with the price. This indicates growing demand and increases the bullish bias, as traders are willing to commit at higher levels.

AVT Open Interets, Source: Coinglass.com

AVT Open Interets, Source: Coinglass.com

When open interest rates rise with the price, it often confirms that the dynamics are supported by real purchase interest rather than short-term speculation. Avantis’ price rose in tandem with spot and futures volume on September 20, strengthening this dynamic. This trend illuminates confidence in Avantis’ long-term growth path.

Upcoming Price Campaign

Avantis is currently consolidating below the $2.60 resistance, but technical data indicates that a break out is setting up for the sequel. A confirmed breakout from the pennant formation could accelerate the price to $3.30 and mark the completion of a strong wave 3 rally.

For more information on Avantis and the cryptocurrency market, please visit https://crypto.news/avantis-price-rebounds-as-open-interest-hints-at-higher-prices/