UK Central Bank Moves Towards Stablecoin Regulation

The Bank of England (BoE) has taken a significant step towards regulating stablecoins by publishing a consultation paper that proposes a regulatory framework for the asset class. This move aims to mitigate the risks associated with systemic stablecoins, which are widely used in payments and could potentially pose a threat to the UK’s financial stability.

The proposed framework specifically targets sterling-denominated “systemic stablecoins,” which are tokens that are widely used in payments. Under the proposal, stablecoin issuers would be required to collateralize at least 40% of their liabilities with non-interest-bearing deposits with the BoE, while allowing up to 60% in short-term UK government debt. This requirement is designed to ensure that stablecoin issuers have sufficient collateral to back their liabilities and maintain financial stability.

Key Components of the Proposal

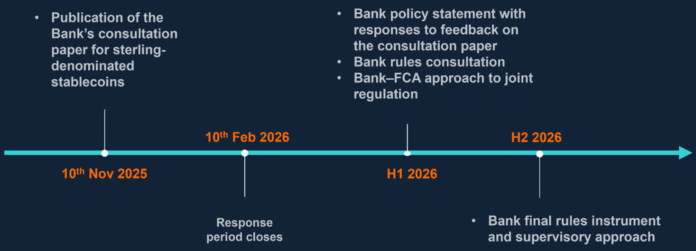

The consultation paper seeks feedback on the proposed regime by February 10, 2026, with the BoE planning to finalize the regulations in the second half of the year. The proposal includes several key components, such as capping holdings of individual stablecoins at 20,000 British pounds ($26,300) per token, while allowing exemptions from the proposed 10,000 pounds ($13,200) for retail businesses. Additionally, the BoE proposed that issuers introduce per-coin holding limits of £20,000 for individuals and £10 million for businesses.

Regarding stablecoin collateralization, the BoE suggested that issuers deemed systemically important could be allowed to hold up to 95% of their collateral assets in UK government bonds as they scale up. However, this percentage would be reduced to 60% once the stablecoin reaches a level where this is appropriate to mitigate the risks posed by the systemic importance of the stablecoin without affecting the viability of the company.

Regulatory Oversight and Supervision

The BoE noted that His Majesty’s Treasury determines which stablecoin payment systems and service providers are considered systemically important. Once designated, these systems would fall under the proposed regime and BoE oversight. The central bank aims to keep pace with the US on stablecoin regulations, ensuring that the UK’s regulatory framework is aligned with international standards.

Schedule for the regulation of sterling-denominated stablecoins by the Bank of England. Source: BoE

For more information on the proposed regulatory framework for stablecoins, readers can refer to the original article published by Cointelegraph.